Podcasts about inheritence

Practice of passing on property upon the death of individuals

- 63PODCASTS

- 74EPISODES

- 37mAVG DURATION

- 1MONTHLY NEW EPISODE

- Nov 5, 2025LATEST

POPULARITY

Best podcasts about inheritence

Latest news about inheritence

- How 50 strangers chose to spend heiress' inheritence BizToc - Jun 20, 2024

Latest podcast episodes about inheritence

Cork-based band Ways of Seeing released their second album The Inheritence of Fear on October 10. Singer and guitarist James O'Donnell talks about his long road to the album, from starting out alongside Eoin 'Talos' French a decade and a half ago to Dear Desert before a years-long estrangement from music. We talk about how he came back to music, his health issues such as losing his voice and tinnitus, literature and influences on The Inheritence of Fear. Ways of Seeing play the Kino, Cork, on Friday, November 14. Tickets: https://www.eventbrite.com/e/ways-of-seeing-album-launch-party-tickets-1773309459329 Buy The Inheritence of Fear: https://waysofseeing.bandcamp.com/album/the-inheritance-of-fear

Today we are talking through one of our favorite topics: DEATH. Kristen and Erika talk about the importance of making a will, the ins and outs of what happens with your property after you die, and how to make a will today for free. (For legal purposes this is not legal advice. Consult a lawyer for verifiable information.)Timestamps:2:33 - Dink Yourself11:46 - Let's talk about wills18:36 - Who gets your property if you don't have a will?20:46 - What is probate & why is it bad?25:54 - When should you update your will?26:26 - Where do I get a will?36:31 - How to establish a free will40:48 - What's in Kristen's will? New Dinky trip alert!! Erika is taking a group of childfree travelers to VIETNAM — and it's an artsy adventurer's dream itinerary! Buy your tickets while they last. The Dinky Patreon is officially live! Join now to support the show + gain access to weekly, ad-free episodes, chat with us & other childfree pals in the Dinky Discord, join our virtual book club, and more! Wanna get your finances in order? Use our link to sign up for a FREE 34 day trial of YNAB (You Need A Budget) and support the show. Wanna connect with us on social media? You can find us on Substack, Instagram, TikTok, and Threads at @dinkypod. Follow us on YouTube.If you have a question or comment, email us at dinky@dinkypod.comBecome a supporter of this podcast: https://www.spreaker.com/podcast/dinky--5953015/support.

Our Inheritence Is Peace In Faith Through The Word Of God - Pastor Xolani Zuma

1179: Sister's Bad Beau Threatens Her Share of Dough | Feedback Friday

You inherited big, but your sister didn't make the will. She's trapped with an abusive partner who'd take it all. Share or protect? It's Feedback Friday!And in case you didn't already know it, Jordan Harbinger (@JordanHarbinger) and Gabriel Mizrahi (@GabeMizrahi) banter and take your comments and questions for Feedback Friday right here every week! If you want us to answer your question, register your feedback, or tell your story on one of our upcoming weekly Feedback Friday episodes, drop us a line at friday@jordanharbinger.com. Now let's dive in!Full show notes and resources can be found here: jordanharbinger.com/1179On This Week's Feedback Friday:You inherited a substantial sum from your uncle, but your sister wasn't included in the will because she's trapped in an abusive relationship with a controlling partner who could drain the money. Do you risk enabling her abuser or withhold what rightfully should be hers?You're a dedicated military service member who sought help for anxiety and found relief through medication, but now that same treatment is blocking your calling to become a chaplain. How do you choose between mental health and your spiritual mission?Your husband has developed an intimate friendship with a female colleague who openly admitted her attraction to him. They're now meeting weekly for "supervision hours" and planning a business together. Is this platonic mentorship or something more dangerous?You survived the layoffs at your new dream job, but watched respected colleagues with decades of experience get cut. Now you're questioning whether any work truly matters when everyone seems expendable. How do you rebuild motivation in a disposable world?Recommendation of the Week: Packing CubesYou're 377 days sober and facing step nine — making amends to those you've harmed through addiction and infidelity. But how do you prove internal transformation isn't just talk? And can you ever date again without your past becoming a warning label?Have any questions, comments, or stories you'd like to share with us? Drop us a line at friday@jordanharbinger.com!Connect with Jordan on Twitter at @JordanHarbinger and Instagram at @jordanharbinger.Connect with Gabriel on Twitter at @GabeMizrahi and Instagram @gabrielmizrahi.And if you're still game to support us, please leave a review here — even one sentence helps! Sign up for Six-Minute Networking — our free networking and relationship development mini course — at jordanharbinger.com/course!Subscribe to our once-a-week Wee Bit Wiser newsletter today and start filling your Wednesdays with wisdom!Do you even Reddit, bro? Join us at r/JordanHarbinger!This Episode Is Brought To You By Our Fine Sponsors:BetterHelp: 10% off 1st month: betterhelp.com/jordanFactor: 50% off 1st box: factormeals.com/jordan50off, code JORDAN50OFFQuince: Free shipping & 365-day returns: quince.com/jordanSimpliSafe: 50% off + 1st month free: simplisafe.com/jordanHomes.com: Find your home: homes.comSee Privacy Policy at https://art19.com/privacy and California Privacy Notice at https://art19.com/privacy#do-not-sell-my-info.

There's often a confusion about our relationship to God, and with our inheritence from our Creator. In this week's episode, I share the essence of our relationship with God and how we can use that awareness to improve our lives and let go of unworthiness. To learn more about A Course in Miracles please visit JenniferHadley.com. For the transcript of this episode and more please visit LivingACourseinMiracles.com. Let's forget these crazy ideas about unworthiness and claim our inheritance. Learn more about your ad choices. Visit megaphone.fm/adchoices

Episode #31 - Julie Boardman

I couldn't keep my fangirling at bay when chatting with my new pal, Julie Boardman; co-founder and Executive Director of the Museum of Broadway; a spectacular new experience in Times Square for theatre lovers and practitioners alike. A multiple TONY Award winning Broadway Producer, Julie is currently keeping busy with smash hit revivals of Romeo and Juliet, Sunset Boulevard, Cabaret at the Kit Kat Klub and boasts tremendously successful Broadway productions of Stephen Sondheim's Company, An American in Paris, Funny Girl, Head over Heels and (this is where my fan-girling came into play) two of the most remarkable nights I have ever spent in a theatre; the Broadway productions of Indecent and The Inheritence. During our time together (not nearly enough...she is a pure joy), Julie talks about the idea of entrepreneurship and bringing a devised concept to life out of nothing but determination and grit. Now a mentor for young thinkers - particularly women who hope to follow a similar path - Julie is a veritable font of knowledge, humor and positive energy and I hope you enjoy the discussion even half as much as I did!

Finances Episode 4-Getting control of your life/Leaving an inheritence

Majestic Marriage/Married Man Podcast With Vince and Charlene Taylor

The goal for most people is to leave something to the next generation. This is know as an inheritence. lLeaving a benficial inheritence is difficult to do if you are burdened with debt. We are going to discuss how to deal with this situation so that you too may be able to leave an inheritence to your childrens children.Keep listeningmarriedmanministry.orgfacebook.com/majesticmarriageandfamilyministriesWe believe in marriage. We believe your marriage should be respected and protected!

Finances Episode 3- Getting control of your life/Leaving an inheritence

Majestic Marriage/Married Man Podcast With Vince and Charlene Taylor

The goal for most people is to leave something to the next generation. This is know as an inheritence. lLeaving a benficial inheritence is difficult to do if you are burdened with debt. We are going to discuss how to deal with this situation so that you too may be able to leave an inheritence to your childrens children.Keep listeningmarriedmanministry.orgfacebook.com/majesticmarriageandfamilyministriesWe believe in marriage. We believe your marriage should be respected and protected!

Finances episode 2- Getting control of your life/Leaving an inheritence

Majestic Marriage/Married Man Podcast With Vince and Charlene Taylor

The goal for most people is to leave something to the next generation. This is know as an inheritence. lLeaving a benficial inheritence is difficult to do if you are burdened with debt. We are going to discuss how to deal with this situation so that you too may be able to leave an inheritence to your childrens children.Keep listeningmarriedmanministry.orgfacebook.com/majesticmarriageandfamilyministriesWe believe in marriage. We believe your marriage should be respected and protected!

Finances getting control of your life / leaving an inheritence

Majestic Marriage/Married Man Podcast With Vince and Charlene Taylor

The goal for most people is to leave something to the next generation. This is know as an inheritence. lLeaving a benficial inheritence is difficult to do if you are burdened with debt. We are going to discuss how to deal with this situation so that you too may be able to leave an inheritence to your childrens children.Keep listeningmarriedmanministry.orgfacebook.com/majesticmarriageandfamilyministriesWe believe in marriage. We believe your marriage should be respected and protected!

The Cruz Show On-Demand 5/3/24- Kendrick vs Drake + Should Wife Split Inheritance $ With Her Man?

Today on the Cruz Show Lechero caught us up on the Drake & Kendrick Beef + we read you a crazy inbox about a husband that expects to get 1/2 of his wife's Inheritence.

In Today's episode Pastor Jeff shares something we often forget about what Job gains after his series of unfortunate events. He reminds us God is good.

Episode 969 - You're on a roll - Houses - Movie theater gimmicks - The top teen list - What had happened was

Welcome to the Instant Trivia podcast episode 969, where we ask the best trivia on the Internet. Round 1. Category: You'Re On A Roll 1: A newspaper covering Congress since 1955, or the act of going down a list as you check class attendance. Roll Call. 2: Nicholas McKay invented this 4-letter roller using a toilet paper roll and tape to spruce up his suit for a dance. a lint roller. 3: "Roll Tide" is a trademarked phrase used by supporters of this state school... a lot. the University of Alabama. 4: Photographers and videographers set this "speed" to avoid the distorting effect called "rolling" this. shutter. 5: This appetizer got its name as it is traditionally served during a specific time of the year--the first day of Chinese New Year. a spring roll. Round 2. Category: Houses 1: A small cottage, its name may come from a Hindi word meaning "of Bengal". a bungalow. 2: Chalets have low-pitched roofs to allow for the accumulation of this, which acts as an insulation. snow. 3: In May 1987 PTL auctioned off Jim and Tammy Bakker's air-conditioned one for $4,500. a dog house. 4: The house in which a Roman Catholic parish priest lives. a rectory. 5: In a song from 1933, it's the type of house I want to go back to in Kealakekua, Hawaii. a little black shack. Round 3. Category: Movie Theater Gimmicks 1: The Odorama process added smells to movies using this 3-word process that involves a card and your fingernail. scratch and sniff. 2: In 1985 3 versions of this mystery comedy were released in theaters with 3 different people killing Mr. Boddy. Clue. 3: Psycho-Rama films used these, split-second hidden images or words, to unsettle the audience. subliminal messages. 4: Some theaters showed this 2019 Will Smith clone movie in 60 frames per second, which made the action look smoother. Gemini Man. 5: This director took his "Jay and Silent Bob Reboot" across the country on a roadshow. Kevin Smith. Round 4. Category: The Top Teen List 1: At 16, he joined the soccer club Manchester United, but he didn't get his first goal for another 3 years. Beckham. 2: Miley Cyrus plays this TV teen. Hannah Montana. 3: This nationalist leader who used nonviolent techniques to help create a free India was married when he was 13. Mohandas Gandhi. 4: Legend says at 13, she saved Capt. John Smith from warriors of Powhatan, her father. Pocahontas. 5: At 17, this "Little Women" author wrote her first novel, "The Inheritence". (Louisa May) Alcott. Round 5. Category: What Had Happened Was 1: In 2000 this man won the popular vote for U.S. president by 500,000 but did not get the job. Al Gore. 2: "Guests" of this fortress who checked out the hard way included Sir Thomas More, Edmund Dudley and Anne Boleyn. the Tower of London. 3: In 1687 the Ottomans found that storing gunpowder at this Acropolis building was a ridiculously terrible idea. the Parthenon. 4: In 1989 he succeeded his late father as emperor of Japan. Akihito. 5: On this mission Pete Conrad said, "Whoopee! Man, that may have been a small one for Neil, but that's a long one for me". Apollo 12. Thanks for listening! Come back tomorrow for more exciting trivia! Special thanks to https://blog.feedspot.com/trivia_podcasts/

Reddit rSlash Storytime r nuclearrevenge where Best Friend Slept with My Boyfriend, so I Sent Her to the Hospital I exposed my sister's long term secret and revealed to my niece that she was adopted Hosted on Acast. See acast.com/privacy for more information.

WEALTH UNTOLD: The cross and the crown have become YOUR EVERLASTING INHERITENCE! (566)

This is episode 566 of the Daily CHRIST TODAY podcast.

Do you expect to receive an inheritance? What is unique about your family?In this episode, Casey and Bernard unlock the gift of inheritance that is available for you TODAY. Your family has given you mindsets, experiences, and behaviors that influence you. You have a choice to learn and unlearn what has been given to you. In this episode you will acknowledge your inheritance, pave the way toward your desired future, and leave a legacy for others!https://ahrkpath.com/

Your inheritance; your destiny is worth fighting for. But what are you fighting for? Vivian Bell is Board Certified Biblical Counselor, Mental Health Coach, Life Coach and Destiny Strategist. Vivian walks boldly in her calling to empower women to accept their identity in Christ by providing personalized strategies to launch them into their God given purpose. Whether you sign up to be coached, take an online course or listen to her Podcast, your perspective about you and who God created you to be will be elevated to the place God intended. If you're ready get connected here: Website - https://www.vivianbell.com/ Facebook - https://www.facebook.com/vivianbellcom Instagram - https://www.instagram.com/vivianbellcom/ Twitter - https://twitter.com/vivianbellcom --- Send in a voice message: https://podcasters.spotify.com/pod/show/vivian-bell/message

GREAT MORNING RISE UP with DR. JC DOORNICK "DRAGON" (5 MINUTES TO TAKE YOUR GOOD MORNING AND MAKE IT YOUR GREAT MORNING) DAILY FOCUS: INHERITANCE: Are you conscious and aware of the connection between who you think you are, how you perceive and respond to the world, and your past programming? JOIN THE RISE UP CHALLENGE: - Wake Up at 5am est - Read for 15 min - Journal for 15 min - Shower, get dressed and check in live at 7:30am est here for Rise Up Focus Awakening each day is no longer a luxury. It's critical. It will stream live to our RUWD Facebook group IG. For those that want to use it in your morning structure with me live. Sponsors: Karmaminds Podcast: Get into the float state with Karmaminds meditation and gear. https://podcasts.apple.com/.../karmaminds.../id1548914205 Arkana Spiritual Center: Number one rated Healing Center rated by AyaAdvisors https://www.arkanainternational.com #arkanaspiritualcenter #ayahuasca FOR LIVE STREAMS: - FB: https://www.facebook.com/riseupwithdragon - IG: @riseupwithdragon

Most people have very mixed emotions about receiving an inheritance from someone. Meaning that although what is being passed down may be a blessing and an honor to receive, this also means that the one who has made you their beneficiary has typically passed on. Unlike a person's legacy, an inheritance specifically refers to an exchange of assets whether that be monetary, real-estate, family heirlooms, stocks, or assets otherwise.Margin Membership Sign-up: https://millennialmargin.com/learn/How are your finances doing? Take the quiz: https://i2tvdm52vbg.typeform.com/to/YFcT68CWJared created Millennial Margin out of necessity, as he has watched countless people schedule-away, mortgage-up, and max-out their lives. Margin is simply the antithesis, providing leeway in an increasingly margin-less culture.Subscribe for daily tips and discussions about how to better manage your personal finances and, by extension, your margin.Listen to the podcast: https://margin.simplecast.com/Have a question? Contact Jared at jared@millennialmargin.comFollow Millennial Margin: facebook.com/millennialmargin, instagram.com/millennialmargin1, or simply visit millennialmargin.comGoal/Disclaimer: My goal with [Margin] is to prepare you with the knowledge but then inspire you to act on that knowledge. My goal is to be in your corner bridging the gap between your trusted CPA, attorney, and financial planner. My advice is simply from my own personal experiences and is not meant to override or replace professional advice from your trusted investment professional. The content found here is for entertainment purposes only.

In today's episode I review anoither Netflix movie currently trending #5 called Inheritence

Founding the Inheritence Project, the importance of company culture, and using questions to find common ground with Katya Stepanov

daf yomi kesubos 84. husband inheritence

daf yomi kesubos 84. husband inheritence by “Dafsplaining”: daf yomi made simple

Today we're in Sicily for a spicy tale about a gullible eldest brother with a purse that's always full of gold. His intended yoinks it, leaving him poor and bereft, but lucky for him, he's got two other brothers with magical items he can borrow. She takes those off him too, though, and it seems like curtains for him until he lands in a mysterious fig tree with fruit that just might help him get his fortune and his fiance back. For sources and links, check out our Patreon, or follow on Twitter. Our theme music is from Carnaval des Animaux, performed by Aitua.

September 19 - A Wonderful Inheritence - A Rev Heys Devotional

This is a devotional taken from "Daily Devotions from the Psalms" written by Rev. John A. Heys, and published by the Reformed Book Outlet in Hudsonville, Michigan. Rev. Heys studied in the Protestant Reformed Seminary under the instruction of Herman Hoeksema and George M. Ophoff. He was ordained to the ministry of the Word, and installed as pastor, in Hope Protestant Reformed Church in Walker, Michigan in 1941. He served consecutively, and under the blessing of God effectively, three other Protestant Reformed churches, till his emeritation in 1980. In his 'retirement' he continued to be of service to the churches, and evidence of which is this set of daily devotions, one for each day of the year, published originally some 25 years ago by the Men's Society of Hudsonville (MI) Protestant Reformed Church, and reprinted here for the spiritual benefit of readers old and new. Scripture passages quoted by Rev. Heys are from the King James Version of the Bible, and the versification of the Psalms to which he refers are from the 1912 edition of the Psalter. May these brief meditations of Rev. Heys serve for the edification of the reader, as they also deepen his appreciation for the psalms-those "immortal songs of the Holy Spirit, those matchless hymns of the Bible which...with their measured language of religious feeling and devotion will abide until the end" (preface to the 1912 Psalter). Reformed Book Outlet Website: www.reformedbookoutlet.com Psalm Choir YouTube Channel: www.youtube.com/user/prpsalmchoir

As a Paralegal and a Certified Financial Planner®, Kraig is uniquely able to assist clients with the careful preparation of asset protection and estate plans. Kraig's team uses a financial-planning approach to ensure that each client obtains the best possible outcomes. With 120 years of combined legal and financial services experience between our team members, we can help you think defensively about protecting your wealth, investments, business intellectual property, and other assets and counsel you through choices you make to prepare for the future. Thanks to the death of private pensions, the devaluation of Social Security benefits and other undeniable retirement factors such as inflation and increased taxes, America is now in a retirement income crisis. Kraig Strom, the host of Personal Pension Radio, is focused on helping you pack your bags for both halves of the retirement journey. Kraig's mission is help you build & protect your wealth and lifestyle today and generationally. Along the way, Kraig is ready to assist with all matters related to your financial wellbeing as well as your business and family legal needs. Optimizing Retirement income and protecting your legacy does not happen with a product. You must have an integrated approach. DISCLAIMER: Kraig Strom is not an attorney or a certified public accountant. Kraig is a Certified Financial Planner Professional®, a Chartered Financial Consultant®, and an Investment advisor representative. As cool as all that may sound, this video is only helpful hints, tips and education. This video is not specific tax, legal or investment advice. Before you decide to take action on anything you see in this video, please consult with your tax, legal or investment advisor first.

A lot has been written about the good fortune of baby-boomers in that, overall, they have enjoyed a long period of economic, share market and property market prosperity. Whilst they haven't enjoyed the full benefit of compulsory super (which only began in 1992), other assets such as property has certainly compensated for that.This means an inheritance tsunami will hit the next generation over the next two decades. Baby Boomers are expected to bequeath $224 billion each year in inheritance by 2050, representing a fourfold increase in the value of inheritances over the next 30 years. This creates a huge financial planning opportunity for many families.At the same time, it invites you to think about the value of assets that you plan to leave your beneficiaries.(A) Planning to receive an inheritanceThere are many factors that you must consider if there's a chance that you may receive an inheritance.Do not rely on it, but certainly plan for itThe size of any potential inheritance and your family's circumstances will typically determine whether it's prudent to rely on receiving an inheritance when developing your personal financial plan.Whilst you might expect to receive an inheritance, we all know that circumstances can quickly change. For example, the expected benefactors (often parents) might end up spending all their money or losing it (poor investments) or changing their mind and leaving it all to charity. Anything can happen.You also must consider your family's circumstances. If there's a risk of conflict (between potential beneficiaries) then it's possible you may not receive what you expect or you may be involved in a long legal battle. Any experienced estate lawyer will tell you how often money issues upset and ruin otherwise well-functioning and happy families. Money and family rarely mix well.How can you factor it into your plans?If you are confident that you will receive an inheritance and that you are unlikely to experience any family conflict, then you may take this into account in your own financial plan. For example, you might be comfortable borrowing additional monies to invest on the assumption that the inherence will assist you in repaying or reducing this debt when you retire. Or perhaps you might prioritise your lifestyle expenditure now (and invest less).I must say that I am often reluctant to include inheritance when developing a financial plan for my clients, because it is just so uncertain – anything can change. If possible, I prefer to develop a strategy that does not consider inheritance and treat it as “icing on the cake” if its ever received.Receive it tax-effectivelyTypically, I prefer my clients to receive all inheritance via a testamentary trust. For this to be an option, a testamentary trust must be included in the benefactor's will. A testamentary trust offers a few advantages.Firstly, it can distribute to minors (your children or grandchildren that are less than 18 years old) and the income or capital gains are taxed at adult tax rates, which means each child can effectively receive circa $20,000 p.a. without paying any tax. This can be a great tax planning tool.Secondly, as it's a discretionary trust, it provides a lot of flexibility as to how income and capital gains are to be distributed which means it's a good gift-making vehicle.And finally, it provides a level of asset protection for the recipients.If you expect to receive an inheritance you need to check with the benefactor whether their will includes a testamentary trust. This can be a delicate conversation and one that is not always possible to have. Sometimes referring them to a good estate planning lawyer can be a good way to indirectly deal with this issue.Record keeping can create nightmares – try to get in front of this issue if you canIt is not uncommon for a client to receive an inheritance from a family member that has owned direct Australian shares for many decades e.g., they purchased CBA or BHP shares when they listed (IPO).If the investor hasn't maintained good records over many decades, it can make it very difficult for my clients to work out the tax cost base for each share holding. It is possible to access share registry information, but it can be time consuming to piece all this information together. Therefore, if you have a family member in this situation, realise that they may struggle to maintain good records as they get older. In this case, it might be advisable to engage their accountant to do this or move their investments onto a wrap platform as it will manage all tax reporting obligations.(B) Planning to leave an inheritanceThis section discusses the matters you may need to consider if you would like to leave some money to your beneficiaries or suspect that you won't spend all your wealth in retirement.Look after yourself firstOften clients tell me that they would like to be in the position to help their children in the future such as helping them buy their first home. This can be one of their main motivations for building their personal wealth.The challenge with planning for this event is that it is often unclear which child will need what help at what time. Therefore, my advice is to look after themselves first and foremost. That is, take all reasonable steps to maximise their own personal wealth. If they do that and put themselves in a very strong financial position, then there will be lots of opportunities available to them to help their children in the future.Most inheritance is received too late in lifeThe average age that people receive an inheritance is 52. By this age, most people have already bought their first home, managed to get their mortgage under control and are very well established. In one sense, most inherences are received too late in life. Therefore, it makes sense to consider gifting monies to your beneficiary's whist you are still alive.I have always thought that struggling to buy your first home is a rite of passage. It teaches people the value of saving, delayed gratification, cash flow management, the power of compounding growth and so on. If you agree with this, then you'll also agree that it's good to help our kids, but not help them too much – we don't want to make it too easy, or they won't benefit from this important life experience.If you do make gifts whilst you are alive, you should ensure that an offset clause is included in your will. This will allow your executor to take into account the gifts you have already made to even up the distribution of your remaining estate fairly.And of course, it's important to have a well-thought-out financial plan to ensure you aren't giving away too much money, too soon and putting your own retirement at risk.How to avoid family conflictThe risk of family conflict is very difficult to predict. As I said above, family and money rarely mix well. But there are some things you can do to minimise this risk.Firstly, be as open as you can about your plans and wishes. If one party is excluded from your will, or will receive less, its best to be upfront about it with them and share your reasonings.Secondly, it is much better to give money away whilst you are still alive. That way you are in control and can deal with any conflict that may arise. You also will enjoy seeing how your gifts help your beneficiaries.Finally, if the risk of conflict is high, keep assets out of your personal name and therefore out of your estate. There are few options to achieve this such as using a family discretionary trust, owning property in joint names (as ownership automatically passes to the remaining joint tenants upon death) and nominating specific people in your super fund's death benefit nomination form i.e., not your estate or personal legal representative.Of course, if you have financial complexity, it is best that you obtain personalised financial and legal advice.A huge transfer of intergenerational wealthOver the next 20+ years, there is going to be a huge transfer of intergenerational wealth. This will create planning opportunities for those receiving this wealth, as well as opportunities to pass remaining wealth onto future generations. Professional management will minimise risk and ensure wealth is maximised.

Entitled Husband Says MY INHERITENCE is "HIS MONEY" but HIS IS NOT MINE

Full Videos - youtube.com/amithejerk?sub_confirmation=1 Learn more about your ad choices. Visit megaphone.fm/adchoices

Entitled Husband Says MY INHERITENCE is "HIS MONEY" but HIS IS NOT MINE

Full Videos - youtube.com/amithejerk?sub_confirmation=1

Marvin Wong from Eden Baptist Church, Cambridge on 27/07/2008

Saved from wrath and saved to an inheritence | 1 Peter 1: 3-7

How do you plan for a smooth transfer of your wealth after you die? And how do you help someone whose loved one has passed on? In this episode, Shray and Deepak explore what you must do in an unfortunate circumstance of a loved one's death, and for an easy transition in case of your own. We also invite Harshavardhan Ganesan, a practicing lawyer, to give us the legal perspective. Listen in for real life anecdotes from covid, succession certificates, legal wills, and some counter-intuitive learnings.

We explore some topics in computer science and relate our experiences delving into this daunting subject. References: Codesmith: https://codesmith.io/ OOP: https://searchapparchitecture.techtarget.com/definition/object-oriented-programming-OOP#:~:text=Object%2Doriented%20programming%20(OOP)%20is%20a%20computer%20programming%20model,has%20unique%20attributes%20and%20behavior. Functional programming: https://www.geeksforgeeks.org/functional-programming-paradigm/#:~:text=Functional%20programming%20is%20a%20programming,is%20%E2%80%9Chow%20to%20solve%E2%80%9D. Inheritence: https://www.computerhope.com/jargon/i/inheritance.htm#:~:text=In%20object%2Doriented%20programming%2C%20inheritance,is%20known%20as%20a%20subclass. Package dependency: https://developer.apple.com/documentation/swift_packages/package/dependency Max MSP: https://cycling74.com/ Supercollider: https://supercollider.github.io/ Godel, Escher, Bach: https://en.wikipedia.org/wiki/G%C3%B6del,_Escher,_Bach Anathem by Niel Stephenson: https://en.wikipedia.org/wiki/Anathem UW CSE142: https://courses.cs.washington.edu/courses/cse142/21sp/ AI episode: https://www.post-wave.com/episode-7-artificial-superintelligence 3blue1brown on neural networks: https://www.youtube.com/watch?v=aircAruvnKk&vl=en Outro music - Dreaming of Zeno by Trevor Villwock: https://soundcloud.com/trevor-villwock/dreaming-of-zeno

GETTING GOD'S PEOPLE, THE CHURCH, TO FOCUS ON LIVING AND SHARING OUR FAITH WITH THE NEXT GENERATION.

Most people acknowledge that a will is an important document to create, but we all hope there’s no urgency to prepare it. As such, many people rarely ‘get around’ to it.One of the reasons for this is they don’t know enough about it and how to get started. This blog answers commonly asked questions and matters that should be considered when drafting estate planning documents.Rules are State basedThe laws that govern the administration of wills and intestacy (if you die without a will) is the State’s jurisdiction. This means rules may vary from state to state.Generally, if you die without a will, it is referred to as dying intestate. There are many adverse consequences of this including your assets being distributed in a way that you would not otherwise agree with. In addition, it creates unnecessary work and complexity for surviving family members to arrange probate.Simple circumstances requires a simple willIf your situation is simple, you only need a simple will. Simple means that you do not have significant assets, you do not have any specific beneficiaries or financial dependents. In this situation, typically, a template will should be satisfactory. You can purchase these online for approximately $200. Make sure your will is witnessed correctly.However, the more assets you have (in terms of value), the greater the need for personalised legal advice. Like in many situations, often it’s what you don’t know that could cause problems.Kids complicate mattersIf you have children (or are contemplating having children), you should engage a lawyer to draft your will. Not only do you need to ensure that all financial dependents will be looked after, but you must address guardianship of your children. In the event that you and your spouse1 pass away, who will be the legal guardian of your children? This is an important decision which must be included in your will.I would typically advise people with children to insert a testamentary trust into their will. A testamentary trust is a special discretionary trust that is created upon death. The will maker can permit the executor to transfer the estate assets into the testamentary trust. Testamentary trust’s provide serval advantages including taxation savings (discussed below) and asset protection benefits.Blended families complicate matters furtherA blended family includes situations such as:both spouses have children from a previous relationship; and/orone spouse has children from a previous relationship as well as children with their current spouse.Blended family arrangements can create a myriad of potential risks that must be considered and addressed when drafting estate planning documents. Anyone in this situation must seek personalised legal advice from an experienced estate planning lawyer.Beneficiaries with special needsIf you have beneficiaries or financial dependants with special needs such as a child with a disability, battling addiction, mental health or similar issues, it is very important that you receive personalised legal advice.Ways to minimise the likelihood of family conflictMoney and grief do not mix well. Otherwise healthy family relationships can turn sour when money is involved. But there are some steps you can take to minimise the chance of your family members fighting over your estate.Have difficult conversations You invite conflict if your wishes surprise your beneficiaries. The best thing to do to avoid this is be brave and have (sometimes difficult) conversations so that everyone knows your wishes before you pass away. For example, if you intend to exclude someone that may expect to be a beneficiary, distribute your estate unevenly or leave specific assets to certain people, be as open as you can about this.Use offset clauses in your will If one of your beneficiaries (often children) has received a higher level of financial support or an early inheritance, then offset clauses can equalise entitlements across all beneficiaries, if that is your wish.An offset clause will say something to the effect that any support already received by a beneficiary will reduce their entitlement. It is important to maintain clear records that are readily available to your executors. If possible, making all beneficiaries aware that any financial support you provide whilst you are alive will reduce their entitlement under your will is helpful.Keep assets out of your estate Your will covers the assets in your estate. Typically, that includes any assets owned by you personally. Assets that are not included in your estate include:assets held in a discretionary family trust that you are not presently entitled to;monies held in superannuation; andassets owned jointly with other parties e.g. the family home. When a joint owner passes, ownership automatically passes to any surviving joint owners.Therefore, if you are worried that your will could be challenged or could create family conflict, the best thing to do is minimise assets that are owned by you personally.Make gifts while you are alive Gifting monies or assets whilst you are alive is one way to avoid any potential conflicts. This also provides some practical benefits. Firstly, it’s likely that receiving monies sooner often assists your beneficiaries. Secondly, you will enjoy witnessing the positive outcomes that these gifts create.Superannuation death benefit nominationsSuperannuation monies are not included in your estate. Instead, the trustee of your super fund must decide who to pay your superannuation monies to. As such, most super funds allow members to complete “binding death benefit nominations”. Often these nominations must be updated every 3 years.Your nomination options include your spouse, children, interdependent relationships (i.e. where you provide financial and domestic support) or your estate. In most circumstances, it is advisable to nominate a financial dependant/s (spouse and/or children), as this will ensure the benefit payment will not be taxed.Steps you can take if you expect to receive an inheritanceIf one of my clients is to receive an inheritance, it would be my preference that they receive this in a testamentary trust.The main benefit is that a testamentary trust can distribute income and capital gains to a minor and they are taxed at adult tax rates. This means children and grandchildren under the age of 18 can receive approximately $20,000 p.a. tax free.Therefore, if you expect to be included as a beneficiary under a will, it is in your best interest to ensure the testator (e.g. your parents or family member) has included a testamentary trust in their will. I appreciate that this can sometimes be a difficult subject to discuss with family.Flexible will plus a letter of wishesIt is advantageous that wills provide wide powers so that your executor is able to achieve the outcomes that you desire. For example, if one of my sons becomes addicted to gambling or drugs, I don’t want my executor giving them large sums of money. That is why you don’t want to be too codified in your will.Instead, I prefer to keep my will such that the executor/s has wide powers as well as providing my executor with a letter of wishes. A letter of wishes is a non-binding document that sets out the manner in which you wish your executor to exercise their discretion. It can include any and all information that you feel is relevant. It might address the circumstances when, and when not to, distribute monies and any other matters. You don’t need a lawyer to draft a letter of wishes. You can draft it yourself and update it at any stage.Power of attorneyIt is important that you and your spouse have enduring (1) financial and (2) medical power of attorney’s so that important decisions can be made, and documents executed, in the event that you are not available or able to do so for yourself.Review your will regularlyA will must be prepared to accommodate your current circumstances and wishes. It is not always possible to draft a will that will accommodate all possible circumstances. For example, if you have young children your will might be structured differently than if you had well-established, adult children. Therefore, you need to review your will every 1-2 years to ensure its still current and the executors are still appropriate.Most potential problems can be avoided with good planning and adviceMaking sure that your estate planning documents are set up correctly really doesn’t take a lot of time. Also, it would be unlikely that you would need to make any substantial changes to them more often than every 10 years or so. Often it doesn’t need to be complex. A small amount of time invested in making sure your affairs are in order can save your family members a lot of heartache.

GETTING GOD’S PEOPLE, THE CHURCH, TO FOCUS ON LIVING AND SHARING OUR FAITH WITH THE NEXT GENERATION.

58th New York Film Festival: Part One - Lovers Rock, Time, On The Rocks, MLK/FBI, Malmkrog plus MORE

On this episode, we discuss the first 7 films we saw at the New York Film Festival!

“Life insurance creates an estate in an instant.” If you have life insurance, even if you were living to paycheck to paycheck, your family will have the money they need to go on. This is not a “get rich quick” scheme, this is a “protect your family against the odds” opportunity. If something were to ever happen to you, life insurance ensures that your family will never be floundering financially in the midst of mourning the loss of you. At 13:00, Stacey discusses the value of completing the free directive you can complete that will specifically state what your decisions are for your health and your life should you ever fall into a state where you cannot speak for yourself. If you would like to fill that out, please visit https://mydirectives.com/ To get on the waitlist for the Emergency Info File course:https://www.gotittogethernow.com/GotItTogetherNowWaitlist544459-3038 If you are interested in being a guest, with a story to tell, go to the website and complete the Storyteller Application. at https://legacytherapypodcast.com/getinterviewed If you are a service professional and would like to be a guest, please complete the Industry Professional Application at https://legacytherapypodcast.com/getinterviewed To get in touch with Bill, please call or email him:lorenzinsurance@gmail.com949-394-7676

The team hunts for a band of criminals re-enacting the SLA kidnapping of Patty Hearst. Hondo experiences discrimination from a fellow officer during a training seminar in Arizona.

05. Are YOU the Problem? How Legacy Plays A Direct Role In Our Divided Society

Are YOU the problem? DO YOU BELIEVE EVERY DECISION or ACTION TAKEN….FROM THE PEOPLE that WE LEAD….is a LEARNED BEHAVIOR? The way we speak, the way we act, the way we react, the way we treat others…..is absolutely a learned behavior.Our actions teach the people we lead, whether the world is a loving place or a fearful place. Our actions towards others, teaches the people we lead, whether or not to trust those people and by the way we REACT, ultimately influences the child's outlook on life.THE REACTIONS YOU ARE SEEING IN THIS WORLD TODAY ARE LEARNED BEHAVIORS….and those learned behaviors can only be changed one way…….BY YOU!The separation in our society….points back to one reason! There is a difference between LEAVING A LEGACY, versus LEAVING an INHERITENCE. What you do today has a direct effect on the LEGACY or INHERITENCE you leave behind tomorrow. One of those two things is FAR more important than the other. Listen to Episode # 5 to learn more.

Royal Identity: Stepping Into Our Inheritence (Clint Schwartz)

Pastor Clint speaks on how to transition from an orphan to a child of God. Message recorded April 19, 2020 | More info: www.lighthousevineyard.church --- Send in a voice message: https://anchor.fm/lighthousevineyard/message

Do you have a collection? Have you thought about what you want to happen to it when you die? Is the collection only of value to you? An investment? What is the point of it? Join Mike the Llama and Dr. Brant Raven as they prick the bubble of what will happen to your collections when you die? It's not as morbid as it sounds ;)

An Inheritence That You Should Think About More Often

Christians have a legacy to pass on more valuable than money and everlasting for all generations. What treasure are you storing up for your family?

This week, Catherine Ann Cullen reads her poem Inheritence, written for her mother

May 25, 2019 – PA Inheritence Tax on Step-Children? Advisor Didn’t Take Enough to Meet RMDs – Now What? Best Way to Transfer Home to Siblings? Can He Trust his Old Employer to Pay him his Pension? Bucket O’ Listener Questions – Part 1

Gene answers tons of listener questions: Rules for selling a home income tax freeSold a revocable trust and wants to ‘exit’Basics of crafting a diversified portfolio?Ok for husband and wife to have different financial advisors?Tons of great listener questions? For our More than Money Audience Free Second Opinion Meetings Social Security ReviewMedicare ReviewInvestments ReviewRetirement ReviewLife Insurance ReviewLong Term Care Insurance ReviewEstate Planning ReviewIncome Tax ReviewComplete Financial Picture Review Do you want a free second opinion meeting with a More than Money advisor? Call today (610-746-7007) or email (Gene@AskMtM.com) to schedule your free review

May 25, 2019 – PA Inheritence Tax on Step-Children? Advisor Didn’t Take Enough to Meet RMDs – Now What? Best Way to Transfer Home to Siblings? Can He Trust his Old Employer to Pay him his Pension? Bucket O’ Listener Questions – Part 2

Gene answers tons of listener questions: Rules for selling a home income tax freeSold a revocable trust and wants to ‘exit’Basics of crafting a diversified portfolio?Ok for husband and wife to have different financial advisors?Tons of great listener questions? For our More than Money Audience Free Second Opinion Meetings Social Security ReviewMedicare ReviewInvestments ReviewRetirement ReviewLife Insurance ReviewLong Term Care Insurance ReviewEstate Planning ReviewIncome Tax ReviewComplete Financial Picture Review Do you want a free second opinion meeting with a More than Money advisor? Call today (610-746-7007) or email (Gene@AskMtM.com) to schedule your free review

Series - Believe Speaker - Dwayne Gibbs

Can the apple fall far from the tree? On inter-generational scripts

Can the apple fall far from the tree?Which behaviors and values did we inherit from our parents and what can we do about it?In this talk I will explain several theories of inter-generational transmission of scripts so you can better understand how you are operating. Examples are given from the clinic and my life. Practical tips will help you find ways in which you expand your repertoire in your personal and professional life.Recorded live on Facebook.www.potentialstate.comhttps://www.psychologytoday.com/intl/blog/the-other-side-relationshipshttp://podcast.potentialstate.com/https://www.youtube.com/channel/UCXwdZhwQFgUcRQgZoI_L2Uwhttps://www.facebook.com/ThePotentialStatehttps://twitter.com/assaelSupport the show (https://www.paypal.com/cgi-bin/webscr?cmd=_s-xclick&hosted_button_id=Q5AG6K7L8GYKA&source=url)

15 - 'The House of the Seven Gables' by Nathaniel Hawthorne (1851)

Inside: Whigs as Zombie Federalists. The Eminem of the "Jump Jim Crow" dance. Inheritence as control by the dead. 19th century amusements: soap bubbles still hot. Trains will make homes obsolete and the telegraph was the internet. feat. @Alecks_Guns and @MattLech Sources: Cook, Jonathan A. "“The Most Satisfactory Villain That Ever Was”: Charles W. Upham and The House of the Seven Gables." The New England Quarterly 88, no. 2 (2015): 252-285. David Grant. "The Death of Anti-Whiggery in The House of the Seven Gables." ESQ: A Journal of Nineteenth-Century American Literature and Culture 63, no. 1 (2017): 79-117. https://muse.jhu.edu/ Ashby, LeRoy. With Amusement for All: A History of American Popular Culture since 1830. University Press of Kentucky, 2006. http://www.jstor.org/stable/j.ctt2jcqsr. Utopian Socialists by Youtuber 'robert King' https://www.youtube.com/watch?v=gRrHBScLhQA

BEYOND the DARKNESS takes a final look at the Kennedy Assasination on it's 55th Anniversary as we investigate The Inheritance: Poisoned Fruit of JFK's Assassination with Christopher Fulton. LISTEN ANYTIME HERE--> Christopher Fulton's journey began with the death of Evelyn Lincoln, late secretary to President John F. Kennedy. Through Lincoln, crucial evidence ended up in Christopher's hands. Fulton had possession of the closest physical evidence to President Kennedy's fatal head wounds and was the first person since Robert F. Kennedy to listen to JFK's secret Oval Office recordings. Get the book here: https://www.amazon.com/Inheritance-Poisoned-Fruit-JFKs-Assassination/dp/1634242173/ref=sr_1_1?ie=UTF8&qid=1542237272&sr=8-1&keywords=Inheritance-Poisoned-Fruit-JFKs-Assassination Support our sponsors for great deals!! Ladies, the future of at-home hair color is here with Madison Reed - Gorgeous salon-quality hair color delivered right to your door for less than $25! Find your perfect shade at www.Madison-Reed.com & get 10% off plus free shipping with code: DARKNESS at checkout Sign up now with Pluto.tv for the leader in FREE Streaming Television, over 100 free TV channels & 1000's of of free movies On Demand www.Pluto.tv When you're ready to buy a new or used car, check out TrueCar and enjoy a more confident car-buying experience. SAVE 30% at Loot Crate for the coolest Pop Culture Swag! www.LootCrate.com/Darkness Use Code: DARKNESS at checkout for 30% off your subscription. Get 20% off your first order. BOMBAS.COM/ DARKNESS and code: DARKNESS Check out Adam and Eve dot com today for this special offer. Get 50% off one item when you type DARKNESS for the offer code upon checkout. When you do, you'll get 3 FREE DVDs, a FREE extra gift and FREE shipping. Just use offer code DARKNESS at Adam and Eve dot com. That's DARKNESS at Adam and Eve dot com See omnystudio.com/listener for privacy information.

The Inheritance: Poisoned Fruit of JFK's Assassination

BEYOND the DARKNESS takes a final look at the Kennedy Assasination on it's 55th Anniversary as we investigate The Inheritance: Poisoned Fruit of JFK's Assassination with Christopher Fulton. LISTEN ANYTIME HERE--> Christopher Fulton's journey began with the death of Evelyn Lincoln, late secretary to President John F. Kennedy. Through Lincoln, crucial evidence ended up in Christopher's hands. Fulton had possession of the closest physical evidence to President Kennedy’s fatal head wounds and was the first person since Robert F. Kennedy to listen to JFK’s secret Oval Office recordings. Get the book here: https://www.amazon.com/Inheritance-Poisoned-Fruit-JFKs-Assassination/dp/1634242173/ref=sr_1_1?ie=UTF8&qid=1542237272&sr=8-1&keywords=Inheritance-Poisoned-Fruit-JFKs-Assassination Support our sponsors for great deals!! Ladies, the future of at-home hair color is here with Madison Reed - Gorgeous salon-quality hair color delivered right to your door for less than $25! Find your perfect shade at www.Madison-Reed.com & get 10% off plus free shipping with code: DARKNESS at checkout Sign up now with Pluto.tv for the leader in FREE Streaming Television, over 100 free TV channels & 1000's of of free movies On Demand www.Pluto.tv When you’re ready to buy a new or used car, check out TrueCar and enjoy a more confident car-buying experience. SAVE 30% at Loot Crate for the coolest Pop Culture Swag! www.LootCrate.com/Darkness Use Code: DARKNESS at checkout for 30% off your subscription. Get 20% off your first order. BOMBAS.COM/ DARKNESS and code: DARKNESS Check out Adam and Eve dot com today for this special offer. Get 50% off one item when you type DARKNESS for the offer code upon checkout. When you do, you’ll get 3 FREE DVDs, a FREE extra gift and FREE shipping. Just use offer code DARKNESS at Adam and Eve dot com. That's DARKNESS at Adam and Eve dot com See omnystudio.com/listener for privacy information.

01.05.18: Family will finally get $846k inheritence lost by UPS

A Canadian family whose $846,000 inheritance was lost by UPS will finally get the cash back from their bank, 10 months after their ordeal started. --- Send in a voice message: https://anchor.fm/ecommerceminute/message Support this podcast: https://anchor.fm/ecommerceminute/support

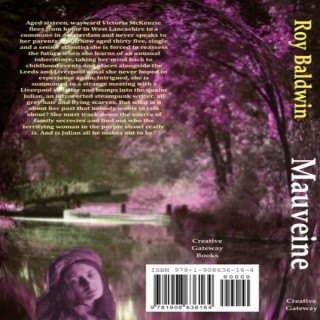

Still in Liverpool, Victoria and Abby agree to hire a car and drive immediately to Parbold to search out the elderly lady, identified by solicitor Lynton Grey, who holds the conditions for Victoria’s potential inheritance of Orsbrick Hall. But along the way, the strange woman in the purple shawl appears again and not where Victoria, inside her remotest dreams, could have remotely envisaged. Unexpected revelations from Abby persuade Victoria to keep calm and they continue to Appleby Lodge to find the mysterious Eveline West, who reveals not only her true identity but the most astonishing secrets and tales of the McKenzie family which Victoria cannot believe possible. She now has to make the most important decision of her life.

Feb 18 - Inheritence - Won't You Be My Neighbour by Freedom House

Jan 1 - Inheritence by Freedom House

Cohabiting Couples in Ireland.......Avoid a Shocking Big Tax Bill

Hi Guys, Thanks for tuning in to Episode 11 of the Informed Decisions Podcast. In this episode we will share with you one of the largest and most unknown potential tax that cohabiting couples can be faced with, and a few pointers on your options to help ensure it's never an issue for you. Please continue to share on social media and spread the word, our listener numbers are increasing every month, meaning we are getting this info out to the millennials of Ireland, who seemingly want it! Thanks all, Paddy. www.informeddecisions.ie Link to Revenue Website and further info regards the Family Home/Dwelling Relief: http://www.revenue.ie/en/tax/cat/leaflets/cat10.html

Show #108, Hour 1 | Guest: Joshua Gamson is an award-winning author of four books: Modern Families (New York University, 2015), Claims to Fame: Celebrity in Contemporary America (California, 1994); Freaks Talk Back: Tabloid Talk Shows, and Sexual Nonconformity (Chicago, 1998). Gamson’s work has been published in magazines such as “The New York Times Magazine” and “The American Prospect.” Gamson is a professor of Sociology at the University of San Francisco, where he moved in 2002 after nine years on faculty at Yale University. He has been a Guggenheim Fellow (2009-10) and is a 2015-16 Fellow at the Stanford Center for Advanced Study in the Behavioral Sciences | Show Summary: Angie interviews author and professor Joshua Gamson on his latest book, Modern Families: Stories of Extraordinary Journeys Through Kinship.

Sean and Derek take some listener questions, and dig into DRY. DRY Single Responsibility Principle (SRP) Inherited Resources Sandi Mets - All The Little Things Sign up for Sandi Metz's "Chainline" newsletter Sunk cost fallacy "Inheritence is not for sharing code" Eric Hayes' Rails PR Larry Bird Thanks for sending us your questions and feedback. Got more? You can email us at hosts@bikeshed.fm or tweet us.

Sunday Sermon 04-07-2013 Your Inheritence Is Imperishable, Undefiled, Unfading!

1 Peter 1: 3-9

02.11.2008 - Realise Our Inheritence Through Jesus' Sonship [Thai]

อ. กนกอร มูดี

02.11.2008 - Realise Our Inheritence Through Jesus' Sonship

Pastor Nok Moody