Podcasts about business taxes

- 164PODCASTS

- 217EPISODES

- 31mAVG DURATION

- 1MONTHLY NEW EPISODE

- Nov 20, 2025LATEST

POPULARITY

Best podcasts about business taxes

Latest news about business taxes

- Business taxes vs sales taxes Korea Times News - Nov 9, 2025

- Rachel Reeves warned not to rely on business taxes to fill Budget black hole The Independent - Nov 6, 2025

- Balancing business taxes: A better approach to local tax collections for cities and counties Smart Cities Dive - Latest News - Sep 11, 2025

- Bosses of UK supermarkets and High Street chains warn Rachel Reeves that new business taxes will force them to hike prices in a fresh blow to Brits' living standards Daily Mail - Aug 21, 2025

- Mastering Side Business Taxes: Essential Strategies for Success Small Business Trends - Jun 12, 2025

- How to save on your taxes with automobile logs MoneySense - May 2, 2025

- AI-Powered Tax Strategies: How Smart Tech Can Minimize Business Taxes Artificial Intelligence on Medium - Apr 12, 2025

- The Ultimate Guide to Business Taxes: What Every Owner Needs to Know Infrastructurist - Mar 18, 2025

- IRS Layoffs 2025: How Businesses Will Feel the Impact TechRepublic - Mar 5, 2025

- I Hate Accounting Software. Here's How I Manage My Freelance and Business Taxes Instead CNET How To - Feb 17, 2025

Latest podcast episodes about business taxes

Carlotta Thompson - Ex IRS Auditor Saving Business Owners Millions

From studying tax law at just 14 years old to landing her dream job inside the IRS, Carlotta Thompson seemed destined for a lifelong career in government. But once she stepped behind the curtain as an IRS auditor, she discovered something shocking: countless business owners were leaving hundreds of thousands of dollars on the table in missed deductions — and the system wasn't built to help them. Realizing she was “on the wrong side,” Carlotta walked away from the IRS to pursue a bigger mission: help entrepreneurs pay the least amount of tax legally possible. Today, as the Founder & CEO of Tax Strategists of America, she leads business owners through her signature Pathway to Zero™ program — a proven framework that uncovers hidden deductions, maximizes tax strategy, and empowers owners to keep more of what they earn. In this episode, Carlotta reveals the truths she learned inside the IRS, the most common (and costly) mistakes business owners make, and the practical steps entrepreneurs can take to dramatically reduce their tax burden without ever crossing legal lines. If you're an investor or business owner who wants to stop overpaying the IRS, this is a must-listen.Follow Carlotta

Patrons-First Podcast: Rachel Smith, Outgoing President & CEO of the Seattle Metro Chamber

Where is Seattle's local economy headed amid concerns over downtown office vacancies, new state and local taxes on businesses, and federal tariff policies? It's a patrons-first episode of Seattle News, Views & Brews, where you can always learn about the latest in local public affairs in about the time it takes for a coffee break! Brian Callanan of Seattle Channel talks with outgoing Seattle Metro Chamber President and CEO Rachel Smith (who's taking on a new role at Washington Roundtable) about how Seattle business leaders are trying to raise awareness about the jobs and industries needed to power the region's future. If you'd like exclusive early access to episodes like this in the future, please support this podcast on Patreon!

278 \\ The Shocking Link Between Healthcare Fraud and Your Business Taxes

SMALL BUSINESS FINANCE– Business Tax, Financial Basics, Money Mindset, Tax Deductions

What does a $14.6 billion healthcare fraud case have to do with your business? Everything. While criminals steal billions from taxpayer-funded programs, business owners like you are still overpaying the IRS every year. In this episode, we break down how government waste affects your bottom line—and why smart tax planning isn't just good business, it's your responsibility. You'll learn why a proactive tax strategy matters, how tax reduction can protect your hard-earned money, and what steps to take to keep more cash in your pocket. If you've ever wondered why your tax bill feels too high, or how to finally take control of your money decisions, this episode is for you. Don't let your money get wasted—tune in now and discover the strategies that could save you thousands. Next Steps:

263 \\ Global Tax Strategy Revealed: How to Slash International Business Taxes Under New Laws (New Tax Laws Decoded Series: Part 15)

SMALL BUSINESS FINANCE– Business Tax, Financial Basics, Money Mindset, Tax Deductions

In this episode of New Tax Laws Decoded, we break down the biggest international tax changes in decades—and why they matter. If your business earns foreign income, exports products or services, or competes globally, understanding these updates could save you hundreds of thousands. We dive into updated GILTI and FDII provisions, how they impact tax planning, and why tax parity between foreign operations and domestic exports matters. Learn how to use these tax strategies to reduce your tax burden, optimize global operations, and outcompete on the world stage. If you're thinking about international expansion, this is the most valuable episode yet. You'll walk away with real insights into international tax planning, deductions, and strategies that give your business a global edge. Next Steps:

Alex Brill- Progressives See the Regressive Nature of Tariffs, but Not Business Taxes

08-13-2025 Alex Brill Learn more about the interview and get additional links here: https://thedailyblaze.com/progressives-see-the-regressive-nature-of-tariffs-but-not-business-taxes/ Subscribe to the best of our content here: https://priceofbusiness.substack.com/ Subscribe to our YouTube channel here: https://www.youtube.com/channel/UCywgbHv7dpiBG2Qswr_ceEQ

Ep. 135 - The IRS Nightmare is a Myth: How to Escape Tax Hell Without Going Broke

Stop hiding from those IRS letters. They're not coming to drag you away in handcuffs.The biggest lie the government ever told you? That tax debt will ruin your life. Here's the brutal truth: 99.9% of people who owe taxes will NEVER see the inside of a jail cell. But they will lose sleep, relationships, and thousands of dollars in penalties because they believe the fear-mongering.In this no-BS episode, Stoy Hall sits down with Morgan Anderson, EA – a 26-year veteran of tax debt resolution who's seen it all. Morgan destroys the myths that keep you paralyzed and reveals the real playbook the IRS doesn't want you to know.You'll discover:Why Al Capone's case has absolutely nothing to do with your $20K tax billThe massive system breakdown that's actually working in your favor right nowHow COVID broke the IRS machine (and what that means for you)The single phone call that can stop wage garnishments before they destroy your reputationWhy your "tax professional" might be setting you up for a $700K disasterThis isn't feel-good fluff. This is war strategy.Morgan pulls back the curtain on settlement negotiations, payment plans, and when to fight versus when to fold. If you're a business owner drowning in payroll taxes or an individual getting crushed by penalties, this episode could save you decades of financial pain.The government wants you scared and compliant. Time to flip the script.Connect with Morgan Anderson:Website: https://www.goldenliontaxsolutions.com/LinkedIn: https://www.linkedin.com/in/morgan-anderson-ea/Facebook: https://www.facebook.com/morgan.q.anderson.ea/Warning: This episode contains explicit tax advice that may cause sudden feelings of empowerment and the urge to finally deal with that pile of IRS notices.Welcome to the No BS Wealth Podcast with Stoy Hall, your candid guide to financial clarity. In our third year, we're spicing things up by enhancing community ties and bringing you straight, no-fluff financial insights. Connect with us on NoBSWealthPodcast.com, and follow Stoy on social media for the latest episodes and expert discussions. Tune in, join the conversation, and transform your financial journey with us—no BS!As always we ask you to comment, DM, whatever it takes to have a conversation to help you take the next step in your journey, reach out on any platform!Twitter, FaceBook, Instagram, Tiktok, LinkedinDISCLOSURE: Awards and rankings by third parties are not indicative of future performance or client investment success. Past performance does not guarantee future results. All investment strategies carry profit/loss potential and cannot eliminate investment risks. Information discussed may not reflect current positions/recommendations. While believed accurate, Black Mammoth does not guarantee information accuracy. This broadcast is not a solicitation for securities transactions or personalized investment advice. Tax/estate planning information is general - consult professionals for specific situations. Full disclosures at www.blackmammoth.com.

Business taxes, skill-game taxes debated—but no state budget. And Visit Hershey & Harrisburg gears up for America250.

Today, June 30, is the deadline for Pennsylvania lawmakers to pass a new state budget. But the legislature appears poised to miss the budget deadline for the fourth straight year. A years-long debate over how much to tax so-called “skill games” in Pennsylvania has escalated, leading up to the state budget deadline. And Democrats in the state House are pushing to reform the Pennsylvania’s tax code to make it harder for corporations to hide income in other places. It's being called America250. On July 4th of next year, the United States celebrates its 250th birthday.Across the country and across Pennsylvania planning is underway. Joining us to tell us more is Sharon Myers, President/CEO of Visit Hershey & Harrisburg. And this programming note: We look forward to bringing you conversations with many additional central Pennsylvania tourism leaders through the month of July to find out how they’re gearing up for next July’s America250, so keep an eye and an ear out for more conversations.Support WITF: https://www.witf.org/support/give-now/See omnystudio.com/listener for privacy information.

How Tax Strategist Jeff Trapp Built a Successful Firm and Learned From Failure

Apple Podcast Description: In this episode of the Inner Edison Podcast, host Ed Parcaut sits down with Jeff Trapp, an experienced tax strategist and founder of Tax Planning Pros. Jeff clarifies the differences between an Enrolled Agent (EA) and a CPA, shares candid stories about his path into the tax field, and offers practical advice for business owners on proactive tax planning. Listen in as Jeff reveals common tax mistakes, the importance of building your personal brand, and key tips for keeping your books in order. Whether you're a solo entrepreneur or a seasoned business owner, this episode is packed with timely insights on saving money, building wealth, and navigating the complex world of taxes. Plus, discover how Jeff overcame setbacks to launch his own successful firm and what you should be asking your accountant to maximize your financial legacy. Learn more about Jeff at taxplanningpros.com and get inspired to take control of your business—and your taxes—today! **Contact Ed Parcaut:** -

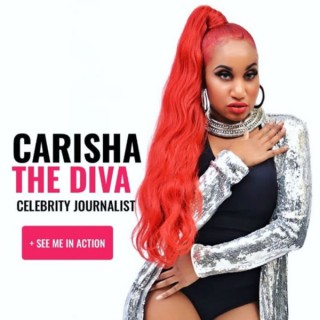

Precious Moorer of Tax Prep Block Discusses Business Taxes, Good Write Offs and more Live with Carisha Podcast

Entrepreneur Precious Moorer CEO of Tax Prep Block on the Live with Carisha Business Series discussing the importance and necessary tricks to know with tax filing, her career and more. Follow them on Instagram @precious_entertainment Contact them at p.moorer@taxprepblockllc.com

How Risky Should You Be with Your Business Taxes? Finding What's Right for You

Key Takeaways: Look for Hidden Tax Treasures There are special tax “bonuses” for doing good things, like hiring veterans or creating new stuff (like inventions). These are called tax credits, and they can save your business a lot of money. Don't Trust Every TikTok Tip Just because someone says something about taxes online doesn't mean it's true. Always double-check with someone who really knows—like a CPA (that's a tax pro!). Keep Good Records—Always Save every receipt, bill, and note about what you spend for your business. If the IRS ever checks your work, you'll be ready and won't panic. Find Your Tax Style Some people take more risks on their taxes, while others play it safe. You need to know what feels right for you and build a plan that fits both your comfort level and your business goals. Get Help From a Pro A CPA can help you find tax savings you didn't even know existed. Meeting with one regularly helps you stay legal, smart, and ahead of the game. Chapters: Timestamp Summary 0:00 Introduction to Tax Deductions and Credits 0:42 The Importance of Tax Deductions 1:06 Finding Valuable Deductions for Your Business 3:21 Tax Credits for Hiring and Innovation 5:00 Documenting Expenses for an Audit 8:02 Balancing Aggressiveness with Tax Risks Powered by ReiffMartin CPA and Stone Hill Wealth Management Social Media Handles Follow Phillip Washington, Jr. on Instagram (@askphillip) Subscribe to Wealth Building Made Simple newsletter https://www.wealthbuildingmadesimple.us/ Ready to turn your investing dreams into reality? Our "Wealth Building Made Simple" premium newsletter is your secret weapon. We break down investing in a way that's easy to understand, even if you're just starting out. Learn the tricks the wealthy use, discover exciting opportunities, and start building the future YOU want. Sign up now, and let's make those dreams happen! WBMS Premium Subscription Phillip Washington, Jr. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

The Mission Driven Business Podcast Episode 91: Deductible Business Expenses That Can Save You Thousands

As an entrepreneur, you know that every dollar counts, so today we're taking a deep dive into a topic that can save business owners thousands of dollars: deductible business expenses. In this episode, we'll cover what makes an expense deductible, the savings that come with deductions, unexpected deductions, and the importance of bookkeeping. By the end of the episode, you'll have a clear picture of how to make the most of your expenses and keep your money in your business. Episode Highlights Deductible expenses must be ordinary and necessary. Deductions are powerful. Every dollar you deduct reduces your taxable income, directly lowering the amount of taxes you owe. However, in order to deduct a business expense, two key rules must be satisfied: the expense must be ordinary and necessary. To be ordinary, the expense must be common and accepted in your industry, such as a yoga mat for a yoga instructor. To be necessary, the expense must be helpful and appropriate for your business operations. Before you write off something, ask yourself whether a business like yours typically needs this type of expense and does it serve a legitimate business function? If the answer is yes, you may have a deduction on your hands. Don't forget unexpected deductions. While rent and office supplies may come to mind as deductible business expenses, consider whether these unexpected events apply to you: Pet expenses -- If a dog protects your office or warehouse, the dog's food, training, and vet bills may be deductible. Coaching -- Hiring a business coach, taking leadership training, and even going to therapy for stress management related to business all might qualify as expenses needed to run and lead a company. Your home office -- If you have a dedicated space in your home exclusively used for business, you can write off some of your rent, utilities, and internet costs. Marketing and promotions -- Hosting an industry event, running a giveaway, collaborating with influencers, and paying for digital ads all count as deductible expenses as long as they are directly tied to promoting your business. Work-related attire -- Buying branded uniforms or specialized attire for your business are legitimate business expenses. Business retreats -- If you take your team on a business retreat to strategize and improve company culture, that expense could be deductible. Make sure you document the business purpose with an agenda and good notes. Good bookkeeping is just as important as knowing the rules. Without solid record keeping, you might miss valuable deductions or struggle to justify an expense in the event of an audit. Here are some tips to keep your books in order: Separate personal and business finances -- Keeping separate personal and business bank accounts and credit cards makes tracking deductible business expenses much more manageable. Use accounting software -- Accounting software, such as Quickbooks or Wave, can help automate tracking, helping to ensure nothing gets overlooked when tax season rolls around. Save your receipts -- The IRS requires proof of deductions, so keep digital or physical copies of receipts and invoices. Work with a professional -- A professional bookkeeper or accountant can help you keep your financial records accurate and compliant. Resources + Links Brian Thompson Financial: Website, Newsletter, Podcast Follow Brian Thompson Online: Instagram, Facebook, LinkedIn, X, Forbes About Brian and the Mission Driven Business Podcast Brian Thompson, JD/CFP, is a tax attorney and Certified Financial Planner® who specializes in providing comprehensive financial planning to LGBTQ+ entrepreneurs who run mission-driven businesses. The Mission Driven Business podcast was born out of his passion for helping social entrepreneurs create businesses with purpose and profit. On the podcast, Brian talks with diverse entrepreneurs and the people who support them. Listeners hear stories of experiences, strength, and hope and get practical advice to help them build businesses that might just change the world, too.

TCS 126. Crownsmen Partners: Business Taxes, Beer Reviews & Borrowing Tips You Need Now

On this episode of *The Crownsmen Show*, Jerrod, Rory, and Roy discuss taxes, smart borrowing, ETFs, and construction site security, while also reviewing Fernie's Huck Berry. Filmed in the Petro-Canada Lubricants Studio. Watch now!Visit Crownsmen Partners to Learn More: https://www.crownsmen.com/Heavy Industry Tour Partner

Re-Releasing Episode 52: An Expert's Guide To Understanding The 1120-S Tax Form

It's tax season crunch time, so we are resharing a timely episode debunking the 1120-S tax return. In this episode, Brian will walk you through the S-Corporation income tax return to help you better understand what you're filing and hopefully catch mistakes before it's too late. He provides a section-by-section analysis of Form 1120-S and highlights key areas that business owners and tax professionals make mistakes. Episode Highlights Part 1: Heading, Income, Deductions, Tax and Payments Most of this information is drawn from your business's Profit and Loss Statement. Here's a breakdown of what's on the first page: Calendar year: The very top of the form asks for the calendar year. If the corporation has a calendar year-end, leave this blank. If a fiscal year or short year put in the appropriate dates. Address: Underneath the calendar year, the form asks for a name and address. Use the name set forth in the charter or other legal documents, such as your Employer Identification Number (EIN) letter. Item A: Located to the left of the address, Item A asks for your S election effective date. You should have a letter from the IRS (CP 261) with your S-Corp starting date. This date should stay the same every year. Item B: Your business activity code. This code shows the IRS exactly what you do. Item C: Item C only applies if you have assets of $10 million or more. Most of the time, Item C will not be checked. Item D: Put your EIN in Item D. Make sure to verify it's correct before you file your form. Item E: Your date of incorporation should match the articles of incorporation. This date may or may not be the same date as your S-election. Like the S-election date, the date of incorporation won't change. Item F: Total assets at the end of the year. Item G: If the corporation is electing to be an S-Corp beginning with the current filing tax year, check the appropriate box. If the S-Corp did not already file the S-Election, attach Form 2553 with the return. Item H: These boxes should be self-explanatory. Check the boxes that apply. Item I: Enter the number of shareholders in the firm (e.g. yourself and your partners). Item J: Most of the time, Item J will not be checked. If you believe that one of the Item J items applies, follow up with your tax accountant. Income: Report gross revenue your business has earned for the year and any additional income or interest income that you may have incurred. Only report trade or business income. Do not list rental income, portfolio income, or tax exempt income (those go on your Schedule K). Expenses: Report all deductions on your Profit and Loss statement. Pay special attention to the following lines: Line 7: Compensation of officers should have something on it. S-Corporations must pay shareholder/employee reasonable compensation for services rendered, and failing to put reasonable compensation could lead to an IRS audit. Also included on this line are fringe benefits, including employer contributions to health plans and group term life insurance, for shareholders/employees owning more than 2% of the corporation stock. If your S-Corp has total receipts of $500,000 or more, you'll need to attach Form 1125-E to explain what was paid to each officer. Line 8: Salary and wages paid to employees (other than officers) of the corporation. Line 17: An S-Corporation can deduct contributions made for its employees under a qualified pension, profit sharing, annuity, SEP plan, Simple plan, or any other retirement deferred compensation plan. This includes shareholders/employees owning more than 2% of the corporation stock. Line 18: Employee fringe benefits provided to officers and employees owning less than 2% go on this line, such as health insurance, disability insurance, and educational assistance. Line 19: Line 19 includes any other deductions. There should be an attached statement, and it should match your profit and loss. The numbers should be close to your Profit and Loss statement. Taxes and payments: In general, an S-Corporation does not pay taxes at the corporate level, so this section will be blank. Signature: It's important to sign the return only after verifying all of the information, including the following sections. Part 2: Schedule B This section is mostly self-explanatory questions. Make sure to read and understand each question. Below are two lines to pay special attention to: Box 1: This easy-to-miss box can change your entire return if you're not careful, since it's where you select whether you're a cash or accrual basis taxpayer. Once you choose an accounting method, you generally cannot change without approval from the IRS. Box 2: Here is where you explain what you do. Part B is an either/or question, so state whether you sell products or services. Also, if you hire contractors, say yes to question 14 -- and hopefully you got out your 1099 forms by January 31. Part 3: Schedules K and K-1 Schedule K reports the pro rata share items in total for the Corporation. Schedule K-1, which you receive in your personal name, reports the percentage of pro rata share items allocable to each shareholder. Lines 1-17 on Schedule K correspond to Boxes 1-17 on Schedule K-1. Most items on Schedules K and K-1 are self-explanatory and come from other parts of the return. Part 4: Schedule L This is where many taxpayers make a mistake. Schedule L matches your business' balance sheet and should agree with your books and records. If it doesn't, find out why before you file. The first two columns match what your accounts were at the beginning of the year and should match what the accounts were at the end of last year. If this is your first year filing an 1120-S return, these two columns should be blank. The second two columns are for what the accounts had on December 31 of the previous year and will carry over to next year's return. Some of the most common assets on Schedule L are: Line 1: Write the amount of cash in your bank account on the last day of the year. Line 7: Loans to shareholders are loans from the corporation to the shareholder. Keep in mind, these loans need to be documented and should have a repayment schedule and interest rate. Line 10a: Buildings and other depreciable assets are fixed assets that the business owns that have been depreciated, such as real estate, furniture, or machinery Some of the most common liabilities on Schedule L are: Line 18: Other current liabilities are expenses incurred at the end of the year but not paid until January of the next year. Current expenses often include wages, state taxes, federal taxes, and payroll taxes payable at the end of the year. Line 19: Loans from shareholders are loans from the shareholder to the corporation. As with the other loans, these loans should be documented and include a repayment schedule and interest rate. Line 22: The par value or stated value of the capital stock issued by the corporation. This amount stays the same each year unless the S-Corporation issues additional stock after incorporation. The corporate charter or minutes should identify the stock. Line 23: Enter the beginning and ending balances of additional paid-in capital. This includes the amount contributed to the S-Corp by shareholders for which the corporation did not issue stock or amounts contributed in excess of the stated or par value. Line 24: This section is especially tricky. You should base the retained earnings on the S-Corporation's books and records. Most of the time, retained earnings should match the Accumulated Adjustments Account (AAA), other adjustments account (OAA), and previously taxed income (PTI) balances on Schedule M-2. Line 27: This line represents the total liability and shareholders equity. This line must match line 15. If you answered “yes” to question 11 on Schedule B that your total receipts were less than $250,000 and total assets were less than $250,000, then you aren't required to file a Schedule L. However, it may be beneficial to file Schedule L anyway because it will be crucial for future balance sheets. Part 5: Schedules M-1 and M-2 Schedule M-1 helps explain discrepancies between the books and your tax return. This section should explain any differences you notice. Some common items reported on Schedule M-2 include: Meal expenses (100% on books, 50% on taxes) Entertainment (100% on books, 0% on taxes) Life insurance premium expense (100% on books, 0% on taxes) Certain fines and penalties (100% on books, 0% on taxes) Political contributions (100% on books, 0% on taxes) Book depreciation expense (100% on books, 0% on taxes) Tax depreciation expense (%0 on books, 100% on taxes) Tax-exempt income (100% on books, %0 on taxes) Schedule M-2 tracks the income and losses and separately states items that the shareholder should report on their tax return. Resources + Links Bank Reconciliation 101 Lessons from the 1099-NEC deadline Follow Brian Thompson Online: Instagram, Facebook, LinkedIn, X, Forbes About Brian and the Mission Driven Business Podcast Brian Thompson, JD/CFP, is a tax attorney and certified financial planner who specializes in providing comprehensive financial planning to LGBTQ+ entrepreneurs who run mission-driven businesses. The Mission Driven Business podcast was born out of his passion for helping social entrepreneurs create businesses with purpose and profit. On the podcast, Brian talks with diverse entrepreneurs and the people who support them. Listeners hear stories of experiences, strength, and hope and get practical advice to help them build businesses that might just change the world, too.

Episode 55: The changing cost of business: taxes, talent & the UK's economic shift

In this episode of the #TalkingRecruitmentPodcast, Neil Carberry speaks with Raj Lal, Senior Sales Director at Totaljobs. They dive into the recent increase in National Insurance contributions, how these changes are affecting businesses and examine the growing disconnect between employee-valued benefits and employer offerings, considering strategies for companies to stay competitive in talent acquisition and retention.

Rob Holbert from Lagniappe - Ivey and Ainsworth on the veterans - Business taxes - Midday Mobile - Wednesday 2-12-25

Taxes Suck! Don't Make it Worse!

I wish I had a dollar for every small business owner who didn't save a dime for their taxes that are due. I'd be rolling in the money! I know why it happens, but let's talk about what to do about it. You MUST be saving for your taxes each year if you want your business to survive! ______ DIVE IN DEEPER & LEARN MORE ABOUT YOUR NUMBERS

Year-End Financial Success: Tax Prep, Payroll Tips, and Business Goals

Send us a textReady for year-end success?

End of Year Tax Prep and Digital Health Impact on Pharmacy | TWIRx

TWIRx News NCPDP Foundation Shares Insights From a Completed Study Focused on Pharmacy Interoperability https://www.prweb.com/releases/ncpdp-foundation-shares-insights-from-a-completed-study-focused-on-pharmacy-interoperability-302307168.html SWAB‑Rx study aims to expand sexual health services in pharmacies https://www.dal.ca/faculty/health/news-events/news/2024/11/15/swab_rx_study_aims_to_expand_sexual_health_services_in_pharmacies.html I'm a pharmacist — the best value medications at Dollar Tree, including a $1.25 ‘lifetime supply' gel https://nypost.com/2024/11/15/lifestyle/im-a-pharmacist-the-best-value-medications-at-dollar-tree/ Special Guests: Scotty Sykes, with Sykes & Company CPA. Business Taxes, preparing for the end of the year. Amit Goldman, with DigitalDx Ventures How will Digital Health impact pharmacists? Sponsored by Sykes & Company CPA and Happier at Home. Shout out to IPC at HLTH 2024, with iCare+ the post-show is releasing next week, the week of November 18th.

Avoiding Tax Traps: Managing Cash Flow and Tax Debt as a Small Business Owner

In today's episode, I'm diving into understanding your cash flow and staying on top of taxes as a small business owner. Whether you're just starting out, a couple of years in, or haven't looked at your numbers in a while, this episode is all about getting clear on your taxes and financial basics that'll keep your business moving forward!Topics Covered:Why managing cash flow and setting aside taxes is essential for business growth.The tax challenges service-based businesses face versus product-based businesses.How ignoring tax payments can lead to debt that's harder to pay off over time.Creative solutions for paying off tax debt if you've fallen behind.Mindset shifts to help you tackle tax debt with grace and motivation .Tune in for practical advice on handling taxes and cash flow to avoid future headaches. Give yourself grace, it's never too late to get on top of your finances!Staci's Links:Instagram. Website.The School for Small Business Podcast is a proud member of the Female Alliance Media. To learn more about Female Alliance Media and how they are elevating female voices or how they can support your show, visit femalealliancemedia.ca.Head over to my website https://www.stacimillard.com/ to grab your FREE copy of my Profit Playbook and receive 30 innovative ways you can add more profit to your business AND the first step towards implementing these ideas in your business!

How to Protect Your Pension Fund from a Stock Market Crash Worried about the impact of a stock market crash on your pension fund? You're not alone. Market volatility can significantly affect your retirement savings, but there are strategies you can implement to safeguard your investments. Watch video https://youtu.be/e2iiYBYCUOw?si=enFe6LD0M8jt3hQG Diversify Your Portfolio: One of the best ways to protect your pension fund is through diversification. By spreading your investments across different asset classes—such as bonds, real estate, and cash—you reduce the risk of a market downturn affecting your entire portfolio. Diversification ensures that even if one asset class takes a hit, others may remain stable or even gain value. Regularly Rebalance Your Portfolio: Market conditions change over time, so it's crucial to regularly review and rebalance your portfolio. This involves adjusting your asset allocation to maintain your desired level of risk. Rebalancing helps you lock in gains from outperforming assets and reinvest them into underperforming ones, maintaining a balanced risk exposure. Consider Safe Haven Assets: Investing in safe haven assets like gold, government bonds, or cash equivalents can provide stability during market crashes. These assets tend to hold their value or even appreciate when stock markets decline, offering protection for your pension fund. Stay Informed and Seek Professional Advice: Keeping up with market trends and seeking advice from a financial advisor can help you make informed decisions. A professional can guide you on how to adjust your pension investments to minimize risks during turbulent times. Protect your retirement savings by taking proactive steps today! See also: Why Are UK Taxes So High? 10 Easy Tips To Drastically Reduce Your Tax Liability – Legally - https://youtu.be/PZ9IFiI2Tio How will Labour's new Renters Rights Bill 2024 affect buy-to-let landlords? The Labour Party's Renters' Rights Bill 2024 is poised to bring significant changes to the UK's rental market, impacting both tenants and buy-to-let landlords. Understanding these changes is crucial for landlords to navigate the evolving landscape effectively. Watch video version - https://youtu.be/Wx1HXgVW1bM A Lifetime of taxes Income tax, VAT, Council Tax, Car Tax, Insurance and Travel Tax, Green Energy Taxes, BBC Licence Tax, Stamp Duty, Capital Gains Tax, Section 24, Business Taxes and the final kicker; Inheritance Tax for your dependents! You can legally reduce and mitigate your taxes and inheritance tax for your dependents. Wills and Trusts New research from Canada Life reveals that over half of UK adults (51%)1 have not written a will, nor are they currently in the process of writing one. This includes 13% of people who state they have no intention to write a will in the future. Section 24 Landlord Tax Hike Interview with Chartered Accountant and property tax specialist who reveals options and solutions to move your properties from your own name into a limited company or LLP whilst mitigating the potential HMRC pitfalls. Email charles@charleskelly.net for a free consultation on how to deal with Section 24, Wills and Trusts. Watch video now: https://youtu.be/aMuGs_ek17s #UKTaxes #TaxTips #CharlesKellyMoneyTips #FinancialFreedom #LegalTaxReduction #section24 #stampduty #PensionFundProtection #StockMarketCrash #RetirementPlanning #FinancialSecurity #Diversification #SafeHavenAssets #InvestingWisely #MoneyTips #CharlesKellyMoneyTips #FinancialAdvice

Victoria Thayer - Novii CPA On Preparing For the Future: "It's always about making sure that you have time as a business owner to keep thinking about, okay, where do I think the industry is moving to? Where is the next thing?" In this insightful episode, we sit down with Victoria Thayer, the dynamic founder of Novii CPA, who has rapidly grown her CPA firm in just over a year, now boasting a team of eight. Victoria shares her unique approach to accounting that goes beyond traditional tax preparation, emphasizing the importance of marketing, long-term strategy, and creating a business that thrives on innovation and client satisfaction. Join us as we delve into Victoria's journey from solo entrepreneur to business owner, where she discusses the challenges and triumphs of managing a growing team, the significance of a well-structured sales funnel, and how her firm has successfully integrated modern marketing techniques to stay top-of-mind in the industry. Victoria also opens up about her commitment to continuous improvement, including her decision to implement a 360-degree feedback system within her team. She candidly shares the lessons learned from this process, revealing how she's working on enhancing her communication and organizational skills to better lead her team. This episode is packed with valuable insights for business owners, particularly in the accounting industry, who are looking to scale their operations, improve team dynamics, and embrace a forward-thinking mindset. Whether you're a small business owner or a seasoned entrepreneur, Victoria's story will inspire you to think critically about your business strategy and the steps you can take to reach the next level. Don't miss this episode if you're interested in learning how to combine financial expertise with business acumen, all while fostering a culture of growth and innovation. Tune in to discover: The importance of balancing short-term and long-term marketing strategies. How to effectively manage and grow a team in a fast-paced business environment. The benefits of adopting a proactive approach to client services and internal operations. Key insights into the financial forecasting and strategic planning that drive business success. Listen now and learn from Victoria's journey as she continues to break new ground in the world of accounting and business management Visit Victoria at: NoviiCPA.com Podcast Overview: 00:00 Consider short and long term marketing strategies. 07:16 Contemplating business success and personal fulfillment. 15:17 Close working relationship, delegation, and operational improvement. 16:05 Initial investment in hiring to create value. 23:15 Dealing with challenges, support is beneficial. 31:02 Improving communication and prioritizing thoughts through organization. 35:07 Improving accountability, efficiency and mindset for success. 40:27 Parenting spurs personal growth and learning. 45:22 Financial modeling helps project future costs, revenue. 48:49 Plan ahead to avoid tax bill surprises. 55:52 Consulted accountant about different tax methods, changed approach. 58:57 Plan ahead for business growth, update strategies. Podcast Transcription: Victoria Thayer [00:00:00]: And now when I have an urge to message someone that is just scattered, it's nothing very urgent, I either message myself or I email myself all my random thoughts, and then at the end of the day, I create a concise email, like, okay, these are all the marketing things or sales things that I thought of. Here it is what the idea is, the reason why, and despite the deadline, or how important it is so that they have. Because otherwise they were like, I don't know what this even mean. James Kademan [00:00:34]: And today we're welcoming, preparing to learn from Victoria Thayer of Novi CPA. And, Victoria, it's been a year. Victoria Thayer [00:00:42]: It's been a year. Yes.

Why Do We Pay So Much Tax in the UK and What Can You Do to Reduce Your Tax Bill Legally?

Taxes in the UK can feel overwhelming, from income tax and National Insurance to VAT and council tax. There are a raft of business taxes, landlord tax hikes under Section 24, as well as taxes on your savings, Capital Gains Tax and Inheritance tax. But why do we pay so much tax? The answer lies in funding public services like the NHS, education, and infrastructure. High taxes are designed to support the welfare state and maintain social programs. Watch video on YouTube - https://youtu.be/PZ9IFiI2Tio 10 Money Saving Tips However, there are legal ways to reduce your tax bill. Here are 10 money-saving tips from Charles Kelly Money Tips Podcast: Utilise Tax-Free Allowances: Make sure to use your personal allowance, savings allowance, and dividend allowance effectively. Invest in ISAs: Individual Savings Accounts (ISAs) offer tax-free interest, dividends, and capital gains. Contribute to a Pension: Pension contributions can reduce your taxable income. Claim Business Expenses: If you're self-employed, claim all allowable business expenses. Gift Aid Donations: Donations to charity through Gift Aid can reduce your tax bill. Marriage Allowance: Transfer part of your personal allowance to your spouse if they're a basic rate taxpayer. Make a Will and Plan for Inheritance Tax: Making a Will and planning ahead could substantially reduce taxes and stress for your dependents. Use Trusts: Protect your assets for you and your family using the laws of trusts. Avoid Section 24: Legally take steps to mitigate landlord taxes under Section 24. Take Professional Advice: Using professional advisers can save you money and even reclaim some overpaid taxes, such as Stamp Duty. By staying informed and using these strategies, you can legally minimize your tax liabilities and keep more of your hard-earned money. For more tips on managing your finances and reducing your tax bill, subscribe to Charles Kelly Money Tips Podcast on YouTube! How will Labour's new Renters Rights Bill 2024 affect buy-to-let landlords? The Labour Party's Renters' Rights Bill 2024 is poised to bring significant changes to the UK's rental market, impacting both tenants and buy-to-let landlords. Understanding these changes is crucial for landlords to navigate the evolving landscape effectively. Watch video version - https://youtu.be/Wx1HXgVW1bM A Lifetime of taxes Income tax, VAT, Council Tax, Car Tax, Insurance and Travel Tax, Green Energy Taxes, BBC Licence Tax, Stamp Duty, Capital Gains Tax, Section 24, Business Taxes and the final kicker; Inheritance Tax for your dependents! You can legally reduce and mitigate your taxes and inheritance tax for your dependents. Wills and Trusts New research from Canada Life reveals that over half of UK adults (51%)1 have not written a will, nor are they currently in the process of writing one. This includes 13% of people who state they have no intention to write a will in the future. Section 24 Landlord Tax Hike Interview with Chartered Accountant and property tax specialist who reveals options and solutions to move your properties from your own name into a limited company or LLP whilst mitigating the potential HMRC pitfalls. Email charles@charleskelly.net for a free consultation on how to deal with Section 24, Wills and Trusts. Watch video now: https://youtu.be/aMuGs_ek17s #UKTaxes #TaxTips #CharlesKellyMoneyTips #FinancialFreedom #LegalTaxReduction #section24 #stampduty

Tax! How to Pay the Least Amount - LEGALLY! with Bob Gauvreau

Taxes are inevitable, but paying more than necessary isn't! Join us in this episode with Bob Gauvreau as we explore legal ways to reduce your tax burden. Perfect for individuals and business owners who want to take control of their finances. Tune in and discover actionable strategies that can help you save big on taxes.

Bank Of England FINALLY Cuts Base Rates By 0.25% To 5% - Good News For Mortgage Borrowers

After months of dithering, the Bank of England has finally cut the base rate to 5 per cent, the first time the central bank has voted to cut the base rate since 2020. On seven consecutive occasions the central bank voted to hold rates at 5.25 per cent between August 2023 and June 2024, despite falling inflation. There had been 14 consecutive base rate hikes since December 2021. The bank's successive interest rate rises between December 2021 and August 2023 were bad news for borrowers but good news for savers. The average two-year fixed mortgage rate is now 5.78 per cent, according to Moneyfacts, and the average five-year fix is 5.39 per cent. Right now, the lowest five-year fix is 3.99 per cent and the lowest two-year fix is 4.42 per cent, but lenders have already started cutting rates, but beware for excessive arrangement fees. Savers Rates Say goodbye to great savers deals, including Santander's 5.2 per cent special edition easy-access rate and NS&I's one-year bond paying 6.2 per cent, which launched in September 2023. One of the best one-year fixed-rate account on the market now pays 5.4 per cent, down from a high of 6.2 per cent in October 2023. Savers should note that 1,638 savings accounts still beat inflation which is now at the Bank of England's target of 2 per cent, according to the Mail Online. This means the value of your money is growing in real terms against inflation. NS&I revealed it will offer a new one-year Guaranteed Growth Bond paying 5.15 per cent or a Guaranteed Income Bond at 5.03 per cent. The offer is exclusive to existing 6.2 per cent bond holders and will be available when their current one matures, starting from the end of next month. A saver putting £10,000 in Union Bank of India's one-year fix will earn a guaranteed £554 interest over one year. It comes with full protection under the Financial Services Compensation Scheme up to £85,000 per person. Are Buy-to-Let property deals still worth it? How will Labour's new Renters Rights Bill 2024 affect buy-to-let landlords? The Labour Party's Renters' Rights Bill 2024 is poised to bring significant changes to the UK's rental market, impacting both tenants and buy-to-let landlords. Understanding these changes is crucial for landlords to navigate the evolving landscape effectively. Watch video version - https://youtu.be/Wx1HXgVW1bM A Lifetime of taxes Income tax, VAT, Council Tax, Car Tax, Insurance and Travel Tax, Green Energy Taxes, BBC Licence Tax, Stamp Duty, Capital Gains Tax, Section 24, Business Taxes and the final kicker; Inheritance Tax for your dependents! You can legally reduce and mitigate your taxes and inheritance tax for your dependents. Wills and Trusts New research from Canada Life reveals that over half of UK adults (51%)1 have not written a will, nor are they currently in the process of writing one. This includes 13% of people who state they have no intention to write a will in the future. Section 24 Landlord Tax Hike Interview with Chartered Accountant and property tax specialist who reveals options and solutions to move your properties from your own name into a limited company or LLP whilst mitigating the potential HMRC pitfalls. Email charles@charleskelly.net for a free consultation on how to deal with Section 24, Wills and Trusts. Watch video now: https://youtu.be/aMuGs_ek17s #finance #moneytraining #moneymanagement #wealth #money #marketing #sales #debt #leverage #property #investment #Homeownership #financialplanning #moneymanagement #financialfreedom #section24tax #financialindependenceretireearly #RentersRightsBill #BuyToLet #LandlordLife #UKPropertyMarket #TenantsRights #RentalProperty #PropertyInvestment #LandlordChallenges #RentControl #PropertyStandards #interestratecut #bankofengland #mortgagerates

If you're: -Struggling financially -Living paycheck to paycheck -Stressed out & credit cards are maxed out -Losing sleep because you're worried about whether or not you're going to be able to pay your bills... Then, the Coins, Cashflow, & Conversations Podcast is for you! Still need to file your business taxes? There's still time to file your taxes if you filed an extension. The tax deadline for extensions is October 15, 2024. However, without this one thing, you will not be able to file your business tax return. Watch the latest episode of the Coins, Cashflow, & Conversations Podcast with Dakota Grady to find out what you need to have your business tax return filed. *The Coins, Cashflow, & Conversations Podcast is sponsored and brought to you by Upstate Essential Solutions, LLC!*

Optimize Your Business Taxes and Credit With Tommy Thornburg

Unlock the keys to effective business structuring, master tax optimization, and learn how to build solid business credit in this enlightening discussion. Gain crucial insights into protecting your assets and enhancing profitability, whether you're starting fresh or scaling up. Dive into this episode for practical advice and essential strategies that every entrepreneur needs to thrive in today's competitive business landscape.

Optimize Your Business Taxes and Credit With Tommy Thornburg

Unlock the keys to effective business structuring, master tax optimization, and learn how to build solid business credit in this enlightening discussion. Gain crucial insights into protecting your assets and enhancing profitability, whether you're starting fresh or scaling up. Dive into this episode for practical advice and essential strategies that every entrepreneur needs to thrive in today's competitive business landscape.

Larry Pendleton - Larry Pendleton CPA On the Getting the Right People: ""I gotta be able to kind of find the right people to trust instead of finding someone that I halfway trust and I gotta oversee every every step of the way." Just about every successful business owner has learned, often the hard and expensive way, that taxes can be a heavy burden to carry. Once your business starts bringing in some money, after going through all of the sweat and challenges, you learn that the government wants a very large piece. But how do savvy business owners navigate the tax code? They do it with skilled CPA's that do more than just enter numbers and spit out results. They do it with careful tax strategy to help you and your business make smart moves before it is tax time. Larry Pendleton is a CPA that went from hustling numbers like most accountants to really bringing tax strategy to his clients. Larry shares his transformative journey from having a limited mindset to becoming an astute real estate investor, thanks to the guidance of a trusted partner. We explore Larry's first profitable residential investment, the challenges of dealing with contractors, and his strategic pivot from property flipping to new construction for better stability and lower risk. Larry sheds light on the intricacies of cost segregation, a powerful tax strategy popularized by the 2017 tax reforms, and discusses the depreciation rules that real estate investors navigate. We also delve into the concept of self-directed retirement accounts, a game-changing financial tool that allows for diverse investment options beyond traditional stocks and bonds. Listen as Larry gives details and strategies for both business taxes as well as real estate investing. Enjoy! Visit Larry at: LarryPendletonCPA.com Podcast Overview: 00:00 Former athlete advising on tax strategies and coaching. 05:15 Accountant becomes year-round adviser and coach. 13:09 Struggling with project, need trustworthy professionals. 15:57 Adapting real estate investments to market changes. 22:45 Rolling over retirement accounts, choosing short-term investments. 29:44 Lack of promotion of self-directing investments. 31:30 Investors look for credibility, security in deals. 38:05 Explore budgeting, technology, and planning for accounting. 45:27 Clients aspire to be investors, achieving freedom. 49:50 Public accounting firms specialize in different areas. 55:52 Depreciation benefits and potential government changes summarized. 57:41 Understanding tax savings and depreciation in investments. 01:04:03 Quick cost assessment for new construction. Podcast Transcription: Larry Pendleton [00:00:00]: Then you wanna know, okay, how much you how much is needed? How is secured? Like, who are you? Like like, what's your credibility and and and and what's my returns are going to be. But it's the security aspect of where like, are you sure, like like like if everything goes wrong, like am I at least gonna be like make my money back where, like, with with stocks and bonds, like, you can really lose everything. You can lose everything in real estate as well, but that's more so just not doing the proper due diligence, not, not really knowing what you're doing. James Kademan [00:00:33]: You have found Authentic Business Adventures, a business program that brings you the struggle stories and triumphant successes of business owners across the land. Downloadable audio episodes can be found in the podcast link found at drawincustomers.com. We are locally underwritten by the Bank of Sun Prairie as well as calls on call extraordinary answering service and the Bold Business Book. Today, we're welcoming slash preparing to learn from Larry Pendleton, CPA and tax investment coach. So, Larry, how is it going today? Larry Pendleton [00:01:04]: It's going great, James. Thanks for having me. How are you doing? James Kademan [00:01:07]: I'm doing well.

How your house can save you $1,500 on business taxes right now.

The IRS allows you to write your house off with no receipts. Here's how! #smallbusinesstaxes #businesstaxes #taxes #tax #taxadvice #smallbusinesstaxstrategy #taxexpert #richpeopletaxes #taxsavings #bigbirdaccounting

344. How Uber Weaponizes Complexity to Abuse Workers and Bully States

We check in with an old enemy of the show, Uber, to discuss it's recent battles with states over wage floors and worker rights, and get a masterclass on how Uber weaponizes complexity through it's platform to abuse workers and avoid regulation, while also wielding the threat of capital flight to great effect against politicians and governments. ••• Minneapolis just called Uber's bluff — other cities must follow their lead https://thehill.com/opinion/civil-rights/4550102-minneapolis-just-called-ubers-bluff-other-cities-must-follow-their-lead/ ••• Uber's and Lyft's ride-hailing deal with Minnesota comes at a cost https://techcrunch.com/2024/05/21/uber-and-lyfts-ride-hailing-deal-with-minnesota-comes-with-a-cost/ ••• The Gig Economy vs. America's Workers https://www.project-syndicate.org/commentary/uber-lyft-doordash-ballot-measures-massachusetts-legalize-gig-workers-by-sandeep-vaheesan-2024-05 ••• How Uber and Lyft Avoid Millions in Business Taxes https://slate.com/business/2024/05/uber-lyft-gig-economy-driver-classification-business-taxes-unemployment.html Subscribe to hear more analysis and commentary in our premium episodes every week! https://www.patreon.com/thismachinekills Hosted by Jathan Sadowski (www.twitter.com/jathansadowski) and Edward Ongweso Jr. (www.twitter.com/bigblackjacobin). Production / Music by Jereme Brown (www.twitter.com/braunestahl)

#58 Tax Tactics: The TOP 5 Ways Pilots Can Save with Toby Mathis

Welcome back to Passive Income Pilots! In this episode we delve into essential tax strategies tailored specifically for pilots. With the expertise of Toby Mathis from Anderson Advisors, we explore five key ways you can reduce your tax liability effectively. Toby brings his depth of tax knowledge directly to our pilot audience, discussing everything from maximizing deductions to strategic asset management. Additionally, we'll cover an intriguing opportunity for pilots interested in aircraft ownership—how purchasing an airplane can not only serve personal and professional needs but also offer significant tax advantages. If you're looking to navigate the complexities of taxes with ease and make informed decisions that could save you thousands, this episode is your must-listen guide.Timestamped Show Notes:(00:00) - Introduction to the episode with hosts Tait and Ryan.(01:29) - Introduction of the guest, Toby Mathis, and discussion on tax and legal workshops.(04:02) - Explanation of tax brackets and progressive tax systems.(05:13) - Discussion on aircraft ownership, benefits, and deductions related to taxes.(10:24) - Detailed analysis of leasing aircraft and tax implications.(17:15) - Strategies for pilots to utilize aircraft ownership for tax advantages.(23:46) - Overview of various tax reduction strategies and charitable giving.(28:36) - Introduction to tax and legal workshops offered by Toby's firm.(32:02) - Five top tax tips for pilots including HSA benefits.(44:58) - Discussion on solo 401k benefits and other tax-deferred accounts.(53:15) - Conclusion and thanks to guest Toby Mathis.Resources Mentioned:Tax & Asset Protection WorkshopDallas Conference June 27-29Remember to subscribe for more insights at PassiveIncomePilots.com!Join our growing community on FacebookCheck us out on Instagram @PassiveIncomePilotsFollow us on X @IncomePilotsGet our updates on LinkedInHave questions or want to discuss this episode? Contact us at ask@passiveincomepilots.com See you on the next one!Legal DisclaimerThe content of this podcast is provided solely for educational and informational purposes. The views and opinions expressed are those of the hosts, Tait Duryea and Ryan Gibson, and do not reflect those of any organization they are associated with, including Turbine Capital or Spartan Investment Group. The opinions of our guests are their own and should not be construed as financial advice. This podcast does not offer tax, legal, or investment advice. Listeners are advised to consult with their own legal or financial counsel and to conduct their own due diligence before making any financial decisions. The hosts, Tait Duryea and Ryan Gibson, do not necessarily endorse the views of the guests featured on the podcast, nor have the guests been comprehensively vetted by the hosts. Under no circumstances should any material presented in this podcast be used or considered as an offer to sell, or a solicitation of any offer to buy, an interest in any investment. Any potential offer or solicitation will be made exclusively through a Confidential Private Offering Memorandum related to the specific investment. Access to detailed information about the investments discussed is restricted to individuals who qualify as accredited investors under the Securities Act of 1933, as amended. Listeners are responsible for their own investment decisions and are encouraged to seek professional advice before investing.

Ep. 89 - How To Save Thousands Every Year On Business Taxes (+Free Template)

How do you save on your taxes as a business owner or entrepreneur? That's exactly what we go over in this video. Get your FREE spreadsheet here: https://bit.ly/4a19z9z In this video Joe covers step by step how to invest in your business the right way to save money on your taxes at the end of the year. Doing this can save you tens of thousands of dollars every year that you can then invest in other areas of your business.

Empowering Small Business Owners: Tax Strategies and Philanthropic Opportunities

Empowering Small Business Owners: Tax Strategies and Philanthropic Opportunities In this engaging podcast, Karen Nowicki discusses proactive tax planning and charitable contributions for small business owners with Aldo Aprile, a CPA, and Donna Rodgers from the Society of Saint Vincent de Paul. Aldo emphasizes the importance of year-round tax advice and planning for small business […] The post Empowering Small Business Owners: Tax Strategies and Philanthropic Opportunities appeared first on Business RadioX ®.

TYDS - Dr. Cozette White - Make the most out of your business taxes!

In this episode Dr. Cozette will helps us all business owners and entrepreneurs how to maximized your business taxes and credits. Listen up! Dr. Cozette is an award winning author and business owner. I'm Yovy D, a former media broadcaster who transitioned into podcasting in 2017. My podcasting journey was driven by a series of layoffs I experienced—three times in just five years. This desire to switch careers was a long-standing passion, dating back to my high school days when I was a devoted TV viewer, particularly of talk shows. During that time, I realized my true calling was in journalism, explicitly producing content. To confirm my abilities, I decided to engage with the public and put my skills to the test. Fast forward to today, and I've successfully launched my English podcast, "The Yovy D," while wholeheartedly embracing and celebrating my unique accent. Moreover, I've ventured into creating the "Chombita Chronicles" podcast. This podcast chronicles my life journey as a Latina, Black, college-educated individual exposed to unique educational and career opportunities. The "Chombita Chronicles" primarily serves as a storytelling platform, advocating for and showcasing the personal narratives of Afrolatinx individuals. DISCLAIMER: Please be aware that the views expressed by our guests, me, or sponsors may not necessarily reflect or align with the policies and ethical standards of ALKIRIA MEDIA PRODUCTIONS, LLC. These opinions are solely those of the individuals, agencies, or businesses involved. Additionally, explicit language may be used for illustrative purposes in the content. Show notes and links: https://thetaxcurativesoftware.com/ https://linktr.ee/yovyd https://myfinancialhome.com/ https://www.patreon.com/Yovy_D PODCAST EDITING & VO SERVICES: https://linktr.ee/the.50fifty https://goomedia.io/about-us/ https://goomedia.io/services/podcast-audio-editing/ https://linktr.ee/yovyd https://www.patreon.com/Yovy_D https://yovyd.com/ #podcaster #podcast #business #cultura #diversity #spanglish #entrepreneurship #idoitallwithanaccent #frombroadcast2podcast --- Send in a voice message: https://podcasters.spotify.com/pod/show/yovy-d/message Support this podcast: https://podcasters.spotify.com/pod/show/yovy-d/support

Ep 119 Make Your Money Count for Taxes and Retirement with David Wilcox, MBA, CTP, EA

If you're feeling overwhelmed by the complexities of tax planning and financial decisions, then you're not alone! Managing your business's tax structure, retirement planning, and investment options can feel like navigating a maze of rules and regulations. David Wilcox sheds some light on how you can take advantage of legal and accounting expertise to make informed decisions and make your money count for taxes and retirement. “You're going to have a lot of tax surprises, operational surprises, things you didn't have to deal with directly as an employee.” -David Wilcox, MBA, CTP, EA Key Takeaways Maximize tax savings and financial growth with optimized tax planning strategies. Ensure legal protection and peace of mind for your business through essential documentation. Discover the best tax classification and entity selection for your business to maximize benefits. Simplify payroll taxes and efficiently manage billing to streamline your business operations. Explore retirement account options and effective tax strategies for long-term financial security. About David Wilcox David Wilcox, MBA, CTP, EA is the Founder of Numbercraft and a skilled tax professional with over 20 years of experience. He is an EA (Enrolled Agent), CTP (Certified Treasury Professional), and Licensed Tax Consultant in Oregon. Beyond the tax, accounting and finance realm, he has years of related IT experience in CRM systems. David also writes and helps others to develop their business ideas through encouraging them and helping them form strategies and identifying potential partners and customers. David obtained his MBA at the University of Barcelona and is completely fluent in Spanish. David also has five years of experience with international and multinational living and is fluent in the unique documentation challenges which this lifestyle entails. David founded Numbercraft to assist small businesses and individuals, harnessing the power of cloud based accounting and CRM systems to create efficiencies and improve data. Find Out More https://numbercraft.tax/ https://www.facebook.com/numberengineer https://twitter.com/numberengineer https://www.linkedin.com/company/numbercraft/ Key Moments 00:00:02 - Introduction to David Wilcox's expertise 00:04:28 - Setting up a Business Entity 00:09:50 - Registering with the IRS 00:11:59 - Importance of Financial Segregation 00:15:06 - Key Considerations for New Business Owners 00:15:29 - Importance of Clear Business Planning 00:19:04 - Difference in Getting Paid 00:23:00 - Deducting Business Expenses 00:27:03 - Cost of Goods Sold and Business Taxes 00:29:27 - Importance of Form W-9 00:30:11 - Tax Structure and Independent Contractors 00:31:43 - 1099 Forms and Tax Deductions 00:35:43 - Employment vs. Contractor Relationships 00:40:30 - Quarterly Tax Filing and Financial Planning 00:43:27 - Payroll Services and Payroll Tax Compliance 00:44:51 - Importance of Payroll Taxes and State Obligations 00:46:06 - Understanding Payroll Tax Liability 00:47:44 - Importance of Outsourcing Billing and Coding 00:50:30 - CEO Mindset and Business Oversight 00:55:38 - Retirement Planning and Tax Benefits for Business Owners 00:59:22 - Traditional vs. Roth IRAs 01:00:53 - Backdoor Roth Contributions 01:02:06 - SEP IRA for Self-Employed 01:04:42 - Business Succession Planning 01:07:17 - Professional Advice and Disclaimers

Kanye West Accused of Owing $1 Million in Unpaid Property and Business Taxes

Kanye West is being accused of owning over $1 million in unpaid taxes after his Yeezy Apparel was hit with four liens totaling a whopping $934,033.56, RadarOnline.com has learned.Advertising Inquiries: https://redcircle.com/brandsPrivacy & Opt-Out: https://redcircle.com/privacy

12: Quarterly Taxes Explained: What You Need to Know About Paying Business Taxes

If you're a sole proprietor or have an LLC, as a business owner, it's inevitable that you'll find yourself googling “quarterly taxes explained.” We all get started needing to figure out how to pay them, but they cause so much confusion, and that can create a lot of anxiety — have I saved enough for my quarterly taxes? How do I pay my quarterly taxes? Am I paying too much in my quarterly taxes? In this episode, Sydney and Kristen explain exactly what you need to understand about quarterly taxes so you can feel confident you know what they are, how much you need to save for them, and why paying quarterly is beneficial to you, plus how to avoid penalties.

Decrypting Crypto Taxes: Navigating IRS Compliance in the Digital Age

In this groundbreaking episode of the Pilla Tax Podcast, Dan Pilla, a luminary in the field of tax litigation and compliance, takes on one of the most pressing issues in modern finance: the tax implications of cryptocurrency. With the digital currency landscape evolving rapidly, Dan provides crucial insights into how these changes impact taxpayers and the IRS alike.In this episode, we delve deep into the world of cryptocurrency and its intersection with tax law:Privacy vs. IRS Oversight: Dan addresses the common belief that cryptocurrency trades are private and beyond the reach of the IRS. He explores whether the IRS can access your crypto trade history and what that means for traders.IRS Focus on Crypto Compliance: Is cryptocurrency compliance really a significant concern for the IRS? Dan examines how the IRS views crypto transactions and why understanding this perspective is crucial for anyone involved in digital currency trading.Understanding the Taxability of Crypto: What are the most common misunderstandings about the taxability of cryptocurrencies? Dan breaks down the complexities and misconceptions surrounding crypto taxation, providing clarity in a field often shrouded in confusion.Staying Compliant with Crypto Taxes: Lastly, Dan offers invaluable advice on what you need to know to stay on the right side of the law when it comes to cryptocurrency and taxes. From record-keeping to reporting, learn how to navigate these murky waters effectively.This episode is a must-listen for anyone engaged in or interested in the world of cryptocurrency. Whether you're a seasoned investor, a curious newcomer, or a tax professional looking to stay ahead of the curve, Dan's insights offer a clear path through the intricate and often misunderstood world of crypto taxation.Tune in to "Decrypting Crypto Taxes" on the Pilla Tax Podcast and arm yourself with the knowledge you need to navigate this rapidly evolving landscape confidently and compliantly.#DanPilla #TaxExpert #PillaTaxPodcast #Cryptocurrency #CryptoTaxes #IRSScompliance #DigitalCurrency #TaxLaw #Finance #CryptoTrading #TaxPlanning #IRS #TaxCompliance #Blockchain #CryptoInvestment

Year-End Tax Mastery: Investments & Business Tax Strategies Unveiled

In this must-listen episode of the Pilla Tax Podcast, Dan Pilla, celebrated as a titan in tax consultation and strategy, delivers an exceptional deep dive into critical year-end tax planning, investment strategies, and business tax considerations. With his unique blend of expertise and clarity, Dan elucidates complex tax scenarios, offering actionable advice for our listeners.This episode covers three significant topics:Reviewing Financial Portfolios: Dan begins by discussing the crucial task of reviewing financial portfolios, focusing particularly on the tax implications of capital gains and losses. This segment is invaluable for anyone looking to optimize their investment strategy for tax efficiency, understand market trends, and navigate the often confusing landscape of investment taxation.Making Smart Equipment Purchases: Next, Dan takes us through the advantages of making business equipment purchases under Code §179. This is a goldmine of information for small business owners seeking to understand how strategic investments in their business can lead to substantial tax savings. Dan's expertise breaks down this complex code into practical, easy-to-implement strategies.Crypto Currency Tax Considerations: Lastly, addressing the burgeoning field of digital currencies, Dan provides essential insights into the key tax considerations for crypto transactions. As crypto continues to gain traction, understanding its tax implications is crucial. Dan's guidance is especially timely and relevant, demystifying the nuances of crypto taxation.Dan Pilla's ability to articulate these intricate topics in a clear and concise manner makes this episode a standout. Whether you're a seasoned investor, a small business owner, or simply keen on staying ahead in the world of finance and taxes, you'll find this episode packed with invaluable insights and tips.Tune in to this episode of the Pilla Tax Podcast for an enlightening journey through the landscape of year-end tax planning and strategic financial decision-making. And remember, for more expert insights from Dan Pilla, don't forget to like, share, and subscribe!Remember to like, share, and subscribe to the Pilla Tax Podcast for more expert insights from Dan Pilla.Be sure to check out the Pilla Tax Academy website for all your tax resources at:www.PillaTaxAcademy.comYouTube: https://www.youtube.com/@pillataxacademyFaceBook: https://www.facebook.com/pillataxacademyInstagram: https://www.instagram.com/pillataxacademy#DanPilla #TaxExpert #PillaTaxPodcast #YearEndTaxPlanning #InvestmentStrategies #BusinessTaxes #FinancialPortfolios #CapitalGains #TaxSavings #Section179 #CryptoCurrency #TaxAdvice #TaxPlanning #FinancialEducation #CryptoTax #BusinessGrowth

End of Year Tax Planning - Strategies and Tips w/ Dan Pilla

Welcome to a crucial episode of the Pilla Tax Podcast, especially designed for those looking to make smart tax moves as the year draws to a close. In Episode 38, we have the privilege of having Dan Pilla, a tax expert with over four decades of experience, who will provide invaluable insights into strategic tax planning as we approach the end of the year.In this episode, we're focusing on three key areas:Prepaying State Income Taxes: Dan addresses the strategy of prepaying state income taxes before December 31st. He elaborates on how this can be a smart move for some taxpayers, while also cautioning about potential downsides. It's a nuanced discussion that can help you decide if this strategy works for your situation.Wage Withholding and Estimated Payments Review: Next, we delve into the often-overlooked aspect of wage withholding and estimated tax payments. Dan guides us through the process of reviewing these payments and identifies common errors that taxpayers should avoid. This segment is essential for anyone looking to optimize their tax situation and possibly increase their take-home pay.Financial Review and Tax Liability Forecast: Finally, Dan emphasizes the importance of reviewing your financial situation before the year ends. He explains how this proactive step can be crucial in managing unexpected tax liabilities and avoiding unpleasant surprises during tax season.This episode is packed with expert advice and practical tips for both individual taxpayers and small business owners. Whether you're seeking ways to minimize your tax liability or just looking to better understand the end-of-year tax landscape, this podcast is for you.Tune in now and step into the new year with confidence, equipped with the knowledge to make informed tax decisions.Remember to like, share, and subscribe to the Pilla Tax Podcast for more expert insights from Dan Pilla.Be sure to check out the Pilla Tax Academy website for all your tax resources at:www.PillaTaxAcademy.comYouTube: https://www.youtube.com/@pillataxacademyFaceBook: https://www.facebook.com/pillataxacademyInstagram: https://www.instagram.com/pillataxacademy#DanPilla #TaxExpert #PillaTaxPodcast #EndOfYearTaxPlanning #TaxStrategies #StateIncomeTax #TaxWithholding #FinancialReview #TaxLiability #TaxTips #FinancialPlanning #TaxAdvice #SmallBusiness #PersonalFinance #IRS #TaxSeasonPrep

98. Impactful Ways to Master Your Business Taxes

This week Dawn sits down with Meagan Hernandez, the visionary founder and CEO of Impactful Numbers. Meagan is a highly sought-after Professional Accountant known for her holistic approach. She bridges the gap between bookkeeping and tax expertise, providing comprehensive solutions and empowering her clients with tax strategies and education. They navigate through tax intricacies pertinent to eComm owners. From unraveling the complexities of sales tax to uncovering crucial tax deductions, Meagan sheds light on tax tips crucial for small business owners in the eComm world. Join Dawn and Meagan as they unravel the mysteries of taxation in the eComm landscape, providing invaluable insights and actionable advice for business owners striving for financial prowess in their ventures. Guest website - impactfulnumbers.com Guest social media - https://www.facebook.com/meagan.w.hernandez https://www.facebook.com/groups/inentrepreneurslounge https://instagram.com/taxsavvybookkeeper Free Training - https://digitaldawn--taxsavvypros.thrivecart.com/tax-savvy-bookkeeper-order/ Digital Dawn Shopify checklist – Shopify Checklist Digital Dawn Website - Digital Dawn Connect with us - Facebook, Instagram, and Linkedin

CBS News Business Analyst Jill Schlesinger says start planning for taxes plus rules for payment through apps.

379: Business Tax Hacks that MUST be Done Before December 31st [w/ Matt Sercely]

Saving money on taxes is one of the biggest focuses of thriving companies because it's one of the only ways they can save thousands, if not hundreds of thousands, of dollars by adjusting the ways they structure their business and pay for things.In this episode, I am absolutely blown away by the tax 'hacks' that Matt Sercely brings to the podcast. The topic of taxes is truly one where you don't know what you don't know so be prepared to hear some vital tax information you haven't heard before no matter what level you're at.Matt SercelyFREE Tax Secrets Report for Pod Listeners: http://agoristtaxadvice.com/smeMain Website: http://agoristtaxadvice.com/-----Hosted by Derek VidellGet First 3 Lessons of Social Launch Formula for Free: My flagship social media growth program that has been exclusively paid for since 2018... until now!Coffee with Creators: Monthly mastermind for social media creators at all levels to network and growBook Complimentary Consultation Call: Get a free review of your current social media strategies on a 1 on 1 call with meInstagram | YouTube | Website

53 \\ 9 Tips to Take the Stress Out of Your Business Taxes

SMALL BUSINESS FINANCE– Business Tax, Financial Basics, Money Mindset, Tax Deductions

If preparing or having your taxes prepared is stressful to you, today's episode will offer helpful tips to take the stress out of your business taxes. In today's episode, I share 9 tips to reduce the stress surrounding your taxes so your 2023 taxes aren't as overwhelming. I hope you enjoy the episode! Tiffany Next Steps:

Ep. 128 - Expert Tips on Business Taxes with Sunita Doobay

Navigating Tax Implications as Your Business Grows In today's episode, you'll be diving deep into the world of taxes and exploring the critical role they play as your business expands and evolves. I'm thrilled to have Sunita Doobay, a highly respected tax partner at Blaney McMurtry, joining me as our special guest. Understanding the Importance of Tax Planning: As my business has grown, I've come to understand just how crucial it is to consider the tax implications and make necessary adjustments to my business structure. Having a trusted tax advisor by your side as you navigate the different stages of business growth is simply invaluable. Navigating Cross-Border Tax Implications: Expanding my business internationally brought a whole new set of challenges, especially regarding the subject of cross-border taxes. For instance, if you're a US employer with employees working in Canada, you might run into payroll tax withholding complexities. Understanding the roles and activities carried out in different countries is important to ensure compliance and avoid any potential penalties. Common Mistakes and Tax Planning Strategies: Many individuals make mistakes when it comes to managing their business's tax affairs. Staying up to date with changes in tax laws is absolutely critical, as failing to do so can have serious consequences. That's where a knowledgeable advisor well-versed in cross-border tax implications comes in—they can be a game-changer. Building a Strong Advisory Team for Business Success: In the business world, having a strong advisory team is one of the most important things when it comes to success. I encourage all of you to take a close look at your current advisors and consider strengthening your advisory team. I highly recommend seeking advice from experts like Sunita Doobay, who can provide invaluable insights and ensure your business remains compliant with the ever-evolving tax laws. Remember, understanding tax laws isn't just about compliance—it can also legally save your business money. Tune in to the full episode to learn more! What's In This Episode Adjusting business structure as business grows Common mistakes and challenges in business taxes Importance of hiring advisors familiar with cross-border issues Value of working with knowledgeable and effective advisors What To Do Next Visit lisalarter.com/e128 for all resources from this episode.

#5 - Keeping the IRS Off Your Back: What You Need to Know About Business Taxes