Podcast appearances and mentions of scott slater

- 14PODCASTS

- 20EPISODES

- 38mAVG DURATION

- ?INFREQUENT EPISODES

- Oct 27, 2023LATEST

POPULARITY

Best podcasts about scott slater

Latest news about scott slater

- Founder of Slater's 50/50 grows 'plug-and-play' portfolio Restaurant Business - Nov 22, 2023

- Late-Night Kebab Spot Lands in Pacific Beach Eater - Oct 17, 2023

Latest podcast episodes about scott slater

The Best First Date Bar in San Diego?

They got weird with it, and it worked. Understory is a concept bar in the middle of a Noah's Ark-looking food hall called Sky Deck in Del Mar, where it is surrounded by nine sit-down restaurants. “Understories” are the natural world of shade-craving trees, soils, and organisms in any forest. And so, this bar—along with its own barrel-aged boozes (their Woodford Reserve is used to make a fantastic Old Fashioned)—is filled with plants and plants and plants and white pseudo-tree limbs that look both modern and apocalyptic. It has tables made out of trees millions of years old. When fossils become bars. It's the shared botanical booze vision of two San Diegans who've had success in other food realms. Scott Slater, an SDSU grad who launched his food empires in the many parking lots of Home Depots, eventually coalescing all that R&D into the better-burger enterprise known as Slater's 50/50 (half the burger patty was beef, the other half was ground up bacon—an oh-duh idea that a billion people couldn't believe they didn't think of first). He's since sold that brand and these are his new ideas. And his good friends Guillaume and Ludivine Ryon, Parisian expats who created one of the city's finest French bakeries, Le Parfait Paris. Food courts have gone ballistic. And it makes perfect sense. Meal monogamy is out. Gone is the tyranny of forcing four or six or two friends to pick one unifying restaurant that will somehow cater to all of their dinner desires (I believe that's called Cheesecake Factory, a wondrous place). With modern food courts like Sky Deck trade the Orange Julius and Cinnabons for omakase sushi spots and noodle restaurants and next-wave pizza places. Understory… well, that's just the loam moat of designer drinks in the middle of all this. And probably why it's become a hell of a first-date place in San Diego. After all, you have no idea what this new Tinder person truly wants in a meal or life, so bring them to a sea of choices and judge them by what they choose. Then un-awkward the whole night by drinking a craft cocktail in the loam. And, they have DJs (ambient chill, not oontz-oontz) on weekends. For this episode of Happy Half Hour, we sit down for drinks with Slater, Ryon, and the man who runs Understory's day-to-day, and un-awkwards a lot of lives, Mr. Chance Curtis.

125: Recent international tax developments for re/insurance & ILS: Scott Slater, PwC Bermuda

Artemis Live - Insurance-linked securities (ILS), catastrophe bonds (cat bonds), reinsurance

Establishing insurance-linked securities (ILS) investment management operations and the impact of recent international tax developments in the industry was the focus of our latest Artemis Live video interview. Our latest Artemis Live podcast episode is with Scott Slater of PwC, a Partner and the Tax Services Leader at PwC Bermuda. Scott also leads PwC in the Caribbean's International Tax Services group, which is based in Bermuda and the Cayman Islands. In this interview we discussed some recent international tax developments and how they could affect insurance, reinsurance and also insurance-linked securities (ILS) interests. Slater explained that a key area of focus for his practice and team, in relation to insurance-linked securities (ILS) market participants, is the controlled foreign corporation (CFC) rules and the passive foreign investment company (PFIC) rules. “In the ILS space, most of these structures are either CFC's or PFIC, and our practice specialises in giving the information that those US investors need to complete their tax returns and satisfy their reporting requirements for making that foreign investment,” he said. Slater also explained that a component of the work his team at PwC undertakes is to help ILS investment managers identify the right structures for their businesses, from a taxation point of view. “It's an interesting conversation, particularly with those asset manager backed ILS vehicles, to explain to them what has to happen in Bermuda and the people they need to get in Bermuda to satisfy those requirements, to mitigate the risk that they've somehow created a taxable presence in the US. “So we work with a lot of clients around the structure, but also the people functions and the activities that need to happen from Bermuda, to achieve that tax result,” he commented. Listen to this podcast episode for more insights from PwC Bermuda's Scott Slater.

Small-Batch Aquavit Is Here (and it's gooooood)

During the pandemic, actor Matthew Arkin got a call from his dad, Alan Arkin. “My dad says, ‘Hey, you know you can make aquavit at home?'” Matthew explains, sipping a damn delicious aquavit tonic in the SDM conference room. Matthew's response was, essentially, “Uh, thanks, dad.” In Scandinavia, aquavit (the word means water of life) is everything. There are over 200 songs dedicated to it. In the U.S., it's mostly known as the stuff they drink in Scandinavia—a bracing blast of northern booze that helps wash down the pickled herring. A couple weeks went by and Matthew's dad called again. He says the thing about the aquavit again. Whether genuinely inspired or just to get his dad to shut up about it, Matthew decided to give it a go. He made a batch—a warmer, smoother version you could sip like bourbon. He stuck it in the freezer and figured he'd forget about it forever. A year later, friends intervened. Visiting one day, Marc Marosi (a stand-in for George Clooney, a dapper fellow) tasted it. Loved it. Told Matthew he could sell it. “I don't drink, but I want more of this,” Marc said at the time. So they called their old friend Bruce Glassman, a San Diego-based food and drinks writer (and former SDM beer columnist) to help perfect the recipe. After finding the perfect mix on the 22nd try, the new American aquavit—Batch 22—was born. The title is also an ode to the man whose random call started the idea, since Alan Arkin famously starred in the 1970s film, Catch 22. Was it really any good? To find out, the three friends—all now in their 60s—set out on a cross-country road trip. With a hundred mason jars full of their small-batch aquavit, they'd drive city to city and let the bartenders of America tell them if they were nuts or not. And every time, the bartenders were floored. They were also thankful it wasn't yet another tequila, another small-batch bourbon. In an evolved cocktail industry constantly looking for something new—this smooth, small-batch aquavit stands out. In just under six months, Batch 22 won several awards from across the country. It is shockingly delicious, not the aquavit most Americans know. The golden-hued spirit tastes of caraway and rye and dill and citrus. As if you liquefied a quality rye bread and put it in a bottle. According to the EU, the dominant flavor of aquavit must come from caraway and must have a minimum 37.5% ABV. Batch 22's three most prominent notes are citrus, caraway, and dill. Unlike traditional aquavit, Batch 22 is smooth, sippable, and exceptionally mixable. The three friends come into the San Diego Magazine offices for one of the more hilarious (and, at times, bawdy) episodes of HHH we've had in a long while. We assemble around the conference room, Bruce acts as bartender. We drink, we laugh. In news, Pacific Beach is getting its own al fresco food hall brought to you by food collective Mission + Garnet for a six-concept eatery from local restaurateur, Scott Slater. Perfecte Rocher has settled in as the new director of culinary operations for Consortium Holdings' most recent project: the Lafayette Hotel in North Park and the venerated golden-age hipster beacon of San Diego history. WashMobile, the family-owned spot for tortas (Mexican sandwiches), is setting up shop at NOVO Brazil Brewing Co. once a week—their first pop-up in San Diego. Soichi Sushi is opening next door in the former De Nada Kitchen on Adams Ave. Sonoran-inspired BBQ spot, Papalito, plans to open in South Park, adding to their map with hubs in North Park and East Village. Lastly, Amplified East Village has been aquired by long time PR head, Aubree Miller. It is being revamped as modbom. They will be switching to more cocktail focused and Drew Bent will be leasing the kitchen. If you wanna meet Glassman and Arkin and Marosi and try their creation—on April 1 they're launching a new cocktail with Understory at the Sky Deck.

See omnystudio.com/listener for privacy information.

As M&A activity continues to accelerate in the wealth management space, are clients receiving better advice and more access to complex planning through these larger enterprises? On this episode, host Scott Slater discusses the M&A landscape with David Canter, head of the RIA and family office segment for Fidelity Institutional.

Scott Slater: How The Stupid Cancer Sausage Was Made

On the show today, my guest is Scott Slater, a longtime friend, a former colleague at Stupid Cancer, and one of the earliest activists who helped build the original young adult cancer movement back in the mid-2000s. Yes, Scott is a cancer survivor, but that's just one of his MANY titles. He's a software engineer and app developer…. He's the founder and punk-in-chief at Codepunk, which is an epic web development company. He's an accomplished musician, and NOW he can add “composer of musicals” to his long list of creds. As the aging GenX'ers that we are, Scott and I wax poetic as about cancer in the age of “Woke Culture,” his new musical, “Fable,” and how the hell we're somehow still here after a combined 35 years of survivorship. Plus, Scott correctly identifies the idiot's bias as the “Dunn Krueger Effect.” Alex Trebek is surely beaming from on high. Enjoy the show!See Privacy Policy at https://art19.com/privacy and California Privacy Notice at https://art19.com/privacy#do-not-sell-my-info.

In this month's episode of Talking Under Water, hosts Lauren Del Ciello, Katie Johns and Bob Crossen provide a brief update on the progress of the Lead and Copper Rule Revision, which is now undergoing community roundtables to gather feedback. The hosts also explore current water scarcity issues in the U.S., including Lake Mead's declining water levels and the impact of water scarcity on the entire water cycle ranging from surface water to groundwater. Finally, the interview this month is with Scott Slater, CEO of Cadiz Inc. about water scarcity and how it affects the economy, relates to water equity and more. Timestamps: Cold Open - Gameshows: (0:00) Host Intro: (0:44) Lead & Copper Rule update: (1:33) Drought in the Western U.S.: (5:28) The connection between agriculture water use and water wells: (9:06) Introducing Scott Slater, CEO of Cadiz Inc.: (13:07) Biggest challenges regarding water scarcity in the Western U.S.: (13:59) Factors contributing to water scarcity: (19:17) Water scarcity's impact on the economy: (23:22) How water scarcity affects water equity: (28:23) Aquifer storage as a water scarcity solution: (35:54) Interview ends: (39:51) Housekeeping: (39:58) End: (42:40)

Long-time water lawyer Scott Slater discusses the Cadiz water project and touches on everything from environmental issues to water equity to efficient use of infrastructure. Take a listen to gain a unique perspective on the development of a water project and how it impacts society in general. In this session, you'll learn about: Scott's long tenure as a California water lawyer The background of the Cadiz water project What a dry lake is How the Cadiz project intercepts groundwater before it evaporates in dry lakes The history of environmental review of the Cadiz project How the Cadiz project achieved a zero environmental impact designation The current state of the opposition to the Cadiz water project How water development relates to economic development activities and housing How the Cadiz project takes advantage of existing infrastructure and land rights How data has played a role in developing the Cadiz project The impact of the Cadiz water project on the equitable distribution of water Resources and links mentioned in or relevant to this session include: Scott's LinkedIn Page The Cadiz Water Project's website LA Times article on the Cadiz Water Project TWV #133: Resiliency and Regionalism in Southern California with Metropolitan's Jeffrey Kightlinger TWV #073: The Coachella Valley's Water Story with CVWD's Board President John Powell, Jr. Thank You! Thanks to each of you for listening and spreading the word about The Water Values Podcast! Keep the emails coming and please rate and review The Water Values Podcast on iTunes and Stitcher if you haven't done so already. And don't forget to tell your friends about the podcast and whatever you do, don't forget to join The Water Values mailing list!

Long-time water lawyer Scott Slater discusses the Cadiz water project and touches on everything from environmental issues to water equity to efficient use of infrastructure. Take a listen to gain a unique perspective on the development of a water project and how it impacts society in general. In this session, you’ll learn about: Scott’s long tenure as a California water lawyer The background of the Cadiz water project What a dry lake is How the Cadiz project intercepts groundwater before it evaporates in dry lakes The history of environmental review of the Cadiz project How the Cadiz project achieved a zero environmental impact designation The current state of the opposition to the Cadiz water project How water development relates to economic development activities and housing How the Cadiz project takes advantage of existing infrastructure and land rights How data has played a role in developing the Cadiz project The impact of the Cadiz water project on the equitable distribution of water Resources and links mentioned in or relevant to this session include: Scott’s LinkedIn Page The Cadiz Water Project’s website LA Times article on the Cadiz Water Project TWV #133: Resiliency and Regionalism in Southern California with Metropolitan’s Jeffrey Kightlinger TWV #073: The Coachella Valley’s Water Story with CVWD’s Board President John Powell, Jr. Thank You! Thanks to each of you for listening and spreading the word about The Water Values Podcast! Keep the emails coming and please rate and review The Water Values Podcast on iTunes and Stitcher if you haven’t done so already. And don’t forget to tell your friends about the podcast and whatever you do, don’t forget to join The Water Values mailing list!

Five Actions Advisors Can Take Today to Position Their Firms for a Successful Merger, Acquisition, or Sale

Despite the challenges of 2020, the year closed with M&A activity at a record-setting pace and no signs of slowing going into 2021. Whether advisors are interested in selling all or a portion of their businesses, there are important steps they can begin to take today to help maximize their valuation in the future and ensure they find the right partner. Catherine Williams, Dimensional's Head of Practice Management, is joined by Scott Slater of Fidelity Institutional to discuss M&A trends and best practices in the industry. You can listen to Fidelity's podcast, Future Ready through M&A, hosted by Scott Slater here.

Nasdaq listed Cadiz took advantage of the 2018 Farm Bill and is now growing hemp thanks to its recent JV with Glass House, one of the largest privately held, vertically-integrated, eco-friendly cannabis and hemp companies in the world. Scott Slater, CEO and President at Cadiz and Graham Farrar, CEO at Glass House Farms join the show to discuss their unique and complementary partnership. We also cover why not all CBD is hype, leading a company during COVID, the business of selling crops and why Cadiz is confident about its cash position and bullish on its prospects. Learn more about your ad choices. Visit megaphone.fm/adchoices

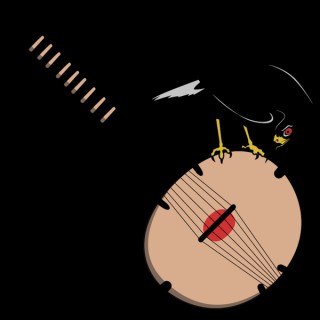

The Hunter gets help on his hunt from a most unlikely place. We are introduced to King Fara "The Handsome" Keita, and his court at Niani. We meet his jeli (bard and chief advisor) Nankoman Doua. Doua's son, Fasali, begins his training as a jeli. We hear the first foretelling of the hero of our story, and its villain. Special thanks to Scott Slater for his editorial assistance. Check out our blog for deeper dives into Manden culture, history, and music! https://tariku.net/blog Check out our YouTube Channel! https://www.youtube.com/channel/UCT4Gk_z95W5gJd50Wu7BRQw Music in this Episode: "Sogononkoun" Manden traditional, performed by Mangue Sylla and The All-Star Drummers of Guinea, Dunnun Kan, Chesky Records, 2015. https://music.apple.com/us/album/dunnun-kan-with-the-all-star-drummers-of-guinea/1020260587 "Kulanjan" Manden traditional, original performances by Sam Dickey and Edouard Chaize Diabate "Kulanjan" Manden traditional, performed by Benyoro, from Benyoro, 2014: vocals- Bebe Camara, jeli ngoni- Sam Dickey, kora- Yacouba Sissoko, bala- Andy Algire. https://music.apple.com/us/album/benyoro/897232752 "Takonani and Demosonikelen" Manden traditional, arranged and performed by Fodè Seydou Bangoura and orchestra, Fakoly 1, 2006. https://music.apple.com/us/album/fakoly-1/200351383 "Soundiata" Manden traditional, Fodè Seydou Bangoura, Fakoly 1, 2006. "Sumaoro Fasa" Manden traditional, original performance by Arouna Kouyate.

EP 8 - David Canter & Scott Slater of Fidelity Clearing & Custody Solutions

In the eighth episode of The COO Roundtable, Matt sat down with David Canter and Scott Slater of Fidelity Clearing & Custody Solutions. David is the Executive Vice President and Head of the RIA Segment at Fidelity. A lawyer by trade, David has been in the industry for 25 years and has been involved in everything from setting up RIAs from a legal and compliance perspective to helping them grow and scale from a practice management standpoint. Scott is the Vice President of Practice Management and Consulting at Fidelity. He helps some of the largest firms in the industry work through their M&A strategy and is also host of the Future Ready Through M&A Podcast. Matt, David, and Scott sit down to discuss their unique perspective into RIAs of various shapes and sizes across the country and much more, including: David and Scott’s respective professional backgrounds and how those affect their roles today The evolution of the Chief Operating Officer role and how they can help a firm navigate the greater RIA ecosystem How Fidelity is working with firms outside of their clearing and custody solutions The four areas Fidelity focuses on to help take RIAs to the next level Scott’s take on what Buyers and Sellers need to do in order to be successful in the M&A market David’s perspective on the profit vs. growth debate Their thoughts on why professional management tends to fail at RIAs We hope you enjoy, share, and subscribe! To subscribe to the podcast on iTunes, click here or to subscribe on Google Play, click here. We are increasing the frequency of our own RIA practice management articles – to sign up to be notified of new content, click here. Check out Scott’s favorite entrepreneurship book, The E-Myth Revisited, here. Check out David’s favorite entrepreneurship podcast, Startup, here. Fidelity Clearing & Custody Solutions® provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC. Fidelity is not affiliated with PFI Advisors.

EP 8 - David Canter & Scott Slater of Fidelity Clearing & Custody Solutions

In the eighth episode of The COO Roundtable, Matt sat down with David Canter and Scott Slater of Fidelity Clearing & Custody Solutions. David is the Executive Vice President and Head of the RIA Segment at Fidelity. A lawyer by trade, David has been in the industry for 25 years and has been involved in everything from setting up RIAs from a legal and compliance perspective to helping them grow and scale from a practice management standpoint. Scott is the Vice President of Practice Management and Consulting at Fidelity. He helps some of the largest firms in the industry work through their M&A strategy and is also host of the Future Ready Through M&A Podcast. Matt, David, and Scott sit down to discuss their unique perspective into RIAs of various shapes and sizes across the country and much more, including: David and Scott’s respective professional backgrounds and how those affect their roles today The evolution of the Chief Operating Officer role and how they can help a firm navigate the greater RIA ecosystem How Fidelity is working with firms outside of their clearing and custody solutions The four areas Fidelity focuses on to help take RIAs to the next level Scott’s take on what Buyers and Sellers need to do in order to be successful in the M&A market David’s perspective on the profit vs. growth debate Their thoughts on why professional management tends to fail at RIAs We hope you enjoy, share, and subscribe! To subscribe to the podcast on iTunes, click here or to subscribe on Google Play, click here. We are increasing the frequency of our own RIA practice management articles – to sign up to be notified of new content, click here. Check out Scott’s favorite entrepreneurship book, The E-Myth Revisited, here. Check out David’s favorite entrepreneurship podcast, Startup, here. Fidelity Clearing & Custody Solutions® provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC. Fidelity is not affiliated with PFI Advisors.

Family Pastor Candidate, Scott Slater, directs us to the book of Luke for a reminder of the urgency of salvation. June 9th 2019.

Rep.Slater joins the Tara Granahan Show to discuss his bill that would protect people on medical marijuana while on the job.

Rep.Slater joins the Tara Granahan Show to discuss his bill that would protect people on medical marijuana while on the job.

Get ready for Future Ready through M&A! In this trailer for our upcoming podcast series on mergers and acquisitions we meet our host, mergers and acquisitions specialist Scott Slater and learn about some of the big questions in the field.

Scott Slater, of Slater’s 50/50 burger, and Buddy Friedman, co-owner of iconic comedy club chain, The Improv.

Aired: 8/16/2014 7 PM:: Richard and Joe interview Scott Slater, the innovator and passionate restaurateur behind the famous Slater’s 50/50 burger, and Buddy Friedman, co-owner of the iconic comedy club chain, The Improv.

Legal Challenges for Groundwater Management

Scott Slater gives a legal view in his "State of the Resource" keynote address. Slater works for Brownstein Hyatt Farber Schreck and is CEO and general counsel for Cadiz Inc.