Podcasts about G20

International forum of 19 countries and the EU

- 3,431PODCASTS

- 8,598EPISODES

- 32mAVG DURATION

- 2DAILY NEW EPISODES

- Feb 21, 2026LATEST

POPULARITY

Categories

Best podcasts about G20

Latest news about G20

- BMW X3 xDrive20d Shadow Edition Debuts in Japan With Blacked-Out Looks and Limited Production BMW BLOG - Feb 20, 2026

- South Africa: Paris Signals Strong, but Nuanced, Support for Pretoria On the Global Stage AllAfrica News: Latest - Feb 19, 2026

- Donald Trump to host G20 summit in Miami on December 14-15 News-Economic Times - Feb 19, 2026

- Capital Controls Are Already Here and No One Seems to Care DollarCollapse.com - Feb 18, 2026

- Starmer has chance to put overseas aid and debt relief on G20 agenda | Heather Stewart The Guardian - Feb 15, 2026

- Do AI summits work? Chatham House: What's New - Feb 18, 2026

- Strategic convergence for mutual benefit Opinion-Economic Times - Feb 17, 2026

- G20 remains relevant platform for economic dialogue — presidential experts’ directorate TASS - Feb 17, 2026

- African Leaders Conclude AU Summit in Addis Ababa with Unified Call for Peace and Security Terrorism Watch - Feb 16, 2026

- Misconfigured AI could trigger the next national infrastructure meltdown The Register - Feb 13, 2026

Latest podcast episodes about G20

91: We Empower! with Prof. Dr. Anabel Ternès von Hattburg - Episode 91

Episode 91 - Environmental art meets activism as Anna Dogadkina transforms landscapes and ocean plastic into collages celebrating beauty and care for the planet. From Harvard to the G20, Malkah Nobigrot turns conflict into leadership.Disclaimer: Please note that all information and content on the UK Health Radio Network, all its radio broadcasts and podcasts are provided by the authors, producers, presenters and companies themselves and is only intended as additional information to your general knowledge. As a service to our listeners/readers our programs/content are for general information and entertainment only. The UK Health Radio Network does not recommend, endorse, or object to the views, products or topics expressed or discussed by show hosts or their guests, authors and interviewees. We suggest you always consult with your own professional – personal, medical, financial or legal advisor. So please do not delay or disregard any professional – personal, medical, financial or legal advice received due to something you have heard or read on the UK Health Radio Network.

連劉以豪都說:今天不練沒關係!運動不該有壓力,而是生活的調劑❤️虎鐵打造最懂你的頻道《今天不練可以嗎?》聊運動、聊生活,也聊那些想變美的時刻✨反正有在聽,就先算你半次訓練!立即收聽

Actu - 15 février 2026 - Parce que... c'est l'épisode 0x708!

Parce que… c'est l'épisode 0x708! Shameless plug 25 et 26 février 2026 - SéQCure 2026 31 mars au 2 avril 2026 - Forum INCYBER - Europe 2026 14 au 17 avril 2026 - Botconf 2026 28 et 29 avril 2026 - Cybereco Cyberconférence 2026 9 au 17 mai 2026 - NorthSec 2026 3 au 5 juin 2026 - SSTIC 2026 19 septembre 2026 - Bsides Montréal Notes IA AI threat modeling must include supply chains, agents, and human risk OpenClaw instances open to the internet present ripe targets Microsoft boffins show LLM safety can be trained away Augustus - Open-source LLM Vulnerability Scanner With 210+ Attacks Across 28 LLM Providers AI-Generated Text and the Detection Arms Race AI agents can spill secrets via malicious link previews Claude add-on turns Google Calendar into malware courier The First Signs of Burnout Are Coming From the People Who Embrace AI the Most Claude and OpenAI fight over ads while Google monetizes Prompt Injection Via Road Signs NanoClaw solves one of OpenClaw's biggest security issues — and it's already powering the creator's biz Microsoft: Poison AI buttons and links may betray your trust Anthropic safety researcher quits, warning ‘world is in peril' Cyber Model Arena AI bot seemingly shames developer for rejected pull request AI Weaponization: State Hackers Using Google Gemini for Espionage and Malware Generation Misconfigured AI could shut down a G20 nation, says Gartner AI Agents ‘Swarm,' Security Complexity Follows Suit OpenAI has deleted the word ‘safely' from its mission – and its new structure is a test for whether AI serves society or shareholders Pentagon used Anthropic's Claude during Maduro raid How AI could eat itself: Using LLMs to distill rivals Your Friends Might Be Sharing Your Number With ChatGPT Souveraineté ou tout ce que je peux faire sur mon terrain Carmakers Rush To Remove Chinese Code Under New US Rules White House to meet with GOP lawmakers on FISA Section 702 renewal Google Warns EU Risks Undermining Own Competitiveness With Tech Sovereignty Push Privacy ou tout ce qui devrait rester à la maison Re-Identification vs Anonymization Strength Ring cancels its partnership with Flock Safety after surveillance backlash Meta Plans To Let Smart Glasses Identify People Through AI-Powered Facial Recognition Red ou tout ce qui est brisé After Six Years, Two Pentesters Arrested in Iowa Receive $600,000 Settlement Notepad's new Markdown powers served with a side of RCE Spying Chrome Extensions: 287 Extensions spying on 37M users Apple patches decade-old iOS zero-day exploited in the wild Exclusive: Palo Alto chose not to tie China to hacking campaign for fear of retaliation from Beijing, sources say Microsoft: New Windows LNK spoofing issues aren't vulnerabilities Microsoft Under Pressure to Bolster Defenses for BYOVD Attacks Blue ou tout ce qui améliore notre posture Microsoft announces new mobile-style Windows security controls Patch Tuesday, February 2026 Edition The EU moves to kill infinite scrolling Meta, TikTok and others agree to teen safety ratings European nations gear up to ban social media for children Divers et insolites Nobody knows how the whole system works Counting the waves of tech industry BS from blockchain to AI Apple and Google agree to change app stores after ‘effective duopoly' claim Hacktivism today: What three years of research reveal about its transformation Europe must adapt to ‘permanent' cyber and hybrid threats, Sweden warns US needs to impose ‘real costs' on bad actors, State Department cyber official says Stop Using Face ID Right Now. Here's Why Collaborateurs Nicolas-Loïc Fortin Crédits Montage par Intrasecure inc Locaux réels par Intrasecure inc

President Netumbo Nandi-Ndaitwah het vertrek na Addis Abeba in Ethiopië om die 39ste gewone sitting van die Afrika-unie se vergadering van staatshoofde en regeringshoofde by te woon, wat vir 14 en 15 Februarie geskeduleer is. Leiers sal beraadslaag oor belangrike kontinentale kwessies, insluitend vrede en veiligheid, die uitkomste van die 2025 G20-beraad, vordering met Agenda 2063, institusionele hervormings binne die Afrika-unie, en die hervorming van die Verenigde Nasies se veiligheidsraad. Kosmos 94.1 Nuus het met presidensiële woordvoerder Jonas Mbambo gepraat.

Były szef MSZ o Putinie na G20: Będzie siedział obok prezydenta Nawrockiego i ...

Jacek Czaputowicz o relacjach z USA, asymetrycznym sojuszu, jak Polska powinna się zachowywać, o G20 i Radzie Pokoju, SAFE i pozycji Polski

Can the African Union withstand fractures to multilateralism?

Mahamoud Ali Youssouf and Amb. Selma Malika Haddadi assumed the leadership of the African Union (AU) at last year's 38th Ordinary Session of the African Union Assembly – ushering what many saw a moment of renewed hope and leadership reset. The AU, however, enters 2026 on uncertain ground. Conflicts are intensifying across several regions; while showing signs of resilience economic prospects remain fragile; and political settlements in a number of countries are under strain. All this is unfolding against the backdrop of shifting global priorities and waning international attention on Africa. In this episode, Chatham House Africa Programme associate fellow, Professor Carlos Lopes, reflects on what lies ahead for the AU, the tests facing its leadership, and how Africa can navigate through changes in the global order. Related content: Africa Aware: Strengthening African-led peace and security initiatives The AU–EU summit in Luanda must mark a strategic reset of relations Africa Aware: What the African Union's G20 membership means for Africa

President Cyril Ramaphosa sê Suid-Afrika ondersteun steeds 'n diplomatieke oplossing vir die konflik tussen Rusland en Oekraïne. In 'n telefoniese gesprek met die Russiese president Vladimir Putin het Ramaphosa herhaal dat alle oorloë deur onderhandelinge moet eindig. Die woordvoerder in die Presidensie, Vincent Magwenya sê die twee leiers het ook handel, beleggings en samewerking in internasionale forums soos Brics en die G20 bespreek:

'Pejotização', benefícios: os próximos passos para a justiça fiscal no Brasil, segundo observatório

A reforma fiscal de 2025 é um primeiro passo para reduzir as desigualdades tributárias no Brasil, mas muito resta a fazer para a justiça fiscal no país, avaliam economistas do recém‑criado Observatório Fiscal Internacional, em Paris. O centro de estudos, dirigido pelo economista francês Gabriel Zucman, concentra pesquisas em temas como tributação da riqueza, evasão fiscal e fluxos financeiros ilícitos. Lúcia Müzell, da RFI em Paris A instituição é a ampliação do Observatório Fiscal Europeu, sediado desde 2021 na Paris School of Economics (PSE). O Brasil atrai uma atenção especial dos pesquisadores, ao ter um dos sistemas tributários mais desiguais, “se não for o mais desigual entre as grandes economias”, segundo Zucman. “Esta situação precisa evoluir. Trata-se de um desafio econômico e político central para o Brasil, que acho que estará no foco da eleição presidencial”, disse, no lançamento da instituição, na última quinta-feira (5). Durante a presidência brasileira do G20, em 2024, o economista contribuiu para a elaboração da proposta de criação de um imposto global de 2% sobre a renda dos ultrarricos, que Brasília levou à mesa de negociações do fórum internacional. A declaração final do evento não incluiu o projeto, que atingiria cerca de 3 mil pessoas no mundo. Entretanto, o comunicado fez uma menção inédita à importância da tributação dos bilionários, uma vitória para os defensores do tributo. Para Zucman, o debate que se sucedeu não só no Brasil, como na França, Holanda, Espanha, África do Sul, Colômbia e o estado americano da Califórnia, mostra que os avanços para uma maior justiça fiscal são uma questão de tempo. “Por todo o lugar, estamos vendo iniciativas para encontrar uma solução para o problema atual, de que as grandes fortunas conseguem se exonerar da solidariedade nacional. Acho que daqui a 20 ou 30 anos, retrospectivamente, veremos o período atual, entre 2024 e 2026, como o ponto de virada: o início de um movimento internacional pela taxação dos bilionários, das grandes fortunas, da mesma forma como houve um movimento internacional no início do século 20 para a criação do imposto de renda progressivo”, frisou. No Brasil, desigualdade ainda maior do que se pensava Em agosto passado, o Ministério da Fazenda apresentou um trabalho da equipe de Zucman em parceria com a Receita Federal sobre a desigualdade tributária no Brasil, ainda maior do que se imaginava. O 1% de brasileiros mais ricos concentram cerca de 27,4% de toda a renda no país, 7% a mais do que apontavam estudos anteriores. Além disso, a pesquisa concluiu que enquanto as classes médias e os trabalhadores no Brasil têm uma alíquota média de impostos de 42,5%, o topo da pirâmide de renda tem menos da metade, 20,6%. Apesar da reforma, que aumentou a faixa de isenção do imposto de renda para os mais pobres e criou um tributo inédito para o topo da riqueza no Brasil, as distorções continuam e a regressividade do imposto no Brasil é uma das mais elevadas do mundo, salienta Theo Palomo, autor principal da pesquisa. “Existem várias propostas, um debate público sobre como reduzir essa regressividade. Mas só é possível avaliar essas propostas quando você tem números de qual é a diferença de tributo que o bilionário está pagando em relação à classe média”, afirmou o doutorando na PSE. “O nosso estudo faz exatamente isso: ele consegue informar o debate e possibilitar uma discussão mais informada da realidade brasileira.” Benefícios fiscais para empresas Um dos focos das próximas pesquisas será avaliar a eficiência dos benefícios tributários, que fazem despencar a arrecadação das empresas, principalmente as grandes. “Existe muito benefício para a inovação, a tecnologia, o desenvolvimento regional. Então, uma pergunta fundamental é: esses benefícios estão cumprindo seu papel?”, disse. “Essa é uma questão superimportante, ainda mais nesse cenário de que o Brasil tem uma restrição orçamentária, e os benefícios tributários são gigantescos. As grandes empresas, como a gente mostra no nosso estudo, são controladas pela população mais rica, ou seja, esses benefícios, no fundo, beneficiam os mais ricos.” Os mecanismos de fuga de impostos também estão na mira do observatório. Um dos movimentos que a reforma fiscal tende a acelerar entre os ricos é o de reter os lucros nas empresas, em vez de distribui-los, e assim evitar a mordida do imposto de renda. “Tem uma discussão de áreas mais cinzentas do que seria evasão e otimização. É uma coisa que a gente está começando a estudar, por exemplo, a pejotização”, destaca Palomo. “A gente está querendo justamente avançar nessa agenda para entender exatamente a contribuição de cada um, não só em termos de orçamento, que é uma questão importantíssima, quanto do orçamento está sendo perdido por evasão fiscal, mas também entender como isso impacta a desigualdade do Brasil.” Em abril, o Observatório Fiscal Internacional publicará um relatório sobre a progressividade dos impostos na América Latina, com foco nos ultrarricos. Brasília exerce atualmente a presidência da Plataforma de Cooperação Tributária para a América Latina e o Caribe (PTLAC), que discute soluções para implementar maior justiça fiscal na região. O fórum foi criado em 2022, no âmbito da Comissão Econômica para a América Latina e o Caribe (Cepal). Leia tambémFrança: volta de Imposto sobre a Fortuna não causaria debandada de ricos, indica estudo

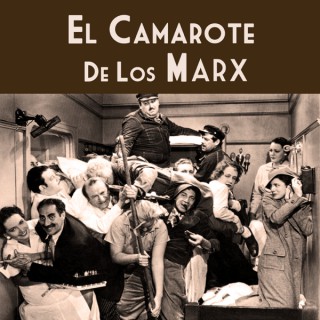

Maracas films presenta... - Lo mejor de 2025 (10-02-2026)

https://elcamarotedelosmarx.blogspot.com.es/ https://t.me/CamaroteMarx Programa de radio de "El Camarote de los Marx" grabado el 10 de febrero... ...en el que elaboramos nuestra lista de las mejores pelis del año 2025... ...y en el que hablamos de tardar 40 minutos en empezar y un pececito azul nadando en agua turbia, de un remedio para la vejiga natatoria y animales que no dan réplica, de estudios rigurosos y culturizar a una mascota, de canarios, perros, podcasters y gallinas prestadas, de hacer una lista sin criterio y películas damnificadas, de guardar mucho rencor y unas guerreras que se quedan fuera, de audios finales y múltiplos de tres, de cosas que hacer de atrás a delante y votar a lo que más nos ha gustado, de humor negro, pestañas postizas y criticar los cánones de belleza, de epílogos pintones y llevarse demasiadas nominaciones, de disfrutar de las cosas buenas que tiene la vida y hablar sobre la pérdida desde un punto de vista optimista, de carreras de coches y un blockbuster muy disfrutón, de nuestro griego loco preferido y estar como unas maracas, retratar la sexualidad en la vejez y volver al armario cuando se ha sido libre, de un secuestro en plena dictadura y una mujer que sostiene a una familia, de películas inmersivas y notar el sabor a tierra en la boca, de mantener un tono extraño y lidiar con un gran dilema moral, de espacios en blanco y jugar a buscar anomalías, de películas pensadas para verse en cines y una primera parte demasiado alargada, de un misil perdido y que todos amamos a Rebecca Ferguson, de contener multitudes y disfrutar con el ritmo de la vida, de gran narrativa animada y cerrar la boca al acabar, de tomar riesgos, dar bofetones y dejarte llevar por una historia... ...de un espacio para reflexionar y lo que te destroza por dentro, de retransmisiones olímpicas, terroristas y ceder un poco, de una película sobre la vida y ver el paso del tiempo, de profundidad emocional, del valor de la amistad y una historia indudablemente bella, de dar miedo con lo que hay detrás y tener un subtexto aterrador, de una peli de batas, un viaje del pasado al presente y una carretera que parece que nunca acaba, de una llamada a las armas y que Benicio del Toro va a ser siempre nuestro 'sensei', de poner música de avanzar y hablar de pelis muy malas, de decepciones que nos hemos llevado y las pelis con las que hemos 'planchado', de series de nuestros oyentes (y de Pilu) y no haber acabado todavía 'Adolescencia', de hacer grupitos de maracas, miedito, españolas bien y más que dramones que te encogen el corazón... y brindar con una pecera porque, aunque no nos gusta la música de Bad Bunny, nos ha encantado el sarao reivindicativo que se ha marcado para la Super Bowl. Las 21 mejores pelis de 2025 para el Camarote (en orden descendente) han sido: La hermanastra fea, Los pecadores, Memorias de un caracol, F1: La película, Bugonia, Maspalomas, Aún estoy aquí, Warfare: Tiempo de guerra, Un simple accidente, Exit 8, Frankenstein, Una casa llena de dinamita, La vida de Chuck, Predator: Asesino de asesinos, Sirât, Valor sentimental, Septiembre 5, Sueños de trenes, Flow, Weapons, Una batalla tras otra. Peores pelis de 2025 para el Camarote: Romería, Devuélvemela, La furgo, El exorcista del Papa, La trampa, Tron: Ares, Jurassic World: El renacer, Jay Kelly, Havoc, G20. Pelis más decepcionantes de 2025 para el Camarote: The Brutalist, The Running Man, Tron: Ares, Estado Eléctrico, Juego sucio, Romería, Materialistas, The Smashing Machine, A complete unknown, Sorda, El cautivo, Expediente Warren: el último rito, Un viaje atrevido y maravilloso, A real pain, Tardes de soledad. María Callas. Pelis de plancha de 2025: Ballerina, Bala perdida, Black Phone 2, Avatar: Fuego y ceniza, Agárralo como puedas. Mejores pelis de 2025 para nuestros oyentes: Una batalla tras otra (27 puntos), La cena (9 puntos), Los pecadores / Weapons (8 puntos), Guardianes de la noche: Kimetsu no Yaiba - La fortaleza infinita / Better Man / Cómo hacerse millonario antes de que muera la abuela (5 puntos), F1: La película / The Brutalist / Superman / Los domingos (4 puntos). Peores pelis de 2025 para nuestros oyentes: Until Dawn (8 puntos), Mountainehead / Fritos a balazos / Padre no hay más que uno 5, Materialistas / Los tipos malos 2, Sirât, The Running Man (5 puntos), The Smashing Machine, El casoplón, El secreto del orfebre, Alarum (4 puntos), La fuente de la eterna juventud / Culpa nuestra / Sin cobertura / La vieja guardia 2 / Laberinto en llamas (3 puntos), Blindado / Amenaza en el aire / Un funeral de locos / Strangers: Capítulo 2 / Muerte de un unicornio (2 puntos). Decepciones de 2025 para nuestros oyentes: Del cielo al infierno, Estado eléctrico, Sirat, Havoc, The Brutalist. Pelis de plancha de 2025 para nuestros oyentes: Anaconda, Mi amiga Eva, Jefes de estado, Nonnas. Mejores series de 2025 para nuestros oyentes: The Pitt (22 puntos), The Studio (16 puntos), Adolescencia (8 puntos), Pluribus (7 puntos), Task (6 puntos) Muchísimas gracias a nuestros queridos oyentes (y amiguetes): Axl Rose, Carlos Pereira, PJ Cleaner, Diana, Javier Gimeno, A Girl, Juanma, Seriéfago y Sodapop por su desinteresada, cariñosa y siempre juiciosa participación.

Curren Affairs: Johannesburg After the G20, Urban renewal or another broken promise?

Aubrey Masango speaks to Sithembiso Zungu, the MMC for Group Corporate and Shared Services in the City of Johannesburg reflecting on the perceived successes and failures of the urban renewal project by the City of Johannesburg, they also touch on the difficulty of getting the city clean and well taken care of. Tags: 702, The Aubrey Masango Show, Aubrey Masango, Current Affairs, Sithembiso Zungu, Johannesburg, G20, Urban Renewal, Joburg CBD, JMPD, Hijacked Buildings, Safety The Aubrey Masango Show is presented by late night radio broadcaster Aubrey Masango. Aubrey hosts in-depth interviews on controversial political issues and chats to experts offering life advice and guidance in areas of psychology, personal finance and more. All Aubrey’s interviews are podcasted for you to catch-up and listen. Thank you for listening to this podcast from The Aubrey Masango Show. Listen live on weekdays between 20:00 and 24:00 (SA Time) to The Aubrey Masango Show broadcast on 702 https://buff.ly/gk3y0Kj and on CapeTalk between 20:00 and 21:00 (SA Time) https://buff.ly/NnFM3Nk Find out more about the show here https://buff.ly/lzyKCv0 and get all the catch-up podcasts https://buff.ly/rT6znsn Subscribe to the 702 and CapeTalk Daily and Weekly Newsletters https://buff.ly/v5mfet Follow us on social media: 702 on Facebook: https://www.facebook.com/TalkRadio702 702 on TikTok: https://www.tiktok.com/@talkradio702 702 on Instagram: https://www.instagram.com/talkradio702/ 702 on X: https://x.com/Radio702 702 on YouTube: https://www.youtube.com/@radio702 CapeTalk on Facebook: https://www.facebook.com/CapeTalk CapeTalk on TikTok: https://www.tiktok.com/@capetalk CapeTalk on Instagram: https://www.instagram.com/ CapeTalk on X: https://x.com/CapeTalk CapeTalk on YouTube: https://www.youtube.com/@CapeTalk567See omnystudio.com/listener for privacy information.

Gabriela Zanfir-Fortuna: GDPR changes, AI Act hangover, Russmedia

Dr. Gabriela Zanfir-Fortuna is a globally recognized data protection law expert, with 15 years of experience in the field split between Europe and the U.S., spanning academia, public service, consulting and policy. She currently is Vice President for Global Privacy at the Future of Privacy Forum, a global non-profit headquartered in Washington DC, coordinating FPF's offices and partners in Brussels, Tel Aviv, Singapore, Nairobi, and New Delhi, and leading the work on global privacy and data protection developments related to new technologies, including AI. She is also a founding Advisory Board Member of Women in AI Governance, and an affiliated researcher to the LSTS Center of Vrije Universiteit Brussel.Dr. Zanfir-Fortuna worked for the European Data Protection Supervisor and is a member of the Reference Panel of the Global Privacy Assembly – the international organization reuniting data protection authorities around the world, as well as a member of the T20 engagement group of the G20 under Brazil's Presidency in 2024.She was elected to be part of the Executive Committee of ACM's Fairness, Accountability and Transparency (FaccT) Conference (2021-2022). Her scholarship on the GDPR is referenced by the Court of Justice of the EU, and in 2023 she won the Stefano Rodota Award of the Council of Europe for the paper “The Thin Red Line: Refocusing Data Protection Law on Automated-Decision-Making“, alongside her co-authors. Dr. Zanfir-Fortuna holds a PhD in Law with a thesis on the rights of the data subject under EU Data Protection Law, and an LLM in Human Rights (University of Craiova).With our guest, here for a third time, we have gone through the logic of the Digital Omnibus package aiming to reform a cluster of important EU regulations, the “birth defects” of the AI Act, the importance of South Korea in the global data protection panorama, and the potential consequences of the recent CJEU case, Russmedia.References:* Gabriela Zanfir-Fortuna at the Future of Privacy Forum* Gabriela Zanfir-Fortuna on LinkedIn* Gabriela Zanfir-Fortuna: A world tour of data protection laws (Masters of Privacy, April 2021)* Data Protection vs. Privacy and Data Privacy: a January 28th conundrum (with Gabriela Zanfir-Fortuna, Masters of Privacy - 2025)* X v Russmedia Digital SRL (CJEU, December 2, 2025). This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit www.mastersofprivacy.com/subscribe

EXPOSED: NEW FED CHAIR AS DOLLAR DIES! - Trump Says Weak Dollar Is Good! - What You Need To Know

BUY GOLD HERE: https://firstnationalbullion.com/schedule-consult/ Avoid CBDCs and work with Mark Gonzales! HELP SUPPORT US AS WE DOCUMENT HISTORY HERE: https://gogetfunding.com/help-keep-wam-alive/# Josh Sigurdson talks with Mark Gonzales about the announcement of a new Chair of the Federal Reserve, Kevin Warsh. Warsh who has worked for countless globalist institutions is the epitome of an establishmentarianist. From Bilderberg to the G30 and G20, from MEGA Group to the White House's National Economoc Council under George W. Bush. His father in-law is Ronald Lauder, a billionaire who has made calls to silence anyone who questions Israel. It's the same old story. In fact, as they say, in with the new boss, same as the old boss. Kevin Warsh will be taking over at the Federal Reserve as we had predicted 6 months ago in a video and will continue the same old policies we have come to expect in the past. This private institution that they call "Federal" will continue to devalue the dollar and push people into poverty as was always the agenda. It makes people more dependent on the state. In fact, President Trump said in an interview a week ago that a weak dollar is a "good thing." No. No it is not. Perhaps it helps competition in trade but the average person on the ground only suffers from it. Besides, the trade argument would work a lot better without massive tariffs effecting small businesses and big alike. The continued move to a cashless society is sure to accelerate under Kevin Warsh who has been supportive of a cashless economy. While we recently saw a large pullback on gold and silver following a historic rise, this is to be expected and should not strike fear into people considering the notion of trading in an appreciating asset for a depreciating asset like the dollar is insane. Zoom out at the 5000 foot view and you will see that wealth insurance does just that. Insures wealth. With the economy in a free fall going into the future and the restrictive nature of CBDCs and digital IDs on the horizon, precious metals will continue to grow in popularity and of course value vs a dying dollar. Stay tuned for more from WAM! BUY TICKETS HERE! https://anarchapulco.com/ Use Code WAM & Save 10%! Get Your SUPER-SUPPLIMENTS HERE: https://vni.life/wam Use Code WAM15 & Save 15%! Life changing formulas you can't find anywhere else! GET HEIRLOOM SEEDS & NON GMO SURVIVAL FOOD HERE: https://heavensharvest.com/ USE Code WAM to save 25% plus free shipping! Get local, healthy, pasture raised meat delivered to your door here: https://wildpastures.com/promos/save-20-for-life/bonus15?oid=6&affid=321 USE THE LINK & get 20% off for life and $15 off your first box! DITCH YOUR DOCTOR! https://www.livelongerformula.com/wam Get a natural health practitioner and work with Christian Yordanov! Mention WAM and get a FREE masterclass! You will ALSO get a FREE metabolic function assessment! GET YOUR APRICOT SEEDS at the life-saving Richardson Nutritional Center HERE: https://rncstore.com/r?id=bg8qc1 Use code JOSH to save money! SIGN UP FOR HOMESTEADING COURSES NOW: https://freedomfarmers.com/link/17150/ Get Prepared & Start The Move Towards Real Independence With Curtis Stone's Courses! GET YOUR WAV WATCH HERE: https://buy.wavwatch.com/WAM Use Code WAM to save $100 and purchase amazing healing frequency technology! GET ORGANIC CHAGA MUSHROOMS HERE: https://alaskachaga.com/wam Use code WAM to save money! See shop for a wide range of products! GET AMAZING MEAT STICKS HERE: https://4db671-1e.myshopify.com/discount/WAM?rfsn=8425577.918561&utm_source=refersion&utm_medium=affiliate&utm_campaign=8425577.918561 USE CODE WAM TO SAVE MONEY! GET YOUR FREEDOM KELLY KETTLE KIT HERE: https://patriotprepared.com/shop/freedom-kettle/ Use Code WAM and enjoy many solutions for the outdoors in the face of the impending reset! PayPal: ancientwonderstelevision@gmail.com FIND OUR CoinTree page here: https://cointr.ee/joshsigurdson PURCHASE MERECHANDISE HERE: https://world-alternative-media.creator-spring.com/ JOIN US on SubscribeStar here: https://www.subscribestar.com/world-alternative-media For subscriber only content! Pledge here! Just a dollar a month can help us alive! https://www.patreon.com/user?u=2652072&ty=h&u=2652072 BITCOIN ADDRESS: 18d1WEnYYhBRgZVbeyLr6UfiJhrQygcgNU World Alternative Media 2026

Brussels bullies Caribbean nations over visa policy. Try that with a G20 economy. That's a completely different conversation.View the full article here.Subscribe to the IMI Daily newsletter here.

The Journaling Rewire: How to Hardwire Your Brain for Wins and Embracing Uncertainty With Coach Jason & Coach Matt

Think journaling is just "dear diary"? Coaches Matt and Jason reveal the neuroscience that makes it a vital tool for high-performing, alcohol-free living. Learn how the physical act of pen-to-paper pulls your attention and your brain's reward circuits into the same moment, tagging your wins as "real" and important to hardwire. Discover how to use journaling to offload the "busy brain," transform a victim mentality into agency, and find the courage to embrace uncertainty in 2026. Whether it's a "breakup letter" to alcohol or a daily "G20" gratitude practice, discover how writing reveals the road ahead with clarity. Download my FREE guide: The Alcohol Freedom Formula For Over 30s Entrepreneurs & High Performers: https://social.alcoholfreelifestyle.com/podcast ★ - Learn more about Project 90: www.alcoholfreelifestyle.com/Project90 ★ - (Accountability & Support) Speak verbally to a certified Alcohol-Free Lifestyle coach to see if, or how, we could support you having a better relationship with alcohol: https://www.alcoholfreelifestyle.com/schedule ★ - The wait is over – My new book "CLEAR" is now available. Get your copy here: https://www.alcoholfreelifestyle.com/clear

Doug McHoney (PwC's International Tax Services Global Leader) is joined by Craig Stronberg, Senior Director on PwC's Intelligence Team. Craig leads analysts focused on macroeconomic and geopolitical intelligence; he previously served in the Office of the Director of National Intelligence. Doug and Craig discuss why business and tax leaders should focus on the geopolitical landscape to understand its impact on cross-border business, including tax. Stability is the new bar for many businesses in 2026, requiring greater agility to deal with change. Craig discusses how many businesses are in a 'wait‑and‑see' mode versus decisive movers across industries. He also describes areas of focus, such as the US policy stance for the Americas, Greenland, and tariffs; the Global South's rising coordination; and governance strains across the G20. While AI data falsification is a significant concern, Craig suggests practical actions for boards such as enabling direct access to the business' risk team.

L'Afrique du Sud quitte "temporairement" le G20 pour éviter les tensions avec Washington

L'Afrique du Sud se retire temporairement du G20, annonce faite la semaine dernière lors du Forum éco mondial de Davos. Le gouvernement dit vouloir éviter une crise diplomatique avec les Américains. Les relations entre Pretoria et Washington sont en effet au plus bas.

挺你所想!與你一起生活的銀行 中國信託行動銀行APP全新聯名主題登場 三大超萌IP:反應過激的貓、無所事事小海豹、貓貓蟲咖波 主題自由切換,快來中信銀行APP打造你的專屬體驗 立即搜尋>中國信託行動銀行APP 體驗主題>https://sofm.pse.is/8nebwa ----以上為 SoundOn 動態廣告---- 日本首相高市早苗將台海議題國際化,引發中國強烈施壓,但無損她在日本的支持率。台海問題國際化會對兩岸局勢造成什麼改變?對習近平的統治又有什麼影響?若要觀察習近平時代的變化,那個年份最為關鍵?當初發生了什麼事,讓習近平停止延續胡溫時代的改革開放,將經濟和外交政策轉回保守箝制?2025年中國財政增長最快的稅種竟是個人所得稅?很多人對中國2025年的經濟狀況霧裡看花,實際上那些亮眼的數字可能只是改革開放40年後未消耗完的慣性,年底的中央經濟工作會議卻顯示中國還要延續2025年的路線?精彩訪談內容,請鎖定@華視三國演議! 本集來賓:#李厚辰 #黃澎孝 主持人:#矢板明夫 以上言論不代表本台立場 #中國經濟 #台海議題國際化 #大外宣 #跨境鎮壓 電視播出時間

Europa in omwenteling. Transatlantische perikelen. Haagse meerderheden of niet. Drie schaakborden waarop de zetten ongewis zijn. Want dit zijn weken dat soms decennia aan gebeurtenissen in een enkele dag geconcentreerd lijken. De labiliteit en onzekerheden bij alle wereldmachten beïnvloeden elkaar, soms ongemerkt. Europa lijkt te ontwaken uit een boze droom en aan de slag te gaan met een eigen perspectief en daarbij nieuwe partners te vinden. En Nederland dreigt als muurbloempje achter de feiten aan te hobbelen. Jaap Jansen en PG Kroeger kijken naar die drie schaakborden en wie per bord op winst staat. *** Deze aflevering is mede mogelijk gemaakt met donaties van luisteraars die we hiervoor hartelijk danken. Word ook vriend van de show! Heb je belangstelling om in onze podcast te adverteren of ons te sponsoren? Zend ons een mailtje en wij zoeken contact. *** De Europese signalen tonen een herstel van zelfvertrouwen en coherentie in de aanpak. Ursula von der Leyen en Manfred Weber kregen ineens de volle steun van Emmanuel Macron en Donald Tusk voor de inzet van het zwaarste kanon in het EU-arsenaal. Alleen zo zou Donald Trump ontnuchterd kunnen worden. In een geheime sessie van de EVP in het Europees Parlement én en plein public op Cyprus kondigde de Commissiepresident een geheel nieuw beleidspakket aan: de Europese veiligheidsstrategie. Ze zette het nieuwe Mercosur-verdrag en komende vrijhandelsverdragen zoals met India nadrukkelijk in dat wereldwijde, geopolitieke kader. Zelfs de inrichting van een EU-Veiligheidsraad met een twaalftal leden staat op de agenda. Dat daarbij meteen 'Arctische veiligheid' prioriteit kreeg kan niet verbazen. Bovendien heeft Noorwegen alarm geslagen over de cruciale eilandengroep Spitsbergen en Vladimir Poetins ambities daar. Ooit was dat een industrieel machtscentrum van de Republiek (het huidige Nederland) en haar mercantiele expansie op wereldschaal. Maar onverwacht werd niet de Poolregio het finale breekpunt voor Europa en haar partners. De 'Board of Peace' waarmee Trump de G7, de G20 en zelfs de VN wil marginaliseren was de laatste druppel. Een entreegeld van $1 miljard en de eerste invitatie aan Viktor Orbán deden de deur dicht. En vervolgens werden Poetin en Aleksandr Loekasjenko uitgenodigd. Deze bewuste poging om de instituties van de op regels gebaseerde wereldorde te onttakelen en door autoritaire structuren te vervangen cementeerde de alliantie van de EU met partners als Canada, het Verenigd Koninkrijk, Noorwegen, Oekraïne en ook landen als Japan. "De ergste bondgenootschappelijke crisis sinds Suez in 1956" werd dit genoemd. De onsamenhangendheid van deze situatie is verbluffend. Terwijl Nederland met nieuwe heffingen bedreigd werd, nodigde Trump Dick Schoof uit lid te worden van zijn Board of Peace en Sigrid Kaag voor acties daarvan voor Gaza. En de Noren werden uitgefoeterd om de Nobelprijs en kregen ook strafheffingen, terwijl ze voor Arctische veiligheid onmisbaar zijn. De inzet om vanuit de coalition of the willing voor Oekraïne nu snel én een Europese NAVO-pijler én een eigen veiligheidsraad in te richten kreeg zo een forse impuls. Alsof dit niet incoherent genoeg was, begon Trump de partner uit 'the special relationship' uit te schelden. De Britten waren slapjanussen omdat zij het eiland Diego Garcia niet in hun macht wilden houden. Amerika dreigde daar plots een soort Krim in de Indische Oceaan van te maken. De geopolitieke consequenties hiervan worden duidelijk als je de locatie, militaire rol en strategische samenwerking rond dat eiland bekijkt. Niet alleen de Britten waren ontzet. Trump joeg met zijn heffingen ook zijn geestverwanten in Europa in de gordijnen. Jordan Bardella bleek een Gaullist, Alice Weidel deed of ze Merkel was, Giorgia Meloni was giftig. In feite isoleerde Trump zich van iedereen, behalve Poetin. Voor het Haagse schaakbord zijn deze turbulente ontwikkelingen evenzovele nieuwe realiteiten. Toen Rob Jetten en Henri Bontenbal hun eerste proeve van samenwerking formuleerden, was van ontmanteling van de NAVO, G20, VN en van de nieuwe EU-structuren rond defensie en geopolitiek nauwelijks nog sprake. Met Dilan Yesilgöz moeten ze hun fundamentele denklijnen vastleggen en Tweede en Eerste Kamer een krachtig, wenkend perspectief presenteren. Ook wat betreft de indringende consequenties voor investeringen in veiligheid, in wereldwijde diplomatie en bovenal in een zeer actieve rol van ons land daarbij na de verlamming onder Schoof. Voor de Voorjaarsnota en Prinsjesdag zal er een langetermijnperspectief moeten komen dat brede steun vindt in beide Kamers. Hoe goed is Rob Jetten als schaker op elk van de drie borden? *** Verder luisteren Het Europese Schaakbord 558 – Poetins rampjaar, Jettens kans https://omny.fm/shows/betrouwbare-bronnen/558-2025-was-voor-poetin-een-rampjaar-2026-wordt-rob-jettens-kans 528 - ‘Europa, ontwaak!’ Manfred Weber en de eenzaamheid van Europa https://omny.fm/shows/betrouwbare-bronnen/528-europa-ontwaak-manfred-weber-en-de-eenzaamheid-van-europa-en-vicepremier-vincent-van-peteghem-over-belgi-en-nederland 490 – Duitslands grote draai. Friedrich Merz, Europa en Nederland https://art19.com/shows/betrouwbare-bronnen/episodes/8bac6adf-1b0e-49f1-8a4a-8340c99c6db3 484 - Hoe Trump de Europeanen in elkaars armen drijft https://art19.com/shows/betrouwbare-bronnen/episodes/c725d191-aa05-46ff-946f-de0d951a94ab 427 - Europa wordt een grootmacht en daar moeten we het over hebben https://art19.com/shows/betrouwbare-bronnen/episodes/84273d61-0203-4764-b876-79a25695bed1 Het Trans-Atlantische Schaakbord 548 – Poetins dictaat voor Oekraïne https://omny.fm/shows/betrouwbare-bronnen/548-poetins-dictaat-voor-oekra-ne 505 - Donald Trump, een ramp voor radicaal-rechts in Europa https://art19.com/shows/betrouwbare-bronnen/episodes/f0fb8fa8-3cae-401c-8d71-ab5ef4db7f23 497 – De krankzinnige tarievenoorlog van Donald Trump https://art19.com/shows/betrouwbare-bronnen/episodes/6726d535-1e03-4b41-92d0-98b29876db9d 476 – Trump II en de gevolgen voor Europa en de NAVO https://art19.com/shows/betrouwbare-bronnen/episodes/3330bc70-e865-4a9b-a480-914f254f7f16 Het Haagse Schaakbord 557 – Hoe overleeft Rob Jetten het premierschap? https://omny.fm/shows/betrouwbare-bronnen/557-rob-jetten-minister-president-tips-en-trucs-voor-de-nieuwe-premier 100 - Nederland in Europa: lusten en lasten door de eeuwen heen https://art19.com/shows/betrouwbare-bronnen/episodes/94ea4076-3118-4fe9-97e5-13b12f7a0355 *** Tijdlijn 00:00:00 – Deel 1 00:44:04 – Deel 2 01:01:16 – Deel 3 01:11:03 – EindeSee omnystudio.com/listener for privacy information.

China and Canada pledged on Thursday to jointly uphold the multilateral trading system and the core role of the United Nations in international affairs while agreeing to strengthen dialogue and promote cooperation in various fields.Premier Li Qiang and visiting Canadian Prime Minister Mark Carney expressed the two countries' commitment to enhancing bilateral relations and safeguarding multilateralism during their talks at the Great Hall of the People in Beijing.Carney arrived in Beijing on Wednesday for a four-day official visit to China, the first trip to the country by a Canadian prime minister in eight years, highlighting the recent warming of bilateral ties. President Xi Jinping is expected to meet with him during Carney's stay in Beijing.Li said that, through joint efforts, China-Canada relations have seen a turnaround, which has been widely welcomed by various sectors in both countries.Maintaining a healthy and stable development of China-Canada relations aligns with the common interests of both nations, he added.Standing at a new starting point, China is willing to work with Canada to maintain the strategic partnership, strengthen dialogue and communication, enhance political mutual trust, respect each other's core interests, seek common ground while reserving differences, and continuously expand pragmatic cooperation to add greater momentum to the development of both countries, Li said. He underlined the need for the two countries to promote stable growth in bilateral trade.Li also stressed the need for both sides to enhance trade facilitation, deepen collaboration in the fields of clean energy, digital technology, modern agriculture, aviation and aerospace, advanced manufacturing and finance, and foster more new drivers of economic growth.While welcoming more Canadian companies to invest in China, the premier expressed the hope that Canada would provide a fair and nondiscriminatory business environment for Chinese companies investing in the country.China is willing to strengthen cooperation with Canada under the frameworks of the UN, the World Trade Organization and the G20, in order to jointly uphold multilateralism and free trade, improve global governance and promote the international order toward a more just and reasonable direction, Li said.

Africa's Business Events Sector ends 2025 strong, eyes growth in 2026

In today's episode recorded as a wrap up of Africa's MICE performance in 2025 with insights from a familiar voice on the podcast, Glenton de Kock. He unpacks a year he describes as “not only successful, but extremely busy,” highlighting South Africa's hosting of the G20 alongside a packed calendar of trade exhibitions and association meetings. Together, these milestones made 2025 a standout year for the region's business events sector.

484. War in Europe, Trump's Destruction of Institutions, and Britain's National Treasures (Question Time)

Will Europe go to war with Russia in 2026? Should National Service be introduced next year? How will AI continue to develop? Should the G20 be moved? And how else will politics change next year? Listen to Rory and Alastair as they answer these questions and more. __________The Rest Is Politics is powered by Fuse Energy. Fuse are giving away FREE TRIP+ membership for all of 2025 to new sign ups

In this special year-end edition of The China in Africa Podcast, Eric, Cobus, and Géraud look back on the top stories of 2025 and look ahead to the key trend to watch in 2026.

In this special year-end edition of The China-Global South Podcast, Eric, Cobus, and Géraud look back on the top stories of 2025 and look ahead to the key trend to watch in 2026.

Sidi Ould Tah: la BAD veut «d'aller au-delà de l'aide publique au développement, vers l'investissement»

Voilà 100 jours que Sidi Ould Tah a pris la tête de la Banque africaine de développement (BAD). Et, le banquier mauritanien affiche déjà une action positive pour ses trois premiers mois : la levée mardi 16 décembre de 11 milliards de dollars pour le Fonds africain de développement. Une hausse de 23 % par rapport à la précédente session des donateurs. Et, ce, malgré la baisse drastique des enveloppes d'aide au développement cette année. Le président de la BAD explique ses ambitions pour l'Afrique dans un environnement financier en recomposition. Il répond à Sidy Yansané RFI : M. le président Sidi Ould Tah, vous êtes à Londres pour la réunion des donateurs du Fonds africain de développement, le FAD, qui est, pour le dire simplement, une cagnotte réservée au financement de projets dans les pays africains les plus pauvres. Et cette semaine, le FAD a recueilli 11 milliards de dollars. Un montant que vous qualifiez d'historique. Sidi Ould Tah : Absolument ! Nous sommes pour l'élan de solidarité historique que nous venons de connaître, qui devrait nous permettre, au cours des trois prochaines années, de mieux répondre aux attentes des populations africaines, en particulier les 37 pays les plus fragiles et les moins dotés de l'Afrique. Du coup, cette année, qui sont les principaux contributeurs ? Malgré le contexte international que nous connaissons tous et qui se caractérise par des pressions fiscales importantes et aussi des pressions sur les ressources, les partenaires du FAD et les pays africains ont décidé ensemble d'augmenter leur enveloppe dans cette 17ᵉ reconstitution du Fonds. C'est un message très fort de solidarité avec l'Afrique et pour l'Afrique. Et aussi un message très fort des Africains pour la prise en charge de leur propre développement. Justement, vous vous félicitez de l'engagement de l'Afrique dans son propre fonds. 23 pays du continent qui ont contribué à près de 183 millions de dollars. Une véritable transformation, vous dites. Mais finalement, 183 millions sur un total de 11 milliards, cette transformation que vous vantez est-elle bien réelle ? Ce qu'il faut regarder au-delà des chiffres, c'est le geste lui-même. Je crois que c'est la dynamique qui commence et ça montre quand même un engagement très fort de la part des pays africains. Si on rapporte ce montant au PIB des pays africains contributeurs, on se rend compte quand même que l'effort est considérable. Mais ce qu'il faut aussi regarder, c'est la volonté commune des deux parties d'aller au-delà de l'aide publique au développement pour aller vers l'investissement, vers le partenariat économique, tout en prenant compte de l'intérêt de nos pays donateurs. Parlons de ces partenaires. Avant de prendre les rênes de la BAD, vous teniez pendant dix ans ceux de la BADEA, la Banque arabe pour le développement économique en Afrique, notamment financée par les pays du Golfe que vous connaissez bien. C'est cette « nouvelle génération de collaborateurs à grande échelle », comme vous le dites, que vous comptez développer ? Il ne s'agit pas d'individualiser des partenaires contre d'autres. Ce qu'il faut voir, c'est l'ensemble des partenaires de l'Afrique. Le continent a toujours reçu un appui constant de la part de ses partenaires historiques, et cet appui continue et se renforce. L'arrivée d'autres partenaires ne fait que renforcer ce partenariat, et ne diminue en rien le partenariat existant. Nous avons consacrée tout une journée au secteur privé avec un certain nombre d'acteurs financiers. Nous sommes à Londres qui est une place financière internationale. Dans ce cadre, le FAD pourrait jouer un rôle important dans l'atténuation du risque perçu dès qu'il s'agit du continent africain, de quoi rassurer les investisseurs et permettre le développement des projets transformateurs dans les différents pays africains. Revenons sur la Banque arabe pour le développement économique en Afrique, qui s'engage à donner jusqu'à 800 millions de dollars pour le développement en Afrique. Engagement similaire de l'OPEP à hauteur de 2 milliards de dollars. Ce sont les sommes annoncées par la BAD que vous présidez. N'y a-t-il pas là une alternative aux contributeurs habituels ? Vous savez, les besoins de l'Afrique sont immenses. Annuellement, on estime ces besoins de financement et de développement à 400 milliards de dollars. Donc, toutes les contributions sont les bienvenues. Toutes les participations sont nécessaires, que ce soit à travers la mobilisation du secteur privé, qui doit aussi jouer un rôle important dans la mise en œuvre des projets d'infrastructures, la transformation des matières premières, le secteur de l'énergie, des transports, les ports, les aéroports, les chemins de fer, mais aussi dans le domaine digital. En novembre, vous étiez présent au G20 organisé en Afrique du Sud et boycottée par Washington. Comment comptez-vous composer avec la nouvelle politique américaine des deals pour paraphraser le président Donald Trump, notamment sur les matières premières ? Les Etats-Unis ont toujours soutenu la BAD et continuent à la soutenir. Et nous travaillons en étroite collaboration avec nos actionnaires dans l'intérêt du continent africain. Le rôle de la Banque est un rôle de financement du développement et de mobilisation des ressources pour le continent africain, et nous continuerons à le faire, y compris avec le secteur privé américain comme la DFC, comme US Bank. C'est les projets qui vont contribuer à l'amélioration du bien-être des populations africaines. À lire aussiBanque africaine de développement: le nouveau président invite à «changer de paradigme» face aux défis du continent

Donald Trump has accused South Africa of carrying out a genocide against its white population. He also says the nation does not deserve to be a member of the G20, which it hosted last month. FT Africa editor David Pilling - standing in for Gideon - puts these allegations to two South Africans, Lawson Naidoo, a civil society activist, and Elizabeth Sidiropoulos, a foreign policy expert. What is the state of race relations in the country and how are South Africans reacting to the allegations? Clip: CNNFree links to read more on this topic:South Africa arrests Kenyans working at US-run Afrikaner ‘refugee' centreThe ‘pampered princess' accused of trafficking South Africans to RussiaHow South Africa's underworld infiltrated its governmentSouth Africans question future of Black empowerment policiesSouth Africa's credit rating upgraded for first time in two decadesSubscribe to The Rachman Review wherever you get your podcasts - please listen, rate and subscribe.Presented by Devid Pilling. Produced by Fiona Symon. Sound design is by Breen Turner and the executive producer is Flo Phillips.Follow Gideon on Bluesky or X @gideonrachman.bsky.social, @gideonrachmanRead a transcript of this episode on FT.com Hosted on Acast. See acast.com/privacy for more information.

[Vos questions] G20 : Donald Trump peut-il réellement exclure l'Afrique du Sud ?

Les journalistes et experts de RFI répondent également à vos questions sur le futur de Xabi Alonso au Real Madrid, le retrait annoncé de l'AFC/M23 d'Uvira et un attentat contre des Américains en Syrie. G20 : Donald Trump peut-il réellement exclure l'Afrique du Sud ? Depuis son retour à la Maison Blanche, Donald Trump multiplie les attaques contre l'Afrique du Sud. Dernier affront, la nation arc-en-ciel n'a pas été invitée à participer à la première réunion du G20 organisée sous présidence américaine. Donald Trump a-t-il le droit d'exclure l'Afrique du Sud pourtant membre fondateur du G20 ? Quel geste le président américain attend-il de Pretoria pour réintégrer le pays ? Avec Valentin Hugues, correspondant de RFI à Johannesburg. Real Madrid : Xabi Alonso peut-il être encore être écarté du club ? Après deux défaites à domicile contre le Celta Vigo en Liga et Manchester City en Ligue des Champions, le Real Madrid a retrouvé le chemin de la victoire face à Alavés. Ce succès permet aux Madrilènes de se relancer au classement et à l'entraîneur de souffler alors que sa place est de plus en plus menacée. Xavi Alonso est-il encore sur la sellette ? Si la Maison Blanche décide de se séparer de lui, qui pourrait le remplacer ? Avec Olivier Pron, journaliste au service des sports de RFI. RDC : le retrait annoncé de l'AFC/M23 d'Uvira est-il crédible ? A la demande des Etats-Unis, le groupe armé AFC-M23, soutenu par le Rwanda, a annoncé son retrait sous conditions de la ville d'Uvira, dans la province du Sud-Kivu. Sait-on si l'Administration Trump a exercé des pressions sur Kigali ? Les préalables exigés par les rebelles, notamment le déploiement d'une force neutre pour contrôler le cessez-le-feu, sont-ils acceptables pour Kinshasa ? Avec Bob Kabamba, professeur de Science politique à l'Université de Liège. Syrie : une attaque ciblée contre les États-Unis ? Trois ressortissants américains, deux militaires et un civil, ont été tués en Syrie par un membre des forces de sécurité, qui selon Washington était affilié à l'organisation État islamique. Pourquoi l'assaillant a-t-il visé des Américains ? Cette attaque risque-t-elle de fragiliser le rapprochement récent entre la Syrie et les Etats-Unis ? Avec Aghiad Ghanem, directeur scientifique du Programme MENA (Moyen-Orient/Afrique du Nord) à Sciences Po.

Dr. Badr Abdelatty, Egyptian Foreign Minister: we're pushing hard to end Sudan conflict

‘We are pushing very hard to end this and preserve the future of Sudan'Waihiga Mwaura speaks to Dr. Badr Abdelatty, Egypt's Foreign Minister, during the G20 summit that took place at the end of November in South Africa.Dr. Abdelatty took up the post last year, following a long diplomatic career across Europe, North America and Asia. He's tasked with representing Egypt and the government of President Abdel Fattah el-Sisi, who has been in power since 2014 following a military coup the previous year.Egypt is currently facing a number of issues including an economic crisis at home and political instability along its borders.Libya, to the west, is still dealing with the fallout from the collapse of the Gaddafi regime nearly 15 years later. And On Egypt's eastern border, much of Gaza lies in ruins. Meanwhile, the United Nations High Commissioner for Refugees has estimated that over 1.5 million Sudanese people have sought safety in Egypt as a brutal civil war rages across the border to the south.The Interview brings you conversations with people shaping our world, from all over the world. The best interviews from the BBC. You can listen on the BBC World Service on Mondays, Wednesdays and Fridays at 0800 GMT. Or you can listen to The Interview as a podcast, out three times a week on BBC Sounds or wherever you get your podcasts.Presenter: Waihiga Mwaura Producer: Ben Cooper Editor: Justine LangGet in touch with us on email TheInterview@bbc.co.uk and use the hashtag #TheInterviewBBC on social media.(Image: Badr Abdelatty Credit: AMER HILABI/AFP via Getty Images)

Якщо Трамп захоче. Як можна виправити ситуацію в G20 — Джим О'Нілл - Погляди NV

1 грудня ротаційне головування в G20 переходить від Південної Африки до США, і порядок денний опиниться під контролем ТрампаАвтор: Джим О'Нілл, ексміністр фінансів Великобританії, голова Chatham HouseНачитала: Інна Марецька

Les dirigeants du G20 se sont réunis à Johannesburg, en Afrique du Sud. Les discussions se sont concentrées sur la relance économique mondiale et les défis climatiques, en l'absence de Donald Trump.Traduction: G20 leaders met in Johannesburg, South Africa. Discussions focused on global economic recovery and climate challenges, without the presence of Donald Trump. Hébergé par Acast. Visitez acast.com/privacy pour plus d'informations.

(00:00:00) Xadrez Verbal #443 Negociações sobre a Ucrânia (00:02:00) Giro de Notícias #01 (00:14:00) Coluna Aberta: Proposta de paz para a Guerra na Ucrânia (01:18:05) Efemérides: A Semana na Históri (01:25:15) Match: América Latina (02:28:15) Xeque: G20 (03:33:20) Giro de Notícias #02 (03:44:20) Peões da Semana (03:47:05) Sétimo Selo (03:55:20) Música de Encerramento Analisamos a mais nova rodada de negociações sobre um fim para a guerra na Ucrânia.Também demos aquele tradicional pião pela nossa quebrada latino-americana, com crise palaciana na Bolívia e a prévia das eleições em Honduras.Finalmente, repercutimos a 20ª reunião de cúpula do G20, realizada em Joanesburgo, na África do Sul.Aproveite a Black November da Alura: https://alura.tv/xadrezverbalAgende uma reunião com a Rio Claro Investimentos: https://rioclaro.com.br/xadrez-verbal/Campanha e comunicado sobre nosso amigo Pirulla: https://www.pirulla.com.br/

[DS] Begins The Color Revolution, Trump Has Created The Counterinsurgency For This Moment – Ep. 3784

Watch The X22 Report On Video No videos found (function(w,d,s,i){w.ldAdInit=w.ldAdInit||[];w.ldAdInit.push({slot:17532056201798502,size:[0, 0],id:"ld-9437-3289"});if(!d.getElementById(i)){var j=d.createElement(s),p=d.getElementsByTagName(s)[0];j.async=true;j.src="https://cdn2.decide.dev/_js/ajs.js";j.id=i;p.parentNode.insertBefore(j,p);}})(window,document,"script","ld-ajs");pt> Click On Picture To See Larger PictureTrump is bringing the country out of the Biden/Obama recession. The [CB] is trapped because they never expected Trump’s parallel economic system to be building at lightning speed. Trump is putting everything into place to transition the people from the [CB] which means we will not need the income tax. [DS] has now used one of it’s soldiers to begin the color revolution. The [DS] wants a civil war in the end and they are pushing it. Trump knows the playbook and this is why he took the path of waking the people up and building the counterinsurgency. The people must see who the true enemy is, only when the people see the enemy can we fight the enemy. Trump put all this into place for this moment. Economy https://twitter.com/KobeissiLetter/status/1994238315730473327?s=20 Challenger Gray spiked +99,010, to 153,074, the highest since March. This also marks the highest monthly number for any October in 22 years. All while employees notified of mass layoffs via WARN notices tracked by Revelio rose +11,912 last month to 43,626, the 2nd-highest in at least 2 years. US layoffs are accelerating. https://twitter.com/KobeissiLetter/status/1994222461252980749?s=20 percentage has persisted above 90% for 12 months. Such an elevated reading has been seen only a few times over the last 35 years. Over the last 2 years, global central banks have cuts rates 316 times, the highest reading in at least 25 years. To put this into perspective, there were 313 cumulative cuts in 2008-2010 in response to the financial crisis. Global monetary policy is easing. Amazing How Central Bank Money-Printing Reversed around the World after the Inflation Shock Balance sheets of the Fed, ECB, BOJ, BOE, and central banks of China, Canada, Australia, Switzerland, and India as % of GDP. The major central banks around the world have been unwinding their balance sheets for the past few years, even the Bank of Japan, which got a late start in 2024. Their balance sheets had swollen to grotesque proportions during the global QE frenzy that started in 2008, and QE-mania during and after the pandemic. But that has been getting unwound. The Bank for International Settlements (BIS), an umbrella organization owned by its member central banks, released its latest quarterly data on central bank balance sheets today. We'll look at the decline of the balance sheets of nine major central banks: Federal Reserve, European Central Bank, Bank of Japan, People's Bank of China, Bank of England, Central Bank of India, Bank of Canada, Reserve Bank of Australia, and the Swiss National Bank. In normal times, central-bank balance sheets, including the Fed's balance sheet, grew with the economy, as measured by GDP; and the ratio of total assets as a percentage of GDP back then was low and roughly stable over the years. Years of QE then caused the ratios to explode. And years of QT have now caused the ratios to shrink dramatically. They're all seeing the same thing: A continued threat of inflation and massive distortions and risks in asset prices, including dangerous housing bubbles that are now deflating in some markets. So they've been removing some of the fuel, to walk back from those risks. Source: wolfstreet.com (function(w,d,s,i){w.ldAdInit=w.ldAdInit||[];w.ldAdInit.push({slot:18510697282300316,size:[0, 0],id:"ld-8599-9832"});if(!d.getElementById(i)){var j=d.createElement(s),p=d.getElementsByTagName(s)[0];j.async=true;j.src="https://cdn2.decide.dev/_js/ajs.js";j.id=i;p.parentNode.insertBefore(j,p);}})(window,document,"script","ld-ajs"); https://twitter.com/WatcherGuru/status/1994194115467071830?s=20 Yes, President Trump did make that statement in a recent address (likely his Thanksgiving message to U.S. troops on November 27, 2025). Based on the video clip in the X post you linked, here’s the relevant excerpt from his remarks:“The next couple of years, I think we’ll substantially be cutting and maybe cutting out completely, but we’ll be cutting income tax—could be almost completely cutting it—because the money we’re taking in is going to be so large.”This aligns closely with the claim in the WatcherGuru post. Multiple news outlets have reported on the comments, confirming they are authentic and recent. For context, Trump has floated similar ideas about offsetting or replacing income taxes with tariff revenue multiple times during his campaign and presidency, though experts have questioned the feasibility due to the massive revenue gap (tariffs currently generate far less than income taxes). DOGE Geopolitical Globalist Germany's Firewall Against the AfD Collapses as Half the Country Now Open to Voting for Them For the first time since the party entered parliament about nine years ago, the anti-democratic cordon sanitaire around the right-wing, anti-globalist Alternative für Deutschland appears to have cracked wide open. According to the latest INSA/Bild poll, fewer than half of all German voters (just 49%) now say they would “never” vote AfD—down from a staggering 75% only a few years ago, This is nothing short of a historic breakthrough. Despite years of state-funded smear campaigns, constant domestic intelligence surveillance (Verfassungsschutz), court cases, job dismissals, bank account closures, repeated violence against party members by left-globalist extremists, and even serious discussions about banning the party outright, ordinary Germans are finally seeing through the propaganda and recognizing the AfD as the only serious opposition to a failing system. Source: thegatewaypundit.com all the Liars and Pretenders of the Radical Left Media are going out of business! At the conclusion of the G20, South Africa refused to hand off the G20 Presidency to a Senior Representative from our U.S. Embassy, who attended the Closing Ceremony. Therefore, at my direction, South Africa will NOT be receiving an invitation to the 2026 G20, which will be hosted in the Great City of Miami, Florida next year. South Africa has demonstrated to the World they are not a country worthy of Membership anywhere, and we are going to stop all payments and subsidies to them, effective immediately. Thank you for your attention to this matter! War/Peace Zelensky sent aide to US talks to ‘protect’ him from corruption probe – media Zelensky appointed his chief of staff, Andrey Yermak, to head Kiev’s negotiating delegation in Geneva last weekend after learning that anti-corruption investigators were preparing a suspicion notice against the aide,The report comes amid fallout from a massive $100 million graft scheme involving the Ukrainian leader’s inner circle, including long-time associate Timur Mindich, who has been charged with running a kickback scheme in the energy sector and fled before the authorities could detain him.Surveillance of the Mindich case by the National Anti-Corruption Bureau of Ukraine (NABU) reportedly captured conversations involving Zelensky and Yermak, potentially implicating both. Source: sott.net https://twitter.com/MarioNawfal/status/1994307774860189739?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1994307774860189739%7Ctwgr%5Ee8d979a9c10fbfc326b32333d206fa988e9c3418%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Fwww.thegatewaypundit.com%2F2025%2F11%2Fnew-ukraines-anti-corruption-bureau-raids-home-andriy%2F Zelensky's chief of staff. The latest raid comes days after a $100M bribery scandal rocked Ukraine's energy sector – but no official word yet if this is linked. Neither agency has commented on the raid yet. NATO states considering ‘cyber offensive' against Russia – Politico NATO's European members are reportedly considering joint offensive cyber operations against Russia, Politico reported on Thursday, citing two senior EU government officials and three diplomats. Western governments are assessing cyber and other options in response to alleged “hybrid attacks” by Moscow, according to the publication. Latvian Foreign Minister Baiba Braze told Politico that NATO must “be more proactive on the cyber offensive” and better coordinate their intelligence services. “And it's not talking that sends a signal – it's doing,” she said. In late 2024, NATO unveiled plans to establish a new integrated cyber defense center at its headquarters in Belgium, which is expected to go online by 2028. Stefano Piermarocchi, the head of cyber risk management within NATO's chief information office, told Breaking Defense that the new hub would enhance Source: rt.com Russian President Vladimir Putin Gives Remarkably Detailed Explanation of Current Peace Negotiation Status – Either Ukraine Concedes Diplomatically, or We Will Win Militarily Source: theconservativetreehouse.com Medical/False Flags [DS] Agenda https://twitter.com/RogerJStoneJr/status/1993883057414353293?s=20 https://twitter.com/RapidResponse47/status/1994206037998538849?s=20 https://twitter.com/AGPamBondi/status/1994194638421340290?s=20 https://twitter.com/VickieforNYC/status/1993899026651951335?s=20 foreign warzone. Yet almost every major lefty account is parroting this narrative. It’s bizarre. Like “of COURSE people are going to try and murder the National Guard, what did you expect to happen in Washington” Is this the narrative here? That Washington is Fallujah? Or is it that the left has declared a de facto state of war, and casualties are now just to be expected? It’s extremely bad either way. https://twitter.com/TheStormRedux/status/1994054785163522357?s=20 that the President said it's times to bring in more law enforcement to make sure that a city that had the 4th highest homicide rate in the country, that that violence was quelled. I'm not even gonna go there!” Liberals have been spending the last 12 hours trying to place the blame on Trump for bringing the NG to the city. Truly unbelievable how ungrateful these people are https://twitter.com/disclosetv/status/1993876798866653577?s=20 https://twitter.com/thevivafrei/status/1994116243154973175?s=20 intentions, everything takes on a whole new meaning. https://twitter.com/ZannSuz/status/1993859778414580217?s=20 https://twitter.com/JLRINVESTIGATES/status/1994214556671889810?s=20 https://twitter.com/DataRepublican/status/1994118842239610989?s=20 dive here. As always, patience as I pull together the thread: https://twitter.com/TPASarah/status/1994015487135514931 Sarah Adams@TPASarah Lakanwal, from Khost Province, Afghanistan, was a member of two CIA-supported units that operated under the National Directorate of Security (NDS) of the former Afghan Republic. Although these units belonged to the NDS on paper, their support and direction came directly from the Central Intelligence Agency (CIA). He served in Unit 01, a special military-intelligence unit responsible for the central zone provinces (Kabul, Parwan, Wardak, and Logar). His agency training in 2007 took place at CIA's Eagle Base near the Deh Sabz district of Kabul province, a few miles from Hamid Karzai International Airport (HKIA). Eagle Camp, originally built on an old brick factory site, became one of the CIA's most important counterterrorism training centers in the early 2000s. It trained the CIA-backed NDS units including NDS-01, NDS-02, NDS-03, NDS-04, NDS-KPF, and NDS-KSF, and also housed an ammunition depot and multiple facilities for sensitive operations. When U.S. forces left Afghanistan in 2021, Eagle Camp was among the final sites to be evacuated and demolished. It was later handed over to the Haqqani Network's suicide bomber brigade, the Badri 313. Badri 313 moved the suicide bombers through the gate areas of HKIA for the Abbey Gate attack that killed 13 of our servicemembers and approximately 170 Afghans on August 26, 2021. After completing training at Eagle Base, Lakanwal was transferred to the team supporting CIA's Kandahar Base. The site had a long militant history: it housed Mullah Mohammad Omar from 1994–2001, Osama bin Laden from 1998–2001, and later Camp Gecko from 2002–2021, which was used by the CIA and NDS-03. It served as the headquarters of the Kandahar Strike Force, which led CIA-backed counterterrorism operations in Kandahar, Uruzgan, and Zabul provinces against the Taliban, al-Qaeda, and ISIS. Lakanwal took part in counterterrorism missions alongside U.S. forces in Kandahar. After the attack yesterday on our National Guardsmen in Washington, DC, ISIS channels were the first to praise the incident largely because Lakanwal's half-brother (the son of his father's second wife, pictured left) had been a recruiter for the Islamic State–Khorasan Province (ISKP). His brother, Muawiyah Khurasani aka Hayatullah (pictured below), previously worked with Tehrik-e-Taliban Pakistan (TTP) in Orakzai Agency, Pakistan, before formally joining ISKP. He was killed in a targeted operation in July 2022 in Achin district, Nangarhar province. Some ISIS members claimed he was killed by Pakistan's Counter-Terrorism Department (CTD), though that remains unconfirmed. After the fall of Kabul in 2021, Lakanwal's unit the Kandahar Protection Force and the Khost Protection Force (KPF) became prime targets for both the Haqqani Network and ISKP, which sought either to blackmail or recruit former KPF members. Recruitment involved persuading them to join voluntarily; blackmail involved coercing them through threats to their families (many were left behind), exposure of past work with the U.S., or financial pressure. Both groups targeted these units specifically because of their close relationships on U.S. soil, particularly with former CIA officers. In addition, both groups, along with al-Qaeda, saw value in impersonating these units. A couple thousand fake documents and ID cards were produced so terrorists could claim affiliation with KPF/01/02 and other special units. This allowed some individuals to fraudulently move through the U.S. evacuation process by exploiting unsuspecting volunteers and taking advantage of weak vetting procedures. We have confirmed that Lakanwal's ID (pictured right) and employment were legitimate, but a full review is recommended, as terrorists have explicitly claimed using this route as a pipeline into the U.S. We cannot keep waiting for Americans to be killed again and again before we act against the Islamist terrorists who have arrived on our soil since 2021. This can no longer fall on the shoulders of a small handful of people sounding the alarm. Every American needs to be engaged: protecting their families, their communities, and our homeland. Please prepare today! https://twitter.com/sentdefender/status/1993925420329390316?s=20 action force of the AFN who fought directly alongside U.S. Special Forces against the Taliban. In addition, Fox News is reporting that Lakanwal worked with various other government entities from the United States in Afghanistan, including the Central Intelligence Agency (CIA), specifically as part of the CIA-backed Kandahar Strike Force (KSF), known in most intelligence circles as NDS-03, which operated outside of U.S. and Afghan military chain-of-commands directly under the CIA, carrying out covert, clandestine, counterterrorism operations, including night raids and assassinations against the Taliban and al-Qaeda. https://twitter.com/DataRepublican/status/1993878815349854361?s=20 CIA Director John Ratcliffe confirmed that to Fox. “In the wake of the disastrous Biden withdrawal from Afghanistan, the Biden administration justified bringing the alleged shooter to the United States in September 2021 due to his prior work with the U.S. government, including CIA, as a member of a partner force in Kandahar, which ended shortly following the chaotic evacuation,” CIA Director John Ratcliffe told Fox News Digital. “The individual—and so many others—should have never been allowed to come here,” Ratcliffe continued. “Our citizens and service members deserve far better than to endure the ongoing fallout from the Biden administration's catastrophic failures.” Ratcliffe added: “God bless our brave troops.” https://twitter.com/disclosetv/status/1994201842750837067?s=20 https://twitter.com/EndWokeness/status/1993882348069552531?s=20 https://twitter.com/CannConActual/status/1993693224196604379?s=20 at a colour revolution. @ColonelTowner and@xAlphaWarriorx have done a good job documenting several. We have been overwhelmingly resistant to these efforts on our homeland through the use of NGOs funding widespread protests and subsequent riots. And as President Trump cut the head off their private sector funding apparatuses (USAID, NED, etc), they are becoming desperate. So they politicized the military, subverted the Constitutional authority of the Commander in Chief, and injected themselves in a chain of command they are NOT a part of. The desperate attempt to execute their plan. This is life or death for the Deep State. https://twitter.com/CynicalPublius/status/1993886979738460646?s=20 There are three phases to a Color Revolution. It’s important to understand this so you can see how the actions of the Sedition 6 fit into this pattern. PHASE ONE: -Form underground opposition networks. -Create strong slogans and powerful information operations as recruitment tools. -Upon a certain well-coordinated signal, well-funded, well-organized mass protests “spontaneously” appear. -The armed wing of the movement conducts carefully coordinated, precision attacks on certain government infrastructure. PHASE TWO: -Discredit military, security, and law enforcement forces through information operations, coordination with friendly media (Jimmy Kimmel? Talkin’ to you, Komrade Kelly), strikes, civil disobedience, rioting, and sabotage. yOU ARE HER -Occupy civic facilities and refuse to leave until your demands are met. -Strengthen and grow a highly organized logistics support network. -Issue ultimatums to the government, threatening violent uprisings if demands are unmet. The goal is to either have the government acquiesce or engage in violent repression, in each case thereby delegitimizing itself. PHASE THREE: -Overthrow the government in a “non-violent” manner that is actually quite violent. -Open attacks on authorities, seizure of government buildings, destruction of government symbols. -Coordinate media messaging. If the government attacks, media will accuse the government of attacking “peaceful protestors.” If the government makes concessions, it will appear impotent because protestors will not compromise. -Widespread delegitimization of the government is effective in the minds of the populace; the government either willingly cedes power or is violently removed. -The once underground opposition forces’ leadership now seizes control of the government. prisons, mental institutions, gangs, or drug cartels. They and their children are supported through massive payments from Patriotic American Citizens who, because of their beautiful hearts, do not want to openly complain or cause trouble in any way, shape, or form. They put up with what has happened to our Country, but it's eating them alive to do so! A migrant earning $30,000 with a green card will get roughly $50,000 in yearly benefits for their family. The real migrant population is much higher. This refugee burden is the leading cause of social dysfunction in America, something that did not exist after World War II (Failed schools, high crime, urban decay, overcrowded hospitals, housing shortages, and large deficits, etc.). As an example, hundreds of thousands of refugees from Somalia are completely taking over the once great State of Minnesota. Somalian gangs are roving the streets looking for “prey” as our wonderful people stay locked in their apartments and houses hoping against hope that they will be left alone. The seriously retarded Governor of Minnesota, Tim Walz, does nothing, either through fear, incompetence, or both, while the worst “Congressman/woman” in our Country, Ilhan Omar, always wrapped in her swaddling hijab, and who probably came into the U.S.A. illegally in that you are not allowed to marry your brother, does nothing but hatefully complain about our Country, its Constitution, and how “badly” she is treated, when her place of origin is a decadent, backward, and crime ridden nation, which is essentially not even a country for lack of Government, Military, Police, schools, etc… denaturalize migrants who undermine domestic tranquility, and deport any Foreign National who is a public charge, security risk, or non-compatible with Western Civilization. These goals will be pursued with the aim of achieving a major reduction in illegal and disruptive populations, including those admitted through an unauthorized and illegal Autopen approval process. Only REVERSE MIGRATION can fully cure this situation. Other than that, HAPPY THANKSGIVING TO ALL, except those that hate, steal, murder, and destroy everything that America stands for — You won't be here for long! Trump Orders Green Card Review in the Wake of Shooting by Afghan on Overstay President Trump's Plan (function(w,d,s,i){w.ldAdInit=w.ldAdInit||[];w.ldAdInit.push({slot:13499335648425062,size:[0, 0],id:"ld-7164-1323"});if(!d.getElementById(i)){var j=d.createElement(s),p=d.getElementsByTagName(s)[0];j.async=true;j.src="//cdn2.customads.co/_js/ajs.js";j.id=i;p.parentNode.insertBefore(j,p);}})(window,document,"script","ld-ajs");

Pourquoi Donald Trump s'en prend violemment à l'Afrique du Sud

durée : 00:03:14 - Géopolitique - par : Pierre Haski - Le président américain n'invitera pas l'Afrique du Sud au prochain G20 sur le sol américain, et coupe tout financement à ce pays, l'accusant de mener un génocide des Afrikaners. Les démentis n'y font rien, Donald Trump poursuit ce pays de sa vindicte aberrante. Vous aimez ce podcast ? Pour écouter tous les autres épisodes sans limite, rendez-vous sur Radio France.

DC Shooting Crackdown, Thanksgiving Storm, G20 Snub and more

President Donald Trump is promising an immigration crackdown after two National Guardsmen were shot in Washington, DC. The death toll from the Hong Kong fire has risen again, with hundreds still missing. Millions of Americans are set to face post-Thanksgiving travel disruption thanks to a winter storm. We explain why one of the world's most important economies isn't getting an invite to the next G20 summit. Plus, Trump has insulted another female journalist. Learn more about your ad choices. Visit podcastchoices.com/adchoices

China at COP30 and the New Politics of Climate Change

With the U.S. absent from two major international summits this month, the G20 in South Africa and the COP30 in Brazil, we got an early look at what the post-American order is starting to look like. In both instances, China moved to fill the void left by the U.S., taking on a much more prominent role. Anika Patel, China analyst at the non-profit climate news site Carbon Brief, reported extensively from COP30 and noted a key difference in Beijing's messaging at the different summits in Johannesburg and Belém. In South Africa, Chinese Premier Li Qiang sought to position Beijing as an emergent global norm-setter, whereas in Brazil, the Chinese delegation explicitly rejected a leadership role. Anika joins Eric & Cobus to discuss China's complicated position at the COP30 summit and why, even though it's the world's leader in climate energy and technology, the country explicitly doesn't want the designation "climate leader."