Podcasts about Danger Zone

- 1,674PODCASTS

- 3,337EPISODES

- 1h 5mAVG DURATION

- 5WEEKLY NEW EPISODES

- Feb 28, 2026LATEST

POPULARITY

Categories

Best podcasts about Danger Zone

Latest news about Danger Zone

- Radiohead demands DHS stop using songs in promotional ICE videos Raw Story - Celebrating 18 Years of Independent Journalism - Feb 28, 2026

- Into the Danger Zone Latest – The Baffler - Feb 19, 2026

- Late-Winter Bee Survival: The 60-Day Danger Zone Every Off-Grid Keeper Must Beat Off The Grid News - Feb 19, 2026

- ECC And OXLC: Highway To The Danger Zone Seeking Alpha - Feb 17, 2026

- XRP enters danger zone: XRP price falls below $1.50 while open interest surges 12% – what will happen next? News-Economic Times - Feb 6, 2026

- Bitcoin Enters a Danger Zone as Investor Profits Collapse – What’s Next? News - Jan 23, 2026

- The rich are powering spending, with the U.S. economy in a danger zone BizToc - Jan 22, 2026

- Syracuse basketball season enters danger zone following Virginia Tech loss Yahoo! Sports - Jan 22, 2026

- The rich are powering spending, with the U.S. economy in a danger zone (Emily Peck/Axios) memeorandum - Jan 22, 2026

- Danger Zone: Shiba Inu Must Hold This Key Level or Risk a Double-Digit Crash Yahoo! Finance - Jan 21, 2026

Latest podcast episodes about Danger Zone

Pope's Point of View Episode 324: Highway To The Danger Zone

Ep. 324: Pope and Pollo Del Mar return to discuss all of the latest In Da Newz including Vince McMahon's Accident Video Release, RAW's Vision woes, AJ Styles HOF Bound and more.

Indo Politics: Why education is now in the political danger zone and Dublin Central battle heats up

The government scrambles to contain the fallout from its SNA allocation controversy, announcing a late night funding reversal but has lasting damage already been done? Plus, Sinn Fein selects Janice Boylan for the crucial Dublin Central by election as Gerry The Monk Hutch gears up for another run. What does it all mean for the political landscape? You can listen to Indo Politics a day early on its own feed by searching Indo Politics See omnystudio.com/listener for privacy information.

Ever held back an idea, question, or concern because it just didn't feel safe? You're not alone. In many workplaces, people stay quiet to avoid rocking the boat — and it's costing teams their full potential. This episode is the recording of the Zoomcast we did, and it dives right smack in the middle of psychological safety: how to create a team culture where people feel confident speaking up, asking questions, taking smart risks, and even making mistakes. Expect real talk, practical ideas, and simple mindset shifts to help you build a workplace where people can truly show up and thrive.

Ryan, Kurt, Laferde and TDW GM Max talk predictions and excitement as we enter the Danger Zone. And Laferde chats with King of the Skies Competitor WIll TyrellPATREON.COM/TALKDORKPODCAST Click The Link for 1 month free Danger Zone tickets link Tree Frog Grading 15% off (Use code: TWD15) check out JCs clothing range below Graffiti WASHED USE THE CODE TALKSWITHDORKS30

Anything that’s in Earth orbit faces the constant threat of radiation – energy and charged particles from the Sun and beyond. It can cause instruments to glitch or fail, and even destroy a satellite. And it poses a health risk for astronauts. The threat is greatest in a zone in the southern hemisphere – the South Atlantic Anomaly. It covers several million square miles above South America and South Atlantic Ocean. It’s a weak spot in Earth’s magnetic field that allows intense radiation to penetrate closer to the surface. And it’s getting bigger. The magnetic field can deflect many of the charged particles that bombard our planet. That protects orbiting satellites and astronauts. It also protects the surface from power blackouts and other effects. But the field is offset a bit from the center of the planet. It extends a little farther into space in some regions, but dips closer to the surface in others. And the South Atlantic Anomaly is the biggest dip of all. Spacecraft that are passing through the region often have to switch off some of their instruments to protect them from the harsh radiation. A recent study found that the anomaly has gotten bigger over the past decade – by about half the area of continental Europe. So the space above that part of Earth is getting nastier – a bigger “danger zone” in the southern hemisphere. We’ll have more about radiation hazards tomorrow. Script by Damond Benningfield

Hat Leipzig den gefährlichsten Bahnhof Deutschlands? Bahn, Polizei und Stadt geben alles, um den Hotspot im Herzen Leipzigs sicherer, sauberer (und auch mausfreier) zu machen! Wir, Eure freundlichen Hosts Daniel Heinze und Guido Corleone, reden drüber in der neuen Folge von HELDENSTADT, dem Leipziger Wohnzimmerpodcast der LVZ. Moin und Servus nach Dresden und Umgebung! ;) Wie immer gibt's bei uns alles, was Leipzig gerade so beschäftigt: Das Ordnungstelefon ist jetzt auch nachts erreichbar. Endlich Ruhestörungen melden, wenn sie passieren! Außerdem klären wir, was der Verkauf der Höfe am Brühl eigentlich für uns als Shopper bedeutet. Und: Das ZDF bringt „Wetten, dass...“ zurück – mit den Kaulitz-Brüdern! Nur… warum zur Hölle ausgerechnet in Halle?! Unter dem Motto „50 Visionen für Leipzig“ hat die LVZ frische Ideen für die Stadt gesammelt: Öffentliche Badestellen mitten in der City? Eine Housing-First-Strategie für Wohnungslose? Mehr Support für die Café-Kultur? Bring it on! Be-Beat-and-Rhythm: Der Top-Veranstaltungstipp ist diesmal die nahende Buchmesse. Das diesjährige Programm ist raus und in Sachen Ticketing und Einlass ist einiges neu. Außerdem legen wir Euch zwei Konzerte ans Herz: Simmcat im Noch Besser Leben und Hanna Rautzenberg im Naumanns. Reddit sei Dank lernt ihr schließlich noch eine ganz besondere Lokalität in Bahnhofsnähe besser kennen - Bock auf Bierchen? Ganz viel Leipzig für Eure Ohren und Herzen - viel Spaß mit der Flussbadestelle unter den Leipzig-Podcasts: „HELDENSTADT. Der LVZ-Podcast aus Leipzig mit Daniel Heinze und Guido Corleone“, Folge vom 23. Februar 2026! Folgt dem Podcast in Eurer Podcast-App, damit neue Episoden automatisch angezeigt werden! @heldenstadt sind wir bei Instagram, Mastodon, Threads und Facebook. Dankeeee!

Ryan chats With Maverick Rumble Entrant Dave Bavarra and Sunset Skip, While Laferde has to deal the lingering presence of the Monster Mordekai ShawPATREON.COM/TALKDORKPODCAST Click The Link for 1 month free Danger Zone tickets linkTree Frog Grading 15% off (Use code: TWD15) check out JCs clothing range below Graffiti WASHED USE THE CODE TALKSWITHDORKS30

Season 8 Episode 7 - Defenders of the Earth

Season 8 goes full pulp-hero mode as Dangerous Dave dives into one of the boldest and most ambitious animated crossovers of the 1980s — Defenders of the Earth.We rewind to 1986 in What Happened Way Back When, uncovering cult movies, era-defining songs, and forgotten TV gems from a year where cartoons weren't just entertainment — they were mythology in motion. Retro Headlines from the UK and US set the scene for peak 80s pop culture excess.In a huge Dangerous Deep Dive, Dave explores the history of Defenders of the Earth, from its King Features pulp roots to its daring attempt to unite Flash Gordon, The Phantom, Mandrake the Magician, and Lothar into one shared animated universe. The episode breaks down the cast, characters, and the Top 20 episodes, exploring the darker tone, epic stakes, and the larger-than-life villainy of Ming the Merciless.Elsewhere in the episode:

Ryan is joined in part 1 by The bad ass of British Wrestling Leia Elise and her opponent for the 28th of February The royalty of wrestling Princessand in part 2 King of the Skies Competitors Sir Ryan Matthews and his opponent Gary of the flying scotsmen plus The other half of the fying scotsmen Stephen talks about the Maverick RumblePATREON.COM/TALKDORKPODCAST Click The Link for 1 month free Danger Zone tickets link:Tree Frog Grading 15% off (Use code: TWD15) check out JCs clothing range below Graffiti WASHEDUSE THE CODE TALKSWITHDORKS30

Confirming Your Calling (Part 8) | 2 Peter 1:8-9 -------------------------- Sermon Outline------------------------------ Introduction: Testimonies and Truth . . . II. Salvation's Service: The Believer's Faithfulness (5-9) A. Faithfulness Demonstrated Through Seven Virtues (5-7) B. Staying Out of the Danger Zone (8-9) 1. A Positive Exhortation (8) 2. A Negative Warning (9) a. Change in grammar from plural to singular (hypothetical example?) b. No such thing as a totally fruitless Christian c. Spiritual blind-spots in our lives Conclusion:

Kurt and Laferde chat with The Enforcer Ian Frost, Mr Dexter and TDW head referee Elliot JamesPATREON.COM/TALKDORKPODCAST Click The Link for 1 month Danger Zone tickets linkTree Frog Grading 15% off (Use code: TWD15) check out JCs clothing range below Graffiti WASHED USE THE CODE TALKSWITHDORKS30

Season 8 takes a gentle but surprisingly powerful turn as Dangerous Dave dives into one of the most quietly memorable British children's shows of the 1980s — The Shoe People.We rewind to 1987 in What Happened Way Back When, uncovering obscure movies, cult songs, and forgotten TV shows from a year dominated by loud pop culture on the surface, but thoughtful, emotionally rich storytelling just beneath it. Retro Headlines from the UK and the US help set the scene for a decade in full swing.In a deeply affectionate Dangerous Deep Dive, Dave explores the full history of The Shoe People — from its origins as illustrated children's books to its calm, distinctive animated style. The episode breaks down the world of Shoe Town, its characters, and a detailed look at the 20 most memorable episodes, revealing how the show tackled loneliness, inclusion, empathy, and community in ways few children's programmes dared to.Elsewhere in the episode:

Zuma Wealth's Spath: Investors are scared, without much real reason for it

Terri Spath, founder and chief investment officer, at Zuma Wealth says it is understandable that investors are nervous with a lot of geopolitical worries and headlines on top of a market winning streak that can't go on forever, but she says that a strong earnings outlook, a healthy economy and the market's hot start to 2026 have her constructive and positive on the year ahead, expecting more good news without the negatives of recession or a bear market. She is urging clients to go back to basics to calm their nerves, noting that the market is going through a sharp rotation away from a few leaders to a broader outlook where investors will benefit from diversification and patience. With Valentine's Day ahead this week, David Trainer, president at New Constructs, eschews the usual worrisome pick for The Danger Zone, and instead goes for something much sweeter, a home-building company that he says is particularly attractive now. With jobs and inflation data on tap for this week — and the stock market coming off a big downturn in software stocks — Vijay Marolia discusses investors' nerves and how some might be letting headlines get in the way of good long-term buying opportunities in software, and whether they will be distracted by the jobs and inflation numbers released this week. Plus, he delves into "bets" versus "predictions" and more in "The Week That Is." Plus, Chuck digs in deeper to his Super Bowl jinx -- the trend he has identified in companies that buy Super Bowl ads within seven years of their initial public offering -- to discuss which companies from Sunday's big game might be losers in the market moving forward.

Once your portfolio crosses $5 million, the game changes. Growing your money is no longer the hard part... protecting it is. Tax mistakes that used to feel like small inefficiencies can quietly turn into six-figure problems that compound throughout retirement.This episode breaks down the tax strategies that actually matter once you're in high-net-worth territory. With multiple account types, portfolio income pushing you into higher brackets, and large pre-tax balances creating future RMD and Medicare risks, the way you withdraw money becomes far more important than how much you've saved.The focus here isn't how to minimize taxes this year. It's how to reduce your lifetime tax liability. James covers intentional tax-bracket filling, when Roth conversions help and when they backfire, why asset location matters more as portfolios grow, how capital gains planning really works, and how charitable strategies can dramatically improve after-tax outcomes. Doing Roth conversions the wrong way can cost nearly seven figures, shown by James' sample case study, helping you see that a disciplined approach creates meaningful long-term gains.If you have $5 million or more invested, this is about control. Control over when you pay taxes, which accounts you pull from, and how much of your wealth you actually get to keep.-Advisory services are offered through Root Financial Partners, LLC, an SEC-registered investment adviser. This content is intended for informational and educational purposes only and should not be considered personalized investment, tax, or legal advice. Viewing this content does not create an advisory relationship. We do not provide tax preparation or legal services. Always consult an investment, tax or legal professional regarding your specific situation.The strategies, case studies, and examples discussed may not be suitable for everyone. They are hypothetical and for illustrative and educational purposes only. They do not reflect actual client results and are not guarantees of future performance. All investments involve risk, including the potential loss of principal.Comments reflect the views of individual users and do not necessarily represent the views of Root Financial. They are not verified, may not be accurate, and should not be considered testimonials or endorsementsParticipation in the Retirement Planning Academy or Early Retirement Academy does not create an advisory relationship with Root Financial. These programs are educational in nature and are not a substitute for personalized financial advice. Advisory services are offered only under a written agreement with Root Financial.Create Your Custom Strategy ⬇️ Get Started Here.Join the new Root Collective HERE!

Jeremy Fears Jr. enters the danger zone; Portland's historic upset of Gonzaga; HUGE Fri/Sat on tap led by UConn-SJU; Duke-UNC; Illinois-Sparty; Florida-A&M

Gary Parrish and Matt Norlander open on a weird week for Michigan State star Jeremy Fears. Dirty plays? Possible benching? What will happen this weekend? Gonzaga has a major stumble and BYU is sliding after a loss to Oklahoma State. Then, the Final Four And 1 previews an incredible slate of college hoops. (0:00) Intro (0:45) Jeremy Fears is a college basketball villain. What is going on here? (11:30) Gonzaga suffers a stunning loss to Portland (21:50) BYU loses a third straight…and Houston is on the horizon (25:45) Houston beats UCF by 3+ touchdowns…but Kelvin says Houston is poor (27:55) Utah State goes to the Pit and smokes New Mexico (31:10) Final Four And 1 (33:15) UConn @ St. John's (41:50) Duke @ North Carolina (51:55) Illinois @ Michigan State (55:45) Florida @ Texas A&M (1:00:35) Miami (OH) @ Marshall (1:03:55) Norlander's Notes: More games to watch Theme song: “Timothy Leary,” written, performed and courtesy of Guster Eye on College Basketball is available for free on the Audacy app as well as Apple Podcasts, Spotify and wherever else you listen to podcasts. Follow our team: @EyeonCBBPodcast @GaryParrishCBS @MattNorlander @Boone @DavidWCobb @TheJMULL_ Visit the betting arena on CBSSports.com for all the latest in sportsbook reviews and sportsbook promos for betting on college basketball. You can listen to us on your smart speakers! Simply say, “Alexa, play the latest episode of the Eye on College Basketball podcast,” or “Hey, Google, play the latest episode of the Eye on College Basketball podcast.” Email the show for any reason whatsoever: ShoutstoCBS@gmail.com Visit Eye on College Basketball's YouTube channel: https://www.youtube.com/channel/UCeFb_xyBgOekQPZYC7Ijilw For more college hoops coverage, visit https://www.cbssports.com/college-basketball/ To hear more from the CBS Sports Podcast Network, visit https://www.cbssports.com/podcasts/ To learn more about listener data and our privacy practices visit: https://www.audacyinc.com/privacy-policy Learn more about your ad choices. Visit https://podcastchoices.com/adchoices

Ryan sits down with The 4 men facing each other at TDW DangerzoneKev dee The Cosplay Nightmare, The Misfit Johnny Royal, Michael 'Parky Streams' Parks and Preston SagePATREON.COM/TALKDORKPODCAST Click The Link for 1 month free Danger Zone tickets linkTree Frog Grading 15% off (Use code: TWD15) check out JCs clothing range below Graffiti WASHED USE THE CODE TALKSWITHDORKS30

Season 8 Episode 5 - Land of the Giants (1968)

Season 8 takes a huge step back into classic science fiction as Dangerous Dave dives into one of the boldest, strangest, and darkest TV shows of the late 1960s — Land of the Giants.We rewind to 1968 in What Happened Way Back When, exploring obscure movies, songs, and television from a year defined by upheaval, paranoia, and ambition, before setting the scene with Retro Headlines from both the UK and the US during one of the most turbulent years of the decade.In a massive Dangerous Deep Dive, Dave breaks down the full history of Land of the Giants — from Irwin Allen's ambitious concept and Cold War undertones to the cast, characters, and the show's survival-driven tone. A detailed countdown of the Top 20 episodes explores why the series leaned more into tension and fear than its sci-fi contemporaries, highlighting themes of power, surveillance, dehumanisation, and life at the mercy of a hostile world.Elsewhere in the episode:

This week on the Exciting & New podcast, Jason, Andy and Dana welcome Shamus back on the show to discuss the 1986 action flick Top Gun. Tom Cruise leads this All-Star cast and their need for speed as they shoot down MIGs and spike volleyballs, all the while trying their best to show the world they're straight. Once again, we have a woman cast just so we aren't confused by the sexuality of the cast, but no one is really fooled. Ice Man, Goose, Maverick and Merlin all want to get into each other's cockpit. DANGER ZONE!! Enjoy the podcast!Jason, Andy and Dana will discuss a 1986 movie weekly, breaking down all the nonsense there within. The 3 hosts all work together and everyone else around them was getting really annoyed at all the movie talk, so they decided to annoy the world in podcast form.Check out previous seasons to hear them discuss 1982, 1983, 1984 & 1985 movies, as well as a full season of Love Boat episodes (if that is your thing). Plus one-off specials and a weekly mini "what are we watching" podcast.#jezoo74 #aegonzo1 #danacapoferri #exciting_new

We went in expecting a messy anthology and came out with a genuinely original love letter to Oakland, 1987 — four stories that start as separate vibes and then click together in the final act like a mixtape that suddenly makes sense.The setup is pure mood: people spilling out of a cinema after The Lost Boys, a bright green “something in the air” glow hanging over the city, and a pulpy, comic-book style that flirts with Sin City / Scott Pilgrim energy. It's stylish, funny, and—when it wants to be—ferociously violent.What we cover in the episodeThe anthology structure: four chapters that interconnect and payoff later, with Oakland culture (music, venues, street energy) doing most of the heavy lifting.Chapter 1: “Strength in Numbers – The Gilman Strikes Back” A straight-edge punk club gets terrorised by Nazi skinheads… and the punks decide they're not taking it anymore. We talk wish-fulfilment retribution, the myth-making tone, and the film's “300-style” brawl choreography.Chapter 2: “Don't Fight the Feeling” Two women from rap group Danger Zone get their shot at a battle with Too $hort — and turn it into an 80s feminist mic-drop. The ice-cream shop scene with a vile, racist cop is one of the most uncomfortable (and effective) bits in the whole film.Chapter 3: “Born to Mack” (Pedro Pascal) A one-last-job crime thread that flips into tragedy and revenge. We dig into how this segment links the others, and why it feels like the “spine” of the film.Chapter 4: “The Sleepy Floyd Story” A real NBA legend (29 points in a quarter) gets turned into a Kill Bill-style revenge myth — samurai swords, home-invasion carnage, and a final twist that goes full pulpy sci-fi.The big theme: modern, direct, and not subtle — Nazis can get in the bin. The film turns that into catharsis, and it lands.The verdictThis is a labour-of-love movie: inventive, ridiculously well-styled, packed with music, and shot so you can actually see what's happening in dark scenes (rare these days). It does get very bloody—especially the final stretch—but it's never boring.If you want an episode with hype, plot breakdown, and us arguing where the film crosses from “clever urban legend” into “absolute madness,” this one's for you.You can now text us anonymously to leave feedback, suggest future content or simply hurl abuse at us. We'll read out any texts we receive on the show. Click here to try it out!We love to hear from our listeners! By which I mean we tolerate it. If it hasn't been completely destroyed yet you can usually find us on twitter @dads_film, on Facebook Bad Dads Film Review, on email at baddadsjsy@gmail.com or on our website baddadsfilm.com. Until next time, we remain... Bad Dads

Season 8 Episode 4 - Winona Ryder in the 80's & 90's

Season 8 continues with a deep, affectionate dive into one of the most important and quietly influential film careers of the late 20th century — Winona Ryder.Dangerous Dave explores how Winona became the defining face of outsider cool, Gen-X intelligence, and emotional honesty across the 1980s and 1990s. We rewind the clock in What Happened Way Back When, digging into obscure movies, cult songs, and forgotten TV shows from the era that shaped her rise, before hitting Retro Headlines from the UK and the US to set the cultural backdrop.In a long-form Dangerous Deep Dive, the episode charts Winona's journey from teenage breakout to generational icon, with detailed discussion of her 80s films (Lucas, Beetlejuice, Heathers) and her defining 90s run (Edward Scissorhands, Reality Bites, Little Women, Girl, Interrupted). Each era is unpacked with context, behind-the-scenes stories, and why these roles still resonate today.Elsewhere in the episode:

The Danger Zone – Is Your Job At Risk? | BBB – 74

How do you know if you're in trouble at work and about to be laid off?Eugene and Stephanie talk about:– How do you know if you're in danger of being laid off? We answer a listener's question and talk – PIPs (Performance Improvement Plans) and how to tell a good faith one from a bad faith one– Why we don't sue even when we could – What the face of your boss's spouse can tell you about your professional future. – And Eugene's newest fashion accessoryListen now and drop a note in the comments about what decisions you are making right now. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit badbossbrief.substack.com/subscribe

WCG's Leger: With tailwinds to overpower worries, the S&P will hit 8,500 in '26

Talley Leger, chief market strategist at The Wealth Consulting Group, says the market is facing seven different headwinds, but that it has 10 tailwinds, all blowing to overcome potential troubles to where he expects the Standard & Poor's 500 to reach 8,500 this year. That would make 2026 the fourth consecutive year with double-digit market gains, but Leger is confident in his pick, noting that easing financial conditions — including a few more rate cuts from the Federal Reserve — should support economic re-acceleration to let the rally roll on. Leger is not the only one who is optimistic, as the latest Business Conditions Survey, released today by the National Association for Business Conditions, showed that the nation's economists have mostly factored recession out of the picture for this year. While the economists do see potential overhangs from tariffs and other policies impacting business, they say that spending plans in their companies — but more broadly for the economy at large — should fuel continued growth. Vijay Marolia, chief investment officer at Regal Point Capital, is also optimistic for the future, coming off of the World Economic Summit at Davos — where he says the lesson was to keep watching geopolitics without over-reacting to them by overhauling your portfolio. Further, in "The Week That Is," he discusses how the market is reacting to feelings rather than fundamentals in the current earnings season, and how it's still not too late for investors to reconsider their commodities holdings, even after gold and silver popped again last week, with silver reaching fresh highs above $100. David Trainer, founder and president at New Constructs, puts five different technology stocks — including Magnificent Seven member Meta Platforms and tech giant Oracle — in "The Danger Zone," noting that they have troubling balance sheets that have created significantly misleading stock valuations, which he says will not hold up once the market recognizes the potential for trouble.

The Meat Dude Spencer Wirt is on Afternoons Live with Tyler Axness every week to answer all your meat related questions.See omnystudio.com/listener for privacy information.

Mark and Tom talk Steelers coach, Penguins, a little baseball, and much more! See omnystudio.com/listener for privacy information.

Mark and Tom talk Steelers coach, Penguins, a little baseball, and much more!

Intervallum's Thomson: 'Fragile' macro backdrop pushes market towards 'thin ice'

Alan Thomson, chief executive officer at Intervallum Technologies — which has developed a factor-rotation index based on evolving market conditions — says that the market's strong conditions are "durable," but that a "fragile" macro environment has created stresses. This makes for a "thin-ice state," where the market shows stability and could stay that way for the foreseeable future, but the underlying risks can not be ignored. He noted that should not put investors out of the market, but should instead have them aware that trouble is possible and to factor downside risk potential into their near-term outlook. Vijay Marolia, chief investment officer at Regal Point Capital, looks at the big start that the latest earnings season got off to last week thanks to some brand-name financial companies, and he talks about two companies that he thinks are must-watch news as earnings season transitions to more of the consumer and industrial names. He also discusses what he's looking for in companies from all industries to make sure they are staying on top of opportunities in the business world. David Trainer, founder and president at New Constructs, put five different stocks in the Danger Zone this week, noting that he expects them all to miss earnings estimates because Wall Street has been listening to whisper numbers or allowing legal accounting tricks to artificially inflate the numbers. Plus, Chuck answers a listener's question about whether he can keep contributing to a Roth IRA now that he has retired.

Podcast: Why Portfolio Managers Overlooking AI Are In the Danger Zone

CEO David Trainer sat down with Chuck Jaffe of Money Life to talk about our Danger Zone pick this week: Portfolio Managers Who Don't Know How to Use AI.

Trust Lending, SMSFs, and the New Property Danger Zone

The Elephant In The Room Property Podcast | Inside Australian Real Estate

Property investing has rarely looked more seductive—or more dangerous. In this episode, Veronica and Chris unpack the growing gap between how property portfolios are being sold and how risk is quietly stacking up beneath the surface. As regulators tighten lending rules and banks pull back, the question isn't whether the rules are changing—it's whether investors are paying attention.The conversation dives deep into aggressive lending practices now under scrutiny: trust lending, SMSF borrowing, equity extraction, and the promise of “instant equity” through optimistic bank valuations. Veronica and Chris challenge the idea that buying multiple properties fast is a strategy, exposing how many portfolios are built on valuation certificates rather than fundamentals—and what happens when interest rates rise, rents soften, or lending conditions tighten.They also examine the uncomfortable incentives driving this behaviour: buyer's agents rewarded for volume, brokers pushed to maximise borrowing capacity, and everyday Australians—often in their late 40s and 50s—being sold complex structures they don't fully understand. From regional markets distorted by borderless buying to SMSFs loaded with illiquid property, the risks are not theoretical—they're already unfolding.This episode is a warning shot. If your strategy relies on constant refinancing, rising valuations, or ever-looser lending, this conversation will force you to rethink it. Because when the cycle turns, the consequences won't be shared evenly—and paper equity won't save you.Episode Highlights00:00 — Introduction to Property Investing Risks01:11 — Regulatory Crackdown on Risky Lending01:46 — The Role of Buyer's Agents and Brokers03:19 — Trust Lending and Self-Managed Super Funds12:19 — Instant Equity and Market Manipulation18:40 — The Pitfalls of Following Bad Advice24:28 — Questionable Advice from Buyer's Agents25:32 — Judging Awards and Industry Practices26:16 — Vulnerable Investors and Risky Promises27:13 — APRA's Role and Investor Lending Trends29:31 — Superannuation and Property Investments35:32 — Private Lending and Market Risks42:53 — Cross Collateralization and Loan Structuring48:54 — Conclusion and Final WarningsAbout the HostChris Bates is a mortgage broker and co-founder of Alcove, working with clients across Australia to help them navigate complex property and lending decisions. Known for his data-driven approach, Chris specialises in long-term strategy, lending structures, and helping buyers avoid costly financial mistakes.Veronica Morgan is a buyer's agent and property strategist with nearly two decades of experience advising owner-occupiers and investors. With a background in research, data analysis, and on-the-ground buying, Veronica is widely respected for cutting through market noise and focusing on fundamentals, risk, and long-term outcomes.Together, they bring a practical, evidence-based lens to Australia's property market — challenging assumptions and unpacking what actually matters.ResourcesVisit our website: https://www.theelephantintheroom.com.auIf you have any questions or would like to be featured on our show, contact us at:The Elephant in the Room Property Podcast - questions@theelephantintheroom.com.auLooking for a Sydney Buyers

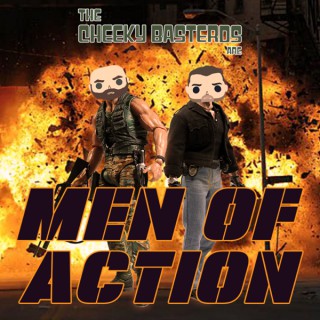

Episode 41: Cruising The Danger Zone Highway

Welcome all you slack jawing sons of bitches to the Men of Action Podcast, the monthly action movie throw down show. On this month's episode we will be examining the mission of Maverick, Phoenix, Bob, Rooster, Payback and Fanboy's from Josh Kosinski's action drama "Top Gun: Maverick" to see if it was a success, epic failure or complete waste of time. So buckle up buckeroos, cuz shit's about to get explosive.The Men of Action:Please be sure to LIKE, SUBSCRIBE and leave us a REVIEW.Follow the Show on our Socials:Facebook, Instagram & Threads: @menofactionpodcastBlue Sky: @CheekyBasterdsEmail: thecheekybasterdspodcast@gmail.comDropping A Bruce:Follow the show on our Socials:Facebook & Instagram: @DroppingABruceEmail: DroppingABrucePod@gmail.com

Isn't it kind of weird how Archer was a huge cultural thing for a minute? Then a group of extremists called themselves ISIS and the whole show started the flush into irrelevance. But at the very least we got a few good memes out of it. So in that spirit, we'd like to do a movie in reference to the Kenny Loggins obsession Archer had. To that end we have Danger Zone(1996). Billy Zane and Robert Downey Jr are dudes in Africa. Downey is running “toxic waste” on behalf of an evil corporation because this is the nineties. Bad things happen and Downey disappears and Zane flees Africa. Then he … Continue reading "Popcorn 256: Tokyo Danger"

Today, we go back to a conversation with Grammy Award-winning singer-songwriter Kenny Loggins. Loggins, who is also known as the "King of the Movie Soundtrack”, discusses his past hits including the recent success of his song “Danger Zone” in the 2022 film “Top Gun: Maverick.” Also, Loggins touches on the early days of his career, joining forces with Jim Messina, and how he looks at the music industry today. Learn more about your ad choices. Visit megaphone.fm/adchoices

The Low pH Danger Zone: Bob Lowry Breaks It Down

Ever wonder why a pool can look fine one week and show stains, rough plaster, or a failing heater the next? The culprit is often low pH—water that turns aggressive, dissolves metals, and etches surfaces long before the damage is obvious. We walk through how acidic water behaves, where metals come from, and why stains show up only after the water hits its saturation point.We dig into real-world service scenarios: vinyl and fiberglass pools that trend acidic because they lack buffering minerals, spa tubs that swing wildly depending on chlorine type and use, and the risky combo of low pH with cheap test kits that feed bad decisions. You'll hear why investing in a reliable photometer that reads copper and iron saves you from surprise stains and equipment corrosion, plus a clear plan for when to use soda ash, borax, or baking soda. We also share a fast spa recovery routine: raise alkalinity first, then aerate to lift pH without overshooting.Along the way, we challenge old chlorine wisdom. With cyanuric acid in play, the classic HOCl charts don't tell the whole story. The smarter approach is keeping free chlorine appropriate to CYA while holding pH near 7.5 for swimmer comfort and stable balance. We cover borates as a pH buffer, how they affect alkalinity readings and the saturation index, and why soda ash lifts pH and alkalinity more strongly than bicarb when both are low.• why low pH makes water aggressive• etched plaster, corroded components, invisible metals• saturation points leading to staining• value of accurate copper and iron testing• vinyl and fiberglass pH drift and tablet use• spa chemistry, aeration, and quick rebalancing• comfort thresholds for bathers around pH 7.5• choosing borax, soda ash, or bicarb by goal• borates' impact on readings and stability• chlorine effectiveness with cyanuric acid• practical dosing plans and test habitsAre you a pool service pro looking to take your business to the next level? Join the pool guy coaching program. Get expert advice, business tips, eSend us a textSupport the Pool Guy Podcast Show Sponsors! HASA https://bit.ly/HASAThe Bottom Feeder. Save $100 with Code: DVB100https://store.thebottomfeeder.com/Try Skimmer FREE for 30 days:https://getskimmer.com/poolguy Get UPA Liability Insurance $64 a month! https://forms.gle/F9YoTWNQ8WnvT4QBAPool Guy Coaching: https://bit.ly/40wFE6y

Annex Wealth's Jacobsen: Yes, the market can rise from here, but not by much

Brian Jacobsen, chief economic strategist at Annex Wealth Management, says 2026 will be a year in which valuations and fundamentals really matter, as the broad market will see more volatility and will have less momentum. After three straight years of gains around 20% annually, Jacobsen says investors will need to curb their enthusiasm and settle for gains that, at best, he thinks will only get to high single-digit levels. He says that valuations in large-cap stocks "have created too many vulnerabilities for us to really sleep well at night," which is why he favors international, small- and mid-cap stocks and value stocks for the year ahead. David Trainer, founder and president at New Constructs, puts the focus squarely on stock pickers in this week's Danger Zone, discussing the benefits — or more importantly the drawbacks, behind active management. Plus, in "The Week That Is," Vijay Marolia, chief investment officer at Regal Point Capital, tells the tale of two tech stocks — one living through the best of times, another the worst of times — covers the evolving battle for content creators and distributors, and offers a holiday wish and suggestion for investors.

Podcast: Why Active Portfolio Managers Are In the Danger Zone

CEO David Trainer sat down with Chuck Jaffe of Money Life to talk about our Danger Zone pick this week: Active Portfolio Managers.

On this week's Keep It Tight, Deirdre & Emma discuss Christmas panic, Paul Mescal's new film and the secrets to longevityThis Podcast is part of the Acast Network.Recorded at D2 Podcast StudioArtwork: Alan Bourke-TuffyThank you for listening! Follow Keep It Tight on Instagram!Hosted on Acast. See acast.com/privacy for more information.Thank you for listening! Follow Keep It Tight on Instagram! Artwork: Alan Bourke-Tuffy Hosted on Acast. See acast.com/privacy for more information.

Is it possible to escape the cycle of desire that keeps us bound? In this episode, Thom explores the subtle mechanics of kaṛma and the paradox of fulfillment, blending ancient wisdom with contemporary dilemmas. Move beyond the myth of desire-free enlightenment and discover the true role desires play in moving us, often mysteriously, right where we need to be. Prepare to step into a new understanding of fulfillment, agency, and the playful nature of wants.Episode Highlights[00:45] Kaṛma: Action that Binds[03:30] The Danger Zone[06:44] Kṛiya: Action that Doesn't Bind[09:33] The Power of a Pink Shirt[13:13] A Literal Bucket List[15:48] The Desirability of a Desire-free State[18:42] Q - Does attachment to the desire for enlightenment keep you bound?[18:50] A - The Hypnosis of Social Conditioning[21:37] Enlightenment's an Acquisition[24:38] Desires Just Move Me AroundUseful Linksinfo@thomknoles.com https://thomknoles.com/https://www.instagram.com/thethomknoleshttps://www.facebook.com/thethomknoleshttps://www.youtube.com/c/thomknoleshttps://thomknoles.com/ask-thom-anything/

Are we ending this civilization? Climate warnings from 8 top scientists in the UK Emergency Briefing. First two new interviews: Prof. Brian Soden: phenomenal heat burst of 2023/24 NOT caused by change in ship pollution regs. Harvard's Dr. Cheng He: “Escalated Heatwave Mortality …

Paranormal NL Podcast -Thinning of the Veil with JJRose777

In this Paranormal NL Podcast UPRN Segment #57 Thinning of the Veil Special -host Jen Noseworthy talks with Guest: JJRose777 from California, USA. JJRose777 was on PNL Podcast season two 2024-S2/E48 & S2/E140 & now Season Three 2025-S3/E50 (UPRN Seg#57). JJRose777 is a lifelong psychic, Lightworker and all things 6th sense and Metaphysical from California, USA. Besides being the lead psychic specialist for a paranormal Investigation team and an Ordained Non-Denominational Minister, she is also a White Witch and Lightworker. She focuses on being a Metaphysical Teacher with her YouTube Channel JJROSE777 where you can find videos from just waking up into the Spiritual world, to advanced videos to help you learn to clear yourself and most especially to Bubble Up which is a form of spiritual protection. Her specialty is energy & entity clearing and cleaning – which is a nice way to say exorcist. Follow JJRose777 on her Linktree https://linktr.ee/jjrose777 and her YouTube: https://www.youtube.com/@jjrose777 JJRose777 is part of the Fab-5 Group. The Fab-5 consists of Kat Ward from Paranormal Heart Podcast from Ontario, Canada (Fellow UPRN host) who was on PNL Podcast Season two 2024-S2/E18 & Season Three-2025- S3/E1(UPRN Seg#9); Tim Sudano from Paranormal Insight & SCARI from California, USA (fellow UPRN host) who was on PNL Podcast season three 2025-S3/E3 (UPRN Seg#11); Tommy Cullum from Let's Get Freaky Podcast from the UK, who was on PNL Podcast season two 2024- S2/E7 & S2/E41 & Season Three 2025-S3/E15 (UPRN Seg#22) and Erick Szilagyi from UN-comfortable Podcast from Indiana, USA who was on PNL Podcast Season Three 2025- S3/E51 (UPRN Seg#58). JJRose777 also Co-hosts the Podcast “3 Sirens and a Squirrel” with Jayce from @Wabi_Sabi (who was on PNL Season Two 2024-S2/E67); and Kim Bishop -white witch (who was on PNL Podcast Season Two 2024-S2/E70, and Season Three 2025-S3/E48 -UPRN Seg#55 with Kim's alchemist & distiller husband Alan Bishop from If You Have Ghosts You Have Everything Podcast). Kim is also owner of the Witches Brew BOOtique; and collabed with Paranormal Coven (Linda & Leva who were also on PNL Podcast Season Two 2024-S2/E134). Shout out to Podcasters Chucky_Dander (Sharles Stephens) from Danger Zone & Countercult who was on PNL Podcast S2/E50,S2/E119 mastermind of the Linktree (International Paranormal Alliance) IPA Shout out to Dayvid Salinas from DTRH (Down The Rabbit Hole) & Dayvid Don't Know, Weird Java in the Morning, Won Nothing who was on PNL Podcast S2/E60, and S3/E53 (UPRN Seg#40) Shout out to Kevin Sapiel Jr. from Where The Weird Ones Are who was on PNL S2/E57, S2/E139 Shout out to UPRN Producer Michelle Desrochers from Ontario, Canada. Michelle is also host of The Outer Realm Radio & Beyond the Outer Realm on UPRN. https://linktr.ee/michelledesrochers_ Jennifer Vallis (JV)-Noseworthy, RN (Jen) Paranormal NL (PNL) Podcast & BOG Team Founder/host "Paranormal NL (PNL) Podcast" Founder/Team Lead: PNL BOG Team. A "Boots on Ground" Paranormal Investigation Team Email: paranormal.nl.podcast@gmail.com Follow Paranormal NL Podcast & the BOG Team at https://linktr.ee/paranormalnlpodcast

Kenny Loggins: Taking Liberties with Rainbows (Re-Release)

Buckle-up because you're about to jet-set into some fantastic stories when Kenny and Rob take the mic. In this "Literally" re-release, find out the origins to “Danger Zone” and “What a Fool Believes”, Why Steve Perry was coaching Cyndi Lauper at the “We are the World” recording, and, of course, "Top Gun!"Make sure to subscribe to the show on YouTube at YouTube.com/@LiterallyWithRobLowe! Got a question for Rob? Call our voicemail at 323-570-4551. Your question could get featured on the show! Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

The Danger Zone: Why Filter Cleaning Requires Real Safety

Pressure doesn't look dangerous—until the instant it is. We take you right to the two moments that matter most in filter service—when the lid comes off and when it goes back on—and show you how to turn a risky task into a safe, repeatable routine.We start by reframing the filter as a pressure vessel, not a harmless canister. Sand filters are usually one-piece and lower risk; cartridge and DE filters come apart, rely on clamps or locking rings, and can fail if misaligned or under-tightened. You'll hear why modern safety designs like the Aquastar Pipeline's interlock are so effective and how to apply the same logic on any system: power down, bleed air, drain, and verify zero pressure before loosening hardware.From there, we share practical safeguards that work in the field. Put automation in service mode, move Intermatic trippers, or cut the subpanel, but don't stop there—remove the pump lid so the system can't prime even if a glitch starts the motor. We talk through clamps in detail: reading spring-barrel nuts, preventing cross-threading with a touch of lube, knowing when a clamp is cosmetic-ugly yet structurally sound, and when to replace hardware for peace of mind. On restart, we step back, open the air relief, and wait for water before approaching. A spiking gauge is your red flag for a blocked return or a clogged salt cell; shut down fast, clear the path, and protect the tank.• treating the filter as a pressure hazard• relative risks of sand, cartridge, and DE filters• turning off power and automation service mode• removing the pump lid as a fail-safe• bleeding air and safe startup distance• clamp types, tightening until spring coils meet• avoiding cross-threading and when to replace clamps• spotting dangerous pressure spikes and return blockages• quick priming tips and avoiding automation glitches• training techs to follow a standard safety checklistLearn more at swimmingpoollearning.com On the banner, there's a podcast icon—click for the archive Learn more at PoolGuyCoachinSend us a textSupport the Pool Guy Podcast Show Sponsors! HASA https://bit.ly/HASAThe Bottom Feeder. Save $100 with Code: DVB100https://store.thebottomfeeder.com/Try Skimmer FREE for 30 days:https://getskimmer.com/poolguy Get UPA Liability Insurance $64 a month! https://forms.gle/F9YoTWNQ8WnvT4QBAPool Guy Coaching: https://bit.ly/40wFE6y

Trump Bitcoin Plan FAILED!? (Danger Zone for Altcoins)

In this episode, we break down what went wrong, why Bitcoin is approaching a dangerous zone, and how this could spell serious trouble for major altcoins.

Hartford Funds' Reganti: There's a risk that rate cuts could spur more inflation

Amar Reganti, fixed income strategist at the Hartford Funds, says "The uncertainty is real," over the potential not only for what the Federal Reserve could do but how the market and economy will respond to whatever decision gets made. Reganti says investors are facing the prospect of rate cuts spurring higher inflation, but a lack of action resulting in a tougher employment market and that both outcomes could make things a lot scarier and nerve-wracking than they are now. Rachel Perez discusses a BestMoney.com survey showing two-thirds of consumers say they lose more money paying annual fees on credit cards than they gain from the benefits and perks on those premium cards. David Trainer, president at New Constructs, puts meals-delivery company DoorDash back into the Danger Zone, noting that recent strong results and a big bounce in the price are masking the real trouble that still exists in the balance sheet and that will eventually result in a much lower share price for the stock. In the Market Call, Martin Leclerc, chief investment officer and portfolio manager at Barrack Yard Advisors, explains why he puts much of his focus and emphasis on companies that can "Show me the cash."

Our guest on the podcast today is Dan Haylett, who's the author of a new book called The Retirement You Didn't See Coming. Dan is a financial planner and head of growth for TFP Financial Planning based in the UK. Dan focuses on financial planning, retirement planning, and life planning for people over age 50. He also hosts a podcast called Humans vs. Retirement that is centered on the behavioral aspects of retirement. Prior to joining TFP, Dan occupied several positions in the asset management industry. Dan, welcome back to The Long View.BackgroundBioHumans vs. Retirement podcastThe Retirement You Didn't See Coming: The Guide to the Human Side of Retirement Nobody Warns You AboutTFP Financial Planning“Dan Haylett: Retirement Planning = Life Planning,” The Long View podcast, Morningstar.com, Dec. 5, 2023.Retirement and Happiness“Can You Afford to Retire?—3 Questions to Ask Yourself!” Humans vs. Retirement video, youtube.com, June 2025.“The Fragile Decade: Retirement's Danger Zone,” by Dan Haylett, humansvsretirement.com, June 30, 2025.“Your Brain Has Two Sides. Retirement Needs Both,” by Dan Haylett, linkedin.com, October 2025.“A Plan for Your First 12 Months in Retirement,” Humans vs. Retirement video, youtube.com, 2024.“Few and Deep: The Retirement Lens That Changes Everything,” by Dan Haylett, humansvsretirement.com, Sept. 9, 2025.“Why Retirement Can Feel More Like a Void Than a Victory,” by Dan Haylett, humansvsretirement.com, March 28, 2025.“The Best Things in Retirement Aren't Things at All,” by Dan Haylett, humansvsretirement.com, Feb. 6, 2025.“Don't Let the Fear of the Future Steal Your Retirement Joy,” by Dan Haylett, humansvsretirement.com, Jan. 14, 2025.“Longevity and Brevity: The Two BIGGEST Risks in Retirement,” by Dan Haylett, humansvsretirement.com, Sept. 3, 2024.OtherMichael Finke Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

Kenny Loggins rips President Trump for using ‘Danger Zone' in AI ‘poop' video

See omnystudio.com/listener for privacy information.