Podcasts about sudol

- 27PODCASTS

- 56EPISODES

- 32mAVG DURATION

- 1MONTHLY NEW EPISODE

- Jul 23, 2024LATEST

POPULARITY

Best podcasts about sudol

Latest podcast episodes about sudol

Highlight Episode: Original Episode: Podcast Perks: Thanks to Screen Skinz, the #1 branded screen protector, for their support of the podcast! Screen Skinz allows you to personalize your screen protector with custom or officially licensed designs that disappear, get yours today by visiting screenskinz.com and use the code “LIFO24” at checkout for 20% off AND don't forget you can get 15% off Suja Organic today with the code "LIFO" at the link: sujaorganic.pxf.io/1rM9Da

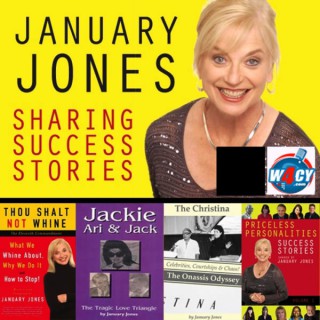

January Jones sharing Affiliate Marketing for Dummies with Ted Sudol

Ted Sudol has been active in making money on the internet for the past 20 years. In the last ten years, he has focused on using affiliate marketing to generate a passive income in a variety of niches. Ted found affiliate marketing to be one of the easiest and most successful methods of making money on the Internet. For Ted the Why of his affiliate marketing business was freedom. The freedom to come and go and work as you wanted to. January Jones Sharing Senior Success is broadcast live Thursdays at 3PM ET. MUST READ Affiliate Marketing for Dummies BY TED SUDOL AND PAUL MLADJENOVIC

January Jones sharing Affiliate Marketing for Dummies with Ted Sudol

Ted Sudol has been active in making money on the internet for the past 20 years. In the last ten years, he has focused on using affiliate marketing to generate a passive income in a variety of niches. Ted found affiliate marketing to be one of the easiest and most successful methods of making money on the Internet. For Ted the Why of his affiliate marketing business was freedom. The freedom to come and go and work as you wanted to. January Jones Sharing Senior Success is broadcast live Thursdays at 3PM ET. MUST READ Affiliate Marketing for Dummies BY TED SUDOL AND PAUL MLADJENOVIC

January Jones sharing Affiliate Marketing for Dummies with Ted Sudol

Ted Sudol has been active in making money on the internet for the past 20 years. In the last ten years, he has focused on using affiliate marketing to generate a passive income in a variety of niches. Ted found affiliate marketing to be one of the easiest and most successful methods of making money on the Internet. For Ted the Why of his affiliate marketing business was freedom. The freedom to come and go and work as you wanted to.Affiliate Marketing for DummiesJanuary Jones Sharing Senior Success is broadcast live Thursdays at 3PM ET.January Jones Sharing Senior Success TV Show is viewed on Talk 4 TV (www.talk4tv.com).January Jones Sharing Senior Success Radio Show is broadcast on W4CY Radio (www.w4cy.com) part of Talk 4 Radio (www.talk4radio.com) on the Talk 4 Media Network (www.talk4media.com).January Jones Sharing Senior Success Podcast is also available on Talk 4 Podcasting (www.talk4podcasting.com), iHeartRadio, Amazon Music, Pandora, Spotify, Audible, and over 100 other podcast outlets.

Nuanez Now May 24, 2023 - Hour 1 - Holly Sudol, Big Sky Softball

After covering the latest news from around the sports world, Colter Nuanez catches up with Holly Sudol, star hurdler of the Montana track team, and provides an update from the UM and Montana State athletes at the NCAA West Regionals. Coach Trevor Subith and star catcher Grace Hood of the explosive Missoula Big Sky softball team also join the show to preview the state tournament.

“Leadership Lessons” - Ohio U Ep 9 - Chad Estis, Legends & Eric Sudol, Dallas Cowboys

Chad Estis of Legends & Eric Sudol of the Dallas Cowboys join for the Ohio U Series “Life After Court Street” Ep 9 to talk about their journey's, lessons learned, how to manage, lead, and much more! Follow us on Instagram @lifeinthefrontoffice for sneak peaks of upcoming episodes and throwbacks to great content from past episodes! Lastly, visit https://www.suaorganic.com to get 15% off Suja online with the code “LIFO”! --- Send in a voice message: https://podcasters.spotify.com/pod/show/lifeinthefrontoffice/message

Many fans, especially young ones, know Alison Sudol for her role as Queenie Goldstein in the Fantastic Beasts franchise. Over three films, she's become part of one of the most beloved cinematic universes. But she's been a musician longer than she's been an actor. Recording as A Fine Frenzy, she built a devoted following and won over critics with releases like One Cell in the Sea and Bomb in a Birdcage. Over the last few years, her sound has evolved into something more layered and complex. Sudol's latest album Still Come The Night, arrived on Sept. 30. Intimate and unpredictable with warm organic production, it's perhaps the best of her career. Jordan Edwards talks to her about the album, how motherhood has inspired her, and how she chooses acting projects.

Stereo Embers The Podcast: Alison Sudol (A Fine Frenzy)

“Still Comes The Night" Raised by a drama teacher mother and an acting coach father, the arts were coursing mightily through the Sudol house. A lover of literature and music, the Seattle-born Alison Sudol started crafting her path at a young age. In her teens, the self-taught pianist created a persona that operated under the A Fine Frenzy sobriquet, releasing a power trio of albums, including 2007's A Cell In The Sea, 2009's Bomb In the Birdcage and 2012's Pines. A Fine Frenzy played SXSW, toured Europe, opened for everyone from the Stooges to Rufus Wainwright and had international hits in Germany, Switzerland and Austria. But by 2011, she announced A Fine Frenzy had been summarily put to bed. Focusing on her acting, Alison joined the cast of Transparent and later the program Dig and in 2016 she got cast as Queen Goldstein in Fantastic Beasts and Where To Find Them. She went on to star in the subsequent two Fantastic Beasts movies—The Crimes Of Grindelwald, and the Secrets of Dumbledore. Retuning to music in 2018, Alison put out two marvelous EPS—Moon and Moonlite—and in September, she put out Still Comes The Night, her first album under her own name. Spellbinding, captivating and utterly riveting, Still Comes The Night is redolent with loss, grief, dreams, magic, introspection and love. It's an album that's filled with poetic finesse, a quiet velocity and devastating melodic beauty. www.alisonsudol.com www.bombshellradio.com Stereo Embers www.stereoembersmagazine.com www.alexgreenonline.com Instagram: @emberspodcast editor@stereoembersmagazine.com

Optogenetic control of YAP can enhance the rate of wound healing

Link to bioRxiv paper: http://biorxiv.org/cgi/content/short/2022.11.04.515183v1?rss=1 Authors: Toh, P. J., Sudol, M., Saunders, T. E. Abstract: Tissues need to regenerate to restore function after injury. Yet, this regenerative capacity varies significantly between organs and between species. For example, in the case of the heart, while some species retain full regenerative capacity throughout their lifespan, human cardiac cells display only limited ability to repair injury. Here, we investigate in cell culture the role of the YAP, a transcriptional co-regulator with a pivotal role in growth, in driving repair after injury. Utilising an optogenetic version of YAP that enables precise control of pathway activation, we show that YAP can increase the speed of wound healing in H9c2 cardiomyoblasts. Interestingly, this is not driven by an increase in proliferation, but by collective cell migration. We subsequently dissect specific phosphorylation sites in YAP to identify the molecular driver of accelerated healing. Overall, our results reveal that YAP activation - through controlled optogenetic activation - can potentially enhance wound healing in a range of conditions. Copy rights belong to original authors. Visit the link for more info Podcast created by Paper Player, LLC

Episode 18: Private Aviation Planning

Welcome to this week's Wisdom and Wealth Podcast. This week, T.J. Sudol from Flexjet, joins me for a conversation about how he helps clients walk through the best private travel option to fit their needs. Specifically, we cover usage rules of thumb for Private Charter, Jet Card, Private Lease and Fractional Ownership. Thank you for listening! Please let us know what you think and also pass along any questions you have after listening.

Episode 18: Private Aviation Planning

Welcome to this week's Wisdom and Wealth Podcast. This week, T.J. Sudol from Flexjet, joins me for a conversation about how he helps clients walk through the best private travel option to fit their needs. Specifically, we cover usage rules of thumb for Private Charter, Jet Card, Private Lease and Fractional Ownership. Thank you for listening! Please let us know what you think and also pass along any questions you have after listening.

It was the wee hours of the morning; mostly everyone was asleep. It was cold and snowy, and no one was around to witness a young woman's horrible and heinous death in the parking lot behind a building in a fairly residential area. But it was a death six years in the making and could have been prevented. And although changes were made to the system in Ontario because of what happened to our victim, it was a hefty price to pay. Music provided by Scout Hurl -Twitter: @scoutlhurt Crime Article & Sources will be listed on the website, as well as additional photos: https://truecrimerealtimepod.com/This episode is brought to you in collaboration with MagicMind bringing the world its first productivity drink!These next 10 days, you can get 40% off your subscription at: https://www.magicmind.co/timeWith my discount code TIME20

Will the magic return to the Fantastic Beasts franchise with “The Secrets of Dumbledore?"

The long-awaited and long-plagued third installment of The Fantastic Beasts franchise finally is in theaters, but does the movie return to the magic we muggles have gotten used to in the ever-expanding Wizarding World of Harry Potter? “Fantastic Beasts: The Secrets of Dumbledore” might be getting mixed reviews from the press, but on this episode of Fan Effect hosts Andy Farnsworth and KellieAnn Halvorsen are joined by the Pop Knowledge blogger' Natalie Mollinet, to take a deeper look at what us “Potterheads” might think of it. The first segment is spoiler-free, then listen at your own peril. Beyond Sci-Fi, Fantasy, Gaming and Tech, the brains behind Fan Effect are connoisseurs of categories surpassing the nerdy. Brilliant opinions and commentary on all things geek, but surprising knowledge and witty arguments over pop culture, Star Trek, MARVEL vs DC, and a wide range of movies, TV shows, and more. Formerly known as SLC Fanboys, the show is hosted byAndy Farnsworth and KellieAnn Halvorsen, who are joined by guest experts. Based in the beautiful beehive state, Fan Effect celebrates Utah's unique fan culture as it has been declared The Nerdiest State in America by TIME. Listen regularly on your favorite platform, at kslnewsradio.com, or on the KSL App.Join the conversation on Facebook @FanEffectShow, Instagram @FanEffectShow, and Twitter @FanEffectShow. Fan Effect is sponsored byMegaplex Theatres, Utah's premiere movie entertainment company. See omnystudio.com/listener for privacy information.

Lessons In Sales Leadership And Sales Growth With The Sales Ninja, Eric Sudol

Leadership is one of the end goals in any career pipeline. But what qualities and values define a leader in sales? Joining Lance Tyson is Eric Sudol, President and CEO of ProStar Energy Solutions, and Vice President of Corporate Partnerships for the Dallas Cowboys. The two discuss various career-changing ideas, including the power of delegation in leadership roles, the impact of dogged persistence in sales growth, and the importance of remaining unbiased when using new and different media to get your message in front of your prospects. The insights from this episode are ones you'll want to get back to. So grab your pen and get ready to take some notes with expert advice from the “sales ninja.”Love the show? Subscribe, rate, review, and share! https://www.lancetyson.com/podcast

Episode 177 of ADJ•ective New Music's podcast, Lexical Tones. Robert McClure interviews composer, computer musician, and educator Jacob David Sudol. http://www.jacobsudol.com Visit www.adjectivenewmusic.com for more information about ADJ•ective New Music, the ADJ•ective Composers' Collective, and Lexical Tones.

Ep. 34 - Eric Sudol, President & CEO - ProStar Energy Solutions

Eric serves in a dual leadership position as President & CEO for ProStar Energy Solutions and Vice President of Corporate Partnership Sales & Marketing for the Dallas Cowboys. He assumed his role at ProStar in April 2020. ProStar, also owned by the Jerry Jones Family, was formed with the opening of AT&T Stadium to solve the challenge of managing electrical energy spend. True to the Jones form, the company has evolved since its inception to be on the forefront of the dynamic needs of the energy industry and its clients. Today, ProStar is a comprehensive energy management company with a complete suite of energy efficiency solutions.Prior to his role with ProStar, Eric spent three years as SVP of Global Partnerships for Legends Global Sales. Legends is an outsourced sports and entertainment company that is owned by the Cowboys, New York Yankees, and a private equity company. At Legends, Eric led the company’s sponsorship portfolio that included selling for properties such as the Las Vegas Raiders & Allegiant Stadium, Los Angeles Rams & Chargers SoFi Stadium & Development, the LAFC expansion Major League Soccer team, and the Toyota Music Factory in Irving, TX to name a few. During his time at the Cowboys that began in 2007, Eric has held a series of roles. Initially, his focus was on new business suites sales for AT&T Stadium, and was later promoted to the Director of Sales, where he oversaw twelve senior sales representatives that set records in both seat licenses and suite sales. He now oversees the 30-person team that leads the NFL in sponsorship revenue. Under Eric’s direction, the Cowboys sponsorship team accomplished a highly successful sales campaign surrounding the team’s practice facility and mixed-use development, The Star, which has become an icon in the sports world.Eric is a native of a small town in Northeast Iowa, holds a Bachelor of Arts in Economics & Business from Cornell College in Mount Vernon, Iowa and a Master of Business Administration and a Master of Sports Administration from Ohio University. Eric was selected to the Dallas Business Journal and Sports Business Journal 40 under 40 in 2015 and 2019 respectively. He and his wife Kate live in Dallas-Fort Worth area with their son James and their dog Blue. Our services for both our clients and candidates can be found below ✔️For Employers: https://www.nenniandassoc.com/for-employers/ ✔️For Candidates: https://www.nenniandassoc.com/career-opportunities/ ✔️Consulting: https://www.nenniandassoc.com/consulting-services/ ✔️Executive Search: https://www.nenniandassoc.com/executive-search/ Nenni and Associates on Social Media: ► Follow on LinkedIn: https://www.linkedin.com/company/nenni-and-associates/ ► Like on Facebook: https://www.facebook.com/nenniandassoc/ ► Email Listing: https://www.nenniandassoc.com/join-email-list/ ► Follow on Twitter: https://twitter.com/nenniandassoc ► Subscribe to our YouTube channel: https://www.youtube.com/c/NenniAssociates

Episode 44 | COVID SHOW 34 | Introducing Matt Sudol

There are a lot of people with great intentions for their finances who are led astray by biased advice from financial advisors. There are also a lot of people who are simply operating under bad financial advice in general. That’s why Price Financial Group Wealth Management decided to start a radio show called Investing Simplified®. They wanted to use the show as a simple way to educate people about the truths of finance and investing. We aim to provide investors, of a varying type or degree of experience, with an edifying experience through the information our veteran hosts and numerous guest-experts will deliver. https://pfgwm.com/wp-content/uploads/sites/2/2020/11/Investing-Simplified-Covid-Show-34.mp3 Our Hosts: Robert (Bo) Caldwell, CFP®, ChFC®, AAMS© Email: bo@pfgwm.com Schedule an Appointment Matt Mai, CIO Email: matt@pricefg.com Schedule an Appointment Matt Sudol, Wealth Advisor Email: mattsudol@pfgwm.com Thank you to our callers, investingsimplifiedradio.com visitors, and listeners for your questions. You make Investing Simplified® possible! Miss an episode of Investing Simplified®? No problem! Catch all our latest shows on our website at pfgwm.com.

An original comedy podcast by Dominick Joseph. DJP Hotline - 425-320-3641 Special Thanks to Andrew Sudol

The Matt & Matt Show Episode 12 " Get The Big Picture In The World Of New York & Connecticut TV News With Traffic & Weather Reporter Lorin Richardson & News 12's Mark Sudol!"

***Get Ready For A TV Themed Episode!*** This Week Matt Zako & Matt Kayan Get The Big Picture In The World Of New York & Connecticut TV News With Traffic & Weather Reporter Lorin Richardson & News 12's Mark Sudol!Just Press Play Because The Matt & Matt Show Starts Now!

CBD 101 with Peter Sudol of Canna Campus

What's Up Sparta! A local podcast about the town and people of Sparta, NJ.

James and Lisa get schooled on CBD with Peter Sudol of Canna Campus.

#248: Percival Dumbledore and the Mating Habits of Dementors

The team plays fast and loose with the definition of "adaptation" so that they can cover Fantastic Beasts: The Crimes of Grindelwald (2018), the newest addition to the Potterverse, about which ours hosts hold very strong opinions. Question of the Week: What are your theories about Credence’s parentage? Follow us! Blog: http://adaptationpodcast.com/ Facebook: https://www.facebook.com/AdaptationPodcast Twitter: https://twitter.com/AdaptationCast Tumblr: http://adaptationpodcast.tumblr.com/ YouTube: http://www.youtube.com/adaptationpodcast

#285: Live with Alison Sudol at LeakyCon 2018

Happy holidays! This week we are going back to LeakyCon in Dallas, where The Ringer's Mallory Rubin and Jason Concepcion interviewed Alison Sudol about Queenie Goldstein, writing, creation, and more. This was conducted BEFORE CoG came out in theaters, so maybe now is a great time to revisit everything we heard. We'll be presenting more of these interviews between now and the day we return in the second week of January! Enoy! And make sure to check out Mal and Jason's podcast, Binge Mode: Harry Potter — they truly are some of the best Potter podcasters in history.

Spoiler Spreekuur: Fantastic Beasts: The Crimes of Grindelwald

Wie onze spoilervrije review heeft geluisterd, weet dat we even niet wisten wat we met de pogingen van Credence om zijn ware achtergrond te vinden of de duistere plannen van Gellert Grindelwald aan moesten. We wisten simpelweg niet wat we van de film moesten vinden. Daarom hebben we de hulp ingeschakeld van food-blogger (The Whisking Friends), maar nog belangrijker, opper-Wizarding-World-Nerd, Nicole Van Nimwegen. In deze aflevering gaan Nils, Narana en Nicole helemaal los over Fantastic Beasts: The Crimes of Grindelwald. Let op! In deze aflevering zijn extreem veel spoilers te horen die te maken hebben met de Harry Potter films en de (bestaande en aankomende) Fantastic Beasts films. Heb je de film nog niet gezien? Dan raden wij je aan om eerst de film te kijken… Je bent gewaarschuwd! Vergeet je niet te abonneren op ons kanaal, laat een review achter via iTunes of Apple Podcasts en volg ons op Facebook: www.facebook.com/filmfanspodcast en Instagram: www.instagram.com/filmfanspodcast. Voor meer reviews, filmnieuws en afleveringen ga je naar www.filmfanspodcast.nl. En volg Nicole haar food-blog "The Whisking Friends" via Facebook: www.facebook.com/TheWhiskingFriends, Instagram: www.instagram.com/thewhiskingfriends en via hun website: www.thewhiskingfriends.wordpress.com.

"Fantastic Beasts: The Crimes of Grindelwald" Deep Dive WITH SPOILERS

OK, you've seen "Fantastic Beasts: The Crimes of Grindelwald" and you've got questions! That's what we're here for. In this episode, Andy Farnsworth is joined by Harry Potter-philes Becky Bruce and KellieAnn Halvorsen for some deep, SPOILER-FILLED discussions of J.K. Rowling's latest entry in the wizarding world we know and love. If you feel like you got a lot of info dumped on you by the end of the movie, we'll help you sort it out, make sense of it and hopefully make your next viewing of "Fantastic Beasts 2" and the latest adventures of Newt Scamander even more enjoyable.

Film Fans Review: Fantastic Beasts: The Crimes of Grindelwald (spoilervrij)

Gellert Grindelwald heeft zijn zinnen gezet op het verzamelen van zoveel mogelijk volgelingen… denken we? Die niets afweten van zijn ware bedoelingen: tovenaars van zuiver bloed grootbrengen om te kunnen heersen over alle niet-magische wezens… denken we? In een poging om Grindelwald’s plannen te dwarsbomen roept Albus Dumbledore zijn voormalige student Newt Scamander op… denken we? We zijn behoorlijk in de war door deze film… In deze aflevering geven Nils en Narana hun spoilervrije review over Fantastic Beasts: The Crimes of Grindelwald. Vergeet je niet te abonneren op ons kanaal, laat een review achter via iTunes of Apple Podcasts en volg ons op Facebook: www.facebook.com/filmfanspodcast en Instagram: www.instagram.com/filmfanspodcast. Voor meer reviews, filmnieuws en afleveringen ga je naar www.filmfanspodcast.nl.

In this episode, Morris Sussex Sports interviews Ryan Sudol to talk about his amazing high school career from his freshman year where all he wanted to do is bring more school spirit to his Morris Hill's sports teams, to becoming one of the most recognized faces in Morris-Sussex through his Football Fanatic's show. Ryan discusses all of the wonderful memories and people he was able to meet through the last two years including snack shack ladies, cheer leaders, athletes, fans and coaches. Listen to all of the hilarity as Ryan recounts all of these special moments. Currently Ryan is a Senior Broadcaster & Analyst for Morris Sussex Sports and is attending William Paterson for broadcast journalism.

Gold Charts, Silver Charts, Dollar Charts and Trump's Iran Pullout

What does Technical Analysis tell us about Gold prices, Silver prices, and the dollar in response to Trump's Iran Pullout. Trump's Iran pullout is in the news and everyone is wondering what the markets response will be. Ted Sudol Interviews Charlie Nedoss, Senior Market Strategist at LaSalle Futures Group. Charlie is an expert in technical analysis. He tells us how the markets are responding to Trump's Iran Pullout and what precious metals investors can expect in the coming weeks and months. Technical analysis is another tool you can add to your investing arsenal to help you profit from the precious metals. If you are not knowledgeable about technical analysis it is a great tool that you can add to your investing strategies to increase your accuracy and profit. Charlie is also a great teacher. I know I have learned from Charlie and I'm sure that the audience here on the Precious Metals Investing podcast will learn also. One of the great additions to this podcast is that Charlie sent me several charts so that you can actually look at the charts and follow along on the points he is making. I will post those charts along with this podcast at https://preciousmetalsinvesting.com Listen to the Precious Metals Investing Podcast You can listen to some of the episodes right here at Precious Metals Investing Podcast Or even better yet subscribe to the podcast on iTunes here: Precious Metals Investing Podcast on iTunes Android Users can subscribe to the Precious Metals Investing Podcast at Google Play here: Precious Metals Investing Podcast on Google Play DISCLOSURE: If you purchase items though the links on this site such as the Amazon Links, PreciousMetalsInvesting.com will be paid a commission. The prices charged are the same as they would be if you were to visit the sites directly. Please do your own research regarding the suitability of making purchases from the merchants featured on this site. The content provided here is for informational purposes only. Investor's situations vary so make sure you consult with your own financial adviser before making any investment decisions. Not all investments are suitable for all investors. Users agree to hold preciousmetalsinvesting.com, its owner and affiliates, harmless for all information presented on the site. PreciousMetalsInvesting.com presents no warranties. PreciousMetalsInvesting.com is not responsible for any loss of data, financial loss, interruption in services, claims of libel, damages or loss from the use or inability to access PreciousMetalsInvesting.com, any linked content, or the reliance on any information on the site. The information contained on this site does not constitute investment advice and may be subject to correction, completion and amendment without notice. PreciousMetalsInvesting.com assumes no duty to make any such corrections or updates. As with all investments, there are associated risks and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal and tax advisers to evaluate independently the risks, consequences and suitability of that investment. PreciousMetalsInvesting.com disclaims any and all liability relating to any investor reliance on the accuracy of the information contained herein or relating to any omissions or errors and as such disclaims any and all losses that may result. The information supplied by the experts featured at PreciousMetalsInvesting.com are assumed to be accurate.

1000 Point Stock Market Plunge - What You Need To Know

What does the 1000 point Stock Market Plunge mean for the future? Does this portend the end to the 8 year bull run? Are further drops in the future? Today on the Precious Metals Investing podcast Ted Sudol interviews Paul Mladjenovic. Paul is the author of Stock Investing For Dummies and Precious Metals Investing For Dummies. I asked Paul to gaze into his crystal ball and tell us what his analysis says about the future of the stock market and the future of precious metals. Please Listen to the Precious Metals Investing Podcast You can listen to some of the episodes right here at PreciousMetalsInvesting.com: Precious Metals Investing Podcast Or even better yet subscribe to the podcast on iTunes here: Subscribe To Precious Metals Investing podcast on iTunes Android Users can subscribe to the Precious Metals Investing Podcast at Google Play here: Subscribe to the Precious Metals Investing podcast on Google Play DISCLOSURE: If you purchase items though the links on this site such as the Amazon Links, PreciousMetalsInvesting.com will be paid a commission. The prices charged are the same as they would be if you were to visit the sites directly. Please do your own research regarding the suitability of making purchases from the merchants featured on this site. The content provided here is for informational purposes only. Investor's situations vary so make sure you consult with your own financial adviser before making any investment decisions. Not all investments are suitable for all investors. Users agree to hold preciousmetalsinvesting.com, its owner and affiliates, harmless for all information presented on the site. PreciousMetalsInvesting.com presents no warranties. PreciousMetalsInvesting.com is not responsible for any loss of data, financial loss, interruption in services, claims of libel, damages or loss from the use or inability to access PreciousMetalsInvesting.com, any linked content, or the reliance on any information on the site. The information contained on this site does not constitute investment advice and may be subject to correction, completion and amendment without notice. PreciousMetalsInvesting.com assumes no duty to make any such corrections or updates. As with all investments, there are associated risks and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal and tax advisers to evaluate independently the risks, consequences and suitability of that investment. PreciousMetalsInvesting.com disclaims any and all liability relating to any investor reliance on the accuracy of the information contained herein or relating to any omissions or errors and as such disclaims any and all losses that may result. The information supplied by the experts featured at PreciousMetalsInvesting.com are assumed to be accurate.

Insurance and Waivers for SUP, active sports, water and outdoor sports | Glenn Sudol, owner of OIG - 014

Outdoor Insurance Group and Surfer Insurance specialize in the active sport, outdoor adventure and water sport industries. Whether you have a board shop, run surf or paddle board camps and lessons, or have a mobile rental business, they can customize the coverage that you need to stay protected. In this episode, Julie asks questions as a standup paddle board instructor to owner Glenn Sudol about the ins and outs of insurance and what is needed for SUP. Find more info: www.thepaddleboardingcpa.com/14

Bitcoin -What You Need to Know Before You Invest

News about Bitcoin is being shouted all around us. According to the poplar press instant bitcoin millionaires are being created every day. There is opportunity but there are also things that you nee to know before you invest in bitcoin or any of the hundreds of cryptocurrencies. Listen to this podcast here. Apple users can also listen on iTunes and Android user can get the episodes at Google Play. Another great option for you if you have a Google Home Mini you can simply say "OK Google" to wake it up. Then say "play Precious Metals Investing Podcast" and it Will play the latest episode. To play a previous episode simple say "Ok Google, Play previous episode" and it will! The Google Home is smart enough to recognize and continue contextual questions. So you don't have to repeat the name of the Precious Metals Investing podcast to play a previous episode just say play previous episode. Or even better you can subscribe to the podcast on iTunes here:Precious Metals investing podcast on iTunes Android Users can subscribe to the Precious Metals Investing Podcast at Google Play here: Precious Metals Investing podcast on Google Play DISCLOSURE: If you purchase items though the links on this site such as the Amazon Links, PreciousMetalsInvesting.com will be paid a commission. The prices charged are the same as they would be if you were to visit the sites directly. Please do your own research regarding the suitability of making purchases from the merchants featured on this site. The content provided here is for informational purposes only. Investor's situations vary so make sure you consult with your own financial adviser before making any investment decisions. Not all investments are suitable for all investors. Users agree to hold preciousmetalsinvesting.com, its owner and affiliates, harmless for all information presented on the site. PreciousMetalsInvesting.com presents no warranties. PreciousMetalsInvesting.com is not responsible for any loss of data, financial loss, interruption in services, claims of libel, damages or loss from the use or inability to access PreciousMetalsInvesting.com, any linked content, or the reliance on any information on the site. The information contained on this site does not constitute investment advice and may be subject to correction, completion and amendment without notice. PreciousMetalsInvesting.com assumes no duty to make any such corrections or updates. As with all investments, there are associated risks and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal and tax advisers to evaluate independently the risks, consequences and suitability of that investment. PreciousMetalsInvesting.com disclaims any and all liability relating to any investor reliance on the accuracy of the information contained herein or relating to any omissions or errors and as such disclaims any and all losses that may result. The information supplied by the experts featured at https://preciousmetalsinvesting.com are assumed to be accurate.

160: The Science of Emotions and How it Applies to Artistic Expression with John Sudol (Part 2)

At the age of 29, John became Artistic Director of the 65th Street Theater - "a theater of passion." With John's leadership, the theater produced American classics, as well as dozens of original pieces, winning him and the theater several accolades for direction and production.

TOTC EP 159 -The science of Emotions and How it Applies to Artistic Expression with John Sudol (Part I)

At the age of 29, John became Artistic Director of the 65th Street Theater - "a theater of passion." With John's leadership, the theater produced American classics, as well as dozens of original pieces, winning him and the theater several accolades for direction and production.

Janet Yellen and the Importance of Precious Metals

Janet Yellen's recent appearance at the annual government hearing did not inspire confidence. At http://www.preciousmetalsinvesting.com we discuss the importance of diversifying away from things that depend upon monetary policy that is being determined by the FED. Precious metals investments allow you to diversify away from investments that have counter party risk. Janet Yellen's inability to answer simple questions, and uncertainty in the future course of action left many investors on edge. I've seen other commentators call her appearance that of an Android Robot or Deer in the headlights. Go to google and enter those phrases and see what you think. I think the point expressed in this podcast is well taken. With people like this running the FED and having control of the country's monetary policy shouldn't you be invested in the precious metals?

Retail Sector Dangers & Precious Metals There is a tightening of consumer spending. Consumer spending can often be divided between necessities like food and water and discretionary items. When people have less money they buy fewer discretionary items. When consumers spend less money retailer suffer. Most retailers have razor thin profit margins to begin with so if you have a tighter market and fewer sales you have store closings. Sports Authority has declared bankruptcy. There is a report McDonald is going to be closing 600 stores this year because of falling sales. When have you ever heard about McDonald closing stores? The story was always about them opening stores. I know they closed the store in my town. Walmart is closing stores. When has a story about Walmart ever been about anything other than how it is an unstoppable colossus? It's time for caution in the retail sector. Put on trailing stops and stop loss orders because there is too much debt. Play it safe take some defensive strategies. Make sure you consult with your financial advisor. The Precious Metals Podcast is now available on iTunes at https://itunes.apple.com/us/podcast/precious-metals-investing/id530765475?mt=2Precious Metals Investing podcast on iTunes

With all of the economic headlines and prognosticators screaming the headline of the minute it's enough to make your head swim. Too much information, rather than helping us sometimes is just throwing up so much smoke it's confusing. Rather than bringing clarity it just's just additional distraction away from what is important. Today at www.preciousmetalsinvesting.com Ted Sudol talks with Paul Mladjenovic about precious metals and the big picture. Paul is the author of Precious Metals Investing For Dummies, Stock Investing for Dummies and High Level Investing For Dummies. Precious metals have been in a tough market for a while. We assumed the bear market would not last as long as it did. But we firmly believe that Gold and silver are up in 2016 and the stock market performance in 2016 has been dreadful. Precious metals and precious metals investments should be a part of the diversification of your portfolio. Remember that gold etf's etc are still just paper carrying counter party risk. It's important that part of your diversification should be in hard assets - the physical precious metals.

Bond Market/h2> Bubble In today's volatile stock market some people look to bonds as a safer alternative investment. But is it? Ted Sudol and Paul Mladjenovic, author of Stock Investing For Dummies discuss bond advantages and bond dangers. Because of the low interest rates some people are considering lesser quality bonds often referred to as "junk bonds." Often time that is an appropriate nickname. For any of you who saw the movie The Big Short you got a taste of what happens when underlying assets can's support the paper that supposedly represents them. Bonds carry counter party risk. You are only holding a piece of paper. A claim on the underlying asset. What happens when that company, city government, state government, or even country government can't support the bonds they have issued. What happens when one of these organizations declares bankruptcy? We think it is a good investment strategy to diversify your investments and part of that diversification should be investments in precious metals. If you are investing in the physical precious metals like bullion, silver eagles, gold eagles, silver maple leaf bullion coins you are also diversifying yourself away from counter party risk. Get your Free Precious Metals Investing buying guide. Go to www.preciousmetalsinvesting.com and enter your email address on the form. The guide is being extensively updated and you will receive your free copy automatically as soon as it is finished.

Futures Trading Here at http://www.preciousmetalsinvesting.com we recommend precious metals of course, but we also recommend diversifying your investments. Today we have a myriad of investment options, stock market, etfs, options trading, and the futures trading. What part should futures trading play in your investment strategy? If you are not familiar with futures trading what is it? What are the investing risks? What are the rewards. Ted Sudol interviews Charlie Nedoss of the LaSalle Futures Group. Charlie has a wide and deep knowledge of just about all aspects of futures trading. He helps us understand what future trading is. He explains both the rewards and the risks. We are often told in investing that the greater the risk the greater the reward. Since futures trading is speculating the risks are greater but the rewards can also be much greater. If you have ever wondered if futures should play a role in your investment strategy we invite you to learn more here about this potentially profitable addition to your investing strategy. The Precious Metals Investing Podcast is now available on iTunes. Click on the link below to subscribe at iTunes. Subscribe at iTunes to the Precious Metals Investing podcast You can also find a listing of the latest podcast episodes here: Podcast Episode Listing

The Coming Bond Market Collapse with Michael Pento

Coming Bond Market Collapse Protect Your Portfolio From the coming Bond Market collapse. Ted Sudol interviews Michael Pento at http://www/preciousmetalsinvesting.com Record debt and prolonged low interest rates are leading to a Bond Market Collapse. Michael Pento is the author of The Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt Market. He correctly predicted the housing bubble. You need to protect your portfolio and assets. Know what to do and when. Precious metals are one of the safest investments in times of turmoil and stock market risk.He correctly predicted the housing bubble. In this wide ranging interview Michael explains why he feels the coming bond market collapse is inevitable. He also explains how to protect your investments and portfolio. The precious metals he feels are a safe haven in the coming collapse and will do very well for people who invest in them. Mr. Pento is a well-established specialist in the Austrian School of economics and a regular guest on CNBC, Bloomberg, FOX Business News and other national media outlets.

On www.preciousmetalsinvesting.com Ted Sudol interviews Richard Maybury Richard is the author of the Uncle Eric series of books. His US and World Early Warning Report geopolitical analysis has been guiding his subscribers to profit. Richard views the world through the prism of empire building. The United States has intervened in wars that extended back to 64 B.C. Western governments have been trying to conquer the Muslims and the Muslims have been trying to make them go away. The US is meddling in wars that have been fought for thousands of years without having reached a solution. On of the images Richard uses to describe the US meddling against the Muslims is "poking rattlesnakes with sticks." The problem is that the average US citizen is not aware of all of the times the US has "poked the rattlesnakes with a stick" by installing dictators around the world, intervening in wars we have no business in, and otherwise trying to tell others around the world how they should live. The only thing the average US citizen notices is when they struck back, There are more than 40 cases of the US overthrowing Latin American governments Every time we send over troops or kill people and their families with drones we create more enemies for the US who then look to join groups who are willing to fight against the US. Then the average citizen can't comprehend why they are against us. Their are more than 40 cases of the US overthrowing Latin American governments. Americans have not been told anything about this history of imperialism that has been running the geopolitics for thousands of years. There are two things that we can depend upon from the government - war and currency debasement. Governments need to debase the currency to pay for the wars they are involved in. Because we can count on the governments for these two things we can use this to guide our investing. Richard says, "I can't see anything but good times ahead over the long term for the precious metals - gold, silver and platinum. The precious metals are a crisis hedge that people go to when governments wreck their economy and I can't see any other outcome from this war." One of the most important things people can do is invest in the precious metals. We discuss sticks the government can use, adjustable yield nuclear weapons, and the future of the universe. People get the government they deserve and are willing to work for. We discuss the part the media play in the current world view held by most citizens. Politics is a corrupting force and we discuss what roll the average citizen should play since politicians take your vote as a mandate for their policies. Richard Maybury's newsletter The US and World Early Waring Report has been helping your readers to profit from your geopolitical analysis. For more information on the books and services Richard offers please go to Richard Maybury's Resource Page .

On www.preciousmetalsinvesting.comTed Sudol interviews Paul Mladjenovic, author of Stock Investing For Dummies about front loading and asset inflation. We been saying for months that the high level of the stock market was due to artificial stimulation. This was something that several commentators claimed the FED was doing too. But of course the FED wouldn't comment. Just recently a FED governor or Ex-Governor admitted the FED was doing this in the hopes of generating a "wealth effect" that would lead to prosperity. The FED has many different ways to flood the market with money. That leads to asset inflation. The recent admission was vindication for a lot of people that were claiming this was happening several months ago.

Ted Sudol interviews Paul Mladjenovic at www.preciousmetalsinvesting.com about the energy sector. The oil boom fueled a lot of debt. Energy companies that pile on debt are now having problems servicing that debt. Saudi Arabia produced at high levels to cause difficulty for high cost producers now are forced to pump at high levels and low oil prices for revenue to meet their people's needs.

Auto Loans and Record Debt Are sales fueled by bad debt good? In this audio interview at http://www.preciousmetalsinvesting.com we discuss the record auto sales. We have been told this is a sign that the economy is healthy. But is it really? A precursor to a bubble is the stimulus of artificial debt. Typically auto sales means consumer is in good shape. But you find today's auto sales have been fueled by an explosion of low quality debt. The ways sub-prime loans fueled the housing bubble today's auto sales have also been fueled by lesser quality loans. If I can get an auto with little money down and great terms that might be great for me. But if I run into economic trouble and can't maintain that debt by making payments that is not a good thing. In the past typically you would be able to get a 36 month loan. Today auto buyers are being offered now an 84 month loans. Although this certainly lowers the monthly payments it also makes autos available to people who might not be able to support the payments in the future. This Precious Metals Investing podcast is also available on iTunes at: Precious Metals Investing podcast at iTunes

FANGS are in the news. But what are FANGS? Today on www.preciousmetalsinvesting.com Ted Sudol and Paul Mladjenovic, author of Stock Investing for Dummies, High Level Investing For Dummies, Precious Metals Investing For Dummies and High Level Investing For Dummies discuss FANGS. FANGS stand for Facebook, Amazon, Netflix and Google. At today's high prices is it a good investment? An important piece of data to look at is the price to earnings ratio. As recently reported although Amazon's sales were at record levels they were only making a tiny sliver of profit. Whenever you are looking at a stock in a slowing market a P/E ratio of over 900 as Amazon's was a few weeks ago is an extreme danger sign. At hyper heated levels like this investing in the precious metals makes them a bargain. Twitter for instance doesn't even make a profit. So what is to justify the stratospheric level of the FANGS prices at these astronomical P/E ratios?

On www.preciousmetalsinvesting.com we discuss factors behind the headline statistics we are bombarded with almost daily. I read a recent article that seemed at first to have a very strange headline relating the FED to the current Star Wars Movie. Sales are currently being touted as the best of all of the movies in the Star Wars Franchise. However those headline statistics may not tell the whole story. People often just take the statistics touted in the headlines and don't ask about factors that are involved. When you compare the INFLATION ADJUSTED sales of the current Star Wars movie against the first Star Wars movie it is actually worse. The sales of the Star Wars movies pale in comparison to the all time champion Gone With The Wind. The point the author was making is that we often hear statistics without hearing about the factors that influenced them. As in the Star Wars movie comparison there are often factors that make what on the surface seem like positive statistics into something deserves less cheering. For instance the government released statistics they touted as showing a positive job growth. But if we look behind those numbers to see what type of jobs are being created we often find they are lower paid positions in the service industry replacing what were once higher paying jobs in manufacturing. Listen to our Precious Metals Investing podcast or go to the posts on www.preciousmetalsinvesting.com that discuss the specific statistics more in depth: Letting the Air out of Job Statistics, Auto Loans and Record Debt On iTunes listen and subscribe to Precious Metals Investing podcast

First Glance at the Headline Statistics Does Not Reveal Some of the Worrying Factors behind the News. If someone who had a good paying full time job can only find a lower paid part time job and must get two part time jobs to make ends meet is that good news? What do the Positive Job Statistics Really Reveal? If so many Jobs are being created why is there no growth in income? If someone who had a good paying full time job can only find a lower paid part time job and must get two part time jobs to make ends meet is that good news? What is the quality of the Jobs being created? On www.preciousmetalsinvesting.com Ted Sudol and Paul Mladjenovic let some of the air out of the job statistics by discussing the worrying factors behind the headlines.

High Level Investing For Dummies Paul Mladjenovic, a frequent guest here at www.preciousmetalsinvesting.com and author or Precious Metals Investing for Dummies and Stock Investing for Dummies has just published a new book in the Wiley series High Level Investing for Dummies. This book is aimed at and investing audience that has some familiarity with basic stock market investments and is ready to learn some more advanced investing techniques. One of the chapters that I found fascinating was the chapter where Paul talks about the legendary investors throughout history and the investing advice their strategies teach us.

Debt Collapse Debt Collapse is in the news today with the default of Puerto Rico on it's debt. That follows other government debt crises like the Greek debt Crisis. This audio is the third part in our crisis series that was originally posted in a video you can find here at

Thanks For You Help at PreciousMetalsInvesting.com

As the year draws to a close I'd like to wish all of the visitors here to preciousmetalsinvesting.com a happy holiday season and happy, healthy, and prosperous New Year. The end of the year is a time for reviewing the past and planning for improvement in the New Year. First thank you for your help in the success of preciousmetalsinvesting.com. The dramatic growth in our subscribers has been very gratifying. We hope we meet and exceed your expectations for the New Year. The strength of preciousmetalsinvesting.com depends upon you, the subscriber. Although we listen to all comments and suggestions those that are coming from our subscribers carry the most weight. So be sure to subscribe if you are not. It's easy using the subscription form here at the site. Don't worry we don't sell you name or provide it to any 3rd party partners. The newsletter is sent out about once a week so you don't get bombarded by a flood of emails from us. Your comments and suggestions are essential to the growth and improvement here at preciousmetalsinvesting.com Let us know how we are doing. Feel free to make suggestions for improvement. If you feel we got something wrong let us know. Enjoy yourselves this New Years Eve if you are out celebrating. But stay safe. From all of us here at PreciousMetalsInvesting.com we wish you a happy, healthy, and prosperous New Year.

Economic Collapse This is the audio version of the Economic Collapse video available on www.preciousmetalsinvesting.com It's the first in our Collapse series of interviews. This audio is one of thePrecious Metals Investing podcasts available on iTunes. lick here to listen or subscribe: https://itunes.apple.com/us/podcast/precious-metals-investing/id530765475?mt=2 Economic Collapse is less likely to occur than the other types of collapses we discussed in this series. When we are talk about Economic collapse we are talking about the system of exchange of goods and series. Generally in a healthy economy there is a balance between demand and consumption. There are things that we all want which makes up demand and consumption. On the other side we have production to satisfied those demands. When supply and demand becomes adversely affected and they are out of balance we can have an economic collapse. For instance in a capitalistic society you have a wide variety of firms competing with each other to supply the goods and services to meet the demands of the consumer. In many cases of economic collapse the supply side of the equation is not meeting the needs. It may be because the demand was being fulfilled by single government run company saddled with bureaucracy and inefficiencies. It may be because government policies promoted too much artificial growth in the absence of demand. Whenever you see an economic collapse you see that supply and demand are out of balance. Paul Mladjenovic is the author of Precious Metals Investing for Dummies, Stock Investing For Dummies and High Level Investing For Dummies. Find out more about Paul and the books and services he offers by visiting his resource page here on the web site. All of the other Precious Metals Experts who have appeared here at www.preciousmetalsinvesting.com have a resource page featuring all of the books and services they offer so make sure you visit their pages too.

Chinese Currency Reserve Status - What does it Mean Your Investments

Chinese Currency & Reserve Status Chinese Currency to achieve reserve status - what does it mean for the stock market, the precious metals market and you? The International monetary fund will give the Chinese currency known as the Yuan or Renminbi reserve status. Sometimes there is confusion on the correct name. To clear up some of the confusion Renminbi means "People's Currency" and the name of their currency while the Yuan is the unit of currency. In this audio interview on www.preciousmetalsinvesting.com Ted Sudol and Paul Mladjenovic talk about the Chinese currency, reserve status and what it will mean for both the US dollar and your investments Some commentators believe there will hardly be any effects from this. They feel the dollar will not be challenged in any way and point to China's closed policies and many of the changes they have to make politically to cause people to have full faith in their currency. The fact that it will take some time for the Yuan to challenge the dollar is no doubt true. However China appears to be positioning itself for dominance in the future. commentators have noticed the record gold buying by China for the past several years. This is just counting their official purchases although other commentators feel when you add that to their "unofficial" purchases something that is potentially seismic is going on. The US gold picture seems much hazier. No one knows how much gold the US has. The government has refused calls for independent audits.The last audit was done in 1950. When Germany recently asked for its gold back that they stored here for safe keeping they were told that they could get it back in 7 years. I don't know about you but that doesn't fill me with confidence that the US government actually has the gold other countries have been storing here for "safe keeping." If it is revealed that China is sitting on a hill of gold and the US just has empty gold vaults I think people's perception will change about the relative value of the currencies. As the Yuan is used in more international trade countries and businesses that once could only conduct business through an exchange of dollars will not have an alternative that completely sidesteps the us dollar. That change though gradual, will certainly be seismic.

The Fed Rate Hike has been in the news lately. Some commentators think that there won't be any effects. They say the rate hike is a measure of the strength of the recovery. Other commentators feel that the economy is still weak and this will start a cascade of negative effects. comment. In this interview at www.preciousmetalsinvesting.com I talk with Paul Mladjenovic, author or Stock Investing For Dummies on what he thinks it means for the stock market, the precious metals market and the future for investors. I don't know if you feel as I do that a drop of the stock market of over 300 points negates the argument that their won't be any effects and I think that we will see increasing economic repercussions. One of the reasons it is wise to invest in the precious metals is for diversification We have seen how some of the junk bond funds have told their investors lately that they can't get their money out. That has made other investors in junk bond funds nervous and has lead to some big withdrawal numbers. As Paul quoted the old investment saying "The only thing better than return on your money is the return of your money." In many ways the highly leveraged debt is like a game of musical chairs. When the music suddenly stops the investor who has not diversified and protected himself loses.

Silver Wheaton is the largest silver streaming company in the world. Randy is one of the founders of Silver Wheaton, joined them full time in 2007 and quickly rose through the company to become CEO in 2011. Silver streaming is one of the best ways to invest in precious metals and participate in the rise of silver while limiting the risks. In this wide ranging interview at www.preciousmetalsinvesting.com learn about how Silver Wheaon grew to be the largest streaming company in the world bypassing several other streaming companies. Randy shares the business plan and philosophy that fueled this growth. Learn how Silver Wheaton selects its assets and limits its exposure to risk. Silver Wheaton allows its shareholders to participate in the rise of silver and gives back to its shareholders 20% of the profits in the form of dividends. Learn some of Randy's thoughts about the future of Silver Wheaton and the precious metals. For more information about Silver Wheaton and Randy please go to www.silverwheaton.com Always consult with your own financial advisor before making any investments. Investments may not be suitable for your situation. The information presented here is believed to be accurate and should not be considered as investment advice.

Ted Sudol interviews Paul Mladjenovic at www.preciousmetalsinvesting.com Paul talks about the impending dangers that may face you in your pension investments and the vital role precious metals should play in your investment strategy. Paul says for a lot of people whose investment portfolio is in pensions they may be facing zero or part of their account may be facing zero. He says the wealthiest people who have survived tough times like this have always invested in portable wealth like gold and silver

Pension Dangers Part 2 Pension Dangers Part 2 - This is the second part in a two part interview at www.preciousmetalsinvesting.com on pension dangers and investing in precious metals. Ted Sudol interviews Paul Mladjenovic Paul talks about some of the impending dangers to those investors who have a significant portion of their investment portfolio invested in pension vehicles and the importance of diversifying your investment portfolio by investing in precious metals. In this second part of the two part services on pension dangers Paul focuses on municipal pensions. Paul contrasts the budgeting processes of individuals who must balance their budgets with governments who make future promises and obligations. In many cases those promises and obligations that people based their future financial health on are coming due and the politicians are saying there is no money. This is adversely affecting both the people that depended upon pensions that are in jeparody and those whose investment portfolio include investments in pension vehicles.

03: John Sudol - "Acting: Face to Face"

John Sudol, is an acting coach for over 30 years now. Before that, he was a successful actor and a director. In today's episode we talk with John Sudol about how he started up his career in the industry and his experience. In addition, John talks about his book “Acting: Face to Face” and gives insights about what your face says about you and how you can use it as a brand .

Roz and Darbi discuss the wonderful things happening in their lives! Roz won a fantastic award celebrating her Broadway debut AND Darbi's Lady Parts Justice is having a Palooza TODAY (September 27) celebrating women. You can go to www.ladypartsjustice.com to find out about the fun! Then, Roz sits down with special guest star John Sudol of Language of the Face. Actors, you REALLY don't want to miss this!