Podcasts about Ridgeway

- 434PODCASTS

- 973EPISODES

- 34mAVG DURATION

- 1EPISODE EVERY OTHER WEEK

- Feb 12, 2026LATEST

POPULARITY

Best podcasts about Ridgeway

Latest news about Ridgeway

- Should the Saints bring back John Ridgeway? Yahoo! Sports - Feb 12, 2026

- ABC diamond geezer - Feb 5, 2026

- [Costco] AAA Striploin whole $30.99/kg - $45 off - Costco Mississauga West RedFlagDeals.com Forums - Hot Deals - Dec 13, 2025

- Volvo Cars x Sergio Hudson: Power Dressing Meets Scandinavian Design JustLuxe: Luxury News and Reviews - Oct 14, 2025

- Skeptical Science New Research for Week #34 2025 Skeptical Science - Aug 21, 2025

- Barry Jenkins in Focus: His 7 Most Striking Films No Film School - Jul 29, 2025

- Construction Begins On Willow At The Ridgeway In Yonkers New York YIMBY - Jun 26, 2025

- Cat Ridgeway on touring and telling her story ahead of X-Ray Arcade show OnMilwaukee: homepage - May 9, 2025

- Uproar as Wisconsin cops pick up rural homeless and 'dump them' in cities Raw Story - Celebrating 18 Years of Independent Journalism - Apr 24, 2025

- Cat Ridgeway – “Sprinter” We All Want Someone To Shout For - Mar 12, 2025

Latest podcast episodes about Ridgeway

Residents of Johannesburg's southern suburbs will hold a peaceful protest over ongoing water outages

Residents of Johannesburg's southern suburbs will this morning hold a peaceful protest over ongoing water outages. Communities from Mulbarton, Robertsham, Ridgeway, Ormonde and Winchester Hills are gathering to demand reliable water supply and better communication from Joburg Water and Rand Water. Elvis Presslin spoke to Joburg southern suburbs community representative, Zubair Patel

She told them to call her back when they got to the “tankini” and so - here we are. The longest running Morgan, Lindsay Ridgeway, shares her experience filming that infamous Season 7 scene, while trying to figure out the random dramatic moments that seemed to go nowhere in the show’s final season. Lindsay also opens up about the online reaction to her taking over the mantle of Morgan, and reveals her definitive response to anyone who thinks she made the character “meaner.” We’re getting a raw and honest perspective from the youngest member of the Matthews family, right here on a new Pod Meets World! Follow @podmeetsworldshow on Instagram and TikTok!See omnystudio.com/listener for privacy information.

This show has been flagged as Clean by the host. With winter in full swing in the UK, Dave and Kevie continue their look at winter warmer ales with a review of a couple of British Barley Wine ales. Dave samples Ridgeway's Criminally Bad Elf whilst Kevie tries out a lmited release from Chiltern Brewery Roger Bodger's Barley WIne. Connect with the guys on Untappd: Dave Kevie The intro sounds for the show are used from: https://freesound.org/people/mixtus/sounds/329806/ https://freesound.org/people/j1987/sounds/123003/ https://freesound.org/people/greatsoundstube/sounds/628437/ Provide feedback on this episode.

In this expansive and entertaining chat, Elizabeth and James Duncan, Gabriel Ricard and Kevin Ridgeway talk about ther book We Have Waited Long Enough as well as others of their works, and treat us to some readings as well. And, in usual Meat For Teacast style, the conversation takes twists and turns and ends up on the four questions...ANSWERS/Kevin Ridgeway:Current Book: 1. Moonglow A Go-Go, by Joan Jobe Smith 2. The Grifters, by Jim Thompson3. Finding God In Arby's, by John Dorsey 4. Waiting on Hummingbirds, by James Benger & Jason Baldinger Current Music: 1. Surf's Up (1971), The Beach Boys 2. Naturally (1971), JJ Cale 3. Feats Don't Fail Me Now (1974), Little Feat4. Link Wray (1971), Link WrayCurrent Shows:1. I Think You Should Leave with Tim Robinson2. The Daily Show 3. South Park 4. Shameless ANSWERS/James Duncan:Book: It's The End Of The World As We Know It: New Tales of Stephen King's The StanTV: Ludwig (British mystery/comedyMusic: The Replacements "Let It Be"Buy the book through James' website: https://www.jameshduncan.com/books

Hour 2: Saints DT John Ridgeway picked Scrim from Zeus' Rescues for "My Cause My Cleats"

Mike and Mike promoted the NFL's "My Cause My Cleats" weekend and spoke to former WDSU chief meteorologist Margaret Orr about Saints DT John Ridgeway's charity choice. The guys interviewed D. Orlando Ledbetter, a Falcons beat writer for The Atlanta Journal-Constitution, about the Saints' NFC South showdown against the Falcons.

[FLASHBACK] Austin Sigg : le monstre au visage enfantin

Jusqu'à quel point une mère peut-elle tolérer les agissements de son enfant ? Où est la limite entre le jeu et la perversité ? Mindy Sigg, maman d'un jeune meurtrier, n'a pas hésité à prendre le téléphone, contacter le 911 lorsque son fils, Austin, lui a avoué toute l'horreur de son crime. Pourtant, il y a certains signes qui ne trompent pas. Ce que Mindy Sigg prenait pour un jeu, était en réalité la préparation minutieuse du crime le plus odieux que la petite ville de Westminster, dans le Colorado, allait connaître. Le meurtre de Jessica Ridgeway 10 ans, violée, tuée, puis démembrée par un jeune adolescent de 17 ans. Ce meurtre abominable va stupéfier l'Amérique...Crimes • Histoires Vraies est une production Minuit. Notre collection s'agrandit avec Crimes en Bretagne, Montagne et Provence.

Today's guest is Indie rocker Cat Ridgeway out of Orlando, FL. I discovered her and her music very recently and in particular her single - What If? I was amazed by the lyrics and the depth of thinking about reality in them. I then went on to listen to many other songs and loved them all. So, I asked if we could chat and here we are....We talk about how she got started in music, her career, how I found her through her duet with Shawn Mullins (another MUST listen) and how she had worked with him, how Indie artists make a living in music at all and about the magic of synergies and life in general - and how music is an important aspect of that magic. If you would like to find out more about Cat - visit her website at www.catridgeway.com.Cat's recent album is called Sprinter and its an awesome Indie rock delight from start to finish. Check out her music...Listen to What If?? at https://www.youtube.com/watch?v=oDhl52BHj1UListen to the duet with Shawn Mullins at https://www.youtube.com/watch?v=RfqTAuw9PgoBuy me a cup of coffee and keep up with me here: https://www.buymeacoffee.com/EarthMagicbrno -One off donation: https://www.paypal.com/paypalme/earthmagicbrno - Buy some merchandize - https://earth-magic-brno.myspreadshop.co.uk/Become a supporter of this podcast: https://www.spreaker.com/podcast/the-magical-world-of-g-michael-vasey--4432257/support.

STEM Everyday #308 | Automation in Education | feat. Chuck Ridgeway

Chuck Ridgeway is the Automation Technology Manager & Senior Customer Advocate at Horner Automation in Indianapolis, Indiana. As an engineer in the automation and robotics industry for over 30 years, Chuck has seen both the changes and valuable uses of automation and robotics in our world, and is an important voice for educators to hear about the value of STEM learning for future careers.Horner Automation has been part of some truly unique projects in their many years in the industry, creating hardware and software that helps make businesses to homes to schools run smoothly. Their sensors, controllers, and automation have been involved with everything from major sports stadiums, Las Vegas resort attractions, cruise ships, and snowmaking at ski resorts, to the US postal service, agricultural facilities, various food & beverage producers, water/wastewater facilities, power management and fuel storage. Horner is currently offering, free for qualifying educational institutions, one of their powerful Horner Controllers to help eliminate lab-time bottlenecks and time limitations. The use of an OCS as part of our Academic Program makes it easy and cost-effective for each student to have their own lab equipment and be able to meet their requirements for your automation educational program. Learn more about it at hornerautomation.com/product/academic-programConnect with Chuck & Horner Automation:Website: hornerautomation.comHorner's Education Resources: hornerautomation.com/product/academic-programYouTube: Horner Automation YouTube LinkedIn: linkedin.com/in/chuck-ridgeway-79993210Chris Woods is the host of the STEM Everyday Podcast... Connect with him:Website: dailystem.comTwitter/X: @dailystemInstagram: @dailystemYouTube: @dailystemGet Chris's book Daily STEM on AmazonSupport the show

Kicking off the episode with some terrible audio after the session crashed, Sam and Max chat the latest from some new friends of the show, look back at a stormy Big Pineapple Festival, and then analyse the best of the internet's favourite pop-punk-turned-pop darling, Hayley Williams.Follow along with the songs we discuss with this week's Spotify Playlist.Discover more new music and hear your favourite artists with 78 Amped on Instagram and TikTok.

On the lonely roads of Ridgeway, Wisconsin, drivers have reported chilling encounters for more than 150 years. A phantom figure—sometimes a man, sometimes a shapeless mist—appears without warning, only to vanish as quickly as it came. Known simply as the Ridgeway Ghost, its legend is steeped in 19th-century murders, frontier justice, and a community terrorized by what they believed was a restless spirit.Is the Ridgeway Ghost a product of folklore passed down through generations, or is there truly something lurking on those rural Wisconsin roads? Tonight, we follow the trail of one of the Midwest's most enduring hauntings. LINKS FOR MY DEBUT NOVEL, THE FORGOTTEN BOROUGHwww.hauntedamericanhistory.comBarnes and Noble - https://www.barnesandnoble.com/w/the-forgotten-borough-christopher-feinstein/1148274794?ean=9798319693334AMAZON: https://www.amazon.com/dp/B0FQPQD68SEbookGOOGLE: https://play.google.com/store/books/details?id=S5WCEQAAQBAJ&pli=1KOBO: https://www.kobo.com/us/en/ebook/the-forgotten-borough-2?sId=a10cf8af-5fbd-475e-97c4-76966ec87994&ssId=DX3jihH_5_2bUeP1xoje_SMASHWORD: https://www.smashwords.com/books/view/1853316 !! DISTURB ME !! APPLE - https://podcasts.apple.com/us/podcast/disturb-me/id1841532090SPOTIFY - https://open.spotify.com/show/3eFv2CKKGwdQa3X2CkwkZ5?si=faOUZ54fT_KG-BaZOBiTiQYOUTUBE - https://www.youtube.com/@DisturbMePodcastwww.disturbmepodcast.com YOUTUBEhttps://www.youtube.com/@hauntedchris TikTok- @hauntedchris LEAVE A VOICEMAIL - 609-891-8658 Twitter- @Haunted_A_H Instagram- haunted_american_history email- hauntedamericanhistory@gmail.com Patreon- https://www.patreon.com/hauntedamericanhistory Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

In this episode of Backstage, Regina Botros speaks with Gabrielle Scawthorn, the writer and director of The Edit, and Matilda Ridgeway, one of its powerhouse performers. The Edit, now on stage at Belvoir, is a sharp, provocative work born from Gabrielle's deep dive into the world of reality television. Drawing on countless interviews, the play explores the blurred lines between truth and performance, and what happens when our lives become content.

Why Does America Have The Most Serial Killers? Part 2: Bureaucracy, Guns & Pop Culture

Why Bureaucracy, Hollywood, and the NRA Helped Serial Killers ThriveWhy does America remain the global epicentre of serial killers? In Part Two of Psycho Killer: Shocking True Crime Stories, Simon Ford and Jacques Morrell uncover how bureaucracy, pop culture, and gun culture shaped the rise of American serial murderers.From the FBI's behavioural profiling to the National Rifle Association's influence, from Hollywood's romanticisation of killers to the chilling question of whether Millennials and Gen Z will break the cycle, this episode digs deeper into America's darkest shadows.We examine cases where red tape let killers roam free, the dangerous glamorisation of Bundy and Dahmer, and how easy access to firearms made serial murder uniquely lethal in the United States.Support us on Patreon for just £5 a month.TranscriptWhat if the system that's meant to protect you is the very thing that lets a killer slip through the cracks? What if the weapons are legally bought and the warning signs ignored? What if Hollywood's obsession with serial murder isn't just entertaining, but prophecy? In Part Two of 'Why Does The United States Have More Serial Killers Than Any Other Country On Earth?' we ask: has America created the perfect breeding ground for serial murderers and psychopaths? And as we race towards 2030, is there still time to stop the next one? But before we dive in, a quick shout out to our friends at Podcast Today, that's podcast dot today. They featured our Ian Huntley episode, 'A Psychopath at School', in their Quick Listens category. If you love discovering new true crime stories, head to podcast dot today and see what else they've lined up. It's free, it's daily and it's curated just for you. Welcome back to Psycho Killer: Shocking True Crime Stories. I'm Simon Ford and I'm Jacques Morrell. If you haven't heard part one yet, hit pause and listen to that first. We explored the growth of suburbia, the aftershocks of war, and the cracks in American policing. Today, in part two, we widen the lens. Bureaucracies that enable killers. Pop culture that glorifies them, guns that empower them, and a generation that might just change everything. Welcome to NBC News Daily. This Tuesday, we're going to start with breaking news. Quadruple murder suspect Austin Drummond is in custody after an intense days long manhunt in Tennessee. Drummond was wanted for the killings of four people, all members of the same family. We've talked about fragmented law enforcement. We've examined the challenges of jurisdictional chaos and under-resourced police departments. But there's another, less visible force at play in the story of America's serial killers. Something deeper, something colder. Bureaucracy? Yeah. Killer bureaucracy. It might sound like the title of a dystopian novel, but in real life, it's one of the quiet enablers of mass murder. Behind many of America's most notorious cases, you'll find crucial opportunities missed, not through lack of intelligence or even intent, but because the gears of the system ground too slowly or didn't turn at all. I think Mr. Little will get his final judgment. Before he died at 80 year old Samuel Little sketched the faces of the women he killed. And I'm sure these jurisdictions will go and try to connect the dots to deal with what he's come to. Take Samuel Little, for example. Officially recognised as America's most prolific serial killer. 89 confirmed victims, possibly over 90. He operated across state lines from the 1970s into the 2000s, murdering vulnerable women, mostly women of colour. And yet, for decades, law enforcement agencies failed to connect the dots. Why? Well, part of it is what we've already discussed decentralised policing. But even what agencies did have the information, there was no unified system compelling them to share that information in a usable way. For much of Little's killing spree. His victims weren't even being recorded as linked cases. And here's the irony. In 1985, the FBI launched ViCAP, the violent criminal apprehension program designed specifically to catch serial offenders by identifying patterns in unsolved cases. But ViCAP was optional. Local departments weren't required to use it. Many didn't. There are 60 confirmed victims so far. Authorities will continue the hunt for the dozens of others. It won't stop, even though little is dead. You know, you just take in for what it's worth. And people like me live with that. And that's bureaucracy for you. A powerful tool. Locked in a cupboard. Because nobody mandate the key. The FBI is still actively searching for information to connect the dots in several of Little's murders. If you have any information, call this number one 800. Call FBI. The weekend I picked up a woman backpack, I weighed. And Matthew was next to me in the seat, and she hopped in. And then two and three. And my son was there, and I killed her. They'll. Sure my son didn't see it, but that only happened one time. So why didn't you do it again? I didn't want my son to see it. And that brings us to something that should chill. Anyone listening to this? In the case of Gary Ridgeway, the green River killer, dozens of women died while multiple police departments worked in silos hoarding information. Detectives even suspected Ridgeway early on. But internal politics and procedural rigidity meant he slipped through their fingers. He kept getting interviewed, kept passing polygraphs. He even gave a cheek swab DNA sample in 1987, but they didn't have the resources to process it properly. Not until the early 2000. That delay. It wasn't because no one was working the case. It was because the system was working exactly as designed, just too slowly. And there's something tragic about that. These weren't rogue officers. This wasn't corruption. This was paperwork. Process. Budgetary constraints. Misalign and incentives. In short, bureaucracy. Now, let's be fair. There have been improvements. ViCAP is more widely used now. DNA databases are better integrated, but there's still no national mandate for data sharing in violent crime investigations. You've still got over 18,000 separate law enforcement agencies in the United States, and no centralised leadership structure. Compare that to the U.K., where a single body like the National Crime Agency can operate across the country. Or Canada's RCMP. In the US, you've got sheriff's departments, city police, state bureaus, federal agencies all working side by side, just not always together. And it's the gaps in those seams where monsters slip through. The killer may be holding the knife. But too often the system is holding the door. So what can be done? That's the million dollar question. Reform, decentralisation, improved training, cross-agency collaboration. These are all part of the conversation. But until bureaucracy becomes more nimble, more coordinated, and more accountable, serial killers will keep finding places to hide. And we'll keep digging into the stories. The stories that reveal just how much damage can be done when no one is steering the ship. It's a firearm in the course of that murder, which is a violation of Penal Code section 12-0-22.5. Do you admit or deny that? I admit. It is further legend in counts 2 through 13... Now we're going to talk about the elephant in the room. The Second Amendment. It's just 27 words long and ratified in 1791. A well-regulated militia being necessary to the security of a free state, the right of the people to keep and bear arms shall not be infringed. At the time, the fledgling United States didn't have a standing army. The founders feared tyranny from without and within. The idea was that every able bodied citizen could take up arms to protect the Republic. But here in the 21st century, bearing arms has morphed into something far more removed from that original context. You don't need to be in a militia. You don't need to register your guns. In many states, and in some places, you don't even need a background check at a gun show. That's not what George Washington had in mind. And if you think we're anti-gun, then hold that thought, because there is an irony here. In a country with a disproportionate number of serial killers, maybe owning a .38 revolver for home defence is, well, just plain common sense. Let's get forensic. Do serial killers actually use guns? Statistically, no. Most serial killers prefer up close and personal methods. Strangulation, blunt force knives. Because for many of them, it's not about killing. It's about control. Exactly. Ted Bundy used a crowbar. Jeffrey Dahmer drugged his victims, then strangled them. John Wayne Gacy, he used rope, torture and pain. A lot has happened in just the past 24 hours as the sniper manhunt literally went nationwide. It began with a task force phone tip from someone claiming responsibility for the sniper killings. One of the few exceptions was the D.C. sniper case. In 2002, John Allen Muhammad and Lee Boyd Malvo. They used a Bushmaster .223 rifle hidden inside the trunk of a blue Chevy Caprice. Random, distant, terrifying but isolated. Don't forget that most serial killers want that proximity. They want intimacy. And that's what makes them so disturbing. They're not looking to pick off targets at a distance. They want to look you in the eye. Police in Nashville are releasing this chilling surveillance video showing the terrifying moments the shooter blasted their way into the small, private Presbyterian school. But while serial killers themselves rarely rely on guns, the wider epidemic of gun violence in America is impossible to ignore. The video also shows the armed person entering a church office and later stalking the halls with an AR-style weapon drawn. Become a supporter of this podcast: https://www.spreaker.com/podcast/psycho-killer-shocking-true-crime-stories--5005712/support.

Sea Control 585: Imperial Germany and China's Basing Ambitions with Chuck Ridgeway

By Jonathan Selling Retired USN Commander Chuck Ridgway joins the podcast to discuss his article “What Imperial Germany Teaches About China's Naval Basing Ambitions,” which appeared in the May issue of Proceedings. Commander Ridgway is a retired U.S. Navy surface warfare and a reserve Africa foreign area officer. After leaving active duty, he worked for … Continue reading Sea Control 585: Imperial Germany and China's Basing Ambitions with Chuck Ridgeway →

Sea Control 585: Imperial Germany and China's Basing Ambitions with Chuck Ridgeway

Links1. "What Imperial Germany Teaches About China's Naval Basing Ambitions," by Chuck Ridgeway, Proceedings, May 2025.

2025 ZIP CODE Breakdown for Real Estate Investors

Dean and Douglas breakdown the rental property investment landscape in every Memphis area ZIP code! 0:00 Introduction 02:36 Frayser 38127 06:43 Raleigh 38128 09:31 Bartlett 38133 12:03 Bartlett 38134 14:41 Bartlett 38135 16:22 Arlington 38002 19:31 Cordova 38016 22:25 Cordova 38018 24:56 Germantown 38138 27:52 Germantown 38139 29:44 Collierville 38017 31:54 SE Shelby Co. 38125 34:29 Hickory Hill 38141 36:21 Hickory Hill 38115 38:38 Ridgeway 38119 41:06 Oakhaven 38118 44:14 Whitehaven 38116 47:48 Westwood 38109 51:17 University 38111 54:03 Orange Mound 38114 56:37 East Memphis 38117 59:30 River Oaks 38120 01:01:50 Berclair 38122 01:04:18 North Memphis 38107 01:05:53 Jackson 38108 01:07:41 Rhodes College 38112 01:09:26 Midtown 38104 01:11:48 Greenlaw 38105 01:13:13 Downtown 38103 01:14:54 West Person 38106 01:16:45 South Memphis 38126 01:18:12 Millington 38053 01:20:41 Desoto County 01:25:04 OutroHave any questions? Shoot me an email: dean@crestcore.comBuild your custom buyer profile, free at Crestcore: https://linktr.ee/crestcoreDean Harris, VP of Sales at CrestCore RealtyDouglas Skipworth, Founder & Principal Broker at CrestCore RealtyPodcast production and design by Parasaur StudiosThis podcast is brought to you byGriffin, Clift, Everton & Maschmeyer PLLC. https://www.gcemlaw.com/contact-us/CoreLend Financial https://www.corelendfinancial.com/contact_us.htmlRiver City Title CompanyCrestCore Property Managment https://www.crestcore.com/Triumph Construction

Livestream from Ridgeway State Park in ColoradoBecome a supporter of this podcast: https://www.spreaker.com/podcast/ham-radio-2-0--2042782/support.

HAPPY THURSDAY COUSINS!!!!We heard that yall love the 1hr+ long episodes so we came to deliver (plus we're both yappers so are we really surprised here?) We recapped our weeks - Sara's becoming a Mississauga girly and Amir & Hanan have embraced the newlywed life by becoming gamers together. We also discussed the new Superman movie and the alleged hidden themes relating to today's political climate. Later, we talked about the TEA APP -- unfortunately for us Canadians, we don't have access to it, but you know who does? Hanan! Lol sooo we found our little hack to go through the app and read all the tea! Somali Week was successful and came with the same problems that most African/ethnic groups experience - you're not alone guys, we know the struggle! See you in #Mogadishu2026? Grab a snack/drink, put the volume allll the way up and enjoy the episode!Thank you guys so much for always rocking with us! If you like what you hear, follow our page for more episodes uploaded every THURSDAY!Don't forget to subscribe to our YouTube channel for more videos:https://www.youtube.com/c/CousinConnectionPodcastFollow us on:IG | https://www.instagram.com/cousinconnectionpod/Tiktok | https://bit.ly/32PtwmK-------------------------------------------------------------------------------------------------

Today I'm joined by the brilliant Ruth Ridgeway - a woman after my own heart who isn't here to perform, polish or pretend. We dive deep into business experiments, behind-the-scenes truth bombs, and why sharing the messy middle matters just as much (if not more) than the shiny end result. We talk about: How our friendship started with a bullet-pointed testimonial and a Voxer chat. Ruth's philosophy of business-as-experiment, and why that mindset is a game-changer for overthinkers. The power of documenting and selling your process before it's “finished.” Honest conversations about launching, flopping, pivoting and still showing up. Why most freebies are overrated (and what works better for email signups). Affiliate marketing done ethically, and why we're not afraid to recommend what we love. The myth of overnight success and why slow, steady growth matters. Letting go of podcasting (gasp!) and honouring your bandwidth. This one is for the creatives, the overthinkers, and the business owners who are tired of pretending it's all perfect. If you've ever felt like the back of your “cross stitch” is too messy to show anyone, this episode is your permission slip to share it anyway. ✨ Ruth makes stuff. She shares it online. Sometimes it's a course, sometimes it's a behind-the-scenes diary, sometimes it's an experiment in real time. It's always real. Always useful. And never sugar-coated.

Get ready to hit the throttle in the debut episode of the Ridgeway Off Road RC Show! Host Aidan Ridgeway kicks things off by diving into the fast-paced world of RC off-road racing. From buggies to trucks, from setups to track strategy, Aidan lays the groundwork for what this show is all about: passion, performance, and pure dirt-flinging fun. Whether you're new to the hobby or a seasoned racer, this episode sets the tone for a show built on power, precision, and everything off-road RC.

I recently aired a Tales of the Magic Skagit podcast episode about the life of Laurie Wells, whose parents, Hiram and Alfreda, settled in Mount Vernon in 1877.During the interview a reference was made to “Ridgeway” as the name of the area where the Wells' family home was located. I recalled that the Skagit County Historical Museum's archivist, Mari Anderson Densmore, had written about Ridgeway in her book, “Lost Cities” of Skagit — Rediscovering Places of Our Past, and I wanted to share that bit of our history with you all. So, here is my reading of “Ridgeway” from Mari's book.

"Sprinter" The Florida-born Cat Ridgeway is speeding into national prominence. Or, to be more specific, she's sprinting there. Ridgeway's new album Sprinter is an adrenalized blast of hook-filled rock and roll, howling blues and scruffy pop that's one of the most refreshing listens of the year. A commanding presence with charisma to burn, Ridgeway, along with her band the Tourists, are full of a howling punk-rock electricity that summons everyone from the White Stripes to the Foo Fighters. Now Ridgeway is a self-taught musician who plays harmonica, trumpet, trombone, mandolin, bass, piano and guitar and that's incredibly impressive, but having spoken to her, she has an autodidact streak that runs through her life. Hence the reference I made to coffee earlier, but I'll let Cat tell you all about that. Named Orlando's Best Singer-Songwriter for the last three years, Ridgeway has played with Houndmouth, Arcade Fire and Lucy Dacus and she's no stranger to playing music festivals around the country. She's a typhoon of positive energy and you're going to love her. www.catridgewaymusic.com (http://www.catridgewaymusic.com) www.stereoembersmagazine.com www.bombshellradio.com (http://www.bombshellradio.com) www.alexgreenbooks.com (http://www.alexgreenbooks.com) Stereo Embers Bluesky + IG: @emberspodcast Email: editor@stereoembersmagazine.com

Wisconsin Grab Bag: Mineral Point Vampire and Ridgeway Ghost - Tree Drunks - 176

This week, Brandon read his copy out of order. Merch: https://www.etsy.com/shop/cryptopediamerch Discord: https://discord.gg/AWpen8aYQG Patreon: https://www.patreon.com/user?u=14015340 YouTube (Videos have [questionable] captions!): http://youtube.cryptopediacast.com/ --- Wisconsin State Journal Mineral Point Vampire - The Capital Times Urban Plains - Dairy State Dracula The Mineral Point Vampire — Wisconsinology The Ridgeway Ghost of Wisconsin | Into Horror History | J.A. Hernandez Village History | Ridgeway WI Some Wisconsin Ghosts - New York Times Hunting the American Werewolf: Beast Men in Wisconsin and Beyond - Linda S. Godfrey

Episode 484 – A secret weekly basketball run at Ridgeway Plaza

The Ramadan Expo is awesome • Ridgeway pickup game surrounded by kebobs • Cheap or legitimate jujitsu techniques • Rogue from the new X-Men vs the OG version…

#130 Chuck Ridgeway: Automation in Facilities Management

In this episode of the Modern Facilities Management Podcast, Griffin Hamilton interviews Chuck Ridgeway, Automation Technology Manager at Horner AutomationThey discuss the importance of automation in facilities management, the hesitations surrounding its adoption, and the critical role of data in driving efficiency and sustainability. Chuck shares insights on starting small with automation initiatives, the significance of intelligent systems, and the future of machine learning in the industry. Enjoy!Chapters00:00 Introduction to Automation in Facilities Management04:05 Understanding Automation and Its Misconceptions06:15 Starting Small: The First Steps in Automation08:05 The Role of Data in Automation11:50 Leveraging Existing Technology for Data Collection15:14 Looking Ahead: Machine Learning in Facilities Management17:09 Key Takeaways and Final Advice

Crazy Train Radio's Interview with Magician Sean Ridgeway

This next guest is a multi-award-winning entertainer who has brought his unique blend of comedy and magic to thousands of audiences across the country for his one man show , as well as audiences on TV such as : Penn & Teller's Fool Us, America's Got Talent. Let's welcome, Magician Sean Ridgeway!Sean RidgewayWebsite: https://www.ridgewaymagic.com/Instagram: https://www.instagram.com/uselesstalentguy/YouTube: https://www.youtube.com/@uselesstalentguyFool Us Appearance: https://www.youtube.com/watch?v=9I1_-0ufkYMCrazy Train RadioFacebook: facebook.com/realctradioInstagram: @crazytrainradioX/Twitter: @realctradioBlueSky: @crazytrainradio.bsky.socialWebsite: crazytrainradio.usYouTube: youtube.com/crazytrainradio

Delicious Flatbreads & Sandwiches At Atrevete Cafe 1888!

Flatbread pizzas, sandwiches, lattes, scones; there's so much to taste and eat here at Cafe 1888! It's Thursday morning and today Cafe 1888 rolls out a new menu with some delicious and tasty additions in addition to the current menu favorites and classics. This morning, Chef Edge Holt will showcase the Waygu Whisper sandwich which is a favorite and he'll also show us the new Sesame Chicken Flatbread! If you like food this is your day to try something new in Aurora! Here's the news: - Our friends of Fox Valley Hands of Hope have support groups available on the first Saturday of each month at 850 Ridgeway in Aurora. The groups are free, open to the public and take place at the Parent Power Center from 9 am to 10:30 am. See the flyer for more details! - Free ESL classes are available at Family Focus, Mondays and Wednesdays from 9:30 am to 12:30 pm. The classes are in cooperation with Waubonsee Community College and registration is required. Contact Christina (630) 844-2550 at extension 7011! Have a great rest of the day! Good Morning Aurora will return with more news, weather and the very best of Aurora. Subscribe to the show on YouTube at this link: https://www.youtube.com/c/GoodMorningAuroraPodcast The second largest city's first daily news podcast is here. Tune in 5 days a week, Monday thru Friday from 9:00 to 9:30 am. Make sure to like and subscribe to stay updated on all things Aurora. Threads: https://www.threads.net/@goodmorningaurorail Instagram: goodmorningaurorail Spotify: https://open.spotify.com/show/6dVweK5Zc4uPVQQ0Fp1vEP... Apple: https://podcasts.apple.com/.../good-morning.../id1513229463 Anchor: https://anchor.fm/goodmorningaurora ACTV (Aurora Community Television): https://www.aurora-il.org/309/Aurora-Community-TV #positivevibes #positiveenergy #kanecountyil #bataviail #genevail #stcharlesil #saintcharlesil #elginil #northaurorail #auroraillinois #cityofaurorail #auroramedia #auroranews #goodmorningaurora #morningnews #morningshow #thursday #livenews #cafe1888

Good morning and happy Monday! This morning we have another great episode of our monthly series: Breakfast At Bloomhaven. In each episode we tour the Bloomhaven campus and learn about the staff, residents and amazing programs that are taking place in this wonderful location. The former Copley hospital is also home to Weston Bridges, Bardwell Residences and Aurora's newest coffee and pastry shop, Atrevete Cafe 1888. This episode is a lot of fun! Stay tuned for more 'Breakfast At Bloomhaven'! Here's the news: - Our friends of Fox Valley Hands of Hope have support groups available on the first Saturday of each month at 850 Ridgeway in Aurora. The groups are free, open to the public and take place at the Parent Power Center from 9 am to 10:30 am. See the flyer for more details! - Free ESL classes are available at Family Focus, Mondays and Wednesdays from 9:30 am to 12:30 pm. The classes are in cooperation with Waubonsee Community College and registration is required. Contact Christina (630) 844-2550 at extension 7011! Have a great rest of the day! Good Morning Aurora will return with more news, weather and the very best of Aurora. Subscribe to the show on YouTube at this link: https://www.youtube.com/c/GoodMorningAuroraPodcast The second largest city's first daily news podcast is here. Tune in 5 days a week, Monday thru Friday from 9:00 to 9:30 am. Make sure to like and subscribe to stay updated on all things Aurora. Threads: https://www.threads.net/@goodmorningaurorail Instagram: goodmorningaurorail Spotify: https://open.spotify.com/show/6dVweK5Zc4uPVQQ0Fp1vEP... Apple: https://podcasts.apple.com/.../good-morning.../id1513229463 Anchor: https://anchor.fm/goodmorningaurora ACTV (Aurora Community Television): https://www.aurora-il.org/309/Aurora-Community-TV #positivevibes #positiveenergy #kanecountyil #bataviail #genevail #stcharlesil #saintcharlesil #elginil #northaurorail #auroraillinois #cityofaurorail #auroramedia #auroranews #goodmorningaurora #morningnews #morningshow #monday #livenews #cafe1888

Voice of the Mountains: What the Mountains Teach with Rick Ridgeway

Rick Ridgeway, renowned mountaineer, environmentalist, and storyteller, joins host Steve House on Voice of the Mountains to share insights from a life lived boldly and with purpose. Known as the "real Indiana Jones," Ridgeway recounts transformative adventures, from summiting K2 to walking across Kenya's wild bushlands. He delves into the profound lessons learned from nature, loss, and resilience, emphasizing the power of purpose-driven living. Along the way, he reflects on his relationships, including partnerships that shaped his climbing career and personal evolution. This episode is a testament to the enduring impact of values, exploration, and living a life bigger than oneself.If you'd like to see the companion essay and more information on Voice of the Mountains, please visit: https://uphillathlete.com/voiceofthemountains/

Milepost 136 Brian RidgewayBrian is an experienced long distance rider a Hoka hey veteran and due to a little bit bad luck had to with draw from this years running. Tune and find out why if you don't already know! Find out why he has a But really tune in and join us. And see why he has been given a new nick name! Flat Brian! Want to help support the channel check out my social media pages and follow there as well

Charitable giving surpasses half a trillion dollars because of people like you

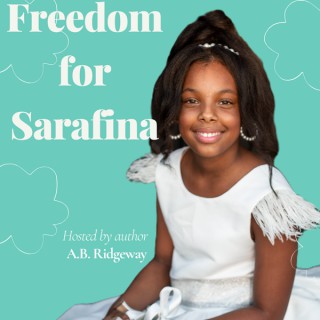

In this episode of Financial Advisors Say the Darndest Things, A.B. Ridgeway explores the trend of billionaires and millionaires giving away significant portions of their wealth. Drawing on data, Biblical principles, and practical financial advice, he helps listeners understand the deeper implications of giving, the pitfalls of financial vanity, and the true blessings that come from generosity.3 Key TakeawaysWealth Isn't SatiatingAccumulating wealth often leads to a cycle of dissatisfaction. As Ecclesiastes 5:10 states, "He who loves money will not be satisfied with money." True fulfillment comes from purposeful giving, not endless earning.Giving Reflects Security, Not ScarcityWhen we give, it signals to ourselves that we have enough and will be okay. Charitable giving not only benefits the receiver but also reinforces the giver's financial confidence.Balance Your GivingGenerosity is vital but should never come at the expense of your own stability. Be mindful to give within your means, ensuring your family's essential needs are met before extending help to others.3 Memorable Quotes"The act of giving is a signal to yourself psychologically that you will be okay.""We work 20, 30 years to accumulate wealth, but it's not about how much you have—it's about what you do with it.""He who loves wealth with his income will not be satisfied; this is also vanity." - Ecclesiastes 5:10

Charitable giving surpasses half a trillion dollars because of people like you

In this episode of Financial Advisors Say the Darndest Things, A.B. Ridgeway explores the trend of billionaires and millionaires giving away significant portions of their wealth. Drawing on data, Biblical principles, and practical financial advice, he helps listeners understand the deeper implications of giving, the pitfalls of financial vanity, and the true blessings that come from generosity.3 Key TakeawaysWealth Isn't SatiatingAccumulating wealth often leads to a cycle of dissatisfaction. As Ecclesiastes 5:10 states, "He who loves money will not be satisfied with money." True fulfillment comes from purposeful giving, not endless earning.Giving Reflects Security, Not ScarcityWhen we give, it signals to ourselves that we have enough and will be okay. Charitable giving not only benefits the receiver but also reinforces the giver's financial confidence.Balance Your GivingGenerosity is vital but should never come at the expense of your own stability. Be mindful to give within your means, ensuring your family's essential needs are met before extending help to others.3 Memorable Quotes"The act of giving is a signal to yourself psychologically that you will be okay.""We work 20, 30 years to accumulate wealth, but it's not about how much you have—it's about what you do with it.""He who loves wealth with his income will not be satisfied; this is also vanity." - Ecclesiastes 5:10

How long will it take to double your money when investing?

In this episode of Financial Advisors Say the Darndest Things, A.B. Ridgeway dives into the Rule of 72, a simple formula that helps you estimate how long it will take to double your money based on the rate of return on your investments. Whether you're investing in CDs, annuities, or the stock market, understanding this concept can help you set realistic expectations, manage risk, and plan for retirement more effectively. Ridgeway also explains why starting early is key to reducing risk and achieving financial goals.Key Takeaways:The Rule of 72 Demystified: The Rule of 72 helps you calculate the time required to double your money. Simply divide 72 by the annual return rate. For example, at 6% interest, it will take 12 years to double your money.Setting Realistic Expectations: Financial advisors aren't magicians who can double or triple your money overnight. The Rule of 72 provides a more realistic view of growth, helping you avoid unnecessary risk.Start Early to Minimize Risk: Beginning your investment journey sooner allows you to take on less risk while still achieving your goals. Investing later often requires higher returns, which can increase your risk exposure.Memorable Quotes:"The Rule of 72 is a tool that simplifies complex financial projections, helping you make better decisions about where to put your money.""The market rarely gives you a consistent 10% return year after year; it's about staying the course through the highs and lows.""Starting early allows you to take on less risk and still meet your financial goals—time is your greatest ally in investing."

How long will it take to double your money when investing?

In this episode of Financial Advisors Say the Darndest Things, A.B. Ridgeway dives into the Rule of 72, a simple formula that helps you estimate how long it will take to double your money based on the rate of return on your investments. Whether you're investing in CDs, annuities, or the stock market, understanding this concept can help you set realistic expectations, manage risk, and plan for retirement more effectively. Ridgeway also explains why starting early is key to reducing risk and achieving financial goals.Key Takeaways:The Rule of 72 Demystified: The Rule of 72 helps you calculate the time required to double your money. Simply divide 72 by the annual return rate. For example, at 6% interest, it will take 12 years to double your money.Setting Realistic Expectations: Financial advisors aren't magicians who can double or triple your money overnight. The Rule of 72 provides a more realistic view of growth, helping you avoid unnecessary risk.Start Early to Minimize Risk: Beginning your investment journey sooner allows you to take on less risk while still achieving your goals. Investing later often requires higher returns, which can increase your risk exposure.Memorable Quotes:"The Rule of 72 is a tool that simplifies complex financial projections, helping you make better decisions about where to put your money.""The market rarely gives you a consistent 10% return year after year; it's about staying the course through the highs and lows.""Starting early allows you to take on less risk and still meet your financial goals—time is your greatest ally in investing."

How to start saving for retirement with little to no money

In this episode of Financial Advisors Say the Darnedest Things, A.B. Ridgeway provides practical and actionable tips for anyone struggling to save money, regardless of their income level. He tackles two key problems: the misconception that saving a set dollar amount is the key to success and the lack of clarity about what you're saving for. A.B. introduces the concept of saving by percentages rather than fixed amounts, offering a simple yet effective strategy to build the habit of saving. He explains how saving even a small percentage of your leftover income, such as 10%, can lead to gradual growth in savings over time. Whether you're saving for an emergency fund or retirement, A.B. emphasizes the importance of creating sustainable habits and understanding the purpose behind your savings goals. This episode will help you shift your mindset and develop a more effective approach to personal finance.Key Takeaways:Save by Percentages, Not Fixed Amounts – A.B. emphasizes that saving a percentage of what's left over after bills, even if it's just a small amount, is more sustainable than setting a fixed dollar target. This method encourages building a habit of saving consistently.Know What You're Saving For – Before you start saving, it's crucial to define your goals. Whether it's for an emergency fund, retirement, or something else, having clear intentions makes your saving efforts more focused and effective.Gradual Growth Leads to Financial Security – By saving small amounts consistently, you'll develop the habit of saving, which can eventually lead to larger savings as your income increases or expenses decrease.Quotes:“You are going to invest or save by percentages. Everyone can save by a percentage. It doesn't matter how small. The important part is getting into the habit.”“If you don't know what number is going to give you financial security, you're always going to be wanting more, because there's always one more dollar to make.”“The key to saving for your future isn't how much you save, but the habit of saving. Even a small percentage over time makes a big difference.”

How to start saving for retirement with little to no money

In this episode of Financial Advisors Say the Darnedest Things, A.B. Ridgeway provides practical and actionable tips for anyone struggling to save money, regardless of their income level. He tackles two key problems: the misconception that saving a set dollar amount is the key to success and the lack of clarity about what you're saving for. A.B. introduces the concept of saving by percentages rather than fixed amounts, offering a simple yet effective strategy to build the habit of saving. He explains how saving even a small percentage of your leftover income, such as 10%, can lead to gradual growth in savings over time. Whether you're saving for an emergency fund or retirement, A.B. emphasizes the importance of creating sustainable habits and understanding the purpose behind your savings goals. This episode will help you shift your mindset and develop a more effective approach to personal finance.Key Takeaways:Save by Percentages, Not Fixed Amounts – A.B. emphasizes that saving a percentage of what's left over after bills, even if it's just a small amount, is more sustainable than setting a fixed dollar target. This method encourages building a habit of saving consistently.Know What You're Saving For – Before you start saving, it's crucial to define your goals. Whether it's for an emergency fund, retirement, or something else, having clear intentions makes your saving efforts more focused and effective.Gradual Growth Leads to Financial Security – By saving small amounts consistently, you'll develop the habit of saving, which can eventually lead to larger savings as your income increases or expenses decrease.Quotes:“You are going to invest or save by percentages. Everyone can save by a percentage. It doesn't matter how small. The important part is getting into the habit.”“If you don't know what number is going to give you financial security, you're always going to be wanting more, because there's always one more dollar to make.”“The key to saving for your future isn't how much you save, but the habit of saving. Even a small percentage over time makes a big difference.”

Beware: Black Travel Agency CANCELS trips and hasn't given any refunds

3 Key Takeaways:Luxury Travel Gone Wrong: The episode delves into the sudden shutdown of "Ladies in Luggage," a Georgia-based travel agency that specialized in luxury group vacations for African American women. Despite advertising high-end trips, the agency abruptly closed, leaving customers without refunds or alternatives.The Importance of Vetting Travel Providers: A key lesson from the episode is the importance of thoroughly vetting any travel service, especially when the price tag is high. The host, A.B. Ridgeway, takes a practical approach by comparing a similar trip to Dubai using reputable platforms like Expedia to demonstrate potential savings and ensure that travelers aren't overpaying.Travel Insurance & Protections: The conversation emphasizes the importance of travel insurance in protecting your investment, particularly for luxury vacations. The host explains how certain travel packages offer guarantees for refunds on unused hotel days and lost luggage, but also stresses that consumers need to read the fine print and understand the protections available before booking.3 Memorable Quotes:“Ladies in Luggage sold luxury group vacations organized specifically for African-American women. She had something for us older ladies, she called us the aunties.” – This quote introduces the concept of the travel service, focusing on how it was tailored to a specific community of women and helped foster a sense of belonging among its clients.“Before we go any further, I actually want to see exactly what she paid for.” – A.B. Ridgeway transitions into his practical analysis, highlighting his financial advisor mindset by comparing the trip's cost with similar offerings from reputable travel platforms.“Let's protect our trip. So this is 100% refund on unused hotel days, 100% refund on your flight... It's essential to cover those bases.” – This quote underscores the importance of purchasing travel insurance and understanding the protections available when investing in high-cost travel experiences.Episode Highlights:Ladies in Luggage Closure: A closer look at how a travel agency specializing in luxury group trips for Black women suddenly shut down, leaving clients in financial distress.Financial Advice: A breakdown of how to plan and protect against similar issues when booking expensive vacations.Travel Insurance: Why securing comprehensive coverage is crucial for luxury travelers.

Mark Longo did OnlyFans to build Peanut the Squirrel Sanctuary

In this episode, we delve into an unusual story involving Peanut the Squirrel's sanctuary owner and their controversial fundraising methods. A.B. Ridgeway offers insights into the implications of supporting causes and managing donations, examining how transparency, ethics, and personal convictions play into financial stewardship.Key TakeawaysFinancial Transparency in Donations: It's crucial to verify where donations go, especially for tax purposes. Charitable contributions should ideally go directly to the organization to ensure proper use and potential tax deductions.Ethics in Fundraising: The episode raises a thought-provoking question about supporting causes when the methods of raising funds may conflict with personal values, such as using an OnlyFans account to support an animal sanctuary.Judgment and Self-Reflection: Referencing Matthew 7:1-3, A.B. Ridgeway emphasizes the importance of self-reflection and applying consistent standards to our actions and those of others.Memorable Quotes"Do you support someone who does something 'bad' to do something 'good'? This is a question many investors need to ask themselves.""We must judge ourselves by the same measure we judge others. If we're going to hold people accountable, we should ensure we're holding ourselves to those same standards.""As a Christian financial advisor, I steward God's wealth and hope you do the same—making sure your investments align with your values."This episode offers valuable insights into the nuances of charity, ethical giving, and staying true to personal beliefs while navigating financial decisions.

Martinsville 2 NASCAR 2024 Weekend Betting Recap I NASCAR Gambling Podcast (Ep. 535)

Welcome to another episode of the NASCAR Gambling Podcast on the Sports Gambling Podcast Network! Five days a week, Rod Villagomez and Cody Zeeb bring their love of NASCAR and their love of sports betting to you to help you set your bets for the weekend of NASCAR action. From the Craftsman Truck Series to the Xfinity Series, to the Cup Series, Rod and Cody have you covered.Today, Rod and Cody break down another exciting Martinsville 2 NASCAR 2024 weekend of racing at the Martinsville Speedway in Ridgeway, Virginia. Which drivers outperformed their starting positions this weekend to post solid finishes in the Xfinity Series? How well did the playoff bubble drivers do and which driver punched their tickets into the championship round? Did we profit again from our Truck Series bets? Are we ever going to come to consensus on the final lap of the Cup Series race? Who came out on the right side of the longshot top 10 and top 5 bets? We'll answer these questions and more on this week's episode.Be sure to subscribe to the NASCAR Gambling Podcast on the SGPN App, and on Apple Podcasts or Spotify. Find Rod (@rjvillagomez) and Cody (@Husker_Zeeb) on Twitter.Introduction Musical Credit: "I Run" by Iconoclast JOIN the SGPN community #DegensOnlyExclusive Merch, Contests and Bonus Episodes ONLY on Patreon - https://sg.pn/patreonDiscuss with fellow degens on Discord - https://sg.pn/discordDownload The Free SGPN App - https://sgpn.appCheck out the Sports Gambling Podcast on YouTube - https://sg.pn/YouTubeCheck out our website - http://sportsgamblingpodcast.comSUPPORT us by supporting our partnersUnderdog Fantasy code SGPN - Up to $1000 in BONUS CASH - https://play.underdogfantasy.com/p-sgpnRithmm - Player Props and Picks - Free 7 day trial! http://sportsgamblingpodcast.com/rithmmADVERTISE with SGPNInterested in advertising? Contact sales@sgpn.ioFOLLOW The Sports Gambling Podcast On Social MediaTwitter - http://www.twitter.com/gamblingpodcastInstagram - http://www.instagram.com/sportsgamblingpodcastTikTok - https://www.tiktok.com/@gamblingpodcastFacebook - http://www.facebook.com/sportsgamblingpodcastFOLLOW The Hosts On Social MediaSean Green - http://www.twitter.com/seantgreenRyan Kramer - http://www.twitter.com/kramercentric================================================================Gambling problem? Call 1-800-GAMBLER CO, DC, IL, IN, LA, MD, MS, NJ, OH, PA, TN, VA, WV, WY Call 877-8-HOPENY or text HOPENY (467369) (NY) Call 1-800-327-5050 (MA)21+ to wager. Please Gamble Responsibly. Call 1-800-NEXT-STEP (AZ), 1-800-522-4700 (KS, NV), 1-800 BETS-OFF (IA), 1-800-270-7117 for confidential help (MI)================================================================

Martinsville 2 DFS Picks 2024 I NASCAR Gambling Podcast (Ep. 534)

Welcome to another episode of the NASCAR Gambling Podcast on the Sports Gambling Podcast Network! Five days a week, Rod Villagomez and Cody Zeeb bring their love of NASCAR and their love of sports betting to you to help you set your bets for the weekend of NASCAR action. From the Craftsman Truck Series to the Xfinity Series, to the Cup Series, Rod and Cody have you covered.Today, Rod and Cody give you their favorite Martinsville 2 DFS Picks 2024 at the Martinsville Speedway in Ridgeway, Virginia. How many drivers above the $10k mark can you trust having in your lineups? Why is it important to have at least one of the playoff drivers in your lineups this week? Which driver below $7,000 offers the most value to your roster? Who will finish worse than their projected finishing position on Underdog Fantasy this week? We'll answer these questions and more on this week's episode.Be sure to subscribe to the NASCAR Gambling Podcast on the SGPN App, and on Apple Podcasts or Spotify. Find Rod (@rjvillagomez) and Cody (@Husker_Zeeb) on Twitter.Introduction Musical Credit: "I Run" by Iconoclast JOIN the SGPN community #DegensOnlyExclusive Merch, Contests and Bonus Episodes ONLY on Patreon - https://sg.pn/patreonDiscuss with fellow degens on Discord - https://sg.pn/discordDownload The Free SGPN App - https://sgpn.appCheck out the Sports Gambling Podcast on YouTube - https://sg.pn/YouTubeCheck out our website - http://sportsgamblingpodcast.comSUPPORT us by supporting our partnersUnderdog Fantasy code SGPN - Up to $1000 in BONUS CASH - https://play.underdogfantasy.com/p-sgpnRithmm - Player Props and Picks - Free 7 day trial! http://sportsgamblingpodcast.com/rithmmADVERTISE with SGPNInterested in advertising? Contact sales@sgpn.ioFOLLOW The Sports Gambling Podcast On Social MediaTwitter - http://www.twitter.com/gamblingpodcastInstagram - http://www.instagram.com/sportsgamblingpodcastTikTok - https://www.tiktok.com/@gamblingpodcastFacebook - http://www.facebook.com/sportsgamblingpodcastFOLLOW The Hosts On Social MediaSean Green - http://www.twitter.com/seantgreenRyan Kramer - http://www.twitter.com/kramercentric================================================================Gambling problem? Call 1-800-GAMBLER CO, DC, IL, IN, LA, MD, MS, NJ, OH, PA, TN, VA, WV, WY Call 877-8-HOPENY or text HOPENY (467369) (NY) Call 1-800-327-5050 (MA)21+ to wager. Please Gamble Responsibly. Call 1-800-NEXT-STEP (AZ), 1-800-522-4700 (KS, NV), 1-800 BETS-OFF (IA), 1-800-270-7117 for confidential help (MI)================================================================

Zip Buy Now, Pay Later 200 Betting Picks 2024 I NASCAR Gambling Podcast (Ep. 533)

Welcome to another episode of the NASCAR Gambling Podcast on the Sports Gambling Podcast Network! Five days a week, Rod Villagomez and Cody Zeeb bring their love of NASCAR and their love of sports betting to you to help you set your bets for the weekend of NASCAR action. From the Craftsman Truck Series to the Xfinity Series, to the Cup Series, Rod and Cody have you covered.Today, Rod and Cody give you their favorite Zip Buy Now, Pay Later 200 Betting Picks 2024 at the Martinsville Speedway in Ridgeway, Virginia. Will Grant Enfinger continue his hot streak and win yet another race this week? How well will the drivers on the cut line perform and can one of them steal a win this week? Are we in for another Corey Heim win on this track? Who will be our longshot top 5 picks for this race? We'll answer these questions and more on this week's episode.Be sure to subscribe to the NASCAR Gambling Podcast on the SGPN App, and on Apple Podcasts or Spotify. Find Rod (@rjvillagomez) and Cody (@Husker_Zeeb) on Twitter.Introduction Musical Credit: "I Run" by Iconoclast JOIN the SGPN community #DegensOnlyExclusive Merch, Contests and Bonus Episodes ONLY on Patreon - https://sg.pn/patreonDiscuss with fellow degens on Discord - https://sg.pn/discordDownload The Free SGPN App - https://sgpn.appCheck out the Sports Gambling Podcast on YouTube - https://sg.pn/YouTubeCheck out our website - http://sportsgamblingpodcast.comSUPPORT us by supporting our partnersUnderdog Fantasy code SGPN - Up to $1000 in BONUS CASH - https://play.underdogfantasy.com/p-sgpnRithmm - Player Props and Picks - Free 7 day trial! http://sportsgamblingpodcast.com/rithmmADVERTISE with SGPNInterested in advertising? Contact sales@sgpn.ioFOLLOW The Sports Gambling Podcast On Social MediaTwitter - http://www.twitter.com/gamblingpodcastInstagram - http://www.instagram.com/sportsgamblingpodcastTikTok - https://www.tiktok.com/@gamblingpodcastFacebook - http://www.facebook.com/sportsgamblingpodcastFOLLOW The Hosts On Social MediaSean Green - http://www.twitter.com/seantgreenRyan Kramer - http://www.twitter.com/kramercentric================================================================Gambling problem? Call 1-800-GAMBLER CO, DC, IL, IN, LA, MD, MS, NJ, OH, PA, TN, VA, WV, WY Call 877-8-HOPENY or text HOPENY (467369) (NY) Call 1-800-327-5050 (MA)21+ to wager. Please Gamble Responsibly. Call 1-800-NEXT-STEP (AZ), 1-800-522-4700 (KS, NV), 1-800 BETS-OFF (IA), 1-800-270-7117 for confidential help (MI)================================================================

National Debt Relief 250 Betting Picks 2024 I NASCAR Gambling Podcast (Ep. 532)

Welcome to another episode of the NASCAR Gambling Podcast on the Sports Gambling Podcast Network! Five days a week, Rod Villagomez and Cody Zeeb bring their love of NASCAR and their love of sports betting to you to help you set your bets for the weekend of NASCAR action. From the Craftsman Truck Series to the Xfinity Series, to the Cup Series, Rod and Cody have you covered.Today, Rod and Cody give you their favorite National Debt Relief 250 Betting Picks 2024 at the Martinsville Speedway in Ridgeway, Virginia. Will Brandon Jones play the role of the spoiler this week and pick up his first win of the season? How well will the drivers on the cut line perform and can one of them steal a win this week? Are we in for another Aric Almirola win on this track? Who will be our longshot top 5 picks for this race? We'll answer these questions and more on this week's episode.Be sure to subscribe to the NASCAR Gambling Podcast on the SGPN App, and on Apple Podcasts or Spotify. Find Rod (@rjvillagomez) and Cody (@Husker_Zeeb) on Twitter.Introduction Musical Credit: "I Run" by Iconoclast JOIN the SGPN community #DegensOnlyExclusive Merch, Contests and Bonus Episodes ONLY on Patreon - https://sg.pn/patreonDiscuss with fellow degens on Discord - https://sg.pn/discordDownload The Free SGPN App - https://sgpn.appCheck out the Sports Gambling Podcast on YouTube - https://sg.pn/YouTubeCheck out our website - http://sportsgamblingpodcast.comSUPPORT us by supporting our partnersUnderdog Fantasy code SGPN - Up to $1000 in BONUS CASH - https://play.underdogfantasy.com/p-sgpnRithmm - Player Props and Picks - Free 7 day trial! http://sportsgamblingpodcast.com/rithmmADVERTISE with SGPNInterested in advertising? Contact sales@sgpn.ioFOLLOW The Sports Gambling Podcast On Social MediaTwitter - http://www.twitter.com/gamblingpodcastInstagram - http://www.instagram.com/sportsgamblingpodcastTikTok - https://www.tiktok.com/@gamblingpodcastFacebook - http://www.facebook.com/sportsgamblingpodcastFOLLOW The Hosts On Social MediaSean Green - http://www.twitter.com/seantgreenRyan Kramer - http://www.twitter.com/kramercentric================================================================Gambling problem? Call 1-800-GAMBLER CO, DC, IL, IN, LA, MD, MS, NJ, OH, PA, TN, VA, WV, WY Call 877-8-HOPENY or text HOPENY (467369) (NY) Call 1-800-327-5050 (MA)21+ to wager. Please Gamble Responsibly. Call 1-800-NEXT-STEP (AZ), 1-800-522-4700 (KS, NV), 1-800 BETS-OFF (IA), 1-800-270-7117 for confidential help (MI)================================================================

Xfinity 500 Betting Picks 2024 I NASCAR Gambling Podcast (Ep. 531)

Welcome to another episode of the NASCAR Gambling Podcast on the Sports Gambling Podcast Network! Five days a week, Rod Villagomez and Cody Zeeb bring their love of NASCAR and their love of sports betting to you to help you set your bets for the weekend of NASCAR action. From the Craftsman Truck Series to the Xfinity Series, to the Cup Series, Rod and Cody have you covered.Today, Rod and Cody give you their favorite Xfinity 500 Betting Picks 2024 at the Martinsville Speedway in Ridgeway, Virginia. Will Kyle Larson rebound from a bad day in Florida and claim his spot in the race for the championship next week? How well will the drivers on the cut line perform and can one of them steal a win this week? Are we in for another pissed off Bowman top 10 run this week? Who will be our longshot top 10 picks for this race? We'll answer these questions and more on this week's episode.Be sure to subscribe to the NASCAR Gambling Podcast on the SGPN App, and on Apple Podcasts or Spotify. Find Rod (@rjvillagomez) and Cody (@Husker_Zeeb) on Twitter.Introduction Musical Credit: "I Run" by Iconoclast JOIN the SGPN community #DegensOnlyExclusive Merch, Contests and Bonus Episodes ONLY on Patreon - https://sg.pn/patreonDiscuss with fellow degens on Discord - https://sg.pn/discordDownload The Free SGPN App - https://sgpn.appCheck out the Sports Gambling Podcast on YouTube - https://sg.pn/YouTubeCheck out our website - http://sportsgamblingpodcast.comSUPPORT us by supporting our partnersUnderdog Fantasy code SGPN - Up to $1000 in BONUS CASH - https://play.underdogfantasy.com/p-sgpnRithmm - Player Props and Picks - Free 7 day trial! http://sportsgamblingpodcast.com/rithmmADVERTISE with SGPNInterested in advertising? Contact sales@sgpn.ioFOLLOW The Sports Gambling Podcast On Social MediaTwitter - http://www.twitter.com/gamblingpodcastInstagram - http://www.instagram.com/sportsgamblingpodcastTikTok - https://www.tiktok.com/@gamblingpodcastFacebook - http://www.facebook.com/sportsgamblingpodcastFOLLOW The Hosts On Social MediaSean Green - http://www.twitter.com/seantgreenRyan Kramer - http://www.twitter.com/kramercentric================================================================Gambling problem? Call 1-800-GAMBLER CO, DC, IL, IN, LA, MD, MS, NJ, OH, PA, TN, VA, WV, WY Call 877-8-HOPENY or text HOPENY (467369) (NY) Call 1-800-327-5050 (MA)21+ to wager. Please Gamble Responsibly. Call 1-800-NEXT-STEP (AZ), 1-800-522-4700 (KS, NV), 1-800 BETS-OFF (IA), 1-800-270-7117 for confidential help (MI)================================================================

John discusses the latest moves by the Commanders which included trading DT John Ridgeway to New Orleans and acquiring former Texans WR Noah Brown. For the entire month of August, The Adventure Park at Sandy Spring is offering multiple ways to save on climbing & zip lining AND 50% off Axe Throwing! Reserve your adventure today at www.TheAdventurePark.com/keim Learn more about your ad choices. Visit megaphone.fm/adchoices

John discusses the latest moves by the Commanders which included trading DT John Ridgeway to New Orleans and acquiring former Texans WR Noah Brown.For the entire month of August, The Adventure Park at Sandy Spring is offering multiple ways to save on climbing & zip lining AND 50% off Axe Throwing!Reserve your adventure today at www.TheAdventurePark.com/keim

The Commanders traded John Ridgeway to the Saints and Signed WR Noah Brown

This episode covers three examples of historically important roads. One is quite ancient, one is an important part of the development of the U.S., and the third is a more modern road that's been lauded for its design. Research: “The Ancient Ridgeway.” Friends of the Ridgeway. https://ridgewayfriends.org.uk/the-trail/the-ancient-ridgeway/· Atkins, Harry. “The Best Historic Sites in Oxfordshire.” History Hit. May 24, 2022. https://www historyhit.com/guides/the-best-historic-sites-in-oxfordshire/· “Avebury.” English Heritage. https://www.english-heritage.org.uk/visit/places/avebury/ Benetti, Alessandro. “The bridge-type autogrill, infrastructure and icon of the Italian highways.” Domus. July 27, 2020. https://www.domusweb.it/en/architecture/2020/07/27/infrastructures-and-icons-the-bridge-type-autogrill-by-angelo-bianchetti-and-mario-pavesi.html Benetti, Alessandro. “Italy's ‘Sun Motorway,' the story of an exceptional infrastructure.” Domus. Aug. 5, 2023. https://www.domusweb.it/en/architecture/gallery/2021/07/16/the-sun-motorway-is-65-years-old-a-short-story-of-an-extraordinary-infrastructure.html Britannica, The Editors of Encyclopaedia. "macadam". Encyclopedia Britannica, 11 Aug. 2014, https://www.britannica.com/technology/macadam-road-construction Britannica, The Editors of Encyclopaedia. "Saxony". Encyclopedia Britannica, 1 Jun. 2024, https://www.britannica.com/place/Saxony-historical-region-duchy-and-kingdom-Europe Calvano, Angela & Canducci, Andrea & Rufini, Andrea. (2023). Urban regeneration of public housing settlements, in Rome: the case study of San Basilio district. Renewable Energy and Environmental Sustainability. 8. 10.1051/rees/2023012 Cleaver, Emily. “Against All Odds, England's Massive Chalk Horse Has Survived 3,000 Years.” Smithsonian. July 6, 2017. https://www.smithsonianmag.com/history/3000-year-old-uffington-horse-looms-over-english-countryside-180963968/ Ellis, Sian. “Just follow the Ridgeway, Britain's oldest highway.” British Heritage. April 30, 2024. https://britishheritage.com/travel/the-ridgeway-britains-oldest-highway Haughton, Brian. “The White Horse of Uffington.” March 30, 2011. https://www.worldhistory.org/article/229/the-white-horse-of-uffington/ Johnson, Ben. “Ancient Standing Stones.” Historic UK. https://www.historic-uk.com/CultureUK/Ancient-Standing-Stones/ “Lane Width.” U.S. Department of Transportation Federal Highway Administration. https://safety.fhwa.dot.gov/geometric/pubs/mitigationstrategies/chapter3/3_lanewidth.cfm Lenarduzzi, Thea. “The Motorway That Built Italy: Piero Puricelli's masterpiece is the focus of an unlikely pilgrimage.” Independent UK. Jan. 30, 2016. https://www.independent.co.uk/travel/europe/the-world-s-first-motorway-piero-puricelli-s-masterpiece-is-the-focus-of-an-unlikely-pilgrimage-a6840816.html Longfellow, Rickie. “The National Road.” U.S. Department of Transportation Federal Highway Administration. https://highways.dot.gov/highway-history/general-highway-history/back-time/national-road Mclaughlan, Scott, PhD. “What were the enclosure acts?” The Collector. Nov. 12, 2023. https://www.thecollector.com/what-were-the-enclosure-acts/ McNamara, Robert. "The National Road, America's First Major Highway." ThoughtCo, Apr. 5, 2023, thoughtco.com/the-national-road-177405 “The National Road.” National Park Service. https://www.nps.gov/articles/national-road.htm “National Road Heritage Corridor.” https://nationalroadpa.org/ "The Nation's First Mega-Project: A Legislative History of the Cumberland Road" United States Department of transportation. 2021. https://rosap.ntl.bts.gov/view/dot/68561 Nifosi, Giuseppe. “Michelucci's Highway Church.” Art Unveiled. https://www.artesvelata.it/chiesa-autostrada-michelucci/ “RESEARCH AND SOURCES FOR WAYLAND'S SMITHY.” English Heritage. https://www.english-heritage.org.uk/visit/places/waylands-smithy/history/research-and-sources/ “The Ridgeway.” National Trails. https://www.nationaltrail.co.uk/en_GB/trails/the-ridgeway/ “The Ridgeway Information.” National Trails. https://www.nationaltrail.co.uk/en_GB/trails/the-ridgeway/trail-information/ Stenton, F. M. “The Road System of Medieval England.” The Economic History Review, vol. 7, no. 1, 1936, pp. 1–21. JSTOR, https://doi.org/10.2307/2590730 “WAYLAND'S SMITHY.” English Heritage. https://www.english-heritage.org.uk/visit/places/waylands-smithy/ “Wayland's Smithy chambered long barrow, including an early barrow and Rion Age and Roman boundary ditches.” Historic England. https://historicengland.org.uk/listing/the-list/list-entry/1008409?section=official-list-entry Whittle, Alasdair & Brothwell, Don & Cullen, Rachel & Gardner, Neville & Kerney, M.. (2014). Wayland's Smithy, Oxfordshire: Excavations at the Neolithic Tomb in 1962–63 by R. J. C. Atkinson and S. Piggott. Proceedings of the Prehistoric Society. 57. 61-101. 10.1017/S0079497X00004515. See omnystudio.com/listener for privacy information.

Minnesota Vikings free agent targets: Michael Thomas, Hasan Ridgeway and more

Minnesota Vikings free agent targets involving Michael Thomas, Hunter Renfrow, Julio Jones, Hassan Ridgeway, Bryan Mone and Linval Joseph; Plus where Sam Darnold and JJ McCarthy fell on Chris Simms' QB rankings and more on Purple Daily. Learn more about your ad choices. Visit podcastchoices.com/adchoicesSee Privacy Policy at https://art19.com/privacy and California Privacy Notice at https://art19.com/privacy#do-not-sell-my-info.

Minnesota Vikings free agent targets: Michael Thomas, Hasan Ridgeway and more

Minnesota Vikings free agent targets involving Michael Thomas, Hunter Renfrow, Julio Jones, Hassan Ridgeway, Bryan Mone and Linval Joseph; Plus where Sam Darnold and JJ McCarthy fell on Chris Simms' QB rankings and more on Purple Daily. Learn more about your ad choices. Visit megaphone.fm/adchoices