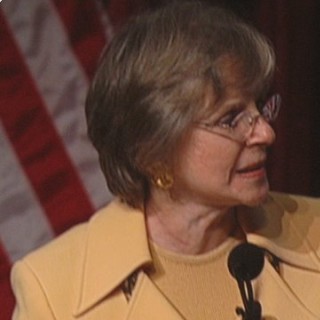

Podcast appearances and mentions of Jane Bryant Quinn

American journalist

- 19PODCASTS

- 28EPISODES

- 42mAVG DURATION

- ?INFREQUENT EPISODES

- Dec 7, 2024LATEST

POPULARITY

Best podcasts about Jane Bryant Quinn

Latest news about Jane Bryant Quinn

- Free to Give HumbleDollar - Jul 5, 2023

Latest podcast episodes about Jane Bryant Quinn

From 2015 - Jane Bryant Quinn, author of "How to make your money last- The Indispensable Retirement Guide."

Episode 148: How to Get Your Financial Life Together: A Guide for Gay Men

Ken reviews the psychological, clinical dynamics of money management, planning aspects of your financial life, and how to talk to the people in your life to reduce financial anxiety and support long-term financial stability.

#086 – Retirement planning chat with a "real" person, Bill Stevenson

Andy chats with a real person (not an advisor) doing their own retirement planning. In this episode, Andy talks with Bill Stevenson, a married military retiree currently living in Hawaii. They talk about a wide array of retirement planning topics such as when Bill started getting serious about retirement planning, what he wishes he would have known earlier, how he planned for the non-financial aspects of retirement, and a variety of financial topics such as Social Security, investing, portfolio distributions, how the GI Bill helped pay for Bill's daughters' colleges and more!Links in this episode:Bill's favorite retirement planning resources:Jane Bryant Quinn books and other resources - hereWade Pfau's book, Retirement Planning GuidebookThe podcast, The Retirement & IRA ShowTenon Financial monthly e-newsletter - Retirement Planning InsightsFacebook group - Retirement Planning Education (formerly Taxes in Retirement)YouTube channel - Retirement Planning Education (formerly Retirement Planning Demystified)Retirement Planning Education website - www.RetirementPlanningEducation.com

Elliot Raphaelson: The Godfather of Financial Journalism

In this episode, The Annuity Man and Elliot Raphaelson discuss: Making sure you get your full benefits Eligibility in Medicare Getting educated through books, experts, and classes The good and the bad of I Bonds Key Takeaways: Turning 65 doesn't automatically mean that you'll get your full benefits. You have to verify what your full retirement age is and plan accordingly. Age 65 is the point at which you are eligible for Medicare. You'll get Part A at no cost. You'll get Part A at no cost. If you work the sufficient amount under Social Security, you'll automatically get Part A at no cost. Part B, which involves medical expenses, is not automatic. That means you have to pay for that. Education is the best way to get the most benefits and the least problems. Read books, listen to experts, or try to attend classes that deal with finance topics you might be interested in. Do your own research, and don't get swayed by the media. I bonds are a great way to earn interest on your money in inflationary times. However, you must consider the three disadvantages. First, you can only put a maximum of $10,000. Second, you have to hold it for at least one year, or else you'll lose three months' interest. Third, you can't put it in an IRA. "I think it's important that people invest from a long-term perspective, and they need a diversified portfolio; you don't want to have all of your eggs in one basket. If you're young, start investing early." — Elliot Raphaelson. Resources: Medicare and You: https://www.cms.gov/Outreach-and-Education/Outreach/Partnerships/MY “Get What's Yours for Health Care” by Philip Moeller: https://www.amazon.com/Get-Whats-Yours-Health-Care/dp/1982134259 “How to Make Your Money Last” by Jane Bryant Quinn: https://www.amazon.com/Make-Your-Money-Last-Indispensable/dp/1982115831 “The New Retirement Savings Time Bomb” by Ed Slott: https://www.irahelp.com/ “The Truth About Crypto” by Ric Edelman: https://www.amazon.com/Truth-About-Crypto-Easy-Understand/dp/1668002329 “Retirement Planning Guidebook” by Wade Pfau: https://www.amazon.com/Retirement-Planning-Guidebook-Navigating-Important/dp/194564009X Purchasing I Bonds: https://treasurydirect.gov/ Connect with Elliot Raphaelson: Articles, “The Savings Game”: https://tribunecontentagency.com/premium-content/business/personal-finance/the-savings-game/ Amazon: https://www.amazon.com/Elliot-Raphaelson/e/B001KE4AM4%3F Connect with The Annuity Man: Website: http://theannuityman.com/ Email: Stan@TheAnnuityMan.com Book: Owner's Manuals: https://www.stantheannuityman.com/how-do-annuities-work YouTube: https://www.youtube.com/channel/UCCXKKxvVslbeGAlEc5sra2g Get a Quote Today: https://www.stantheannuityman.com/annuity-calculator!

Today, we re-visit my conversation with Joe Saul-Sehy. "It's not about being smart; it's about protecting your blind spots and having someone in the corner to disagree with you". -Joe Saul-Sehy Joe Saul-Sehy, is a former Financial Planner and the Founder and Host of the Award-Winning Podcasts The Stacking Benjamins Show and Money With Friends Podcast. With his years of experience and passion for finance, he has helped many people retire early and reach their financial goals. Let's dive right in as we talk about money, shame, why, and how to hire a financial coach. [00:01 - 04:49] Opening Segment I introduced Joe to the show Joe and I talk about how we met I Joined the Stacking Benjamins Community Joe checked out Micro Empired Podcast [04:50 - 15:20] The Podcast and Diverse Community Joe talks about building a brand through the podcast Be a part of a community and the discussion Joe talks about the perks of being in a Podcast Community Have friends around the world He shares about his experience meeting his audience for the first time The ability to add value and gain more knowledge The art of being in the community is, you will find people that are like you and also those that are very different Learning from diversity in the community Uncovering the society labels Fighting against the discrimination Joe talks about the injustice and challenges that people of color have to face [15:21 - 24:55] Work Smarter and Harder Quick shoutout to my Podcast Producers: Streamlined Podcasts Use promo code: jives and get a discount Joe talks about his money culture growing up Discussing money was considered taboo Credit card debt issues Having hard-working parents Joe shares the story about the money talks he got with his neighbor In current culture, people tend to not talk about money or debt openly, but still spends alot It creates a deadly cycle life [24:56 - 40:09] Finding The Right Financial Advisor The smartest people that I know always surround themselves with smarter people than them Joe shares his experience being a financial advisor Surround yourself with the people that handle money well Don't be emotionally invested in your goals. Why does someone say, ‘Don't have a financial advisor because they are corrupt.' Due to bad experiences and tainted impressions It's not about being smart; it's about protecting your blind spots and having someone in the corner to disagree with you Joe shares some tips for finding a good financial advisor Interview more people Ask about their credentials Fee-only advisors are a better way to go Joe talks about being a good and successful advisor Fee-only advisor vs. commission advisor Commission, only advisors, aren't incentivized enough to make correct decisions 100% of the time He talks about Jane Bryant Quinn's research Joe talks about how some people look for financial advices from social media groups and the people that they never know [40:10 - 59:00] The Money Culture of Learning and Shame Every time you are about to make a financial decision, ask yourself, “Towards what end will this take me?” The systemic culture of the fear of learning something new Create the learning culture for yourself It is okay not to be right. What am I going to learn next? Create your MBA for yourself Don't feel stupid for asking. Being curious keeps you young. It's not about chasing the money but doing something that you love. Joe talks about his coaches. Tony Stubblebine If you want to learn something fast, hire a coach Joe talks about the Strategic Coach Program he had signed up for Learning from other entrepreneurs too At what age do you think you are going to die, and how do you want people to know you? Why do you have to wait to get to that age and not to live it now? [01:00:00- 01:02:46] Closing Segment Joe and I share some jokes about money and chicken Final words Tweetable Quotes: “It's not about being smart; it's about protecting your blind spots and having someone in the corner to disagree with you.” - Joe Saul-Sehy. “The only way for your clients to win is for you to stay in business.” - Joe Saul-Sehy. “The smartest people that I know always surround themselves with smarter people than them.” - Joe Saul-Sehy Resources Mentioned: The Stacking Benjamins Podcast Money with Friends Podcast Tony Stubblebine Strategic Coach The Personal MBA: Master the Art of Business by Josh Kaufman Josh Kaufman If you'd like to connect with Joel, you can find him on Linkedin and Twitter. You can visit his website at https://joesaulsehy.com/ or email to joe@stackingbenjamins.com. You can connect with me on LinkedIn, Twitter, Instagram, and Facebook. I'm excited to know more about you. I'm excited to know more about you. Also, feel free to shoot me an email at jennifer@micro-empires.com. You can call or text 213-973-7206 TELL US WHAT YOU THINK! LEAVE A REVIEW + help someone who wants to explode their business growth by sharing this episode or click here to listen to our previous episodes. This podcast is about YOU. We all have a story, whether your story is a lot like mine or totally different. Maybe you have a good job, but you know in your heart that you want more. Let's Work Together Subscribe to download my FREE eBook, "3 Steps to Pivot and Thrive: Using Micro-Risks to Build Your Micro Empire." Click https://micro-empires.com/coaching and I'll see you there!

Beating the New IRA Tax DeathJim Lange, Lange Financial Group– The Sharkpreneur podcast with Seth Greene Episode 456 Jim LangeJim Lange is a CPA, Attorney and Financial Advisor. His estate and tax planning strategies have been endorsed by TheWall Street Journal (36 times), Newsweek, Money Magazine, Smart Money, Reader's Digest, Bottom Line, Kiplinger's, and most recently, Forbes Magazine. Jim has authored five peer-reviewed articles in Trusts & Estates. He is a regular columnist for Forbes.com, and his expertise on Roth IRA conversions was solicited for an article in the February 2019 issue of Forbes magazine.With 35 years of retirement and estate planning experience, Jim and his team have drafted 2,680 wills and trusts, as well as sophisticated beneficiary designations for IRAs and other retirement plans using Lange's Cascading Beneficiary Plan. They have also administered hundreds of estates whose families have benefitted from these plans.Jim is the author of eight best-selling books, including three editions of Retire Secure!, endorsed by Charles Schwab, Larry King, Ed Slott, Jane Bryant Quinn, Roger Ibbotson, and 50 other experts; The Roth Revolution, endorsed by Ed Slott, Natalie Choate, and Bob Keebler; The $214,000 Mistake, How to Double Your Social Security and Maximize Your IRAs endorsed by Larry Kotlikoff, Jonathan Clements, Paul Merriman, and Elaine Floyd; and The IRA and Retirement Owner's Guide to Beating the New Death Tax endorsed by Burton Malkiel, Jack Tatar, Bill Losey, and Stephan Leimberg.Jim created The Roth IRA Institute—offering professionals in the industry advice and recommendations. His proof of the tax and estate planning advantages of Roth IRA conversions has been peer-reviewed by the top tax journal of the American Institute of . Further, all 15 IRA experts interviewed on his radio show have indicated that most taxpayers, at some point, will benefit from a Roth IRA conversion—and that was before today's favorable new tax brackets made Roth IRAs even more advantageous.Listen to this informative Sharkpreneur episode with Jim Lange about beating the new death tax.Here are some of the beneficial topics covered on this week's show:● How providing relevant content and pursuing the press helps gain endorsements.● Why helping people and the satisfaction of doing a good job feels the best.● How your should be so good that you can outspend your competitors.● Why you need to stay in front of your clients and keep in touch to serve them.● How the best way to obtain new clients is through in-person workshops.Connect with Jim:Guest Contact InfoTwitter @rothguyFacebook facebook.com/RothRevolutionLinkedIn linkedin.com/in/jameslangecpa YouTube youtube.com/user/retiresecureLinks Mentioned:paytaxeslater.com Learn more about your ad choices. Visit megaphone.fm/adchoices

Beating the New IRA Tax Death Jim Lange, Lange Financial Group – The Sharkpreneur podcast with Seth Greene Episode 456 Jim Lange Jim Lange is a CPA, Attorney and Financial Advisor. His estate and tax planning strategies have been endorsed by TheWall Street Journal (36 times), Newsweek, Money Magazine, Smart Money, Reader’s Digest, Bottom Line, Kiplinger’s, and most recently, Forbes Magazine. Jim has authored five peer-reviewed articles in Trusts & Estates. He is a regular columnist for Forbes.com, and his expertise on Roth IRA conversions was solicited for an article in the February 2019 issue of Forbes magazine. With 35 years of retirement and estate planning experience, Jim and his team have drafted 2,680 wills and trusts, as well as sophisticated beneficiary designations for IRAs and other retirement plans using Lange’s Cascading Beneficiary Plan. They have also administered hundreds of estates whose families have benefitted from these plans. Jim is the author of eight best-selling books, including three editions of Retire Secure!, endorsed by Charles Schwab, Larry King, Ed Slott, Jane Bryant Quinn, Roger Ibbotson, and 50 other experts; The Roth Revolution, endorsed by Ed Slott, Natalie Choate, and Bob Keebler; The $214,000 Mistake, How to Double Your Social Security and Maximize Your IRAs endorsed by Larry Kotlikoff, Jonathan Clements, Paul Merriman, and Elaine Floyd; and The IRA and Retirement Owner’s Guide to Beating the New Death Tax endorsed by Burton Malkiel, Jack Tatar, Bill Losey, and Stephan Leimberg. Jim created The Roth IRA Institute—offering professionals in the industry advice and recommendations. His proof of the tax and estate planning advantages of Roth IRA conversions has been peer-reviewed by the top tax journal of the American Institute of . Further, all 15 IRA experts interviewed on his radio show have indicated that most taxpayers, at some point, will benefit from a Roth IRA conversion—and that was before today’s favorable new tax brackets made Roth IRAs even more advantageous. Listen to this informative Sharkpreneur episode with Jim Lange about beating the new death tax. Here are some of the beneficial topics covered on this week’s show: ● How providing relevant content and pursuing the press helps gain endorsements. ● Why helping people and the satisfaction of doing a good job feels the best. ● How your should be so good that you can outspend your competitors. ● Why you need to stay in front of your clients and keep in touch to serve them. ● How the best way to obtain new clients is through in-person workshops. Connect with Jim: Guest Contact Info Twitter @rothguy Facebook facebook.com/RothRevolution LinkedIn linkedin.com/in/jameslangecpa YouTube youtube.com/user/retiresecure Links Mentioned: paytaxeslater.com Learn more about your ad choices. Visit megaphone.fm/adchoices

Become a Financial Black Belt - David Carico

Become a Financial Black Belt Resources :: Money 101 at CNN Money Dave Ramsey: Baby Steps Finance at Khan Academy How to Invest Time Value of Money Find a Certified Financial Planner Making The Most of Your Money Now, Jane Bryant Quinn, Publisher - Simon & Schuster The Millionaire Next Door, Thomas Stanley & William Danko, Publisher - Taylor Trade Publishing

Jane Bryant Quinn talks 'financial pornography' and much more

Personal finance journalism legend Jane Bryant Quinn joins Chuck today for two interviews, the first focused on the reboot of her book 'How to Make Your Money Last,' the second about the state of the financial media and more. In 1995, Quinn labeled most personal finance journalism as 'financial pornography,' appealing to the worst characteristics of investors; the media world has changed dramatically, but her feelings for much of the information out there have not. Also on the show, Tom Lydon of ETFTrends.com makes the sister fund to a big, brand-name issue his ETF of the Week, and Nan Morrison on the Council for Economic Education discusses financial education and literacy in the nation's school systems.

Does Your Income Fit in With the Retirement Lifestyle You Want?

Is there a way to be certain that you will always have enough money to follow the retirement lifestyle of your choice? Personal finance commentator Jane Bryant Quinn, author of How to Make Your Money Last: The Indispensable Retirement Guide, explains why there is no magic formula for retirement planning and how one of the keys to making your money last is to “right-size” your expectations. Can the economy change for the better? Doug Goldstein, CFP®, talks about looking at the longer-term view of the world economy. Can things get better? Will you benefit from the world’s future abundance? Get a more optimistic outlook on the world economy, and find out what Doug learned from Peter Diamandis, author of Abundance. Follow Jane Bryant Quinn at: http://janebryantquinn.com and on Twitter @JaneBryantQuinn

The Morning Show - 09/28/19 - Jane Bryant Quinn (archives)

Jane Bryant Quinn is one of the country's leading commentators on personal finance and financial planning. This 2017 concerns her best-selling book "How to Make Your Money Last: The Indispensable Retirement Guide."

If you fail to plan, you plan to fail. It's especially true for retirement planning. Listen in to get tips from Suze Orman, Jean Chatzky, Jane Bryant Quinn, and Steve Vernon on preparing for your financial future.

Getting ready to retire? Social Security, savings, investments, income and expenses – it’s a lot to consider, but it’s all very manageable. Jane Bryant Quinn, author of How to Make Your Money Last, shares with us how to prepare for retirement.

Episode 204 - The Best Estate Plan for Married Couples, Lange’s Cascading Beneficiary Plan, with Attorney Matt Schwartz

Uncertainly has long been the enemy of estate planning as family, financial, and even legal circumstances can change dramatically over time. An estate plan that is intricately thought through and in-line with your testamentary intent today could be inappropriate once you die. However in the early nineties, Jim began thinking creatively about this problem. Lange’s Cascading Beneficiary Plan, as it came to be called, uses specific language and disclaimers to provide the most flexibility when it is needed the most—at the time of the death of the first spouse when the surviving spouse and the family have the most current picture of their finances and family dynamics. No more guess work decades in advance. The plan was first picked up by Jane Bryant Quinn in 2001 and published in Newsweek and from there it has been featured in peer-reviewed journals and in dozens of major publications like The Wall Street Journal and Kiplinger’s. Lange Legal Group, LLC has drafted 2,444 estate planning documents to date, most of which incorporate elements of this superb plan. Tonight on The Lange Money Hour, our lead estate attorney, Matthew Schwartz and Jim will discuss Lange’s Cascading Beneficiary Plan in detail as well as offer examples of how beautifully it has worked out over time for our clients and their families. Using disclaimers, this plan can offer great tax benefits, but it also gives the opportunity to provide children with some inheritance money earlier than at the death of both of their parents—that can be very helpful especially during the years when they are raising your grandchildren or trying to send them to college. Tonight, Matt and Jim will shed fresh light on how Lange's Cascading Beneficiary Plan uses disclaimer planning and specialized language to help IRA and retirement plan owners prepare for the unknown. You will learn: The details of the plan: how and why it works What disclaimer planning entails How to include a disclaimer in your estate plan The downsides of disclaimers The tax implications of disclaimers How Lange's Cascading Beneficiary Plan might be even more useful when the Death of the Stretch IRA legislation passes.

The Financial Risks You Need to Protect with Mark Maurer

HOW CAN INSURANCE HELP ME? This week I sat down with the President & CEO of Low Load Insurance Services, Mark Maurer. Mark joined Low Load Insurance Services (LLIS) in 2003, assumed the role of president in 2008, and CEO in January, 2013. He earned his CFP® designation in 2006, his bachelor’s degree in business and finance from Emory University’s Goizueta Business School in Atlanta, Georgia, and his MBA from University of Florida’s Warrington College of Business. Mark is a member of the National Association of Insurance and Financial Advisors, and a popular speaker for financial organizations including The Alliance of Cambridge Advisors, NAPFA, Garrett Planning Network, LIMRA, LOMA, and Society of Actuaries. He is also a contributing insurance resource to industry publications including Business Week, Bloomberg.com, Forbes, NAPFA Advisor, AMA Physicians’ Guide to Financial Planning, NY Daily News, Jean Chatzky’s Talking Money, and Jane Bryant Quinn’s book, Making the Most of Your Money Now. Here’s WHAT YOU’LL LEARN FROM THIS EPISODE: The biggest misconception people have around insurance The types of insurance you need for your situation Why disability insurance is an important consideration for your family The difference between term and whole life insurance and which is best for you How to streamline the insurance application process for yourself How policies will pay out and how much coverage you need How disability insurance payments are taxed LINKS WE MENTIONED ON THE SHOW: Low Load Insurance Services Mark’s e-mail Schedule a free 30-minute consultation with me Blog posts from the Workable Wealth blog that address insurance: #YOLO: So Don’t Ignore Your Need for Life Insurance Are You Protecting Your Most Valuable Asset?

MTI118: How to Not Run Out of Money In Retirement, with Jane Bryant Quinn

Are you close to retirement without adequate savings? Jane Bryant Quinn’s most recent book, How to Make Your Money Last, addresses this problem for those facing retirement and those in retirement. Social Security, working longer, and how large of a Read more › The post MTI118: How to Not Run Out of Money In Retirement, with Jane Bryant Quinn appeared first on Money Tree Investing Podcast.

Episode 13: Jane Bryant Quinn On How To Make Your Money Last As Long As You DO!

I am so proud to call Jane Bryant Quinn a friend as well as a mentor. You know her as a female pioneer and personal finance advocate, trusted by millions as a columnist for Newsweek, a reporter for CBS News and a prolific author, but to me, she is an inspiration. This week we dig in and get granular about the biggest financial fear going: Outliving your money. Jane explains simple strategies that’ll get you there, and why “right-sizing” your life now –– not later –– can be key.

Kwame Chrisitan Esq., M.A. is a lawyer that focuses on serving the needs of small businesses. He also started a consulting firm that specializes in teaching entrepreneurs and professionals how to negotiate in the business world and is regularly invited to speak on the topic.He also hosts a podcast called Negotiation for Entrepreneurs where he interviews successful entrepreneurs and shares powerful persuasion techniques Jane Bryant Quinn leading commentator on personal finance. Her new book is How to Make Your Money Last: The Indispensable Retirement Guide. She is the author of the bestselling Making the Most of Your Money NOW, Smart and Simple Financial Strategies for Busy People, and Everyone's Money Book. Her personal finance column currently appears in the AARP Bulletin Lupe-Rebeka Samaniego expert in human development, relational trauma, and traumatic stress, Lupe-Rebeka Samaniego, Ph.D. is a licensed Clinical Psychologist and Certified High Performance Coach. Twice Best Selling Author. Dr. Samaniego has recently co-authored the Best Selling Book: THE WINNING WAY: The World's Leading Entrepreneurs/Professionals Share How They are Winning in Life and Business and You Can Too! For more information go to MoneyForLunch.com. Connect with Bert Martinez on Facebook. Connect with Bert Martinez on Twitter. Need help with your business? Contact Bert Martinez. Have Bert Martinez speak at your event!

Your Diet. Your Money. Your Child's Education

Meet a mom who lost a hundred pounds and launched a delicious business. Stacey Hawkins' spices and oils may set you on a tasty path to health. - Jane Bryant Quinn can help you save for retirement. Don't be afraid! And - Dr. Timothy McNiff explains what's happening today at Catholic Schools in New York. Shine On! This Health & Happiness show airs Sunday, March 20 on 100.7 WHUD

Episode 163 - Jane Bryant Quinn Shows You How to Make Your Money Last

Episode 163 - Jane Bryant Quinn Shows You How to Make Your Money Last - TOPICS COVERED: Guest Introduction: Jane Bryant Quinn, Safe Withdrawal Rates, Immediate Annuities: Who Are They Right For? Pension Decisions: Single or Two-Life? Reverse Mortgages

Internationally renowned financial journalist and personal finance expert, Jane Bryant Quinn, author of the bestselling Making the Most of Your Money NOW, Smart and Simple Financial Strategies for Busy People, and Everyone's Money Book discusses her latest and just released book, How to Make Your Money Last:The Indispensable Retirement Guide (Simon & Schuster.January 5, 2016). Retirement has always been a psychological adjustment but in recent years, with people living longer and corporate pensions largely a thing of the past, it has become a financial challenge of critical importance. Multitudinous new ways of financing retirement have become available through government benefits and other tax-advantaged investments, but they vary with age, income,and other factors and become hopelessly complicated without knowledgeable guidance. Jane Bryant Quinn's books and articles have long been praised for their wisdom, thoroughness--and appealing congeniality.

Internationally renowned financial journalist and personal finance expert, Jane Bryant Quinn, author of the bestselling Making the Most of Your Money NOW, Smart and Simple Financial Strategies for Busy People, and Everyone's Money Book discusses her latest and just released book, How to Make Your Money Last:The Indispensable Retirement Guide (Simon & Schuster.January 5, 2016). Retirement has always been a psychological adjustment but in recent years, with people living longer and corporate pensions largely a thing of the past, it has become a financial challenge of critical importance. Multitudinous new ways of financing retirement have become available through government benefits and other tax-advantaged investments, but they vary with age, income,and other factors and become hopelessly complicated without knowledgeable guidance. Jane Bryant Quinn's books and articles have long been praised for their wisdom, thoroughness--and appealing congeniality.

Episode 98 - Jane Bryant Quinn, America’s Leading Financial Journalist, Joins Jim Lange

Episode 98 - Jane Bryant Quinn, America’s Leading Financial Journalist, Joins Jim Lange

Jason Parker interviews Jane Bryant Quinn on Retirement Planningwww.janebryantquinn.com

The economic downturn is hitting home with more and more young adults living with their parents after high school or college graduation. We'll talk about young adult's 'failure to launch' with certified family therapist Marie Donlan of Tidewater Psychotherapy Services and Dr. John Allen, Director of the Virginia Institute of Development in Adulthood (VIDA) at UVA and co-author of Escaping the Endless Adolescence: How We Can Help Our Teenagers Grow Up Before They Grow Old. We'll also be joined by personal finance maven Jane Bryant Quinn to get her advice on how to handle the financial issues that crop up in multi-generation households.

www.JaneBryantQuinn.comHer Career includes a column syndicated by The Washington Post, a biweekly column in Newsweek, the CBS Morning and Evening News, and an online column at Bloomberg.com

Episode 20 - Smart Advice From Jane Bryant Quinn for Making the Most of Your Money

Jane Bryant Quinn joins the Lange Money Hour with tips on making the most of your money! Learn about saving for retirement while you're still working, the importance of knowing what your retirement benefits are, and so much more!