Podcasts about enterprise value

- 181PODCASTS

- 261EPISODES

- 36mAVG DURATION

- 5WEEKLY NEW EPISODES

- Feb 24, 2026LATEST

POPULARITY

Best podcasts about enterprise value

Latest news about enterprise value

- Why Intelligence Without Authority Cannot Deliver Enterprise Value HTML Goodies - Feb 17, 2026

- Escaping the pilot trap: How composable AI data platforms move enterprise AI to production SiliconANGLE - Feb 12, 2026

- Medifast Is A Net-Net With Negative Enterprise Value Long Investing Ideas from Seeking Alpha - Feb 4, 2026

- Hidden Value? 8 stocks with enterprise value higher than market cap Markets-Economic Times - Jan 5, 2026

- Indian IT services provider Coforge agrees to acquire Encora, which offers AI tools for product, cloud, and data engineering, at an enterprise value of $2.35B (Reuters) Techmeme - Dec 27, 2025

- Indian IT services provider Coforge agrees to acquire Encora, which offers AI tools for product, cloud, and data engineering, at an enterprise value of $2.35B BizToc - Dec 27, 2025

- Varun Beverages To Acquire South African Beverage Firm Twizza At Enterprise Value Of Rs 1,118.7 Crore NDTV News - Special - Dec 22, 2025

- Varun Beverages to acquire South African beverage firm Twizza at enterprise value of ₹1,118.7 crore The HinduBusinessLine - Home - Dec 22, 2025

- What drove Varun Beverages arm Bevco to acquire South African Twizza for ₹1,118.7 crore? mint - Companies - Dec 22, 2025

- SAMIL in talks to acquire Nexans Autoelectric wiring harness biz at 207 mn euros enterprise value News-Economic Times - Dec 22, 2025

Latest podcast episodes about enterprise value

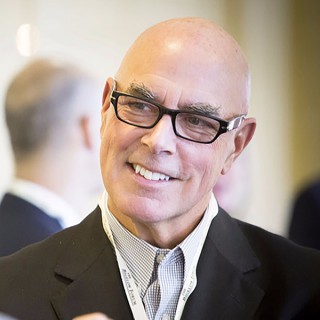

Enterprise Value, Only-ness & the Myth of More Leads with Mark Osborne

S6:E18 You can be fully booked and still be building a fragile business. Queue Up Episode This week on Small Business Stories, Dr. LL sits down with Mark Osborne, founder of Modern Revenue Strategies and author of Are Your Leads Killing Your Business? If people don't trust you, they won't buy. If you don't differentiate, you attract the wrong buyers. Mark explains how chasing more leads can erode margins, as well as lead to team burnout and stalled growth. He introduces the concept of "only-ness" and breaks down the three interlocking systems that drive scalable enterprise value: attraction, acceleration, and activation.

Enterprise Value, Only-ness & the Myth of More Leads with Mark Osborne

S6:E18 You can be fully booked and still be building a fragile business. Queue Up Episode This week on Small Business Stories, Dr. LL sits down with Mark Osborne, founder of Modern Revenue Strategies and author of Are Your Leads Killing Your Business? If people don't trust you, they won't buy. If you don't differentiate, you attract the wrong buyers. Mark explains how chasing more leads can erode margins, as well as lead to team burnout and stalled growth. He introduces the concept of "only-ness" and breaks down the three interlocking systems that drive scalable enterprise value: attraction, acceleration, and activation.

In this podcast episode, Altruists' Jason Wenk discusses the launch and impact of Hazel, their AI-driven tax planning and wealth management software. The conversation explores Hazel's development, strategic release timing, and advanced features—such as real-time data integration, automated tax analysis, and personalized financial planning. Hazel streamlines advisor workflows, reduces reliance on multiple tools, and democratizes sophisticated planning for clients. The episode also covers Hazel's role in boosting firm efficiency and valuation, its transparent AI-driven recommendations, and the competitive edge Altruist offers over traditional custodians, highlighting Hazel's transformative potential in the wealth management industry.Altruist Introduction To Tax Planning (2:10)How Is Altruist Disrupting The Indsutry (5:42)What Should We Expect From Hazel Moving Forward (10:20)Hazel and Altruist..The All-in-One Tool? (20:30)Is Ai Accretive to Enterprise Value? (29:20)The Adjustment for Major Custodians (34:00)NEWSLETTER (WHAT NOW): https://substack.com/@9icapital?r=2eig6s&utm_campaign=profile&utm_medium=profile-pageFollow Us: youtube: / @9icapLinkedin: / kevin-thompson-ricp%c2%ae-cfp%c2%ae-74964428facebook: / mlb2cfp Buy MLB2CFPHere: https://www.amazon.com/MLB-CFP%C2%AE-90-Feet-Counting-ebook/dp/B0BLJPYNS4Website: http://www.9icapitalgroup.comHit the subscribe button to get new content notifications.Corrections: Editing by http://SwoleNerdProductions.comDisclosure: https://sites.google.com/view/9idisclosure/disclosure

In this episode, Makenzie and Jason explore how anyone, regardless of title or department, can create enterprise value from their seat in the company. In an employee-owned environment, revenue generation isn't limited to sales roles; it's a mindset rooted in ownership. They break down how every function contributes to profitability and long-term value, and how both extroverts and introverts can leverage their unique strengths to drive impact. If you've ever wondered how your role ties to the bigger financial picture, this conversation will challenge you to think and act like an owner.

Can a Mission-Driven Brand Survive Beyond Its Founder? Leadership, Risk, and Enterprise Value - Bob Bush

How do you build a mission-driven brand that survives beyond a single personality - and still create real enterprise value? On this episode of Behind The Numbers With Dave Bookbinder, I speak with Bob Bush, founder and CEO of Mutombo Coffee, about building a purpose-driven specialty coffee company rooted in relationships, disciplined execution, and long-term thinking. Bob traces the origin of Mutombo Coffee from his friendship with NBA legend Dikembe Mutombo to the development of a “commerce over charity” model designed to create sustainable economic opportunity - particularly for women coffee farmers. Drawing on his background in finance and supply chain management, Bob explains how operational discipline and mission alignment must coexist if a social enterprise is going to scale. We discuss: Launching a consumer brand during COVID and the realities of supply chain disruption Managing key-person risk following Dikembe Mutombo's passing The operational complexity of international sourcing and distribution Leadership lessons for founders building mission-centered businesses Aligning profit with purpose without compromising either Bob also shares the evolution of the product strategy - from single-serve sachets and K-Cups to stroopwafels and espresso martini offerings - along with partnerships that have supported growth, including the Houston Rockets and Temple University. This conversation offers practical insight for business owners and management teams navigating growth, brand identity, and enterprise resilience. It's a case study in building sustainable systems, listening to customers, and proving that purpose and profitability are not mutually exclusive - but must be intentionally engineered. If you're interested in entrepreneurship, management, impact investing, or the mechanics behind scaling a mission-driven brand, this episode delivers both strategic perspective and operational lessons. ** Behind The Numbers With Dave Bookbinder listeners can get 20% off of their order by using the discount code BTN20 here: insert web address https://www.mutombocoffee.com/collections/all About Our Guest Bob Bush is a senior investment executive with experience across industries, geographies (USA, Europe, China, Middle East, and Africa), as well as asset classes (venture capital, private equity, Islamic Finance). He has engaged in various financial and operating special projects for sovereign-related entities, family businesses, family offices, investment companies, corporations, and startups. Bob provides live television commentary and keynotes at global conferences on innovation, social impact, sustainability, global investing, and international trade. His unique experiences, love for learning and teaching, as well as an established network of relationships, fuel his interests in innovative business models, public-private partnerships, and entrepreneurship. Bob's international experiences with multinational corporations and government advisory as well as his love for learning and teaching have given him a unique perspective on solving global challenges. About the Host: Dave Bookbinder is known as an expert in business valuation and he is the person that business owners and entrepreneurs reach out to when they need to know what their most important assets are worth. Known as a collaborative adviser, Dave has served thousands of client companies of all sizes and industries. Dave is the author of two #1 best-selling books about the impact of human capital (PEOPLE!) on the valuation of a business enterprise called The NEW ROI: Return On Individuals & The NEW ROI: Going Behind The Numbers. He's on a mission to change the conversation about how the accounting world recognizes the value of people's contributions to a business enterprise, and to quantify what every CEO on the planet claims: “Our people are this company's most valuable asset.” Dave's book, A Valuation Toolbox for Business Owners and Their Advisors: Things Every Business Owner Should Know, was recognized as a top new release in Business and Valuation and is designed to provide practical insights and tools to help understand what really drives business value, how to prepare for an exit, and just make better decisions. He's also the host of the highly rated Behind The Numbers With Dave Bookbinder business podcast which is enjoyed in more than 100 countries.

On this episode of the 9Innings Podcast, Kevin Thompson sits down with Derrick Kinney — former financial advisor, successful practice owner, and now coach and speaker to entrepreneurs nationwide.Derrick walks through his journey from grinding it out early in his career to building — and ultimately selling — a thriving advisory firm. He breaks down how authentic community engagement attracted million-dollar clients, why specialization beats commoditization, and how integrity builds long-term enterprise value.The conversation also dives into the emotional side of selling a business, overcoming revenue plateaus, avoiding shiny object syndrome, and why comparison can quietly kill growth.At its core, this episode is about ownership, sacrifice, and running your own race — with practical lessons for advisors and entrepreneurs who want to build something that actually lasts.From Humble Beginnings to Betting on Himself (00:03:24) Community Over Cold Calls (00:04:37) Specialize or Stay Stuck (00:09:46) The Emotional Reality of Selling a Business (00:15:29) The “You Know How” Framework (00:24:00) The Non-Negotiables for Growth (00:32:20) Breaking Revenue Plateaus (00:37:20) Comparison vs. Celebration (00:43:10) NEWSLETTER (WHAT NOW): https://substack.com/@9icapital?r=2eig6s&utm_campaign=profile&utm_medium=profile-page Follow Us: youtube: / @9icap Linkedin: / kevin-thompson-ricp%c2%ae-cfp%c2%ae-74964428 facebook: / mlb2cfp Buy MLB2CFP Here: https://www.amazon.com/MLB-CFP%C2%AE-90-Feet-Counting-ebook/dp/B0BLJPYNS4 Website: http://www.9icapitalgroup.com Hit the subscribe button to get new content notifications. Corrections: Editing by http://SwoleNerdProductions.com Disclosure: https://sites.google.com/view/9idisclosure/disclosure

egtv #448 Die 10 teuersten Aktien der Welt – Tesla, Walmart, Costco & Hermès im Bewertungs-Check

echtgeld.tv - Geldanlage, Börse, Altersvorsorge, Aktien, Fonds, ETF

Nach der letzten Sendung mit Stefan Waldhauser kamen viele Aktienwünsche aus den Kommentaren – und bei einigen haben bei Tobias Kramer sofort die Alarmglocken geläutet: Vieles wirkt einfach überteuert? Gleichzeitig ist „teuer“ ein Begriff, der zwei Ebenen hat: Unternehmenswert (Marktkapitalisierung bzw. Enterprise Value) und Bewertung der Aktie (Multiples wie KGV). In dieser Folge wird deshalb nicht „gefühlt“, sondern systematisch gefiltert: Ausgehend von Unternehmen mit mehr als 200 Mrd. US-Dollar Marktkapitalisierung wird bewusst nach hohen Bewertungen gesucht – mit einem klaren Kriterium: KGV > 40 - auf zwei verschiedenen Zeitebenen. Ergebnis: zehn Aktien, die diese Hürden erfüllen – mit einer Tabelle, die die wichtigsten Kennzahlen auf einen Blick zusammenführt (u.a. Trendindikator über die 200-Tage-Linie, Debt/EBITDA, Price/Sales, erwartetes Umsatz- und Gewinnwachstum sowie eine 3-Jahres-Perspektive auf das KGV. Der wertvollste teure Aktie, Tesla, wird genutzt, um die Logik der Tabelle zu erklären – inklusive der Frage, wie stark bei manchen Unternehmen heute bereits Zukunftsversprechen im Kurs eingepreist sind (z.B. neue Märkte wie autonomes Fahren oder humanoide Roboter). Danach folgt der Überblick über alle zehn Werte, die so wohl noch nie zusammengestellt wurden. Mit dabei sind unter anderem auch ASML, Palantir, Intel, Lam Research, GE Vernova und GE Aerospace. Drei Unternehmen werden anschließend ausführlicher eingeordnet: - Hermès als Luxus-Ausnahme mit starker Marke und Preissetzungsmacht – bei gleichzeitig begrenzter „Luft“ für weitere Multiple-Expansion. - Costco als extrem beliebtes Mitgliedschaftsmodell mit hoher Kundentreue und der Spagat zwischen Qualität, Execution und Multiple. - Walmart als zwar größte Vertriebsmaschine der Welt, bei der sich aber und die Bewertungsfrage aufdrängt, denn wieso notiert ein Lebensmittelhändler mit einem derartig hohen KGV? Am Ende steht wie immer die Einladung: Welche Auswertungen wären als Nächstes spannend (z.B. andere Marktkapitalisierungs-Schwellen oder Filterkombinationen) – und welche Aktien sollen in künftigen Folgen genauer auf den Prüfstand? Aktienmarkt, Marktanalyse, Börsenüberblick: Die 10 teuersten Aktien der Welt per Filter (Marktkapitalisierung, KGV, Forward-KGV) – Bewertung, Risiko-Management, Sektortrends und Echtgeld-Depot-Einordnung.

Building the Leadership Layer that Drives Execution and Enterprise Value with Chris Lacy of Priority Search Management 2-3-26

In this episode, Chris Lacy, President at Priority Search Management, joins Scott Becker to share practical insights on hiring, onboarding, and why companies often overlook the critical “missing middle” below the executive level.

Building the Leadership Layer that Drives Execution and Enterprise Value with Chris Lacy of Priority Search Management 2-3-26

In this episode, Chris Lacy, President at Priority Search Management, joins Scott Becker to share practical insights on hiring, onboarding, and why companies often overlook the critical “missing middle” below the executive level.

From Growth to Exit: How the Right Executive Team Creates Stability and Enterprise Value with Jon Fidler

On this week's episode of the Group Practice Accelerator, host Jamie Falasz sits down with Jon Fidler, Founder and CEO of Fidler & Associates, to talk about why the team you build around you matters more than almost anything else as you scale. Jon shares what he's seen working with multi-site groups across the country - from where leaders get hiring wrong to how alignment at the executive level creates stability, reduces risk, and ultimately drives higher exit value.They cover when to stop doing it all yourself, which leadership roles to prioritize as you grow, and what buyers really look for when it's time to sell. If you're ready to scale, or thinking about an eventual exit, this episode will help you hire with intention and build a team that supports long-term value.Contact Jon Fidler:www.fidlerandassociates.comjfidler@fidlerandassociates.com(512)550-8604

The Sell Side Masterclass for Tech Services Founders: What is my Take Home?

What we coverEnterprise value vs. net proceeds: why the headline number isn't the check you cashThe biggest “below-the-line” items that reduce proceeds:Taxes (often the largest bite)Debt payoff in cash-free, debt-free dealsWorking capital targets and true-upsProfessional fees (M&A, legal, tax, accounting/QoE)Timing vs. reduction: how escrow/holdbacks and seller notes can delay (not always reduce) proceedsReps & warranties: why buyers want protection, and the two common ways to structure it (escrow vs. RWI)QoE + diligence: how add-backs get challenged, how deals get “retraded,” and how to defend your EBITDAThe recurring theme: start early—prep with M&A, tax, and legal advisors before you're in a live deal Listener takeawayIf you want confidence in your outcome, don't just ask “What's my valuation?” Ask “What's my take-home, when do I receive it, and what could reduce it?” Other Episodes in this SeriesEpisode 1: Knowing When It Is Time to Sell. Listen now >>Episode 2: Get Your House in Order. Listen now >>Episode 3: Valuation Drivers. Listen now >> Listen to Shoot the Moon on Apple Podcasts or Spotify.Buy, sell, or grow your tech-enabled services firm with Revenue Rocket.

Stop Building, Start Buying: How to Grow Enterprise Value by 1,200% with Tom Shipley

Want a quick estimate of how much your business is worth? With our free valuation calculator, answer a few questions about your business, and you'll get an immediate estimate of the value of your business. You might be surprised by how much you can get for it: https://flippa.com/exit -- Are you trying to grow your business by 10% year over year? You might be leaving massive wealth on the table. In this episode, we sit down with Tom Shipley, a former Special Forces operator turned serial entrepreneur and aggressive investor. Tom challenges the traditional startup narrative with a shocking reality: Growing organically might increase your value by 50% over five years, but buying competitors can increase it by 1,200%. Tom shares his incredible journey from the dot-com bust, where he was days away from missing payroll, to buying a $15M division of Boise Cascade without using his own capital. We unpack the "Programmatic M&A" playbook, how to use acquisitions to solve operational weaknesses, and why the best path to a massive exit is often buying your way there. -- Tom Shipley is a serial entrepreneur and M&A strategist known for creating the “Add a Zero” growth philosophy, which helps founders rapidly scale their businesses through strategic acquisitions. From his early career as an IDF special forces operator to building and advising brands that have generated more than $2 billion in revenue, Tom brings a rare combination of disciplined execution and bold dealmaking. A pioneer of programmatic M&A for mid-market companies, he has raised over $100 million, led multiple acquisition platforms, and now teaches 7 to 9 figure founders how to accelerate growth, close capability gaps, and engineer premium exits through smart, repeatable deals. Websites - https://www.tshipley.com/ - https://dealconlive.com/ LinkedIn - https://www.linkedin.com/in/t-shipley/ Time Stamps: 00:00 - Intro 02:47 - Buying a division of a Fortune 500 company without cash 05:05 - Scaling a beauty brand from $30k to $100M+ via acquisition 08:09 - How Mezzanine debt works (and why it's better than pure equity) 12:51 - The Golden Stat: 50% vs. 1,200% Enterprise Value growth 17:58 - The thought exercise that will force you to raise your prices today 20:41 - The biggest mistakes entrepreneurs make when selling 24:14 - Why "Day One" after closing is the most dangerous time 27:31 - What is Programmatic M&A? -- The Exit—Presented By Flippa: A 30-minute podcast featuring expert entrepreneurs who have been there and done it. The Exit talks to operators who have bought and sold a business. You'll learn how they did it, why they did it, and get exposure to the world of exits, a world occupied by a small few, but accessible to many. To listen to the podcast or get daily listing updates, click on flippa.com/the-exit-podcast/

The Art of Scaling: From Family Business to Enterprise - Rafael Pinho & Brandon Moon | 10x Your Team Ep. #457

Ever wondered how to bridge the gap between vision and execution in your business? In this conversation with Rafael Pinho and Brandon Moon, co-founders of TD Pine Advisors, Cam and Otis explore the art of scaling founder-led businesses with clarity and sustainable momentum."Scaling is not just about growth; it's about clarity and structure," Brandon explains, drawing from his extensive experience in operational upgrades and team alignment. Rafael adds, "Understanding your numbers is key to unlocking enterprise value," highlighting the importance of financial clarity in strategic decision-making.What makes this episode particularly valuable is their combined approach to business growth. From discussing the nuances of cash flow modeling and valuation to sharing insights from "Coffee with My TD Pine Advisor," Rafael and Brandon offer practical strategies for business owners ready to scale, sell, or stabilize.Whether you're a founder seeking to enhance operational efficiency or a business leader looking for financial insights, this episode provides a roadmap for building businesses that rise with confidence and clarity.More About Rafael:Rafael Pinho is a seasoned finance executive and CFA charterholder who brings a sharp analytical lens and deep strategic insight to every business challenge. As co-founder and CFO of TD Pine Advisors, Rafael helps founder-led companies understand their numbers, unlock enterprise value, and prepare for scalable growth or a successful exit. With a background in corporate finance, investment analysis, and business valuation, Rafael excels at translating complex financials into clear, actionable strategies. He's built a reputation for asking the right questions, grounding decisions in data, and helping business owners see both the forest and the trees. At TD Pine, Rafael leads the financial clarity work, whether it's cash flow modeling, valuation, capital strategy, or long-term planning, so that founders can stop guessing and start building with confidence.More About Brandon:Brandon Moon is a strategic operator with a proven track record of helping founder-led businesses scale with clarity, structure, and sustainable momentum. As the co-founder and COO of TD Pine Advisors, he specializes in bridging vision and execution, guiding clients through operational upgrades, team alignment, and enterprise value growth. With a background spanning family-business scalability, leadership development, and organizational change, Brandon brings a grounded, results-first perspective to business growth. His approach is relationship-focused focused ensuring that every business is built to rise and every founder has the clarity they need to lead. Known for his coffee-fueled insights, Brandon is also the voice behind Coffee with My TD Pine Advisor, where he answers real questions from real business owners who are ready to scale, sell, or simply stabilize.#10xyourteam #FounderLedBusiness #BusinessScaling #VisionToExecution #OperationalExcellence #FinancialClarity #EnterpriseValue #LeadershipDevelopment #StrategicGrowth #CashFlowManagement #BusinessAdvisoryChapter Times and Titles:Introduction to TD Pine Advisors [00:00 - 10:00]Meet Rafael Pinho and Brandon MoonThe journey to founding TD Pine AdvisorsBridging vision and execution in businessScaling with Clarity and Structure [10:01 - 20:00]Operational upgrades and team alignmentThe importance of sustainable momentumInsights from family-business scalabilityFinancial Clarity and Enterprise Value [20:01 - 30:00]Understanding numbers for strategic growthCash flow modeling and valuation explainedPreparing for scalable growth or a successful exitCoffee-Fueled Business Insights [30:01 - 40:00]Highlights from "Coffee with My TD Pine Advisor"Real questions from real business ownersPractical strateg

12 DAYS OF CHRISTMAS - DAY 3: What is Enterprise Value with Tej Gill

Welcome to Day 3 of our 12 Days of Christmas - Magic Moments!

How Smart Home Service Owners Should Invest (P&L, EBITDA, and Enterprise Value)

In this episode of Owned and Operated, John Wilson and Jack break down what “smart investing” actually looks like for home service operators—starting with the truth most owners miss: if you run a business, you're already an investor. You're investing money, attention, and people every day.They start with a practical framework for P&L investing (software, headcount, SG&A): if your business sells for a multiple, then any new expense should produce a return that justifies that multiple—otherwise, you may be quietly reducing enterprise value.From there, they unpack the difference between balance sheet investments (trucks, equipment, inventory) vs P&L investments, why banks and buyers mostly care about EBITDA, and how focusing on fewer initiatives can drive more profitable growth.Then they shift into the “outside the business” conversation: when diversification helps, when it's a distraction, and how operators can think in two buckets—cash-flow assets that fund life, and enterprise-value assets that build wealth.If you're adding software, hiring leaders, buying equipment, or debating real estate vs reinvesting in the core business—this episode gives you a clean way to think about ROI, focus, and capital allocation.What You'll LearnWhy every operator is an investor (capital, people, and attention allocation)A simple rule for P&L expenses: should this generate a 3x+ return based on your business multiple?The difference between investing on the balance sheet vs the P&L

Episode 382: Building Enterprise Value Through Fee-Based Transitions with David Lau

From chief marketing officer at the first internet bank to building the leading annuity platform for RIAs, David Lau shares proven strategies for raising capital, navigating public company challenges, and why converting commission-based revenue to fee-based can multiply your exit value by five times. In this episode of the DealQuest Podcast, host Corey Kupfer sits down with David Lau, founder and CEO of DPL Financial Partners, who has raised over $500 million across multiple ventures and built DPL into a platform serving more than 10,000 advisors at over 3,500 RIA firms. WHAT YOU'LL LEARN: In this episode, you'll discover why organic growth matters far more than market growth when acquirers evaluate your business, how converting commission-based annuity business to fee-based can multiply both your revenue and your exit multiple, the real tradeoffs of taking institutional capital and signing up for aggressive growth, the critical difference between venture capitalist optimism and private equity scrutiny, and how recognizing when your business has "run its course" can open the door to building something bigger. DAVID'S JOURNEY: David's career began as chief marketing officer of Telebank, the first internet bank, where he helped raise over $500 million. When preparing to go public, the stock jumped from $17 to $150 in weeks before Goldman Sachs stabilized pricing at $105. He later built Jefferson National, an insurance carrier he sold to Nationwide. That experience taught him the valuable part was distribution, not the capital-intensive balance sheet, leading directly to founding DPL in 2018. KEY INSIGHTS: A billionaire David met admitted he "mistook a bull market for brilliance." Acquirers only pay premium multiples for organic growth. If you did nothing different over the last decade as an RIA, you're making twice as much just from market performance. Buyers know this. Converting from commission to fee-based transforms exit potential with three times the revenue and five times the multiple, while expanding your buyer pool. DPL's technology reviews 2,500 policies per hour, and a significant portion of DPL's $4 billion in annuity sales were M&A related. When launching DPL, David planned to bootstrap until meeting Todd Boehly. Taking institutional capital means signing up for aggressive growth where some team members won't make it to the next stage. Venture capitalists are optimists who see your vision. Private equity investors see everything that can go wrong. Perfect for RIA owners considering M&A, hybrid advisors evaluating fee-based transitions, and entrepreneurs weighing capital raising decisions. FOR MORE ON THIS EPISODE: https://www.coreykupfer.com/blog/davidlau FOR MORE ON DAVID LAU: https://www.dplfp.com https://www.linkedin.com/in/david-lau-b6449b7/ https://x.com/dpl_fp FOR MORE ON COREY KUPFER: https://www.linkedin.com/in/coreykupfer/ https://www.coreykupfer.com/ Corey Kupfer is an expert strategist, negotiator, and dealmaker. He has more than 35 years of professional deal-making and negotiating experience. Corey is a successful entrepreneur, attorney, consultant, author, and professional speaker. He is deeply passionate about deal-driven growth. He is also the creator and host of the DealQuest Podcast. Get deal-ready with the DealQuest Podcast with Corey Kupfer, where like-minded entrepreneurs and business leaders converge, share insights and challenges, and success stories. Equip yourself with the tools, resources, and support necessary to navigate the complex yet rewarding world of dealmaking. Dive into the world of deal-driven growth today! Episode Highlights with Timestamps [00:00] - Introduction: David Lau's journey to building DPL Financial Partners [04:00] - Capital raising at Telebank: $500 million raised, stock jumping from $17 to $150 [08:00] - The tradeoffs of taking institutional capital and signing up for aggressive growth [12:00] - Venture capitalists as optimists versus private equity investors who see downside [16:00] - Why choosing the right capital partners matters more than just getting funded [20:00] - How DPL solved the RIA insurance problem with commission-free products [24:00] - Converting to fee-based: Three times the revenue and five times the multiple [28:00] - Why organic growth matters more than market growth in valuations [33:00] - The future of RIA consolidation and when to sell a business [40:00] - Freedom: Working with Russian defectors and gaining perspective Guest Bio David Lau is founder and CEO of DPL Financial Partners, the leading annuity platform for RIAs. Since 2018, DPL has worked with 20 insurance carriers and built an advisor base of more than 10,000 advisors from over 3,500 RIA firms. Before founding DPL, David was COO of Jefferson National, which he helped build and sell to Nationwide. Earlier, he served as chief marketing officer at Telebank, the first internet bank, where he helped raise over $500 million. His work has been covered in The Wall Street Journal, The New York Times, Barron's, and CNBC. DPL is backed by Todd Boehly's Eldridge and Bob Diamond's Atlas Merchant Capital. Host Bio Corey Kupfer is an expert strategist, negotiator, and dealmaker with more than 35 years of professional deal-making and negotiating experience. Corey is a successful entrepreneur, attorney, consultant, author, and professional speaker deeply passionate about deal-driven growth. He is the creator and host of the DealQuest Podcast. Show Description Do you want your business to grow faster? The DealQuest Podcast with Corey Kupfer reveals how successful entrepreneurs and business leaders use strategic deals to accelerate growth. From large mergers and acquisitions to capital raising, joint ventures, strategic alliances, real estate deals, and more, this show discusses the full spectrum of deal-driven growth strategies. Get the confidence to pursue deals that will help your company scale faster. Related Episodes Episode 350 - When NOT to Take Venture Capital with Tom Dillon: Explore alternative funding sources when traditional VC doesn't fit your exit strategy. Episode 339 - Next-Gen Leadership and M&A: Why G2 Matters: Understand why developing Generation 2 leadership commands premium valuations. Episode 209 - M&A Talk with Leading RIA Aggregators and Integrators: Bob Oros of Hightower Advisors: Explore what aggregators look for in acquisition targets. Social Media Follow DealQuest Podcast: LinkedIn: https://www.linkedin.com/in/coreykupfer/ Website: https://www.coreykupfer.com/ Follow David Lau: LinkedIn: https://www.linkedin.com/in/david-lau-b6449b7/ Company: https://www.dplfp.com Twitter/X: https://x.com/dpl_fp Keywords/Tags s RIA M&A, capital raising, fee-based revenue, commission-free annuities, DPL Financial Partners, organic growth, enterprise value, hybrid advisor transition, RIA consolidation, private equity, venture capital, going public, IPO, exit strategy, insurance for RIAs, annuity platform, wealth management M&A, financial services, startup funding, institutional capital, valuation multiples, deal structures, business growth strategies, dealmaking

Louis Diamond: Advisor Transitions, Independence, and Building Enterprise Value

Louis Diamond (CEO of Diamond Consultants) joins David DeCelle to break down what really drives advisor transitions—and how top teams evaluate moves to independence, new platforms, or M&A opportunities. Louis shares the "consultative recruiting" model his firm has built over nearly 30 years, why freedom, flexibility, and control are the three core forces behind most breakaway decisions, and what a realistic timeline looks like from exploration to execution. You'll also hear how Diamond Consultants structures compensation (including a refundable retainer approach), what their 7-step consulting framework looks like, and how advisors can avoid getting overwhelmed when independence opens up a "toy box" of tech, compliance, and infrastructure decisions. What You'll Learn The difference between traditional recruiting vs recruitment consulting Why most advisor pain points trace back to Freedom, Flexibility, and Control How Diamond Consultants helps advisors compare 3–7 best-fit destinations (wirehouse, IBD, RIA, aggregators, etc.) How fees work: firm-paid recruiting model + when a refundable retainer comes into play A realistic view of the transition timeline: 6–12 months is common, longer for breakaways How many breakaway teams simplify tech decisions by plugging into existing RIA platforms #FinancialAdvisor #RIA #AdvisorTransition #BreakawayAdvisor #WealthManagement #ModelFA #DiamondConsultants #MergersAndAcquisitions #SuccessionPlanning #AdvisorGrowth Connect with Louis: Website: https://www.diamond-consultants.com/team/louis-diamond/ LinkedIN: https://www.linkedin.com/in/louisdiamond Email: ldiamond@diamond-consultants.com --- About the Model FA Podcast The Model FA podcast is a show for fiduciary financial advisors. In each episode, our host David DeCelle sits down with industry experts, strategic thinkers, and advisors to explore what it takes to build a successful practice — and have an abundant life in the process. We believe in continuous learning, tactical advice, and strategies that work — no "gotchas" or BS. Join us to hear stories from successful financial advisors, get actionable ideas from experts, and re-discover your drive to build the practice of your dreams. Did you like this conversation? Then leave us a rating and a review in whatever podcast player you use. We would love your feedback, and your ratings help us reach more advisors with ideas for growing their practices, attracting great clients, and achieving a better quality of life. While you are there, feel free to share your ideas about future podcast guests or topics you'd love to see covered. Our Team: President of Model FA, David DeCelle If you like this podcast, you will love our community! Join the Model FA Community on Facebook to connect with like-minded advisors and share the day-to-day challenges and wins of running a growing financial services firm.

Join Newton One Advisors (Mark Singer and Steve Target) and Rich Carroll, Principal and Co-Founder of Maximus Partners, as they explore the significance of pristine historical accounting and the power of forward looking financial forecasting and budgeting. This discussion will highlight how these practices directly impact the successful and lucrative sale of privately held businesses.

Send us a textBuyers don't pay top dollar for a founder's heroics; they pay for a business that runs without the founder. We sit down with M&A advisor John Martinka to map the moves that turn people power into enterprise value, from reducing owner dependency to proving that your management team and systems deliver results without you. If you've ever wondered when to start planning an exit, how to treat addbacks, or what actually spooks a lender, this conversation is your field guide.John explains why clean, believable financials are worth far more than the taxes you think you're saving, and how sloppy addbacks quietly shave six figures off your outcome. We go deep on the HR and compliance traps—especially contractor misclassification and state-specific rules—that can crater a deal late in diligence. Then we dig into the real engine of valuation: people. Learn how to build redundancy, design retention bonuses that keep key talent through integration, and communicate culture so employees trust the transition instead of fearing it.We also lay out the biggest value drags—coasting on past wins, customer or supplier concentration, and penny-wise decisions that starve growth—and offer practical fixes you can deploy this quarter. Whether you'll sell to an outside buyer, a team, or family, the same principle holds: good businesses let sellers control the deal. Get the playbook to turn an exit into a legacy, not just a liquidity event.Subscribe for more unfiltered strategies, share with someone building something big, and leave a quick review with your top takeaway. Mention this podcast at Nokomasadvisory.com for a free e-copy of Exit Risk Style, Grace and More Money.Support the show

What Really Drives Enterprise Value (and What Destroys It) – Anthony Franco

What truly drives enterprise value - and what quietly destroys it? In this episode of Behind The Numbers With Dave Bookbinder, Dave speaks with Anthony Franco, managing partner at First Strategy, serial entrepreneur, AI strategist, and co-author of AI First Principles and the WISER Method. Anthony breaks down the core factors that influence valuation long before an owner thinks about selling. They discuss the impact of profitable revenue, clean financials, customer concentration, operational discipline, and how reducing reliance on the founder increases both value and buyer confidence. Anthony also explains why toxic employees, the “genius jackass,” and organizational apathy can erode enterprise value in ways owners often overlook. The conversation moves into practical AI adoption for mid-market companies. Anthony outlines the AI First Principles framework and the WISER Method, including specific tools and realistic first steps leaders can take to improve productivity, decision-making, and operational speed without overwhelming their teams. His guidance is grounded: AI is a force multiplier, not a job killer. They wrap with insights from Anthony's Shark Tank experience, his How To Founder podcast, and the steps every business owner can take now to protect, strengthen, and increase enterprise value. Subscribe to Behind The Numbers With Dave Bookbinder on your favorite podcast platform so you never miss an episode. If you enjoyed this conversation, please share it with your network and leave a review—it helps more business owners and advisors discover the show! About Our Guest: Anthony Franco—serial entrepreneur, AI strategist, and the co-author of AI First Principles and the WISER Method. Anthony successfully exited six of his own businesses, and spent over two decades guiding business leaders on how to grow smarter, automate strategically, and prepare for valuable exits. As the host of his own podcast, How to Founder, Anthony is passionate about sharing practical, no-nonsense strategies that entrepreneurs and business owners can immediately put into action. About the Host: Dave Bookbinder is known as an expert in business valuation and he is the person that business owners and entrepreneurs reach out to when they need to know what their most important assets are worth. Known as a collaborative adviser, Dave has served thousands of client companies of all sizes and industries. Dave is the author of two #1 best-selling books about the impact of human capital (PEOPLE!) on the valuation of a business enterprise called The NEW ROI: Return On Individuals & The NEW ROI: Going Behind The Numbers. He's on a mission to change the conversation about how the accounting world recognizes the value of people's contributions to a business enterprise, and to quantify what every CEO on the planet claims: “Our people are this company's most valuable asset.” Dave's book, A Valuation Toolbox for Business Owners and Their Advisors: Things Every Business Owner Should Know, was recognized as a top new release in Business and Valuation and is designed to provide practical insights and tools to help understand what really drives business value, how to prepare for an exit, and just make better decisions. He's also the host of the highly rated Behind The Numbers With Dave Bookbinder business podcast which is enjoyed in more than 100 countries.

Calculating NRR in Usage- and Outcome-based Pricing

In this episode, "The Metrics Brothers," Growth (Ray Rike) and CAC (Dave Kellogg), dive into a critical challenge for modern SaaS and AI-Native companies: accurately calculating Net Revenue Retention (NRR) in environments that utilize variable pricing models (usage-based, outcome-based, etc.).They begin by defining NRR, emphasizing its importance as a key metric and its high correlation with Enterprise Value-to-Revenue multiples.The brothers then dissect the primary challenge: the absence of traditional Annual Recurring Revenue (ARR) in non-annual contract models. They explore different proxies for ARR, including MRR x 12 and Implied ARR (Quarterly Revenue x 4), and discuss the pitfalls of each, particularly the risk of overstating annual revenue due to seasonality or significant one-time deals.Finally, they offer their preferred, cohort-based method for calculating NRR—the "Snowflake Method" or "Two-Year Look Back"—which compares the current revenue of a specific group of customers (cohort) to their revenue from a year ago. They conclude with a discussion on how this method helps dampen the "noise" and variability inherent in usage-based data when trying to measure expansion and contraction.

#124 The Mindset of Enterprise Value w/Louis Diamond

Financial advisors are rethinking what it means to grow, scale, and build real enterprise value. In this episode of The Stephen and Kevin Show (SK 125), we sit down with Louis Diamond, CEO of Diamond Consultants, to explore the mindset, marketing habits, and strategic decisions that separate advisors who simply manage a book from those building enduring firms.You'll discover: ✅ The mindset shifts advisors must make to thrive in independence ✅ Why enterprise value is becoming more important than AUM ✅ What advisors should expect when they take control of their own marketing ✅ Why thought leadership, video, and digital visibility matter more than ever ✅ What the most advisor-friendly firms are doing to attract top talent ✅ How to think about the next five years if you want to build something exceptionalIf you're a financial advisor who's curious about advisor movement, independence, and the marketing strategies driving top firms forward, this episode will give you a clear picture of what's working today.???? Subscribe for more financial advisor growth strategies ???? Explore coaching, digital marketing, and resources at www.Oechsli.com

JF 4099: Building Systems, Teams and Enterprise Value in CRE ft. Nick Jones

Richard McGirr interviews Nick Jones, founder and CEO of Alakai Capital, about how he scaled his commercial real estate company from a solo operation into a multi-department organization. Nick shares how he transitioned from land brokerage into development, why retail provided the best entry point for his early deals, and how cultivating tenant and broker relationships became the backbone of his growth strategy. He also discusses building organizational infrastructure—accounting, asset management, operations, and culture—to transform a deal-operator model into a scalable business. Nick JonesCurrent role: Founder & CEO, Alakai CapitalBased in: Orlando, FloridaSay hi to them at: https://alakai-capital.com/ Alternative Fund IV is closing soon and SMK is giving Best Ever listeners exclusive access to their Founders' Shares, typically offered only to early investors. Visit smkcap.com/bec to learn more and download the full fund summary. Join us at Best Ever Conference 2026! Find more info at: https://www.besteverconference.com/ Join the Best Ever Community The Best Ever Community is live and growing - and we want serious commercial real estate investors like you inside. It's free to join, but you must apply and meet the criteria. Connect with top operators, LPs, GPs, and more, get real insights, and be part of a curated network built to help you grow. Apply now at www.bestevercommunity.com Podcast production done by Outlier Audio Learn more about your ad choices. Visit megaphone.fm/adchoices

Maximizing Exit Strategies for Founders with Mark Osborne

This episode is essential for veteran entrepreneurs who want to stop chasing bad leads and start building a high-value business ready for a profitable exit. Mark Osborne dives into why "sales is a process, not an event." He shows how founders can leverage their military discipline to implement predictable, scalable B2B revenue systems. He shares that the goal is to maximize your company's Enterprise Value (EBITDA)—not just top-line revenue—by clearly defining your product's difference and building documented, transferable sales and marketing processes that any future buyer will pay a premium for. Episode Resources: FreeDownload - Modern Revenue Strategies About Our Guests Mark Osborne is the Founder of Modern Revenue Strategies. Advertising Age Magazine named him a “Marketing Technology Trailblazer” putting him in the top 25 people in the world at using Technology and Data for Marketing. He is the Author of the #1 Best-Selling B2B Marketing and Sales book “Are Your Leads KILLING Your Business?” Host of “The B2B Growth Blueprint Podcast” with over 100 episodes and Top 5 ranking in Apple Podcasts with 500+ monthly listeners. He is one of very few marketing and sales experts in the US who is a Certified Exit Planning Advisor (CEPA) with an MBA, highlighting my expertise at growing Enterprise Value and EBITDA, not just Top-line Revenue. About Our Sponsors Navy Federal Credit Union Navy Federal Credit Union offers exclusive benefits to all of their members. All Veterans, Active Duty and their families can become members. Have you been saving up for the season of cheer and joy that is just around the corner? With Navy Federal Credit Union's cashRewards and cashRewards Plus cards, you could earn a $250 cash bonus when you spend $2,500 in the first 90 days. Offer ends 1/1/26. You could earn up to 2% unlimited cash back with the cashRewards and cashRewards Plus cards. With Navy Federal, members have access to financial advice and money management and 24/7 access to award-winning service. Whether you're a Veteran of the Army, Marine Corps, Navy, Air Force, Space Force or Coast Guard, you and your family can become members. Join now at Navy Federal Credit Union. At Navy Federal, our members are the mission. Join the conversation on Facebook! Check out Veteran on the Move on Facebook to connect with our guests and other listeners. A place where you can network with other like-minded veterans who are transitioning to entrepreneurship and get updates on people, programs and resources to help you in YOUR transition to entrepreneurship. Want to be our next guest? Send us an email at interview@veteranonthemove.com. Did you love this episode? Leave us a 5-star rating and review! Download Joe Crane's Top 7 Paths to Freedom or get it on your mobile device. Text VETERAN to 38470. Veteran On the Move podcast has published 500 episodes. Our listeners have the opportunity to hear in-depth interviews conducted by host Joe Crane. The podcast features people, programs, and resources to assist veterans in their transition to entrepreneurship. As a result, Veteran On the Move has over 7,000,000 verified downloads through Stitcher Radio, SoundCloud, iTunes and RSS Feed Syndication making it one of the most popular Military Entrepreneur Shows on the Internet Today.

Building Enterprise Value in the New Age of Consolidation and the Millennial Consumer

In this episode of the Business of Aesthetics Podcast, host Don Adeesha is joined by Audrey Neff, Chief Marketing Officer at Aviva Aesthetics, to discuss a critical industry paradox: why, in a booming $25.3 billion market, do so few practices build sustainable, scalable value? Audrey lays out a blueprint for long-term success, arguing that the practices that win will be those who master generational behavior, patient experience, and recurring revenue. She identifies major industry shifts, including the intersection of wellness with functional medicine and the acceleration of private equity consolidation, which is forcing owners to think strategically about their exit from day one. A major focus is on the rise of the millennial consumer, now the largest demographic in aesthetics. Audrey explains that this group values human interaction and experiences above all else, and studies show they will pay more for a provider they trust. This makes "experience-driven marketing" the new invisible engine for growth. She provides actionable strategies for building this trust online, where millennials conduct their research, emphasizing the need to dominate Google Reviews (aiming for "triple digits") and Instagram, a platform used by 83% of millennials to research aesthetic providers. From a business perspective, Audrey advises owners to "begin with the end in mind" and operate "as if it were for sale" from the start. She warns against selling too early out of fear, noting that in a valuation, "culture is everything" because aesthetics is a human-to-human business, a nuance many investors miss. She also identifies a massive "profit leak" in most practices: retail. She urges owners to target 15-20% of gross revenue from retail, up from the common 2-5%, framing it not as being "pushy" but as a critical tool for delivering better clinical results, which in turn creates happier, more loyal patients. Finally, Audrey looks to the future, predicting that as competition increases and treatments become commoditized, differentiation is paramount. She reminds listeners, "competition only exists if you're doing the same thing as everybody else." Her key takeaway for all practitioners is to "put the noise on mute" to ignore the social media drama and "shiny new toys" and instead focus with intensity on what is happening inside their own business, with their own patients, and with their own team.

Today, I'm speaking with Jim Emerich, founder of Backbone CFO, a fractional CFO practice that specializes in supporting construction firms and manufacturers. Jim and I talk about the role data plays in making strong business decisions, and he walks me through a simplified framework he created to help identify key financial issues and constraints that often hold businesses back. The framework focuses on five core areas: cash, profit, people, systems, and position. Jim shares insights from his work with business owners and explains how financial planning and a clear understanding of enterprise value can shape the growth and scalability of a company. Whether you're running a lifestyle business or working to build long-term enterprise value, this conversation offers practical strategies to move from chaos to clarity and control. What you'll hear in this episode: [01:50] The Backbone CFO Framework [05:40] Diagnosing Financial Issues [12:55] Case Study: Financial Control Framework in Action [24:00] Understanding the Data Equity Ratio [25:30] Framework for Financial Control [26:25] Managing Inventory and Cash Conversion [27:45] Educating Business Owners on Financial Metrics [29:00] Financial Projections and Growth Planning [34:35] Balancing Tax Savings and Enterprise Value [43:25] Aligning Business Goals with Actions If you like this episode, check out: How to Build Investor-Ready Financials Your Most Expensive Habit How to Create Enterprise Value for Your Business Learn more about Backbone CFO: https://backbonecfo.com/ Learn more about our CFO firm and services: https://www.keepwhatyouearn.com/ Connect with Shannon: https://www.linkedin.com/in/shannonweinstein Watch full episodes: https://www.youtube.com/channel/UCMlIuZsrllp1Uc_MlhriLvQ Follow along on IG: https://www.instagram.com/shannonkweinstein/ The information contained in this podcast is intended for educational purposes only and is not individual tax advice. We love enthusiastic action, but please consult a qualified professional before implementing anything you learn.

Playing Your Part When Leadership Changes

In this episode, Ray Sclafani explores how advisory firm leaders can move from solo leadership to shared, high-performing teams. Using the metaphor of a musical ensemble, Ray shares lessons from his high school band and real-world coaching with billion-dollar firms to show how clarity, trust, and accountability create lasting success. Learn how to define team roles, foster trust, and lead through leadership transitions while keeping your firm's performance in harmony.Key Takeaways Leadership is most effective when responsibility is shared across the team.Clear roles help every team member understand how they contribute to the bigger picture.Trust among team members strengthens performance and accountability.Transitions in leadership are opportunities to evolve and sustain firm value.Every team member's contribution is essential, like instruments in a symphony.Click here for the Decision Making Problem Solving Model™. Find Ray and the ClientWise Team on the ClientWise website or LinkedIn | Twitter | Instagram | Facebook | YouTubeTo join one of the largest digital communities of financial advisors, visit exchange.clientwise.com.

Ep. 96: Jeremy Schein, Corsair Capital | Driving Enterprise Value in Financial Services with Strategic Collaboration

On this episode Shiv interviews Jeremy Schein, Partner and Member of the Buyouts Investment Committee at Corsair Capital, to discuss how private equity firms can drive enterprise value in financial services through collaborative operating expertise.Jeremy shares Corsair's approach to partnering with management teams in fintech, payments, and adjacent sectors, emphasizing the importance of aligning on value creation strategies early. He explores how their operating partner model leverages technical expertise in human capital, product technology, and go-to-market strategies to transform portfolio companies.He also dives into navigating the complexities of AI integration, balancing short-term priorities with long-term investments like rebranding, and ensuring management teams are equipped to execute on ambitious growth plans.

The Iconiq State of Software 2025 Report

Iconiq recently published its State of Software 2025: Rethinking the Playbook. Whenever a new industry benchmark report is published, Dave "CAC" Kellogg and Ray "Growth" Rike try to quickly read, analyze and decide if the report should be discussed on an episode of the Metrics Brothers. The Iconiq State of Software 2025 is a solid industry report that includes several key findings that Dave and Ray discuss during this episode including:Ai-Native vs AI-Enabled vs non-AI segmentationGrowth's impact on Enterprise Value to Revenue multiplesRevenue growth trends by company sizeNet Revenue Retention BenchmarksCAC Payback Period BenchmarksAdoption vs Engagement vs Outcomes for AI software companiesFunnel Conversion metrics for AI vs non-AI companiesIf you are interested in how the top tier, maybe I should say top quartile of SaaS companies are performing, in context of SaaS companies leveraging AI, those not leveraging AI and AI-Native software companies - this episode has something for everyone!See Privacy Policy at https://art19.com/privacy and California Privacy Notice at https://art19.com/privacy#do-not-sell-my-info.

Ep. 93: Kelly Ford Buckley, Edison Partners | Driving Enterprise Value Through Execution-Focused Growth Strategies

On this episode, Shiv interviews Kelly Ford Buckley, General Partner at Edison Partners, a growth equity firm with over 39 years of experience investing in high-growth software companies in secondary markets. Kelly dives into Edison's hands-on approach to value creation, emphasizing their preference for taking on execution risk over product or market risk, and how they use maturity assessments across five centers of excellence—like go-to-market, product, and finance—to identify and prioritize opportunities for portfolio companies.She shares real-world examples of transforming pricing models, aligning sales and marketing for faster growth, and building operational muscle to scale without paralysis, while stressing the importance of capital efficiency in today's macro environment. Kelly also discusses the role of AI as an efficiency tool rather than a distraction, the advantages of focusing on secondary markets for more grounded founders, and how Edison's domain expertise in verticals like fintech and healthcare IT drives repeatable success. This episode offers actionable insights for investors and operators looking to maximize enterprise value through focused, low-risk execution.

Scaling Smarter: How Fractional CFOs Unlock Enterprise Value | Ellen Wood

In this episode of the Millionaire Mindcast, Matty A. welcomes Ellen Wood, founder and CEO of VCFO, who pioneered the fractional CFO model and has supported more than 6,000 companies through growth and exit planning.Ellen shares her journey in building VCFO, the inspiration behind trademarking “virtual CFO,” and why more businesses are turning to fractional financial leadership. From the power of the V360 Assessment to the critical role of accountability and culture, Ellen outlines the strategies that differentiate businesses that scale successfully from those that stall.She also dives into common exit planning mistakes, the importance of preparation years in advance, and her perspective on the future of fractional CFO services as AI and private equity reshape the office of the CFO.What You'll Learn in This Episode:The origins of VCFO and the rise of fractional CFO servicesHow the V360 Assessment identifies risks and opportunitiesWhy accountability and culture are key drivers of valueThe biggest mistakes business owners make before an exitStrategies to scale successfully and retain top talentHow AI and private equity are transforming finance functionsEllen's personal lessons and advice to entrepreneursTimestamps: 01:00 – Ellen Wood's background and founding VCFO 03:30 – Building the fractional CFO model 07:00 – Expanding into HR and operational support 11:45 – Using V360 to prepare for growth and exit 17:30 – Culture and accountability as hidden value drivers 21:30 – Exit preparation: what most founders get wrong 25:45 – Scaling vs. stalling businesses 29:00 – The future of fractional CFO services 32:00 – Advice to her younger entrepreneurial selfConnect with Ellen Wood: LinkedIn: https://www.linkedin.com/in/ellenewood/Episode Sponsored By:Discover Financial Millionaire Mindcast Shop: Buy the Rich Life Planner and Get the Wealth-Building Bundle for FREE! Visit: https://shop.millionairemindcast.com/CRE MASTERMIND: Visit myfirst50k.com and submit your application to join!FREE CRE Crash Course: Text “FREE” to 844-447-1555FREE Financial X-Ray: Text "XRAY" to 844-447-1555

Building Enterprise Value Through Strategic Client Selection

In this episode of Building the Billion Dollar Business, Ray Sclafani explores one of the most underutilized but essential skills in financial advisory: the art of choosing clients wisely. Shifting from “more clients, more assets” to “right clients, sustainable growth,” Ray outlines how high-performing firms assess both behavioral and financial indicators to identify their next generation of A+ clients—even before they build wealth.He introduces a client selection framework that focuses on advice-receptivity, future potential, values alignment, and more—all geared toward improving enterprise value through predictable cash flow. Ray also offers coaching questions to help leaders train their teams, align their growth strategy, and build a firm designed for the future.Key TakeawaysStrategic firms focus on those who enhance predictable cash flow and align with long-term goals.Traits like curiosity, respect for process, and ambition signal a high-value client even before assets arrive.Scorecards, life-event triggers, and fee-based onboarding help firms assess clients strategically.When firms define who they're built to serve, growth strategies, referrals, and client experiences improve.Find Ray and the ClientWise Team on the ClientWise website or LinkedIn | Twitter | Instagram | Facebook | YouTubeTo join one of the largest digital communities of financial advisors, visit exchange.clientwise.com.

Ep. 110: From Novelty to Necessity: How Agentic AI Is Reshaping Enterprise Value

Agentic AI is becoming a strategic layer in enterprise operations. In this #shifthappens episode, Shashank Kapadia, AI and Machine Learning Thought Leader, shares how AI is evolving from content generator to intelligent decision-maker. He breaks down what this shift means for leaders, how to overcome adoption hurdles, and why 2025 is the breakout year for agentic AI. Shashank Kapadia's comments and opinions are provided in their personal capacity and not as a representative of Walmart. They do not reflect the views of Walmart and are not endorsed by Walmart.

Exiting Your Trade Business For High Multiples (Enterprise Value) | ft. Jeff Armstrong | Ep. 461

Send us a textIn this episode, host Matt Jones sits down with Jeff Armstrong from Cultivate Advisors—a seasoned entrepreneur and expert in helping business owners unlock the true value of their companies. Building on conversations from previous episodes about buying and selling trade businesses, Matt and Jeff dig deep into what it really takes to prepare your business to be an attractive, saleable asset.⏱️ Timestamps:00:00 Trade Business Mergers & Sales Insights05:04 Business Owners' Ownership Transfer Blind Spot08:17 "Business Exit Strategy Insights"12:05 Business Health Score Evaluation15:11 "Evaluating Enterprise Value"18:51 Owner Dependency in Business Operations22:21 "Exit Planning Methodology Overview"24:19 "Measuring Success Beyond Financial Metrics"29:32 Transitioning to Paid Marketing Strategies32:47 Business Evaluation and Future Planning34:10 Customized Growth Strategy Blueprint37:31 Discussing Business Exits and ValueTakeaways:Why 70% of trade businesses never sell—and how to avoid being one of themWhat “enterprise value” actually means for tradies, and why it mattersThe top blind spots that keep owners stuck as the main cog in the machineHow to turn your business into a cash cow OR sale-ready assetJeff shares powerful insights into the concept of “enterprise value,” explaining why most business owners mistakenly view their companies as just income producers rather than valuable, transferable assets. The conversation explores common blind spots, key value drivers like owner dependency and financial clarity, and practical steps you can take—even if you're not planning to sell right away—to build a business that runs without you and stands out to buyers or investors. Get FREE marketing insights for your business when you complete the Opportunity Scorecard - https://go.tradiewebguys.com.au/ Don't let your business fall behind—explore the power of AI with Tradie Hub. Visit tradiehub.net to see the innovative AI tools crafted just for tradies. Discover how you can stay ahead and transform your business with cutting-edge technology!

426: Building Enterprise Value for Entrepreneurs with Steve Toth

SummaryIn this week's episode of Startup Junkies, hosts Daniel Koonce, Caleb Talley, and Jeff Amerine are joined by Steve Toth, CEO of Crestline Leaders, a company helping high-capacity leaders move their enterprises forward. Steve's entrepreneurial journey is as hands-on as it gets. He chronicled his early days rebuilding Volkswagen motors before discussing his role in co-founding Tango Press, a corrugated packaging startup that he grew and successfully exited.One standout insight was Steve's emphasis on integrating people and culture strategies from the beginning. He argues that no business can thrive or be successfully exited unless it's built on trust, documented systems, and well-defined accountability. Steve explains how risk management, strategy, and a focus on enterprise value need to be front and center, no matter your stage of growth. Additionally, he shared advice for entrepreneurs: think about succession and exit from day one. If your business cannot thrive without you, then there's work to be done. For anyone building a business with an eye toward value creation and longevity, Steve's blend of practical, people-first advice and battlefield-tested experience makes this episode a must-listen!Show Notes(00:00) Introduction(04:27) Building Transferable Business Value(12:06) A Prioritized Risk Management Approach(18:00) The Importance of Enterprise Value in Exiting(25:33) Utilizing a Hands-On Leadership Transition(30:00) Rethinking Work-Life Balance(38:01) Focusing on a Growth Mindset(40:36) Closing ThoughtsLinksDaniel KoonceCaleb TalleyJeff AmerineStartup JunkieStartup Junkie YouTubeSteve TothCrestline Leaders

Episode 356: Building Enterprise Value Through Intentional Business Design with Scott Beebe

Eighty percent of business owners have eighty percent of their net worth locked in their business.But only twenty percent of businesses survive to see their tenth birthday.This conversation will change how you think about building enterprise value forever.Scott Beebe didn't just build a successful consulting practice...He proved that the secret to enterprise value isn't your product, your market, or your marketing.Scott is the founder of Business on Purpose and certified exit planning advisor who has helped hundreds of business owners liberate themselves from chaos while building sellable assets.In this DealQuest Podcast episode, I sat down with Scott to uncover the real drivers of enterprise value and why most businesses fail the ultimate test.In our conversation, we explored: The eighty percent rule that destroys most businesses Why your product isn't actually your product The enterprise value litmus test every owner should know How to break free from "hero complex" that kills scalability The five meeting types that build culture and systems Cash domination strategies that put owners in control And much more!Whether you're planning an exit in two to three years, building for long-term growth, or struggling with operational chaos, this conversation provides actionable frameworks for immediate implementation. • • •FOR MORE ON THIS EPISODE:https://www.coreykupfer.com/blog/scottbeebe• • • FOR MORE ON SCOTT BEEBECompany: https://www.businessonpurpose.com Assessment Tool: https://www.businessonpurpose.com/healthy Books: "Let Your Business Burn" and "The Chaos Free Contractor" FOR MORE ON COREY KUPFERhttps://www.linkedin.com/in/coreykupfer/https://www.coreykupfer.com/ Corey Kupfer is an expert strategist, negotiator, and dealmaker. He has more than 35 years of professional deal-making and negotiating experience. Corey is a successful entrepreneur, attorney, consultant, author, and professional speaker. He is deeply passionate about deal-driven growth. He is also the creator and host of the DealQuest Podcast.Get deal-ready with the DealQuest Podcast with Corey Kupfer, where like-minded entrepreneurs and business leaders converge, share insights and challenges, and success stories. Equip yourself with the tools, resources, and support necessary to navigate the complex yet rewarding world of dealmaking. Dive into the world of deal-driven growth today!

Justin Donald, The Lifestyle Investor…Living Life On His Own Terms

On this episode of the Positive Enterprise Value Podcast we are joined by Justin Donald an entrepreneur, investor, and author of the Lifestyle Investor. Justin's built a stellar reputation helping other successful founders and entrepreneurs move from being what he calls “time starved operators,” to becoming intentional investors who design their lives around freedom, not just financial returns. You know how I feel about entrepreneurs their freedom and intention. So, this conversation with Justin isn't merely about capital or cash flow, it's about something vastly more valuable. It's about the invisible inflection points. When an entrepreneur wakes up and says, “Holy smokes, there's gotta be a better way to live!” What does success feel like anyway? It's about the psychology of letting go, the courage to slow down, and the quiet discipline required to live life on your own terms. Really. To put your lifestyle first. Do you own your business, or does your business own you? So, if you're someone who spent years building Enterprise Value and you're wondering what it means to build personal value, this episode is for you.

In this episode of Building the Billion Dollar Business, Ray Sclafani challenges advisory firm leaders to adopt a shareholder mindset by asking a powerful question: What's your stock worth? While traditional metrics like AUM, revenue, and profit margins signal a thriving business, they don't fully reflect enterprise value—especially when planning for succession or outside investment.Ray walks through four key metrics that valuation experts use: EBITDA multiples, free cash flow, recurring revenue, and reinvestment strategy, and explains why every billion-dollar RIA should track an implied share price just like a public company. He outlines how creating a simple, annual “financial DNA” slide can drive internal dialogue, next-gen engagement, strategic clarity, and market appeal.To close, Ray offers four coaching questions to help advisors reframe how they lead, grow, and position their firm for long-term value creation.Key TakeawaysEvaluate your firm like a public company.Focus on EBITDA and free cash flow.Recurring revenue enhances valuation.Reinvestment strategies are crucial for growth.Create a financial DNA slide deck annually.Engage next-gen leaders as shareholders.For more information click here to visit the Best in the Business Blog.Find Ray and the ClientWise Team on the ClientWise website or LinkedIn | Twitter | Instagram | Facebook | YouTubeTo join one of the largest digital communities of financial advisors, visit exchange.clientwise.com.

This season features conversations with key decision-makers who have shaped the evolution of today's leading technology platforms and ecosystems. We talk to C-suite executives, board members, investors, and others who must be bought into the platform journey.In this episode, Avanish and Greg discuss:Greg's journey at the intersection of technology and professional services, including his role building EY's global partnerships practice into a substantial business driverWhy most companies remain confused about partnerships, platforms, and ecosystems, and how successful companies are "built from the ground up" to orchestrate ecosystemsMicrosoft's transformation under Satya Nadella as the gold standard for ecosystem strategy - shifting from competing against everyone to becoming a platform that orchestrates the capital of hundreds of thousands of companiesWhy the future belongs to companies that shift from linear value chains to orchestrated ecosystems where they either orbit around or become the center of mass for other participantsThe urgency for C-suites to think beyond operational AI improvements and envision what their industry will look like in five yearsHost: Avanish SahaiAvanish Sahai is a Tidemark Fellow and served as a Board Member of Hubspot from 2018 to 2023; he currently serves on the boards of Birdie.ai, Flywl.com and Meta.com.br as well as a few non-profits end educational boards. Previously, Avanish served as the vice president, ISV and Apps partner ecosystem of Google from 2019 until 2021. From 2016 to 2019, he served as the global vice president, ISV and Technology alliances at ServiceNow. From 2014 to 2015, he was the senior vice president and chief product officer at Demandbase. Prior to Demandbase, Avanish built and led the Appexchange platform ecosystem team at Salesforce, and was an executive at Oracle and McKinsey & Company, as well as various early-to-mid stage startups in Silicon Valley.About GregGreg is the Founder of Sarafin Advisory which he launched in 2024 to provide companies with actionable advice and insights to help them grow Enterprise Value in an era of immense change and opportunity. Previously, Greg spent over 9 years at EY where he was most recently the Global Vice Chair - Alliances and Ecosystems. Prior to joining EY in 2015, he spent seven years as an executive at IMB, running one of the top five accounts at the firm and then managing the professional services P&L for Banking and Financial Markets in North America. He also held significant leadership positions in financial service technology and digital disruption across industries. In addition, he helped found a health payments dot-com and, prior to that, ran his own software development company.About TidemarkTidemark is a venture capital firm, foundation, and community built to serve category-leading technology companies as they scale. Tidemark was founded in 2021 by David Yuan, who has been investing, advising, and building technology companies for over 20 years. Learn more at www.tidemarkcap.com.LinksFollow our guest, Greg SarafinFollow our host, Avanish Sahai

269. Levers To Pull To Build Your Brand's Enterprise Value—Zack Fishman

How are you building the enterprise value of your company? What types of marketing and PR are you doing to help create awareness? Our guest today is Zack Fishman, and he shares with us the some of the levers to pull to build your brand's enterprise value.TODAY'S WIN-WIN:The rush to the space to become more "professionalized” is happening across franchising. This is raising the bar for franchising in general.LINKS FROM THE EPISODE:Schedule your free franchise consultation with Big Sky Franchise Team: https://bigskyfranchiseteam.com/. You can visit our guest's website at: https://fishmanpr.comAttend our Franchise Sales Training Workshop: https://bigskyfranchiseteam.com/franchisesalestraining/Connect with our guest on social:https://www.linkedin.com/in/zack-fishman/ABOUT OUR GUEST:Zack has been involved in the franchise space since he could walk (literally), devoting his life to understanding all facets of the industry. Currently, Zack is the Chief Growth Officer for Fishman PR, the world's foremost PR firm specializing in franchising and Franchise Elevator, the world's preeminent emerging brands PR firm.In his spare time, Zack is also the Co-Founder of Franchise YoungConference, the only conference for Millennial/Gen-Z franchise executives, Host of Modrn Business Podcast, an award-winning podcast focusing on showcasing franchising's most exciting entrepreneurs and is Partner & COO of Franchise Supplier Network, where he specializes in matching franchisors with best-fit suppliers.ABOUT BIG SKY FRANCHISE TEAM:This episode is powered by Big Sky Franchise Team. If you are ready to talk about franchising your business you can schedule your free, no-obligation, franchise consultation online at: https://bigskyfranchiseteam.com/.The information provided in this podcast is for informational and educational purposes only and should not be considered financial, legal, or professional advice. Always consult with a qualified professional before making any business decisions. The views and opinions expressed by guests are their own and do not necessarily reflect those of the host, Big Sky Franchise Team, or our affiliates. Additionally, this podcast may feature sponsors or advertisers, but any mention of products or services does not constitute an endorsement. Please do your own research before making any purchasing or business decisions.The information provided in this podcast is for informational and educational purposes only and should not be considered financial, legal, or professional advice. Always consult with a qualified professional before making any business decisions. The views and opinions expressed by guests are their own and do not necessarily reflect those of the host, Big Sky Franchise Team, or our affiliates. Additionally, this podcast may feature sponsors or advertisers, but any mention of products or services does not constitute an endorsement. Please do your own research before making any purchasing or business decisions.

In this episode, Shannon breaks down the essential steps to building enterprise value in your business. Whether you're planning to scale, sell, or simply want to create a more resilient and valuable company, Shannon shares practical strategies and mindset shifts to help you get there. Tune in to focus on intentional budgeting and aligning expenses with your growth goals. What you'll hear in this episode: [1:40] The Power of SOPs, Processes, and Documentation [3:35] Managing Risk: Tax, Legal, and Cybersecurity Essentials [7:15] Building a Business People Want to Work For (Culture & Attractiveness) [9:50] Reducing Key Man Risk & Empowering Your Team [12:25] Aligning Costs with Profit & Offers Learn more about our CFO firm and services: https://www.keepwhatyouearn.com/ Connect with Shannon: https://www.linkedin.com/in/shannonweinstein Watch full episodes: https://www.youtube.com/channel/UCMlIuZsrllp1Uc_MlhriLvQ Follow along on IG: https://www.instagram.com/shannonkweinstein/ The information contained in this podcast is intended for educational purposes only and is not individual tax advice. We love enthusiastic action, but please consult a qualified professional before implementing anything you learn.