Podcasts about AWM

- 73PODCASTS

- 296EPISODES

- 32mAVG DURATION

- 1MONTHLY NEW EPISODE

- Jan 23, 2026LATEST

POPULARITY

Best podcasts about AWM

Latest news about AWM

- JPM Kicks Off Q4 Earnings Season With Rare Miss Driven By Weakness In Debt Underwriting ZeroHedge News - Jan 13, 2026

- PUBG: BLINDSPOT Launches for PC on February 5 in Early Access VGChartz - Jan 8, 2026

- Unlock the Power of AWM Token for Maximum Gains Blockchain on Medium - Sep 21, 2025

- I invested £160,000… then my financial adviser went bust: TONY HETHERINGTON investigates CoinSpectator - Sep 14, 2025

- Affordable Wire Management unveils cabling solution for utility-scale energy storage projects Solar Power World - May 19, 2025

- The Black List Seeks Next Great Novel Poets & Writers - Dec 11, 2024

- What Is Avalanche: From Subnets to Sovereign Layer 1s CoinGecko Buzz - Sep 12, 2024

- An outsider on the inside: how Ans Westra created New Zealand’s ‘national photo album’ Arts + Culture – The Conversation - May 7, 2024

- Australian War Memorial kept ministers in the dark on contracts for $550m redevelopment, audit finds World news | The Guardian - Apr 11, 2024

- SSG 69 airsoft suppressor Thingiverse - Newest Things - Mar 27, 2024

Latest podcast episodes about AWM

"PLAYERUNKNOWN'S (PUBG) BATTLEGROUNDS - SALES & REVIEW ROUND-UP"

Linktree: https://linktr.ee/AnalyticJoin The Normandy For Additional Bonus Audio And Visual Content For All Things Nme+! Join Here: https://ow.ly/msoH50WCu0KDive into the enduring legacy of PUBG: Battlegrounds with Analytic Dreamz on Notorious Mass Effect. In this segment, Analytic Dreamz unpacks the battle royale pioneer from PUBG Studios under Krafton, launched in Early Access March 2017 and fully released December 2017—boasting over 75 million PC and console sales, more than 17 billion dollars in franchise revenue, and a historic Steam peak of 3.25 million concurrent players.Experience the core mechanics: parachute drops into 100-player matches on expansive 8x8 km maps like Erangel, realistic ballistics with bullet drop and recoil, no auto-aim or superpowers—just scavenging for weapons such as the M416 and AWM, grabbing armor and vehicles, then surviving the shrinking Blue Zone for intense 20–40 minute rounds ending in the iconic “Winner Winner Chicken Dinner.” Free-to-play since 2022, the shift delivered a massive 486% player surge, supported by Battle Pass progression, cosmetic unlocks, ranked modes, and arcade variants like Team Deathmatch.Critically praised with an OpenCritic score of 77 out of 100 and IGN's 8 out of 10 for its thrilling, skill-based tension and tactical depth over arcade-style competitors, PUBG continues to battle persistent cheating issues—Krafton bans millions of accounts annually, including over 7.81 million in 2025—while the community pushes for stronger hardware-level measures.The latest Update 39.2, rolled out on PC January 7 and consoles January 15, intensifies Erangel: Subzero with harsher blizzards and whiteout conditions, introduces high-risk Satellite Crash zones replacing traditional Red Zones, and adds survival tools like Frost Zone Bombs and Thermal Protection Suits for better cold resistance.PUBG Mobile's ongoing Peaky Blinders collaboration, running January 9 through February 5, brings themed Shelby family skins, Foggy City Thompson SMG, Razor Newsboy Hat accessories, misty vehicle wraps, signature emotes, and the narrative-driven “Shelby Trials” event packed with player choices and exclusive rewards.Spin-offs such as the tactical top-down PUBG: Blindspot further grow the franchise. Recent Steam activity shows peaks around 786,000 in 2025, with daily averages holding strong between 350,000 and 700,000 players.Join Analytic Dreamz for in-depth gameplay breakdowns, anti-cheat discussions, the latest update impacts, and analysis of why PUBG remains the defining battle royale experience heading into 2026.Support this podcast at — https://redcircle.com/analytic-dreamz-notorious-mass-effect/donationsPrivacy & Opt-Out: https://redcircle.com/privacy

Send us a textAbout This EpisodeJanine Moreno, CIO Advisor at Zoom, tells us all about what happens when you stop waiting for permission and start owning the room. Janine shares how stepping into visibility transformed her leadership, leading to table talks and roundtables that blend authenticity and expertise. She discusses multi-generational collaboration, leading remote teams with clarity, and overcoming perfectionism to lead without a title. This episode is a wonderful guide for anyone ready to trade hesitation for action and claim the seat they have earned. About Janine MorenoJanine Moreno is a CIO Advisor with Zoom Video Communications and a former Executive Director for J.P. Morgan's Asset & Wealth Management division. She leads Zoom's CIO, CX, and Women in Leadership Virtual Table Talks, fostering thought leadership and creating spaces for executives to share insights, collaborate, and discuss the latest technology trends, challenges, and innovative solutions. As Chairperson of Zoom's Cross Industry, she drives initiatives to enhance customer experiences across sectors. Previously, Janine was Head of Strategy for J.P. Morgan's Business Technology Optimization group and led AWM's Technology Training and Communications teams. She has also consulted with Bank of America and served as Sr. Director at Broadridge Financial Solutions, focusing on IS Governance and Compliance. With 19 years at Citigroup, Janine held roles including Head of Front Office Sales Operations & Compliance and Chief of Staff. Her career is defined by visionary leadership and a passion for innovation, shaping the future of virtual and hybrid workspaces. Additional ResourcesLinkedIn: @JanineMorenoSupport the show-------- Stay Connected www.leighburgess.com Watch the episodes on YouTube Follow Leigh on Instagram: @theleighaburgess Follow Leigh on LinkedIn: @LeighBurgess Sign up for Leigh's bold newsletter

In this week's episode of The Weekly Grill, host Kerry Lonergan chews the fat with red meat wholesaling identity David McNally, head of Australian Wholesale Meats. Since 2001 AWM has grown to become one of the largest domestic beef wholesalers in the country, with offices in Brisbane, Sydney and Melbourne supplying food service customers across the restaurant, pubs and clubs sector, retail butchers, supermarkets and hospitality venues across the nation. The pair discuss the level of demand for beef and lamb this year, how the food service sector is performing, consumer reaction to higher red meat prices, the role of Meat Standards Australia and other topics. The Weekly Grill is brought to listeners by Rhinogard and Bovi-Shield MH-One - the One Shot, One Spray, One Time BRD Vaccines by Zoetis.

Join the Brother Cousins along with Ian Jones for the last episode of the 2025 AWM coverage.

Join the Brother Cousins along with Ian Jones for the last episode of the 2025 AWM coverage.

Join Christopher, Jeffrey and guest, Chase Palmer as they discuss the next segment in the 2025 AWM coverage series. This week ‘s threat from within is “ME”. Enjoy!

Join Christopher, Jeffrey and guest, Chase Palmer as they discuss the next segment in the 2025 AWM coverage series. This week ‘s threat from within is “ME”. Enjoy!

Financial services in transformation - asset and wealth management - S7E3

In the first of a three-part mini series exploring the trends impacting the financial services sub sectors, host Tessa Norman is joined by Albertha Charles, PwC UK and Global Asset and Wealth Management (AWM) Leader, and Andrew Strange, Director in PwC UK's Regulatory Insights team, to take a deep dive into the drivers of change in the AWM sector. Against a backdrop of market volatility, shifting investor expectations, and increasing regulatory complexity, our expert guests explore the forces reshaping the AWM landscape - from the rapid rise of private markets to generational wealth transfer.We discuss how technology is driving change, enabling both operational efficiencies and new revenue opportunities through innovations such as tokenised funds and tech-as-a-service offerings. Our guests also unpack the UK's policy drive for growth, examining regulatory initiatives including the FCA's advice guidance boundary review, consumer composite investment regime, and outcomes-based model of supervision.We conclude with a look at how firms are rethinking strategy in light of these trends, and what will differentiate those that thrive in this period of transformation. You can contact our PwC speakers if you'd like to discuss any of the topics covered, at tessa.norman@pwc.com, albertha.charles@pwc.com, and andrew.p.strange@pwc.com. You can access the publications mentioned in the podcast below:PwC value in motion: https://www.pwc.com/gx/en/issues/value-in-motion.html PwC's Asset and Wealth Management Revolution: https://bit.ly/44lQVZF To hear more from us on financial services risk & regulation, you can also access all our regular publications at this site: https://www.pwc.co.uk/industries/financial-services/understanding-regulatory-developments.html.

Beyond the Game: Leading Family Offices of Professional Athletes

Highlights from this week's conversation include:Justin's Journey into Finance (1:11)Changes in Investment Management (4:59)Institutionalization of RIAs (7:47)Overview of AWM Capital's Services (11:22)Athletes as Clients (15:16)Engaging Athletes as LPs (16:21)Educating Clients on Private Markets (20:19)Regulatory Shifts in Venture Funds (24:23)Insider Segment: Emerging Managers and Diverse Perspectives (27:38)Complex Fund Agreements (31:02)Venture Capital Strategy Insights (33:11)Evolution of Partnerships (36:16)Due Diligence Criteria Overview (40:14)Stewardship of Capital (44:08)In-Person Connections (47:58)Challenges for Emerging Managers (51:00)Human-Centered Capital Allocation (55:39)Final Thoughts and Takeaways (57:18)AWM Capital is a multi-family office dedicated to providing comprehensive wealth management services to professional athletes, business owners, and multi-generational families. With a commitment to independent, conflict-free advice, AWM integrates investment management and financial planning to help clients achieve their financial goals. Learn more: https://awmcap.com/Sidley Austin LLP is a premier global law firm with a dedicated Venture Funds practice, advising top venture capital firms, institutional investors, and private equity sponsors on fund formation, investment structuring, and regulatory compliance. With deep expertise across private markets, Sidley provides strategic legal counsel to help funds scale effectively. Learn more at sidley.com.Swimming with Allocators is a podcast that dives into the intriguing world of Venture Capital from an LP (Limited Partner) perspective. Hosts Alexa Binns and Earnest Sweat are seasoned professionals who have donned various hats in the VC ecosystem. Each episode, we explore where the future opportunities lie in the VC landscape with insights from top LPs on their investment strategies and industry experts shedding light on emerging trends and technologies. The information provided on this podcast does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this podcast are for general informational purposes only.

Matt and Bob 4-17-25 Gala Tonight, Scams and Know Your Customers

Today Bob is a little worries about his performance tonight at eh AWM awards. Then we get into scams after Fyre Festival 2 was canceled. Then we take calls from so many walks of life while we get to know our custoomers!Support the show: https://www.klbjfm.com/mattandbobfm/See omnystudio.com/listener for privacy information.

Insights on Tariffs | AWM Insights #196

In this episode of AWM Insights, the focus is on the unexpected impacts and implications of the newly imposed tariffs in global trade. Hosted by AWM's Chief Investment Officer and Partner, Justin Dyer, and Portfolio Manager, Mena Hanna, we dissect the nature of tariffs and their immediate reaction in the financial markets. The conversation pivots around how tariffs are escalating tensions with trading partners, leading to a potential trade war. The episode also provides valuable insights on maintaining investment discipline amidst market volatility and strategies for long-term financial success.Key HighlightsDefinition and fundamental understanding of tariffs and their role in global trade.The negative market reactions following the announcement of new US tariffs.Discussions on the potential onset of a trade war due to retaliatory tariffs from other countries.Insights into the importance of preparation and portfolio diversification during economic uncertainty.Strategies for leveraging market downturns, such as tax loss harvesting and portfolio rebalancing.The relationship between risk and reward in investment strategies, emphasizing disciplined approaches.

The Power Found in a Good Teacher: Abe Lopez Found Success in a Title 1 School. (S7E014)

Abe Lopez returns to AWM after almost four years. When last here, he was a candidate for the position of mayor of Oviedo, a race that ended with him in second place. Abe returned to the classroom, a Title 1 School classroom, and became well known for his creative, effective teaching methods and approach. He has since risen to lead the Florida Debate Initiative...teaching other teachers to train students in the art of debating and in the knowledge found in the study of civics.

Calling for a Convention of States: Political Activist and Attorney Mark Meckler Returns. (S7E007)

Returning to AWM for the second visit, Mark Meckler offers an insider's look into the activities in the nation's capitol. Mark is active in American Politics, and leads the movement that is calling for a Convention of States - an action envisioned by our founding fathers, and one that Mark feels is necessary to protect our American way of life under the Constitution.

Looking Ahead in Faith: Apologist Alex McFarland shares viewpoints and hopes for 2025. (S7E003)

Speaking from an incredibly informed position, Alex McFarland is regarded internationally as a leading apologist, author, campus speaker and minister. He travels the globe, sharing the Gospel, and adding his thoughts on apologetics to liberal college campuses. He gives an outlook toward our days ahead on this, his first visit to AWM in the new year.

A Fresh Start: Connie Albers Returns, Discussing the Topic of Hope in 2025. (S7E01)

Recognized as a Central Florida expert in parenting and today's youth, Connie Albers is regularly featured on Fox 35 in Orlando. She returns to AWM to discuss the fact that much has already happened in this brand new year. She talks about the distinctives of Gen Z, and our culture's need for hope.

Discerning the Maze of Health Care Options: Barry Draper Offers Expert Open Enrollment Advice. (S6E188)

Barry Draper leads Draper Financial Services, and he has been helping families and individuals alike as they have to sort through the many options and decisions before them regarding their health care options. Be it Medicare, supplemental insurance, or plans within the marketplace, Barry is a seasoned pro with a listening ear and genuine care for his clients. He returns to AWM.

Winds of Change: Kevin McGary on the Election Results, and also Eric Carroll from Dad Talk Today. (S6E175)

Kevin McGary is an author and leader, having co-founded "Every Black Life Matters." Kevin returns to AWM and talks about the outcome of the Nov. 5th election, and what it means for America. Also, the leader of Dad Talk, Eric Carroll shares the story of his life, and the lives of dads who have been impacted through divorce.

Commander John B. Wells on the election, and his role in advocacy, plus interviews with Brian Sanders and Linda J Hansen. (S6E173)

Commander John B. Wells, US Navy Retired, offers thoughts and expectations on the changes coming for America under a second Trump presidency. Also, a film director named Brian Sanders makes his first appearance on AWM, with a new film in hand called "Why Stand With Israel." Finally, a return visit with the leader of Prosperity 101 - Linda J. Hansen, as she returns to talk impact on business that she sees coming with a new administration.

Dave Zanotti, President of American Policy Roundtable and host of "The Public Square" shares what is critical in next week's election. (S6E168)

Millions of voters have already cast their selections for the 2024 ballot. Official election day is Tuesday, Nov. 5 - Public Square host Dave Zanotti returns to AWM to share his thoughts on the most critical issues facing voters...and all of America. If you haven't yet voted, consider listening to this episode before going to the polls.

Episode 195: Toni Morrison and the Geopoetics of Place, Race, and Be/longing

This week, scholar Marilyn Sanders Mobley visits the AWM to discuss her book Toni Morrison and the Geopoetics of Place, Race, and Be/longing, which Henry Louis Gates, Jr. calls a “powerful and learned meditation, and one that deserves a prominent place in the field of Morrison studies.” Mobley is joined in conversation by poet Parneshia [...]

We had to hit pause this week, as our guests are busy men and schedules didn't align. So this week, Jared, Jeffery and Christopher discuss the personal responsibility aspect of discipleship. Per usual, we range far ad wide, but eventually come back home. Next week, we'll resume the AWM 2024 coverage with our next guest.

We had to hit pause this week, as our guests are busy men and schedules didn't align. So this week, Jared, Jeffery and Christopher discuss the personal responsibility aspect of discipleship. Per usual, we range far ad wide, but eventually come back home. Next week, we'll resume the AWM 2024 coverage with our next guest.

Event season is in full swing! While Bill Banham will be in Las Vegas next week for the HR Technology Conference and Expo, Chris Bjorling will be in Westlake Village, California for the Talent Management Summit by the Marcus Evans Group. In this special episode of the HRchat pod, Chris and Bill preview the Talent Management Summit happening September 23 and 24 at the Four Seasons Hotel. The summit is an invitation-only event bringing talent management execs, suppliers, and solution providers together. It features presentations, interactive roundtables, one-on-one meetings, and lots of networking. Key topics at this year's summit include:Leadership and Change ManagementTech in Talent ManagementChampioning Diversity, Equity and InclusionDesigning a Winning Employee ExperienceWinning the Talent WarFuture-Proofing Your WorkforceSpeakers include Chel Stewart, Senior HR Director at Comcast Cable, Jamie Librot, Global Head, Executive Talent Management, AWM at JPMorgan Chase & Co and Chris Wortmann Senior Director, Talent Management Cubic Corporation.We do our best to ensure editorial objectivity. The views and ideas shared by our guests and sponsors are entirely independent of The HR Gazette, HRchat Podcast and Iceni Media Inc.---Message from our sponsor: Looking for a solution to manage your global workforce?With Deel, you can easily onboard global employees, streamline payroll, and ensure local compliance. All in one flexible, scalable platform! Join thousands of companies who trust Deel with their global HR needs. Visit deel.com to learn how to manage your global team with unmatched speed, flexibility, and compliance.---Feature Your Brand on the HRchat PodcastThe HRchat show has had 100,000s of downloads and is frequently listed as one of the most popular global podcasts for HR pros, Talent execs and leaders. It is ranked in the top ten in the world based on traffic, social media followers, domain authority & freshness. The podcast is also ranked as the Best Canadian HR Podcast by FeedSpot and one of the top 10% most popular shows by Listen Score. Want to share the story of how your business is helping to shape the world of work? We offer sponsored episodes, audio adverts, email campaigns, and a host of other options. Check out packages here. Follow us on LinkedIn Subscribe to our newsletter Check out our in-person events

Golf entertainer Buddy Shelton combined his crazy golf skills with his sense of humor. Also, Ben and Sheri Boyd's incredible faith journey. (S6E145)

No doubt about it...Buddy Shelton had some serious game when it came to golf. A veteran on the PGA Tour, he found a niche with his humor, and ability to do trick shots. He started a new career as a speaker and entertainer at golf tourneys around the world. Today, he lives in Central Florida, and returns to AWM. Also, a visit with Ben and Sheri Boyd with a heartwarming story about their child.

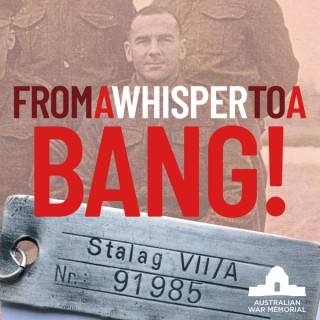

Ep228: Australian War Memorial - Behind the Scenes

Mat visits the Australian War Memorial in Canberra for a special behind-the-scenes tour of the artefacts and large items that are rarely on public display. During this special visit he is guided by Head of Military History Dr Karl James, and speaks to historian Dr Lachlan Grant about the new Australians in Bomber Command exhibition.Topics discussed: 'G for George', the AWM's famous Lancaster bomber; the German ME262 German aircraft; a Chinook helicopter that carried Australian troops into combat in Afghanistan; a smashed engine from a Hawker Hurricane that tells the story of an Australian airman who died over Europe; a caravan that was home to a famous WW2 general; a Japanese midget submarine that raided Sydney Harbour; a German V2 rocket on its original carrier; and a special preview of the future Australians in Bomber Command exhibition, which utilises aircraft, objects and technology to tell the story of the air war in WW2.Presenter: Mat McLachlanGuests: Karl James and Lachlan GrantProducer: Jess StebnickiSubscribe via Patreon for exclusive bonus episodes, early access to all episodes, ad-free listening and special online events with Mat McLachlan! https://www.patreon.com/MMHistoryJoin one of our battlefield tours and walk in the footsteps of the Anzacs! Visit https://battlefields.com.au/ for more information. Hosted on Acast. See acast.com/privacy for more information.

Don Shenk, from Tide Global Ministry, talks ministry to Muslims, and Mat Staver gives info on Amendment 4. (S6E127)

Returning to AWM, Don Shenk, the Director of Tide Global Ministry, is well aware of the risks that foreign pastors are willing to undergo for the sake of preaching the Gospel. And their work is bearing fruit, for there is an amazing number of Muslims that have converted to Christianity, always at the risk of their own lives. He brings an exciting report. Also - Mat Staver from The Liberty Counsel shares on Amendment 4.

Author Troy Anderson talks about famous literature from the 19th Century and its surprising connection to today. (S6E121)

Troy Anderson returns to AWM with an amazing look at some ironic names from the late 1890s literature, as well as offering thoughts on current day events. Troy co-authored the book REVELATION 911.

Fierce Manosn is Founder of The Fierce Female Network which is a subsidiary company of AWM, Inc. We are passionate regarding inspiring those who are challenged with Alzheimer's, and we encourage their caretakers. We are passionate in regard to encouraging parents who are challenged with caring for children with cancer. We strive to encourage, uplift, inspire those who experiencing grief, loss, or faced with unbearable life situations. Proficient in; Public Speaking, Laser Sessions, Themed Venue Event Motivational speaking, and Specialized Caveat Coaching which are, and can be spiritual based for individuals who seek services with a spiritual influence; those categories are: I AM A Spirit Strategist- contact Fierce Manson at thefiercefemales@gmail.com

Community leader Chris Messina introduces us to his son Evan. (S6E111)

A community leader, entrepreneur, and former mayoral candidate, Chris Messina returns to AWM, and brings his son Evan, who is about to begin college. Chris shares the story of how much Evan has had to overcome in his life, and what an inspiration he is to all who know him.

Dr. David Swanson, Pastor of First Presbyterian Orlando, discusses the need for unity in the Church. (S6E108)

David Swanson (Senior Pastor at First Presbyterian Orlando) played a key role in the early days of Mike's move back to Orlando, serving as a connector for several city leaders. He has been a frequent and valued guest on AWM, and today he discusses unity and, as believers, how to respond to the events of our day.

This week, journalist Mark Bowden discusses his new book The Steal: The Attempt to Overturn the 2020 Election and the People Who Stopped It, co-written with Matthew Teague. Bowden is interviewed by reporter Natalie Y. Moore. This conversation originally took place May 19, 2024 and was recorded live at the 2024 American Writers Festival. AWM [...]

Dr. Jerry Newcombe discusses American liberty on the eve of Independence Day. (S6E101)

As we prepare to celebrate The 4th of July holiday, Dr. Jerry Newcombe visits AWM to discuss not only the meaning of this holiday, but the root of America's liberty. Dr. Newcombe joined Corel Ridge Presbyterian years ago, working with D. James Kennedy, with whom he co-wrote numerous books. Jerry is President of Providence Forum, and he produces media with incredible historic significance.

Strategic Tax Planning: Maximizing Wealth Beyond Tax Season | AWM Insights #195

Tax has a crucial role in wealth generation and preservation. Professional athletes have very complex tax situations which make tax planning a year-round endeavor, not just a one-time stop during tax filing season. The importance of integrating tax strategies with investment planning can't be stressed enough as we have seen the countless pitfalls of receiving separate tax and investment advice. Proactive strategies must be taken on, and changing the game plan to account for updates in the tax code is essential to maximize and optimize wealth. Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Decoding Crypto's Comeback: Navigating Blockchain, Bitcoin ETFs, and Strategies| AWM Insights #194

Crypto has reemerged in the financial landscape with the recent rally in Bitcoin and the significant role of the SEC's approval of Bitcoin Spot ETFs. With all the hype, a cautious approach to the crypto space is prudent. This does not mean that the trend should be ignored. It's essential to know and understand the ever-evolving investment universe. However, prioritizing investments in businesses with predictable cash flows over speculative bets on price movements is a tried and tested path to success. Venture capital and public company investments can provide exposure to innovative technologies including blockchain and even underlying crypto holdings via company assets. This approach gives you a higher probability of success in your journey for multi-generation wealth. Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Economic Trends and Market Insights | AWM Insights #193

The economy and the stock market are not the same. Usually, the market has a head start and prices in future economic events. The market's recent rally preceded the positive news that came out in terms of inflation, GDP, and employment rates. Making alternative bets has been shown to be counterproductive. Investing with a long-term mindset and avoiding market timing and speculation has been the winning gameplan, and gives investors the best odds of creating and sustaining multigenerational wealth. Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Real Estate in the Multi-Generational Wealth Formula | AWM Insights #192

Real Estate is one of the most talked about asset classes. The allure of real estate comes from fact, fiction, and fallacy. Tax benefits, inflationary hedges, and income streams come with potential risks that are sometimes neglected, such as leverage, volatility, liquidity, and concentration. Incorporating real estate's unique advantages while considering and planning for the challenges is essential to building a well-diversified and prudent financial structure. Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Building a Winning Portfolio | AWM Insights #191

What does it take to build a Winning Portfolio? The answer has a significant amount of overlap with how a GM would build a winning team. It starts with expertise and knowledge. You need to assemble a group that understands what winning is, what it takes to win, and how to get there. Compiling a cohesive team and continuously coaching and improving the team is needed, but also utilizing those players effectively and efficiently with a proper game strategy and playbook are the only ways to get the most out of your resources. Finally, plans and strategies must be constantly evaluated and updated for changing conditions. Building and maintaining a successful personal portfolio follows the same logical framework! Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Investing Beyond Elections | AWM Insights #190

The complexity of predicting market reactions due to events or scenarios playing out can be perfectly proved by looking at elections. There has been no statistically significant data that has shown elections swaying markets in any direction. Making investment decisions based on election results is a dangerous game to play. Long-term financial planning can create value while short-term trading strategies influenced by political events are more likely to destroy it. Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Rose Ann Forte shares on her recovery from alcohol, plus talks with ex-gangster Robert Borelli, and author Micah Van Huss. (S6E030)

Rose Ann Forte returns to AWM, sharing on her road to victory over addiction, outlining the ways she helps others to do the same. Also returning to the podcast is Robert Borelli, whose life of crime landed him in prison...where he found Jesus. Finally, author Micah Van Huss is part of the ministry of Southwest Radio Church, and he shares on his new book just days of way from its release.

We are a local band from New Zealand that will blow your mind with our face melting, gut wrenching, cosmically orgasmic, ball busting tunes. Get ready for an unforgettable show filled with energy and passion. Passion for Music Our principles We are driven by our deep passion for music, which fuels our creativity and dedication to delivering the best rock experience. High Energy Performances We believe in giving our audience an electrifying experience through our high energy performances that leave them craving for more. Authenticity and Originality We pride ourselves on creating and performing original modern rock music that is authentic, raw, and true to our artistic vision.

Clarifying Misconceptions: The Real Impact of Elections on Markets | AWM Insights #189

There are many perceived effects of presidential elections on investment strategies and markets, but the data clearly shows that there is a misconception here. Over the past 100 years, there have only been 4 election years that have had negative returns, all of which were not influenced by presidential elections. Those 4 negative years were 1932 (Great Depression), 1940 (World War II Ramping Up), 2000 (Dot com bubble), and 2008 (Great Recession). Counterintuitively, the S&P 500 typically sees an average return of 11.5% during election years, which is slightly above the average return in all years (10.3%). Instead of being a critical component, elections are merely one of many factors at play when it comes to market performance. The importance of maintaining a long-term investment strategy and preparing for potential market fluctuations underscores the need for investors to distinguish between informed decision-making and impulsive reactions to political news. Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji to Brandon at (714) 504-7689 to join our new AWM Insights Network. Episode Highlights 00:00 Intro 01:21 Data on the S&P 500 returns during election years, highlighting the minor impact of elections on market performance02:53 The principle of voting in the ballot box, not with your portfolio 03:51 Volatility is elevated leading up to elections 04:44 Text us!

Investing Through Elections with Evidence-Based Strategies | AWM Insights #188

Presidential elections and financial markets have a nuanced relationship. All the media coverage and speculation around elections creates a significant panic and worry that can sway investor emotions.However, the historical data does not support making investment decisions based on the election outcome. Election years have shown no signs of differing performance from normal years.Financial markets are highly complex, and even though elections are important to policy, they are a single piece in a sea of factors that impact markets.Focusing on long-term financial goals and adhering to disciplined investment principles creates far more successful opportunities and outcomes for investors when compared to playing the election guessing game.Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Navigating Market Uncertainty and Elections in 2024| AWM Insights #187

2023 was a year filled with surprises. It showed us how different predictions are from reality. As we kick off a year that is already starting with a lot of uncertainty and ending with a presidential election, it's critical to keep the lessons we have already learned top of mind.The key to successful outcomes is to block out the noise and focus on what matters over the long term. Market fluctuations are like the turbulence that a well-positioned portfolio can weather. It is imperative to stay disciplined, avoid emotional investment decisions, and continuously align your portfolio with personal priorities.There will be bumps along the way. Getting over the bumps and to the other side is what separates the best from the rest.Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

A Year of Surprises and Resilience | AWM Insights #186

In 2023, financial markets displayed remarkable resilience despite countless global challenges. Contrary to the predictions of a majority of economists, a recession was averted. This year highlighted the unpredictable nature of inflation, interest rates, and ultimately, financial markets. The year's developments and the strong performance of markets underscore the importance of adopting a long-term, systematic approach to investing, rather than making reactive decisions based on short-term market fluctuations or media reports.Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Reflecting on Your Financial Structure | AWM Insights #185

Creating a personalized financial structure is an intricate process that isn't a “set it and forget it” task. As our clients move through their lives, they evolve and so should their financial structure.Accommodating these updates and protecting new, important priorities is the only way to keep a portfolio relevant to a client's needs. It takes constant and clear communication to establish and reestablish a plan that will continue to position our clients in an optimal position to achieve their goals.Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Measuring Your Financial Success | AWM Insights #184

Evaluating custom portfolios can be tricky. Unlike off-the-shelf investments, each custom portfolio is unique and tailored to an investor's family, making it hard to compare using the standard benchmarks you see every day.Private investments further complicate the process as they are valued in different ways and at different time intervals. The key to measuring success with these portfolios isn't just about how much money they make, but how well they help you reach your personal financial goals.It's more about the total progress of your financial structure, than just numbers.Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Scheduling Your Financial Success | AWM Insights #183

Figuring out your purpose and intention is the first step to maximizing the impact of your wealth. After your intention is established, time needs to be set aside to execute on that intention and take actions that turn the concept into reality. Figuring out what needs to be done and how it needs to happen is crucial.We work with our clients to build a game plan that is realistic to execute and advise them along the way to achieve the goal at hand with a customized set of scheduled checkpoints. The Scheduling step on the road to success needs to be interactive to evolve with our clients' changing schedules and goals.Setting up a well-thought-out plan that takes the guesswork out of achieving your goals and being able to effectively adjust for any changes gives our clients clarity into what they can accomplish and the impact they can make.Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Intentionally Personalizing Your Portfolio | AWM Insights #182

Investing should be centered around you and the plan should evolve as your life develops and changes. This general concept may sound straightforward and logical, but the ideology of setting an intention for the funds in your portfolio and constantly reevaluating and adjusting them is not a common one.The simple reason for the lack of adoption is that this process is highly sophisticated. Foundations and Endowments manage their funds in this way. They have large teams dedicated to constantly finding purpose and making the updates necessary to stay on track.Our Family Offices' human-centered approach enables families to implement the same sophisticated process as billion-dollar entities and accomplish the goals most important to them. Meaning matters, and honing in on that meaning through intentionality is the first step to properly managing multigenerational wealth.Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (

Attract High-Quality Limited Partners Who Value Your Experience

Justin Dyer, Chief Investment Officer at AWM Capital, shares insights into AWM's venture strategies and human-centered approach to athlete wealth management. He talks about the critical role of networks in VC and gives useful tips for choosing the right limited partner. In this episode, you'll learn:[6:13] AWM Capital's human-centered approach to athlete wealth management[9:14] Venture capital's role in family office asset allocation[16:15] The pivotal role of networks in venture capital[19:36] Assessing venture funds, navigating both the easy and challenging aspects[28:13] Tips on selecting the best Limited Partner for your companyThe non-profit organization that Justin is passionate about: RAISE GlobalAbout Justin DyerJustin Dyer is the Chief Investment Officer, Director of Wealth Strategy, and Partner at AWM Capital. He leads AWM's investment committee, research teams and investment operations. He has served on LP Advisory Committees and has been on the selection committee for the RAISE Global Conference, which is the premier community for forward-thinking venture capital investors and emerging fund managers. About AWM CapitalAWM Capital is a multi-family office serving professional athletes, entrepreneurs, and business professionals, with a deeply-rooted belief that wealth goes beyond the financial.Subscribe to our podcast and stay tuned for our next episode.

Building a Winning Plan | AWM Insights #181

Brian Cain works with dozens of professional athletes to push them to Mental Performance Mastery. His 4-step formula transcends sports performance and actually has a direct application to managing wealth holistically.Establishing your goals and envisioning your priorities is Step 1. Creating Intention is followed by Scheduling time to do the work to get there. As time is being spent to get to the target, progress and improvement need to be measured and monitored. Finally, a reflection regarding the development needs to be made which leads to refocusing to keep charging forward. Applying this formula to your financial framework creates focus, intentionality, and accountability to take the right steps to grow your wealth.Have questions for an upcoming episode? Want to get free resources, book giveaways, and AWM gear? Want to hear about when we release new episodes? Text “insights” or the lightbulb emoji (