Podcasts about Cape

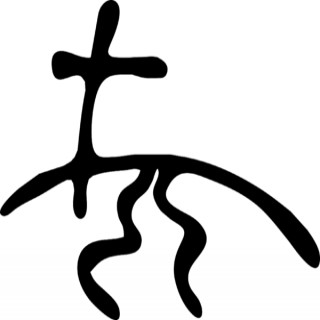

Sleeveless outer garment of varying lengths, sometimes attached to a coat

- 3,740PODCASTS

- 9,338EPISODES

- 42mAVG DURATION

- 1DAILY NEW EPISODE

- Mar 3, 2026LATEST

POPULARITY

Categories

Best podcasts about Cape

Latest news about Cape

- The Houthi dilemma: Why Yemen’s rebels are hesitating after the fall of Khamenei Terrorism Watch - Mar 3, 2026

- A purple waterproof rain cape FehrTrade - Mar 3, 2026

- The Iran Question Is All About China ZeroHedge News - Mar 2, 2026

- CMA CGM avoids Suez Canal in newest China-Europe route DC Velocity - Mar 2, 2026

- The Next 72 Hours In Iran: The Post-Khamenei Order, Command Continuity, And Targeting Strategy – Analysis Eurasia Review - Mar 3, 2026

- Middle East conflict halts Gulf container trade and reroutes global shipping AIR CARGO WEEK - Mar 2, 2026

- Cape Fever: A Novel - down 4.76% ($1.06) to $21.20 from $22.26 Top Amazon Price Drops - Mar 2, 2026

- OEG’s New Crew Transfer Vessel Ready for Inch Cape Offshore Wind Farm Offshore Wind - Mar 2, 2026

- GREAT DEAL Flight deals from Europe, USA, Asia and Australia | Fly4free - Mar 1, 2026

- Vessels Diverted Around Cape of Good Hope MarineLink News - Mar 1, 2026

Latest podcast episodes about Cape

Get ready for a deep dive into the "yeasty moments" of acting life with David Lyons, as he reveals how he transitioned from studying criminology in Australia to landing a career-defining role on the juggernaut series ER. From the intense pressure of leading The Cape to his "blank slate" philosophy for capturing the "dark matter" of a performance, Dave offers a raw, behind-the-scenes look at the persistence needed to survive as an artist. Alongside stories of meeting his wife, Carly Pope, on a pilot and navigating their shared journey as actors, he delivers a powerful reminder that it is absolutely never too late to tell your story. These are the unforgettable stories that landed David Lyons right here. Credits: The Beast in Me The Night Agent Truth Be Told Electric Dreams Eat, Pray, Love The Cape Safe Haven E.R. Revolution The Commons Sea Patrol Guest Links: IMDB: David Lyons, Actor, Director, Writer THAT ONE AUDITION'S LINKS: For exclusive content surrounding this and all podcast episodes, sign up for our amazing newsletter at AlyshiaOchse.com. And don't forget to snap and post a photo while listening to the show and tag me: @alyshiaochse & @thatoneaudition THE BRIDGE FOR ACTORS: Become a WORKING ACTOR THE PRACTICE TRACK: Membership to Practice Weekly CONSULTING: Get 1-on-1 advice for your acting career from Alyshia Ochse COACHING: Get personalized coaching from Alyshia on your next audition or role INSTAGRAM: @alyshiaochse INSTAGRAM: @thatoneaudition WEBSITE: AlyshiaOchse.com APPLE PODCASTS: Subscribe to That One Audition on Apple Podcasts SPOTIFY: Subscribe to That One Audition on Spotify STITCHER: Subscribe to That One Audition on Stitcher EPISODE CREDITS: Host/Producer: Alyshia Ochse Writer: Maddie McCormick WEBSITE & GRAPHICS: Chase Jennings SOCIAL: Alara Cerikcioglu

Are You Mad At Me? with Meg Josephson

On today's episode I welcome psychotherapist and author Meg Josephson to the podcast. Her book Are You Mad at Me? names something so many of us feel but rarely say out loud: Did I do something wrong? Are you mad at me? Meg and I talk about the fawn response, people-pleasing, and the parts of us that learned early on to stay ahead of conflict. We explore how "being nice" can disconnect us from ourselves, why grief and anger are essential to healing, and how mindfulness helps us slow down enough to notice what's really happening inside. If you've ever swallowed your needs to keep the peace, felt resentful after saying yes, or worried that one mistake could cost you connection, our conversation will resonate. We Explore: • Why "Are you mad at me?" isn't really a question, but a feeling. • The difference between being nice and being compassionate. • How grief challenges the hope that if we try harder, we'll finally be seen. • Small corrective experiences that help our parts learn we're actually safe. Here's a link to the workshop she mentioned in the episode. About Meg Josephson Meg Josephson, LCSW, is a licensed psychotherapist and the author of the New York Times bestselling book Are You Mad at Me?, which has been translated into over 20 languages. In her private practice, she specializes in trauma-informed care through a mindfulness-based, compassion-focused lens. She holds a Master of Social Work from Columbia University. Episode Sponsor: Cape Cod Institute Deepen your IFS practice at the Cape Cod Institute this summer, now in its 46th year. Choose from 38 half-day courses, either in person on Cape Cod or live online. Spend your mornings learning, and your afternoons applying insights, connecting with colleagues, or exploring the Cape. If you use IFS, this is a rare opportunity to learn directly from the people shaping the model. A dedicated IFS Week features Richard Schwartz and IFS practitioners teaching couples work, addictive processes, leadership, disordered eating, and psychedelic-assisted psychotherapy. Learn more and register at cape.org, and use code theoneinside2026 for $50 off. About The One Inside I started this podcast to help spread IFS out into the world and make the model more accessible to everyone. Seven years later, that's still at the heart of all we do. Join The One Inside Substack community for bonus conversations, extended interviews, meditations, and more. Find Self-Led merch at The One Inside store. Listen to episodes and watch clips on YouTube. Follow me on Instagram @ifstammy or on Facebook at The One Inside with Tammy Sollenberger. I co-create The One Inside with Jeff Schrum, a Level 2 IFS practitioner and coach. Resources New to IFS? My book, The One Inside: Thirty Days to Your Authentic Self, is a great place to start. Want a free meditation? Sign up for my email list and get "Get to Know a Should Part" right away. Sponsorship Want to sponsor an episode of The One Inside? Email Tammy.

Human-First Operations: Leading Without Sacrificing People with Tamara Whilden

Tamara Whilden is the founder of Behind the Screens, an operations partner for online CEOs ready to scale smarter with leaner systems, stronger teams, and more time to lead. Top 3 Value Bombs 1. AI is not the competitive advantage; your people and how you empower them are. 2. Efficiency without intention leads to burnout, churn, and loss of trust. 3. Human-first leadership creates higher retention, better performance, and real freedom for founders. Check out Tamara's website and take the 2-minute bottleneck assessment - Are you the bottleneck? Sponsors HighLevel - The ultimate all-in-one platform for entrepreneurs, marketers, coaches, and agencies. Learn more at HighLevelFire.com. Cape - A privacy-first mobile carrier, built from the ground up with security as the priority. If you care about protecting your digital life without giving up your smartphone, Cape makes that possible. Visit Cape.co/fire and use code FIRE for 33% off cape for 6 months today!

Tips and Tricks of the 1031 Exchange with Dave Foster: An EOFire Classic from 2022

From the archive: This episode was originally recorded and published in 2022. Our interviews on Entrepreneurs On Fire are meant to be evergreen, and we do our best to confirm that all offers and URL's in these archive episodes are still relevant. Dave Foster is founder and CEO of The 1031 Investor, an accountant and real estate investor helping clients legally reduce taxes through 1031 exchanges and strategic tax planning. Top 3 Value Bombs 1. The IRS encourages a 1031 exchange. It's a normal way to invest in real estate. 2. A 1031 lets you move real estate anywhere in the country, of any type or nature. 3. People use a 1031 to sell in high-value areas and invest where cash flow is higher. Keep all your taxes working for you and get $50 off your first online order - this offer is just for Fire Nation - The 1031 Investor special offer Sponsors HighLevel - The ultimate all-in-one platform for entrepreneurs, marketers, coaches, and agencies. Learn more at HighLevelFire.com. Cape - A privacy-first mobile carrier, built from the ground up with security as the priority. If you care about protecting your digital life without giving up your smartphone, Cape makes that possible. Visit Cape.co/fire and use code FIRE for 33% off cape for 6 months today!

Communities down the Cape and throughout the South Shore are still cleaning up and trying to recover from Monday’s monster Nor’easter! The historic blizzard that dumped more than 3 feet of snow in some areas caused multiday school closures, roadway hazards, and widespread power outages. Residents in Barnstable County and Plymouth County were hit the hardest with over 95k residents without power in Barnstable County and over 35k residents without power in Plymouth County, as of Wednesday afternoon. The power companies report that some customers might not have their power fully restored till Friday! Listeners gave us an update on their community in the aftermath of the Blizzard of 26!See omnystudio.com/listener for privacy information.

Cape Cod hotels fill up with residents sheltering after the blizzard

Crews have worked to restore power over the course of the week, the situation is increasingly dire for Cape residents. While some in area have taken refuge at overnight shelters, others are clamoring for the few hotel rooms in a region that famously shuts its doors in the offseason.

How Millionaires Are Managing Their Own Money and Beating Wall Street with Tan Gera

Tan Gera is an Ex-Wall Street Banker turned Crypto Educator. Top 3 Value Bombs 1. True financial control in 2026 comes from education and eliminating middlemen, not relying on traditional advisors. 2. Predictable income is possible through tokenized assets like stablecoin liquidity pools and tokenized gold. 3. Following smart money means investing early, replicating institutional strategies, and accessing native digital markets. Learn how to become your own bank and manage digital assets - Decentralized Masters Sponsors HighLevel - The ultimate all-in-one platform for entrepreneurs, marketers, coaches, and agencies. Learn more at HighLevelFire.com. Cape - A privacy-first mobile carrier, built from the ground up with security as the priority. If you care about protecting your digital life without giving up your smartphone, Cape makes that possible. Visit Cape.co/fire and use code FIRE for 33% off cape for 6 months today! Scaylor - Ready to simplify and unify your business data? Go to Scaylor.com and get your free demo today.

On the couch: Winning Cape2Rio team finally home after yacht sinks

Pippa Hudson speaks to Sibusiso Sizatu, the winning skipper of the Cape 2 Rio Yacht Race, whose return trip turned into a nightmare, with the crew having to be rescued in mid-ocean, and the boat going down. Lunch with Pippa Hudson is CapeTalk’s mid-afternoon show. This 2-hour respite from hard news encourages the audience to take the time to explore, taste, read, and reflect. The show - presented by former journalist, baker and water sports enthusiast Pippa Hudson - is unashamedly lifestyle driven. Popular features include a daily profile interview #OnTheCouch at 1:10 pm. Consumer issues are in the spotlight every Wednesday while the team also unpacks all things related to health, wealth & the environment. Thank you for listening to a podcast from Lunch with Pippa Hudson Listen live on Primedia+ weekdays between 13:00 and 15:00 (SA Time) to Lunch with Pippa Hudson broadcast on CapeTalk https://buff.ly/NnFM3Nk For more from the show, go to https://buff.ly/MdSlWEs or find all the catch-up podcasts here https://buff.ly/fDJWe69 Subscribe to the CapeTalk Daily and Weekly Newsletters https://buff.ly/sbvVZD5 Follow us on social media: CapeTalk on Facebook: https://www.facebook.com/CapeTalk CapeTalk on TikTok: https://www.tiktok.com/@capetalk CapeTalk on Instagram: https://www.instagram.com/ CapeTalk on X: https://x.com/CapeTalk CapeTalk on YouTube: https://www.youtube.com/@CapeTalk567 See omnystudio.com/listener for privacy information.

Ep.106 Atlanta Adventure: Hunts, Stars, DSC, And Two Country Boys Loose In The City

Send a textTwo country boys hit Atlanta for the Dallas Safari Club Expo and come home with a year's worth of stories, hard-won tips, and new friends from across the hunting world. We start with a chaotic travel day—dead battery on the plane, a tarmac standoff, and a near-miss at a crosswalk—then step into the Georgia World Congress Center and realize just how big DSC really is. With more than 1,300 booths and outfitters from over 43 countries, it's a living map of global hunting, conservation, and gear innovation.We meet TV icons Ralph and Vicki from Archer's Choice, shake hands with Mr. Whitetail himself, Larry Weishuhn, and connect with DSC leadership on why the show's funding model matters: grants for habitat, education, and anti-poaching. A South African outfitter lays out Botswana's elephant math—land that can carry around 75,000 elephants now holds more than 150,000—making a clear case for science-based management. On the North American front, an Alaskan captain opens our eyes to a sleeper DIY blacktail hunt in the panhandle with accessible tags and high densities.Seminars deliver real field value. Dan Adler's glassing masterclass shows how scanning right to left slows your brain and helps you catch the small, wrong-shaped details that give animals away. We get a primer on long-range thinking, then pivot to Craig Boddington's Cape buffalo insights—angles, bullets, and the look that says you “owe it money.” The floor itself is a wonder: jaw-dropping taxidermy, museum-quality replicas for restricted imports, premium optics, Kenetrek boots, Holland & Holland and Rigby, and a $238,000 double in .700 Nitro that we admired more than we dared handle. Add Ox Ranch's tanks and machine guns, plus the history and scale of King Ranch, and the spectrum from tradition to adrenaline comes into focus.The curveball? A late-night wander through a locked-down film set where Tulsa King shoots under cranes and fog. We watch the same scene run a dozen times, then a blacked-out van glides by with the cabin light on and Sylvester Stallone five feet away—scrolling, smoking, and still larger than life. We leave with future podcast guests booked, better glassing habits, and new perspective on how conservation, community, and adventure intersect.If you enjoyed this story-packed ride, follow the show, share it with a friend, and drop a quick rating or review—your support helps us bring more experts and epic hunts to your feed.Check us out on Facebook Hunts On Outfitting, or myself Ken Marr. Reach out and Tell your hunting buddies about the podcast if you like it, Thanks!

MTN SA & RLabs join forces to accelerate youth digital skills development in W Cape

Clarence Ford speaks to Noluthando Pama, General Manager at MTN W Cape about their partnership with RLabs to launch a 12-month youth digital skills and empowerment initiative in the Western Cape Views and News with Clarence Ford is the mid-morning show on CapeTalk. This 3-hour long programme shares and reflects a broad array of perspectives. It is inspirational, passionate and positive. Host Clarence Ford’s gentle curiosity and dapper demeanour leave listeners feeling motivated and empowered. Known for his love of jazz and golf, Clarrie covers a range of themes including relationships, heritage and philosophy. Popular segments include Barbs’ Wire at 9:30am (Mon-Thurs) and The Naked Scientist at 9:30 on Fridays. Thank you for listening to a podcast from Views & News with Clarence Ford Listen live on Primedia+ weekdays between 09:00 and 12:00 (SA Time) to Views and News with Clarence Ford broadcast on CapeTalk https://buff.ly/NnFM3Nk For more from the show go to https://buff.ly/erjiQj2 or find all the catch-up podcasts here https://buff.ly/BdpaXRn Subscribe to the CapeTalk Daily and Weekly Newsletters https://buff.ly/sbvVZD5 Follow us on social media: CapeTalk on Facebook: https://www.facebook.com/CapeTalk CapeTalk on TikTok: https://www.tiktok.com/@capetalk CapeTalk on Instagram: https://www.instagram.com/ CapeTalk on X: https://x.com/CapeTalk CapeTalk on YouTube: https://www.youtube.com/@CapeTalk567See omnystudio.com/listener for privacy information.

Is the S&P 500 Too Concentrated? What Investors Need to Know

The S&P 500's top 10 companies now represent over 40% of the index — the highest market concentration in modern history. What does that mean for investors?In this episode of Gimme Some Truth, we break down market concentration risk, the CAPE ratio (Shiller P/E), and how today's valuations compare to the dot-com bubble. With U.S. large-cap stocks trading at historically elevated levels, we explore whether international diversification, emerging markets, and value-oriented strategies may offer better risk-adjusted opportunities.If you're concerned about overexposure to the Magnificent Seven, high valuations, or portfolio risk heading into 2026, this discussion will help you think strategically about global asset allocation and long-term investing.

In this episode of A Table in the Corner, Russel travels to Boschendal to sit down with Travis Finch, head chef of Arum, to talk about cooking inside one of the Cape's most ambitious agricultural ecosystems. Travis reflects on a career shaped by formative years with Peter Tempelhoff's team and long stints abroad, before returning home to cook at the intersection of land, produce and restraint.The conversation centres on what it means to cook on a regenerative farm at scale, with direct access to gardens, livestock and orchards, and how that proximity reshapes menu thinking, waste, seasonality and responsibility. Travis talks about breaking down formality without lowering standards, working with whole animals and vegetables alike, and designing food that reflects abundance rather than excess.We also explore the realities of running a restaurant across breakfast, lunch and dinner, collaborating with farming teams, and feeding produce back into the wider restaurant group. This is a thoughtful, grounded discussion about provenance, process and pace, told by a chef who understands that the future of cooking is inseparable from how the land beneath it is treated.Learn more about Arum at Boschendal hereGet a fair price with HeadsUpEvery booking is a first impression. Make a good one with NovelMessage me here with comments or guest suggestions.Treat yourself - order direct from Zuney Wagyu www.rwm2012.com On Instagram @a_table_inthecorner Cover image sketched by Courtney Cara Lawson All profile portraits by Russel Wasserfall unless otherwise credited Title music: 'In Time' by Olexy via Pixabay

Fully Embracing a Foolish Message – February 22, 2026

Cape Elizabeth Church of the Nazarene - Weekly Sermon Podcast

“Fully Embracing a Foolish Message”Text: 1 Corinthians 1:18-25We welcome Pastor Eric Larsen back to the pulpit as this week’s guest preacher. What are the messages that come from the cross of Jesus? For Rome, it was capital punishment; for the Jews, rejection. For those who are saved, it is the transformative power of God on…

A journeyman creator and jack of all trades whose build an immersive fictional world pops in to discuss his work!Braxton A. Cosby is an award-winning author, health professional, and the CEO of Cosby Media Productions. A Doctor of Physical Therapy by trade, he has authored over 20 novels and is credited with pioneering the "Sci-Fance" genre, which blends science fiction with romance. His most notable literary work includes the acclaimed Star-Crossed Saga and the superhero series The Cape. Beyond writing, Cosby is a sports nutritionist, actor, and executive producer who develops intellectual properties across film, television, and his comic imprint, Starchild Comics. Based in Georgia, he continues to lead his production company while promoting wellness through non-fiction works like Fat Free for Life.Braxton discusses finding comics, working across various mediums to continue his stories and the vast world he and his co-creators have created. Send a textSupport the show

Episode 263 - How Black Voters Helped Elect Cecil Rhodes: Kimberley and the Cape Franchise, 1879

The battles are coming thick and fast because this is the end of the seventh decade of the 19th Century - the British have just been defeated at the Battle of Hlobane mountain on the 28th March. There's been so much skop skiet and Donner it's time to reflect on matters further south west Before we buzz back to Zululand next episode. n the Transvaal, resistance to British rule was slowly setting, like mortar hardening between stones, the scattered grievances of the Boers beginning to cohere into something firmer, more deliberate. Far to the west, Kimberley glittered with a different intensity - fortunes were rising from the dust, deals were struck in the heat and noise, and the great hole in the earth swallowed men and money alike. Yet beneath the clangour of picks and the shimmer of diamonds, another current was moving. For even as the town prospered, a sequence of personal tragedies was about to cast a longer shadow over Kimberley shaping not only its mood but the hardening temper of one of its most ambitious young men. Cecil John Rhodes would endure a series of personal blows in the years ahead. These losses did not soften him. If anything, they seemed to harden an already melancholic temperament. One by one, the setbacks accumulated, and the young speculator who often appeared distant in manner would, in time, come to embody the ruthless vanity and moral ambiguity that marked the diamond fields and the empire they fed. The string of tragedies began with his brother Herbert. It was he who had come to South Africa first and started the Cotton farm at Richmond near Pietermaritzburg. And It was he who had impulsively upped and off to Kimberley to look for diamonds. Once these had been unearthed and he'd convinced young Cecil to join him — he upped and off once more to the eastern Transvaal, where gold had been discovered. After a while he tired of that life and began gun running from Delagoa Bay to amaPedi people, then roved about into northern Mozambique and what is Malawi today. He hunted the next gold find everywhere he went, a mad Victorian searching for his personal treasure. Cecil John Rhodes watched and took his own notes. He was already thirsting for power, and now he realised there were two routes. From Barney Barnato he learned the value of politics, and from JB Robinson he came to understand the uses of Journalism. Rhodes wanted something much bigger, and that was a seat in the Cape Parliament. He ran for representative of a rural territory, Barklay West which was a mistake. When he appeared at a meeting one of the local boers told him off “In the first place, you are too young, in the second, you look so damnably like an Englishman…” Rhodes, unlike certain modern politicians, listened. First stage of campaign complete, time for second stage. And here it may surprise many listeners, but he turned to black South Africans because at this time in our history, blacks could vote in the Cape. All they had to do was show they had enough cash, the Cape qualified franchise. Every voter had to show either 25 pounds of land or more in value or prove they received at least 50 pounds a year in income. After disbursing black workers with an unknown sum of money, 250 turned up to vote for Rhodes on election day and largely because of this support, he won. It is truly amazing that Cecil John Rhodes won his seat in the Cape Parliament because of black voters, and would go on to hold that seat in periods of triumph, disgrace and depression, until the day he died.

Episode 263 - How Black Voters Helped Elect Cecil Rhodes: Kimberley and the Cape Franchise, 1879

The battles are coming thick and fast because this is the end of the seventh decade of the 19th Century - the British have just been defeated at the Battle of Hlobane mountain on the 28th March. There's been so much skop skiet and Donner it's time to reflect on matters further south west Before we buzz back to Zululand next episode. n the Transvaal, resistance to British rule was slowly setting, like mortar hardening between stones, the scattered grievances of the Boers beginning to cohere into something firmer, more deliberate. Far to the west, Kimberley glittered with a different intensity - fortunes were rising from the dust, deals were struck in the heat and noise, and the great hole in the earth swallowed men and money alike. Yet beneath the clangour of picks and the shimmer of diamonds, another current was moving. For even as the town prospered, a sequence of personal tragedies was about to cast a longer shadow over Kimberley shaping not only its mood but the hardening temper of one of its most ambitious young men. Cecil John Rhodes would endure a series of personal blows in the years ahead. These losses did not soften him. If anything, they seemed to harden an already melancholic temperament. One by one, the setbacks accumulated, and the young speculator who often appeared distant in manner would, in time, come to embody the ruthless vanity and moral ambiguity that marked the diamond fields and the empire they fed. The string of tragedies began with his brother Herbert. It was he who had come to South Africa first and started the Cotton farm at Richmond near Pietermaritzburg. And It was he who had impulsively upped and off to Kimberley to look for diamonds. Once these had been unearthed and he'd convinced young Cecil to join him — he upped and off once more to the eastern Transvaal, where gold had been discovered. After a while he tired of that life and began gun running from Delagoa Bay to amaPedi people, then roved about into northern Mozambique and what is Malawi today. He hunted the next gold find everywhere he went, a mad Victorian searching for his personal treasure. Cecil John Rhodes watched and took his own notes. He was already thirsting for power, and now he realised there were two routes. From Barney Barnato he learned the value of politics, and from JB Robinson he came to understand the uses of Journalism. Rhodes wanted something much bigger, and that was a seat in the Cape Parliament. He ran for representative of a rural territory, Barklay West which was a mistake. When he appeared at a meeting one of the local boers told him off “In the first place, you are too young, in the second, you look so damnably like an Englishman…” Rhodes, unlike certain modern politicians, listened. First stage of campaign complete, time for second stage. And here it may surprise many listeners, but he turned to black South Africans because at this time in our history, blacks could vote in the Cape. All they had to do was show they had enough cash, the Cape qualified franchise. Every voter had to show either 25 pounds of land or more in value or prove they received at least 50 pounds a year in income. After disbursing black workers with an unknown sum of money, 250 turned up to vote for Rhodes on election day and largely because of this support, he won. It is truly amazing that Cecil John Rhodes won his seat in the Cape Parliament because of black voters, and would go on to hold that seat in periods of triumph, disgrace and depression, until the day he died.

The Most Interesting Trader in the World with Timothy Sykes: An EOFire Classic from 2022

From the archive: This episode was originally recorded and published in 2022. Our interviews on Entrepreneurs On Fire are meant to be evergreen, and we do our best to confirm that all offers and URL's in these archive episodes are still relevant. Timothy Sykes is a stock trader, teacher, philanthropist, traveler, and a foodie. Top 3 Value Bombs 1. Learning has never been easier. Choose what you love and commit to it. 2. If something doesn't fulfill you, give yourself permission to change. 3. Travel and push your limits. It will shift your perspective on life. Visit Tim's website to learn how he has successfully traded penny stocks for 20 years - TimothySykes.com Sponsors HighLevel - The ultimate all-in-one platform for entrepreneurs, marketers, coaches, and agencies. Learn more at HighLevelFire.com. Cape - A privacy-first mobile carrier, built from the ground up with security as the priority. If you care about protecting your digital life without giving up your smartphone, Cape makes that possible. Visit Cape.co/fire and use code FIRE for 33% off cape for 6 months today! Scaylor - Ready to simplify and unify your business data? Go to Scaylor.com and get your free demo today.

The long wait for freedom for South Africa's slaves

In this special episode, we are honoured to be joined by Karen Jennings, a former Booker Prize longlist nominee, to discuss her powerful new novel, The First of December.Set in South Africa during the final days of November 1838, the book explores the fraught moment of full emancipation for the enslaved. We delve into the brutal reality of the "apprenticeship" system that followed the 1833 Abolition Act, the unique Asian roots of Cape slavery under the Dutch East India Company, and the cynical economics of a system where human beings were mortgaged like property.Karen shares the deeply personal and unsettling family history that inspired the novel—from ancestors who were French Huguenot settlers to a shocking discovery about a colonial forebear. We also discuss the enduring legacy of these injustices, connecting the dashed hopes of 1838 with the ongoing struggles for equality in South Africa today.It's a profound conversation about history, memory, and why the fight for liberation is never truly "happy ever after."The First of December will be available in March but here in the meantime is a selection of Karen's writingExplaining History helps you understand the 20th Century through critical conversations and expert interviews. We connect the past to the present. If you enjoy the show, please subscribe and share.▸ Support the Show & Get Exclusive ContentBecome a Patron: patreon.com/explaininghistory▸ Join the Community & Continue the ConversationFacebook Group: facebook.com/groups/ExplainingHistoryPodcastSubstack: theexplaininghistorypodcast.substack.com▸ Read Articles & Go DeeperWebsite: explaininghistory.org Hosted on Acast. See acast.com/privacy for more information.

In this interview Vijoy Pandey from Cisco Outshift discusses the "Internet of Agents," the donation of the AGNTCY framework to the Linux Foundation, and the new open-source SRE tool "Cape." Plus, how Swisscom is using agentic workflows to validate networks. Big thanks to Cisco for sponsoring this video and sponsoring my trip to Cisco Partners' Summit 2025 // Vijoy Pandey SOCIALS // LinkedIn: / vijoy X: https://x.com/vijoy // David's SOCIAL // Discord: discord.com/invite/usKSyzb Twitter: www.twitter.com/davidbombal Instagram: www.instagram.com/davidbombal LinkedIn: www.linkedin.com/in/davidbombal Facebook: www.facebook.com/davidbombal.co TikTok: tiktok.com/@davidbombal YouTube: / @davidbombal Spotify: open.spotify.com/show/3f6k6gE... SoundCloud: / davidbombal Apple Podcast: podcasts.apple.com/us/podcast... // MY STUFF // https://www.amazon.com/shop/davidbombal // SPONSORS // Interested in sponsoring my videos? Reach out to my team here: sponsors@davidbombal.com // MENU // 00:00 - Coming Up 00:37 - Introduction 01:00 - What is Internet of Agents? 02:11 - The 4 Steps of Internet of Agents 03:25 - Project AGNTCY 04:40 - A DNS of the Agentic Internet 06:07 - To What End is the Agency Stack 07:21 - Use-cases for the Agency Stack 11:28 - The Future of the Agency Stack 12:55 - Guardrails for Agents 13:38 - Timeline for the Integration of Agents 14:51 - Outro Please note that links listed may be affiliate links and provide me with a small percentage/kickback should you use them to purchase any of the items listed or recommended. Thank you for supporting me and this channel! Disclaimer: This video is for educational purposes only. #agenticai #agntcy #cisco @Cisco

ANC W Cape flags home affairs service delivery crisis in Atlantis

ANC provincial Convenor Jerimia Thuysnma spoke to Clarence Ford about the home affairs service delivery crisis in Atlantis. Views and News with Clarence Ford is the mid-morning show on CapeTalk. This 3-hour long programme shares and reflects a broad array of perspectives. It is inspirational, passionate and positive. Host Clarence Ford’s gentle curiosity and dapper demeanour leave listeners feeling motivated and empowered. Known for his love of jazz and golf, Clarrie covers a range of themes including relationships, heritage and philosophy. Popular segments include Barbs’ Wire at 9:30am (Mon-Thurs) and The Naked Scientist at 9:30 on Fridays. Thank you for listening to a podcast from Views & News with Clarence Ford Listen live on Primedia+ weekdays between 09:00 and 12:00 (SA Time) to Views and News with Clarence Ford broadcast on CapeTalk https://buff.ly/NnFM3Nk For more from the show go to https://buff.ly/erjiQj2 or find all the catch-up podcasts here https://buff.ly/BdpaXRn Subscribe to the CapeTalk Daily and Weekly Newsletters https://buff.ly/sbvVZD5 Follow us on social media: CapeTalk on Facebook: https://www.facebook.com/CapeTalk CapeTalk on TikTok: https://www.tiktok.com/@capetalk CapeTalk on Instagram: https://www.instagram.com/ CapeTalk on X: https://x.com/CapeTalk CapeTalk on YouTube: https://www.youtube.com/@CapeTalk567See omnystudio.com/listener for privacy information.

5 Creativity Hacks for Entrepreneurs with Jason Keath

Jason Keath is a creativity keynote speaker, author of The Case for More Bad Ideas, and cofounder of Social Fresh, the conference that helped launch the modern social media industry. Top 3 Value Bombs 1. The most creative people aren't the most inspired—they're the most prepared. Systems and lists matter more than random genius. 2. Bad ideas are often stepping stones to brilliant outcomes. Embrace them, refine them, and keep going. 3. Scaling creativity is possible—and essential. The secret? More ideas, more iteration, and a willingness to question every assumption. Subscribe to Jason's newsletter for weekly creativity strategies, stories, and AI tools - More Bad Ideas Sponsors HighLevel - The ultimate all-in-one platform for entrepreneurs, marketers, coaches, and agencies. Learn more at HighLevelFire.com. Cape - A privacy-first mobile carrier, built from the ground up with security as the priority. If you care about protecting your digital life without giving up your smartphone, Cape makes that possible. Visit Cape.co/fire and use code FIRE for 33% off cape for 6 months today!

Bouvet. Soleiðis eitur ein oyggj, sum liggur umleið 1500 fjóðringar í útsynningi úr Cape Town í Suðurafrika. Ongin býr í oynni, sum øll er dekkað við ísi, tí hitalagið har liggur millum fýra kuldastig og fýra hitastig. Men komandi tríggjar vikurnar verður fólk í oynni, tá tilsamans 18 radioamatørar úr øllum heiminum fara rannsóknarferð til Bouvet. Ein av radioamatørunum er Regin Nicolajsen úr Skopun. - Sum radioamatørur samskifti eg við nógv fólk kring heimin, og tað var eisini av einum øðrum radioamatøri, at eg bleiv bjóðaður við á hesa ferðina, sigur Regin Nicolajsen, sum ikki tók av tilboðnum alt fyri eitt. - Men eftir at hava hugsað meg um í eina tíð, helt eg hetta vera ein spennandi og stuttligan møguleika. Og eg haldi tað er stuttligt, at eg soleiðis eisini kann hitta ymiskar radioamatørar, sum eg eri vanur at samskifta við, sigur Regin Nicolajsen. Endamálið við ferðini er at seta samskiftisútgerð upp í oynni og at samskifta haðani næstu tríggjar vikurnar ella so. Eftir ætlan verður farið úr Cape town við báti í dag, og ferðin til Bouvet tekur væntandi millum sjey og 10 dagar.

Build a Subscription Model So Compelling, Your Customers Will Never Want to Leave with Robbie Baxter

Robbie Baxter is the world's leading expert on subscription and membership models. She wrote two bestselling books The Membership Economy and The Forever Transaction, hosts the podcast Subscription Stories, and has advised organizations like Netflix, Microsoft and the Wall Street Journal. Top 3 Value Bombs 1. Success comes from solving a real problem—not always from following your passion. 2. Subscriptions aren't about dumping content—they're about building trust and solving an ongoing need. 3. Subscribers stay for the community—make them feel they belong and they'll never want to leave. Explore Robbie's work and books. Check out her website - Robbie's Website Sponsors HighLevel - The ultimate all-in-one platform for entrepreneurs, marketers, coaches, and agencies. Learn more at HighLevelFire.com. Cape - A privacy-first mobile carrier, built from the ground up with security as the priority. If you care about protecting your digital life without giving up your smartphone, Cape makes that possible. Visit Cape.co/fire and use code FIRE for 33% off cape for 6 months today! Framer - A website builder that offers real-time collaboration, a robust CMS with everything you need for great SEO, and advanced analytics that include integrated A/B testing. Get started building for free today at Framer.com/fire. For 30% a Framer Pro annual plan use code FIRE!

Should Roman Anthony Play In The WBC? | Ranking Boston Sports Presidents | Tatum Nearing A Return? | The Christmas Tree Bandits - 2/16 (Hour 2)

(00:00) Zo and Joe discuss whether or not you should be concerned with Roman Anthony playing in the WBC?(9:30) The guys rank the Boston sports presidents. (21:18) Is Jayson Tatum nearing a return in the coming weeks? Zo and Joe talk about how Tatum and NBC appear to be hyping up his return. They also touch on Jaylen Brown's weekend at the All-Star Game, and his pop-up event that was shut down. (32:51) Zo and Joe dive into some summer Cape talk. Zo has to take down his Christmas tree today. Please note: Timecodes may shift by a few minutes due to inserted ads. Because of copyright restrictions, portions—or entire segments—may not be included in the podcast.For the latest updates, visit the show page on 985thesportshub.com. Follow 98.5 The Sports Hub on Twitter, Facebook and Instagram. Watch the show every morning on YouTube, and subscribe to stay up-to-date with all the best moments from Boston's home for sports!See Privacy Policy at https://art19.com/privacy and California Privacy Notice at https://art19.com/privacy#do-not-sell-my-info.

In this episode, we are joined by Ali Lipman and James Christopher of the up and coming Boston emo-punkers Cape Crush! These guys have been tearing it up since around 2021 with anthemic, high-energy tracks that blend raw emotion with seriously catchy punk rock. Music Clips from The Charms, The Dogmatics, The Long Wait, Blame It On Whitman, and Cape Crush are included in this epsisode. Produced and Hosted by Steev Riccardo

On this episode, we had on friends of ours from Cape Cod, Rich Milkos (@through_the_keepers_eye) and Dan Peterson (@thegreenskeepah). Rich and Dan are teaming up in 2026 to start a podcast about golf on the Cape. They share with us an overview of what they have in store for the upcoming adventures. After we share our opinions to some burning internet questions. Enjoy the episode!Music Credithttps://soundcloud.com/davidhydemusic/piano-rock-instrumental?utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

Storm Cape Episode 40 - Divided and Conquered Part I

The party splits up in an attempt to find some answers to lingering questions about the Trinity and the Veritus Want more world details? Check out our World Anvil page! https://www.worldanvil.com/w/senta-lelandsteel Like our Stuff? Let us know on social media! Connect with us: Twitter: @IncorrigiblePar Instagram: instagram.com/incorrigibleparty Facebook: facebook.com/groups/theincorrigiblepartypodcast/ Website: http://incorrigibleparty.com/ Youtube: The Incorrigible Party YT Twtich: https://www.twitch.tv/incorrigibleparty Support us and get exclusive mini campaign content! https://www.patreon.com/incorrigibleparty Music by Tabletopaudio.com and Sorastro Music The Incorrigible Party podcast is sponsored by the amazing and very generous Critical Hit Design!

(Part 3 of 3) On the morning of February 8, 1983, a plumber working in London's Muswell Hill neighbor opened a drainage cover behind a Cranley Gardens apartment building and made a horrific discovery—the drain was blocked by pieces of bone and human tissue. Upon investigation, detectives traced the blockage back to one apartment in the building, where additional evidence suggested things were far worse than they'd initially thought.When the occupant of the apartment, Dennis Nilsen, was confronted with the human remains, he began telling investigators a shocking story and when he was finished, Nilsen had confessed to murdering and dismembering at fifteen men over the course of five years. In the annals of British crime, Dennis Nilsen ranks among the worst serial killers the country has ever seen, not only because of the number of people he killed, but also the method of disposal and the motive. Mentioned in the EpisodeRead Jay Manuel's Fictional book inspired by ANTM The Wig, The Bitch & The Meltdown ReferencesBarlass, Tim, and Robert Mendick. 2006. "Killer: This was my first victim." Evening Standard (London, UK), November 9: 1.Davies, Nick. 1983. "A nice person, says the man who escaped." The Guardian, October 26: 5.—. 1983. "Nilsen 'claimed to have no tears for victims, bereaved, or himself'." The Guardian, October 26: 5.—. 1983. "Nilsen 'enjoyed power of his victims'." The Guardian, November 1: 4.—. 1983. "Nilsen tells of horror and shame at killings." The Guardian, October 28: 2.Henry, Ian. 1983. "'My fury if visitors didn't listen to me'." Daily Telegraph (London, UK), October 27: 3.—. 1983. "Nilsen 'has admitted 15 or 16 killings'." Daily Telegraph (London, UK), October 25: 3.Liverpool Echo. 1983. "London body: Man in court." Liverpool Echo, February 12: 1.Masters, Brian. 1985. Killing for Company: The Case of Dennis Nilsen. London, UK: J. Cape.McMillan, Greg. 1980. "Family scours Britain for missing son." Hamilton Spectator (Hamilton, ON), January 31: 10.Murphy, Fin. 2021. "I struck up a friendship with serial killer Dennis Nilsen. Then I edited his memoirs." Vice, January 29.Nicholson-Lord, David. 1983. "Doctor tells jury of Nlsen's false-self." The Times, October 28: 1.—. 1983. "Nilsen given 25-year sentence." The Times, November 5: 1.Tatchell, Peter. 2022. Police failed Dennis Nilsen's victims. Decades later, little has changed. January 24. Accessed September 15, 2025. https://www.theguardian.com/commentisfree/2022/jan/24/police-dennis-nilsen-victims-homophobic-murders.The Guardian. 1983. "State of mind issue put to Nilsen jury." The Guardian, November 3: 3.The Times. 1983. "Nilsen strangled, cut up and burnt men he met in pubs, jury told." The Times, October 25: 1.—. 1984. "Prisoners live in fear of Nilsen." The Times, June 21: 3. Cowritten by Alaina Urquhart, Ash Kelley & Dave White (Since 10/2022)Produced & Edited by Mikie Sirois (Since 2023)Research by Dave White (Since 10/2022), Alaina Urquhart & Ash KelleyListener Correspondence & Collaboration by Debra LallyListener Tale Video Edited by Aidan McElman (Since 6/2025) Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

How To Start With Nothing And Build Your Own Personal Empire with Jon Boyd

Jon Boyd slept on a mattress on the floor, made 12k dollars/year, listened to EOFire, changed himself, learned business, made 24M dollars teaching guitar, visited 35 countries, now lives an ideal life and helps others. Top 3 Value Bombs 1. Big goals often fail, but small, inspired actions done daily compound into massive results. 2. Every person, place, thing, or idea is a form of capital that can be converted into higher-value capital. 3. Sustainable success comes from operating within your business "power band," not going too fast or too slow. Check out Jon's website to explore lessons and resources on how to build your own personal empire - Capital Craft Sponsors HighLevel - The ultimate all-in-one platform for entrepreneurs, marketers, coaches, and agencies. Learn more at HighLevelFire.com. Cape - A privacy-first mobile carrier, built from the ground up with security as the priority. If you care about protecting your digital life without giving up your smartphone, Cape makes that possible. Visit Cape.co/fire and use code FIRE for 33% off cape for 6 months today! Quo - The #1-rated business phone system on G2 with over 3,000 reviews! Try QUO for free PLUS get 20% off your first 6 months when you go to Quo.com/fire! Quo — no missed calls, no missed customers.

I'm willing to bet that most of our listeners - like us - have traditionally seen acorns as food for squirrels, not people. But as Elspeth Hay points out in this conversation, that assumption says more about our food system than it does about the acorn.For much of human history, acorns were a staple. They fed communities across North America, Europe, North Africa, and Asia - and in some cases - still do. They were managed, processed, stored, and celebrated. So how did we go from acorns as everyday food to acorns as woodland debris? In her fantastic book Feed Us with Trees, Elspeth traces how enclosure, industrial agriculture, and a narrow definition of “real farming” pushed perennial forest foods to the margins of our imagination.In this episode, we dive into: • Why acorns were once reliable staple crops, not novelty ingredients • The myth that we can only feed ourselves with annual row crops • How the loss of commons reshaped our relationship to forests and food • What Indigenous land management, including fire, meant for food abundance • The false divide between farming and foraging • How pigs, oaks, and people once formed integrated food systems • What it would take to bring acorns and other perennial tree foods back into our dietsMore about Elspeth:Elspeth Hay is the creator and host of the Local Food Report, a weekly feature that has aired on the Cape and Islands NPR station since 2008, and the author of Feed Us with Trees: Nuts and the Future of Food.Deeply immersed in her own local-food system, she writes and reports for print, radio, and online media with a focus on food and the environment. You can learn more about her work at elspethhay.com.Agrarian Futures is produced by Alexandre Miller, who also wrote our theme song. This episode was edited by Drew O'Doherty.

Clay Clark is a founder of Several Multi-Million Dollar Companies, U.S. Small Business Administration Young Entrepreneur of the Year, Best-Selling Author, Investor and Award-Winning Business Coach. Top 3 Value Bombs 1. If revenue-producing activities aren't protected on your calendar, your business will stall no matter how hard you work. 2. Time-blocking VISMD activities daily can double income through consistent execution. 3. Professionals have coaches; amateurs don't; accountability accelerates results. This is your year to take your business to the next level! Schedule Your FREE 13-Point Assessment with Clay - Thrivetime Show Sponsors HighLevel - The ultimate all-in-one platform for entrepreneurs, marketers, coaches, and agencies. Learn more at HighLevelFire.com. Cape - A privacy-first mobile carrier, built from the ground up with security as the priority. If you care about protecting your digital life without giving up your smartphone, Cape makes that possible. Visit Cape.co/fire and use code FIRE for 33% off cape for 6 months today! Quo - The #1-rated business phone system on G2 with over 3,000 reviews! Try QUO for free PLUS get 20% off your first 6 months when you go to Quo.com/fire! Quo — no missed calls, no missed customers.

Part 2 of 3) On the morning of February 8, 1983, a plumber working in London's Muswell Hill neighbor opened a drainage cover behind a Cranley Gardens apartment building and made a horrific discovery—the drain was blocked by pieces of bone and human tissue. Upon investigation, detectives traced the blockage back to one apartment in the building, where additional evidence suggested things were far worse than they'd initially thought.When the occupant of the apartment, Dennis Nilsen, was confronted with the human remains, he began telling investigators a shocking story and when he was finished, Nilsen had confessed to murdering and dismembering at fifteen men over the course of five years. In the annals of British crime, Dennis Nilsen ranks among the worst serial killers the country has ever seen, not only because of the number of people he killed, but also the method of disposal and the motive. Mentioned in the episode: Book Counter DecorReferencesBarlass, Tim, and Robert Mendick. 2006. "Killer: This was my first victim." Evening Standard (London, UK), November 9: 1.Davies, Nick. 1983. "A nice person, says the man who escaped." The Guardian, October 26: 5.—. 1983. "Nilsen 'claimed to have no tears for victims, bereaved, or himself'." The Guardian, October 26: 5.—. 1983. "Nilsen 'enjoyed power of his victims'." The Guardian, November 1: 4.—. 1983. "Nilsen tells of horror and shame at killings." The Guardian, October 28: 2.Henry, Ian. 1983. "'My fury if visitors didn't listen to me'." Daily Telegraph (London, UK), October 27: 3.—. 1983. "Nilsen 'has admitted 15 or 16 killings'." Daily Telegraph (London, UK), October 25: 3.Liverpool Echo. 1983. "London body: Man in court." Liverpool Echo, February 12: 1.Masters, Brian. 1985. Killing for Company: The Case of Dennis Nilsen. London, UK: J. Cape.McMillan, Greg. 1980. "Family scours Britain for missing son." Hamilton Spectator (Hamilton, ON), January 31: 10.Murphy, Fin. 2021. "I struck up a friendship with serial killer Dennis Nilsen. Then I edited his memoirs." Vice, January 29.Nicholson-Lord, David. 1983. "Doctor tells jury of Nlsen's false-self." The Times, October 28: 1.—. 1983. "Nilsen given 25-year sentence." The Times, November 5: 1.Tatchell, Peter. 2022. Police failed Dennis Nilsen's victims. Decades later, little has changed. January 24. Accessed September 15, 2025. https://www.theguardian.com/commentisfree/2022/jan/24/police-dennis-nilsen-victims-homophobic-murders.The Guardian. 1983. "State of mind issue put to Nilsen jury." The Guardian, November 3: 3.The Times. 1983. "Nilsen strangled, cut up and burnt men he met in pubs, jury told." The Times, October 25: 1.—. 1984. "Prisoners live in fear of Nilsen." The Times, June 21: 3. Cowritten by Alaina Urquhart, Ash Kelley & Dave White (Since 10/2022)Produced & Edited by Mikie Sirois (Since 2023)Research by Dave White (Since 10/2022), Alaina Urquhart & Ash KelleyListener Correspondence & Collaboration by Debra LallyListener Tale Video Edited by Aidan McElman (Since 6/2025) Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

*EXPLICIT LANGUAGE* The Adventure continues after hours as the party discusses episodes 31 to 39 of Campaign 2 Want more world details? Check out our World Anvil page! https://www.worldanvil.com/w/senta-lelandsteel Like our Stuff? Let us know on social media! Connect with us: Twitter: @IncorrigiblePar Instagram: instagram.com/incorrigibleparty Facebook: facebook.com/groups/theincorrigiblepartypodcast/ Website: http://incorrigibleparty.com/ Youtube: The Incorrigible Party YT Twtich: https://www.twitch.tv/incorrigibleparty Support us and get exclusive mini campaign content! https://www.patreon.com/incorrigibleparty Music by Tabletopaudio.com and Sorastro Music The Incorrigible Party podcast is sponsored by the amazing and very generous Critical Hit Design!

Episode 224 - The Mauritius Command (Part 3)

We arrive at the Cape of Good Hope, receive Jack's true orders, and witness the immediate elevation—and corresponding pressure—that comes with the new post of Commodore Aubrey. Meanwhile there's a surprise reunion with a couple of old Jack Aubrey followers, and a protestant parrot.

Managing Money with Robert Gauvreau: An EOFire Classic from 2023

From the archive: This episode was originally recorded and published in 2023. Our interviews on Entrepreneurs On Fire are meant to be evergreen, and we do our best to confirm that all offers and URL's in these archive episodes are still relevant. Robert Gauvreau is the founder of Gauvreau: Accounting, Tax, Law and Advisory, an 8-figure professional services firm working exclusively with entrepreneurs to save tax, make more money, and build wealth. Top 3 Value Bombs 1. Spend your money on what's truly necessary. 2. If you have kids, put them on payroll. They deserve it. 3. Be strategic with timing when spending or reinvesting. It can save you a lot on taxes. Transform tax burden into savings - Gauvreau CPA Sponsors HighLevel - The ultimate all-in-one platform for entrepreneurs, marketers, coaches, and agencies. Learn more at HighLevelFire.com. Cape - A privacy-first mobile carrier, built from the ground up with security as the priority. If you care about protecting your digital life without giving up your smartphone, Cape makes that possible. Visit Cape.co/fire and use code FIRE for 33% off cape for 6 months today! Quo - The #1-rated business phone system on G2 with over 3,000 reviews! Try QUO for free PLUS get 20% off your first 6 months when you go to Quo.com/fire! Quo — no missed calls, no missed customers.

On the agenda, politics, Apple products, and phantom energy. Shop Talk Focus Group reminds you to unplug at night. Caught My Eye announces the closure of the Cape Cod Potato Chip Factory in Hyannis and outdoor retailer Patagonia takes issue with Drag Queen Pattie Gonia. Mark Dawson, of DRZ Entertainment, is the Business Birthday this week. We're all business. Except when we're not. Apple Podcasts: apple.co/1WwDBrC Spotify: spoti.fi/2pC19B1 iHeart Radio: bit.ly/4aza5LW Tunein: bit.ly/1SE3NMb YouTube Music: bit.ly/43T8Y81 Pandora: pdora.co/2pEfctj YouTube: bit.ly/1spAF5a Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

Dan Rasmussen & D.A. Wallach on Biotech's Surge, China, IPOs, US Valuations & Japan | #617

Today's returning guests are Dan Rasmussen, founder of Verdad Advisers, and D.A. Wallach, a venture capital investor for Time BioVentures. In today's episode, we unpack the recent biotech surge through the lens of Dan's recently published biotech report. We also explore China's growing biotech market, shifting IPO and VC trends, and how valuation tools like CAPE fit into today's regime. Finally, we also discuss technology's effect on productivity and corporate profits in the US, Japan's economic anomaly, home country bias, and more. (0:00) Starts (1:20) Dan's research on the biotech sector (19:10) D.A. on biotech in China (27:01) IPO landscape (31:01) Biotech VC update from D.A. (32:16) Are US stocks overvalued? (51:53) Dan's view of Japanese stocks (57:40) Global equity markets and home country bias (1:03:34) Book recommendations (1:11:55) Wrap-up and future plans ----- Follow Meb on X, LinkedIn and YouTube For detailed show notes, click here To learn more about our funds and follow us, subscribe to our mailing list or visit us at cambriainvestments.com ----- ----- Sponsor: Visit Alpha Architect's 351 Education Center for use cases, tools, FAQs, upcoming launches, and more. Follow The Idea Farm: X | LinkedIn | Instagram | TikTok ----- Interested in sponsoring the show? Email us at Feedback@TheMebFaberShow.com ----- Past guests include Ed Thorp, Richard Thaler, Jeremy Grantham, Joel Greenblatt, Campbell Harvey, Ivy Zelman, Kathryn Kaminski, Jason Calacanis, Whitney Baker, Aswath Damodaran, Howard Marks, Tom Barton, and many more. ----- Meb's invested in some awesome startups that have passed along discounts to our listeners. Check them out here! ----- Editing and post-production work for this episode was provided by The Podcast Consultant (https://thepodcastconsultant.com). Learn more about your ad choices. Visit megaphone.fm/adchoices

On the morning of February 8, 1983, a plumber working in London's Muswell Hill neighbor opened a drainage cover behind a Cranley Gardens apartment building and made a horrific discovery—the drain was blocked by pieces of bone and human tissue. Upon investigation, detectives traced the blockage back to one apartment in the building, where additional evidence suggested things were far worse than they'd initially thought.When the occupant of the apartment, Dennis Nilsen, was confronted with the human remains, he began telling investigators a shocking story and when he was finished, Nilsen had confessed to murdering and dismembering at fifteen men over the course of five years. In the annals of British crime, Dennis Nilsen ranks among the worst serial killers the country has ever seen, not only because of the number of people he killed, but also the method of disposal and the motive. Want to help out the people of Minneapolis? Click here to help small business owners impacted by current events!ReferencesBarlass, Tim, and Robert Mendick. 2006. "Killer: This was my first victim." Evening Standard (London, UK), November 9: 1.Davies, Nick. 1983. "A nice person, says the man who escaped." The Guardian, October 26: 5.—. 1983. "Nilsen 'claimed to have no tears for victims, bereaved, or himself'." The Guardian, October 26: 5.—. 1983. "Nilsen 'enjoyed power of his victims'." The Guardian, November 1: 4.—. 1983. "Nilsen tells of horror and shame at killings." The Guardian, October 28: 2.Henry, Ian. 1983. "'My fury if visitors didn't listen to me'." Daily Telegraph (London, UK), October 27: 3.—. 1983. "Nilsen 'has admitted 15 or 16 killings'." Daily Telegraph (London, UK), October 25: 3.Liverpool Echo. 1983. "London body: Man in court." Liverpool Echo, February 12: 1.Masters, Brian. 1985. Killing for Company: The Case of Dennis Nilsen. London, UK: J. Cape.McMillan, Greg. 1980. "Family scours Britain for missing son." Hamilton Spectator (Hamilton, ON), January 31: 10.Murphy, Fin. 2021. "I struck up a friendship with serial killer Dennis Nilsen. Then I edited his memoirs." Vice, January 29.Nicholson-Lord, David. 1983. "Doctor tells jury of Nlsen's false-self." The Times, October 28: 1.—. 1983. "Nilsen given 25-year sentence." The Times, November 5: 1.Tatchell, Peter. 2022. Police failed Dennis Nilsen's victims. Decades later, little has changed. January 24. Accessed September 15, 2025. https://www.theguardian.com/commentisfree/2022/jan/24/police-dennis-nilsen-victims-homophobic-murders.The Guardian. 1983. "State of mind issue put to Nilsen jury." The Guardian, November 3: 3.The Times. 1983. "Nilsen strangled, cut up and burnt men he met in pubs, jury told." The Times, October 25: 1.—. 1984. "Prisoners live in fear of Nilsen." The Times, June 21: 3. Cowritten by Alaina Urquhart, Ash Kelley & Dave White (Since 10/2022)Produced & Edited by Mikie Sirois (Since 2023)Research by Dave White (Since 10/2022), Alaina Urquhart & Ash KelleyListener Correspondence & Collaboration by Debra LallyListener Tale Video Edited by Aidan McElman (Since 6/2025) Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

Another chunk of State highway 35 around the East Cape has slipped away after more rain this week; with communties still cut off two weeks after the district was hammered by severe weather.

From Saving Lives to Building Empires: A Firefighter's Rogue Path to 7 Figures with Sean Percy Travis

Sean Percy Travis is a Retired LA County Firefighter-Paramedic turned 7-figure eCom builder. He founded Ecom For Heroes to empower first responders and veterans with purpose-driven structure, leading them from the firehouse to lasting financial freedom. Top 3 Value Bombs 1. Freedom doesn't come from removing structure. It comes from building the right structure. 2. There is no such thing as self-made success; every win is built on the shoulders of giants. 3. Simple systems scale: chunk complexity down, automate what matters, and execute with discipline. Check out Sean's website. Build a sellable & profitable online business as a first responder - Ecom for Heroes Sponsors HighLevel - The ultimate all-in-one platform for entrepreneurs, marketers, coaches, and agencies. Learn more at HighLevelFire.com. Cape - A privacy-first mobile carrier, built from the ground up with security as the priority. If you care about protecting your digital life without giving up your smartphone, Cape makes that possible. Visit Cape.co/fire and use code FIRE for 33% off cape for 6 months today!

Radio Show: Meb on Markets at Extremes, Anything BUT Market Cap, and Embracing Volatility | #616

In today's radio show, Meb breaks down why market-cap–weighted investing may be nearing its limits after an extraordinary run in U.S. stocks. He explores CAPE ratios near historic extremes, the quiet resurgence of gold and commodities, and why equal weight, value, and global markets are suddenly back in the conversation. To close, Meb explains how trend following and real assets can help investors navigate regime shifts. Note: this was recorded on January 29, 2026. (0:00) Starts (3:03) US stock market update (11:24) Global stock performance (18:03) The role of gold in asset allocation (27:52) Demographics of gold investors (35:47) One-fund portfolios & 351 conversions (42:07) Meb's travel plans ----- Follow Meb on X, LinkedIn and YouTube For detailed show notes, click here To learn more about our funds and follow us, subscribe to our mailing list or visit us at cambriainvestments.com ----- Follow The Idea Farm: X | LinkedIn | Instagram | TikTok ----- Interested in sponsoring the show? Email us at Feedback@TheMebFaberShow.com ----- Past guests include Ed Thorp, Richard Thaler, Jeremy Grantham, Joel Greenblatt, Campbell Harvey, Ivy Zelman, Kathryn Kaminski, Jason Calacanis, Whitney Baker, Aswath Damodaran, Howard Marks, Tom Barton, and many more. ----- Meb's invested in some awesome startups that have passed along discounts to our listeners. Check them out here! ----- Editing and post-production work for this episode was provided by The Podcast Consultant (https://thepodcastconsultant.com). Learn more about your ad choices. Visit megaphone.fm/adchoices

Over $170,000 of desperately needed money has been raised for whanau in the flood ravaged East Cape of the North Island. But the chair of Manaaki Matakaoa says locals are in for a long slog when the initial response dies down and the community is left to ready themselves for the next bout of heavy weather. Bill Hickman has more.

Simplifying Franchising with Simply Cabinetry with Diana Simmons

Diana Simmons, CEO and co-founder of Simply Cabinetry, transformed a garage startup into a thriving franchise redefining cabinetry through simplicity, quality, and community—blending design passion, business acumen, and family-driven leadership. Top 3 Value Bombs 1. Success comes from doing less, but doing it better; simplicity creates speed, consistency, and scalability. 2. A lean franchise model protects cash flow and allows owners to scale by appointments booked, not crews hired. 3. Community-driven relationships lower acquisition costs and build long-term referral flywheels. Check out Diana's website to learn more about franchising - Simply Cabinetry Sponsors HighLevel - The ultimate all-in-one platform for entrepreneurs, marketers, coaches, and agencies. Learn more at HighLevelFire.com. Cape - A privacy-first mobile carrier, built from the ground up with security as the priority. If you care about protecting your digital life without giving up your smartphone, Cape makes that possible. Visit Cape.co/fire and use code FIRE for 33% off cape for 6 months today!

The party's research pays off as they learn more about the city's history Want more world details? Check out our World Anvil page! https://www.worldanvil.com/w/senta-lelandsteel Like our Stuff? Let us know on social media! Connect with us: Twitter: @IncorrigiblePar Instagram: instagram.com/incorrigibleparty Facebook: facebook.com/groups/theincorrigiblepartypodcast/ Website: http://incorrigibleparty.com/ Youtube: The Incorrigible Party YT Twtich: https://www.twitch.tv/incorrigibleparty Support us and get exclusive mini campaign content! https://www.patreon.com/incorrigibleparty Music by Tabletopaudio.com and Sorastro Music The Incorrigible Party podcast is sponsored by the amazing and very generous Critical Hit Design!

E.241 Step Away From The Cape, You're Not The Department Of Everything

Send us a textIf you're the one everyone turns to, you might be carrying more than you realize. We sit down with psychotherapist and mental wellness consultant Leah Marone to unpack the “serial fixer” habit—why it thrives in first responder culture and how it quietly fuels burnout, resentment, and frayed relationships. Leah works extensively with police, fire, EMS, and dispatch, and she brings sharp, compassionate insights you can use today without adding hours to your schedule.We break down the real difference between therapy and consulting, then rebuild the foundation of wellness with small, sustainable practices: bookending your mornings and nights, using micro resets during daily transitions, and reclaiming self-care as single-task presence instead of numbing or multitasking. Leah introduces a practical rule that changes conversations fast—support, don't solve—along with validation skills that help teammates, partners, and kids think more clearly and take ownership. You'll hear how the fixer impulse can become “compassion as control,” why quick advice often backfires, and how to replace that urge with grounded presence.Expect concrete tools and memorable metaphors. The internal “balloon” lets you notice pressure before it pops, and that shaken “soda bottle” reminds you to release slowly, not explode. We also cover sleep hygiene as the no‑nonsense cornerstone of recovery, data collection to challenge “dark cloud” thinking, and first responder-ready ways to downshift from high gear without losing your edge. If you want stronger boundaries, steadier energy, and deeper connection, this conversation will help you change your default settings.To reach Leah, here is the link to her work: https://linktr.ee/leahmaronelcswIf this resonates, tap follow, share it with a teammate who needs lighter armor, and leave a quick review so more first responders can find these tools. Your support helps this community stay sharp, safe, and human.Support the showYouTube Channel For The Podcast

3PLs dominate industrial leasing, Alaska Airlines vs. Amazon & C.H. Robinson's AI fix | The Daily

The logistics sector is sending mixed signals in early 2026, with some data pointing to a boom while other indicators suggest fragility. On the growth side, 3PLs are dominating industrial leasing as corporations aggressively outsource their complex supply chains. Financial metrics back up this optimism, with Triumph Financial reporting rising invoice sizes and the addition of major fleets like J.B. Hunt to their network. This consolidation suggests big players are circling the wagons around platforms that provide stability and value. Operational efficiency is also improving, as C.H. Robinson uses AI agents to automate ready-checks and reduce unnecessary return trips by 42%. These technological advancements are helping stabilize networks by cutting out pure waste like fuel and driver time. However, friction remains in the air cargo sector, where Alaska Airlines is dissatisfied with its Amazon contract due to pilot scheduling issues and thin margins. The airline is looking to renegotiate terms or exit the deal as it struggles to optimize utilization between passenger and cargo operations. Regulatory and geopolitical risks are also mounting, highlighted by a court decision denying a reprieve for non-domiciled CDL renewals in California. Furthermore, global trade lanes face renewed uncertainty after Houthis threatened new attacks in the Red Sea, potentially forcing ships back around the Cape of Good Hope. Follow the FreightWaves NOW Podcast Other FreightWaves Shows Learn more about your ad choices. Visit megaphone.fm/adchoices

Arthur Hayes Predicts Massive Market Crash and Bitcoin Surge by 2030

Cape: 33% off your first 6 months with code IMPACT at https://cape.co/impact HomeServe: Help protect your home systems – and your wallet – with HomeServe against covered repairs. Plans start at just $4.99 a month at https://homeserve.com Shopify: Sign up for your one-dollar-per-month trial period at https://shopify.com/impact Huel: 15% off with this exclusive offer for New Customers only with code impact at https://huel.com/impact (Minimum $75 purchase). Quince: Free shipping and 365-day returns at https://quince.com/impactpod IT EPISODES: What's up, everybody? It's Tom Bilyeu here: If you want my help... STARTING a business: join me here at ZERO TO FOUNDER: https://tombilyeu.com/zero-to-founder?utm_campaign=Podcast%20Offer&utm_source=podca[%E2%80%A6]d%20end%20of%20show&utm_content=podcast%20ad%20end%20of%20show SCALING a business: see if you qualify here.: https://tombilyeu.com/call Get my battle-tested strategies and insights delivered weekly to your inbox: sign up here.: https://tombilyeu.com/ ********************************************************************** If you're serious about leveling up your life, I urge you to check out my new podcast, Tom Bilyeu's Mindset Playbook —a goldmine of my most impactful episodes on mindset, business, and health. Trust me, your future self will thank you. ********************************************************************** FOLLOW TOM: Instagram: https://www.instagram.com/tombilyeu/ Tik Tok: https://www.tiktok.com/@tombilyeu?lang=en Twitter: https://twitter.com/tombilyeu YouTube: https://www.youtube.com/@TomBilyeu Learn more about your ad choices. Visit megaphone.fm/adchoices

How Money Printing, Inflation, and AI Will Reshape Wealth and Employment | Arthur Hayes X Impact Theory w/ Tom Bilyeu

Cape: 33% off your first 6 months with code IMPACT at https://cape.co/impact HomeServe: Help protect your home systems – and your wallet – with HomeServe against covered repairs. Plans start at just $4.99 a month at https://homeserve.com Shopify: Sign up for your one-dollar-per-month trial period at https://shopify.com/impact Huel: 15% off with this exclusive offer for New Customers only with code impact at https://huel.com/impact (Minimum $75 purchase). Quince: Free shipping and 365-day returns at https://quince.com/impactpod IT EPISODES: What's up, everybody? It's Tom Bilyeu here: If you want my help... STARTING a business: join me here at ZERO TO FOUNDER: https://tombilyeu.com/zero-to-founder?utm_campaign=Podcast%20Offer&utm_source=podca[%E2%80%A6]d%20end%20of%20show&utm_content=podcast%20ad%20end%20of%20show SCALING a business: see if you qualify here.: https://tombilyeu.com/call Get my battle-tested strategies and insights delivered weekly to your inbox: sign up here.: https://tombilyeu.com/ ********************************************************************** If you're serious about leveling up your life, I urge you to check out my new podcast, Tom Bilyeu's Mindset Playbook —a goldmine of my most impactful episodes on mindset, business, and health. Trust me, your future self will thank you. ********************************************************************** FOLLOW TOM: Instagram: https://www.instagram.com/tombilyeu/ Tik Tok: https://www.tiktok.com/@tombilyeu?lang=en Twitter: https://twitter.com/tombilyeu YouTube: https://www.youtube.com/@TomBilyeu Learn more about your ad choices. Visit megaphone.fm/adchoices

2026 is not about opportunity or danger — it's about avoiding one catastrophic mistake.

On this episode of Impact Theory, Tom Bilyeu delivers a no-nonsense deep dive into the overwhelming financial and psychological challenges we're all facing as 2026 approaches. With global instability, mounting debt, political turmoil, and the rise of artificial intelligence changing the landscape faster than most people can adapt, Tom Bilyeu explains how a unique convergence of psychological traps could trigger catastrophic money mistakes for millions. Instead of doom and gloom, though, you'll learn exactly how to keep your head when everyone else is losing theirs—mastering your biology, thinking from first principles, and relying on time-tested investing heuristics. If you want to avoid becoming another cautionary tale and instead spot real opportunities in turbulent times, this is an episode you won't want to miss. Cape: 33% off your first 6 months with code IMPACT at https://cape.co/impact HomeServe: Help protect your home systems – and your wallet – with HomeServe against covered repairs. Plans start at just $4.99 a month at https://homeserve.com Shopify: Sign up for your one-dollar-per-month trial period at https://shopify.com/impact Huel: 15% off with this exclusive offer for New Customers only with code impact at https://huel.com/impact (Minimum $75 purchase). Quince: Free shipping and 365-day returns at https://quince.com/impactpod What's up, everybody? It's Tom Bilyeu here: If you want my help... STARTING a business: join me here at ZERO TO FOUNDER: https://tombilyeu.com/zero-to-founder?utm_campaign=Podcast%20Offer&utm_source=podca[%E2%80%A6]d%20end%20of%20show&utm_content=podcast%20ad%20end%20of%20show SCALING a business: see if you qualify here.: https://tombilyeu.com/call Get my battle-tested strategies and insights delivered weekly to your inbox: sign up here.: https://tombilyeu.com/ ********************************************************************** If you're serious about leveling up your life, I urge you to check out my new podcast, Tom Bilyeu's Mindset Playbook —a goldmine of my most impactful episodes on mindset, business, and health. Trust me, your future self will thank you. ********************************************************************** FOLLOW TOM: Instagram: https://www.instagram.com/tombilyeu/ Tik Tok: https://www.tiktok.com/@tombilyeu?lang=en Twitter: https://twitter.com/tombilyeu YouTube: https://www.youtube.com/@TomBilyeu Learn more about your ad choices. Visit megaphone.fm/adchoices

2025 is finally over. We had bad consumer sentiment vibes, tariffs, and a seemingly ascendant stock market. And those are just a few indicators from last year! As we enter 2026, what indicators should we keep an eye on … in the future? On today's episode, our top indicator predictions for the new year.Related: What AI data centers are doing to your electric bill Tariffs. Consumer sentiment. Cape ratio. Pick the Indicator of the Year! What indicators will 2025 bring? For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter. Learn more about sponsor message choices: podcastchoices.com/adchoicesNPR Privacy Policy