Podcasts about Woo

- 3,833PODCASTS

- 8,467EPISODES

- 55mAVG DURATION

- 1DAILY NEW EPISODE

- Feb 27, 2026LATEST

POPULARITY

Categories

Best podcasts about Woo

Latest news about Woo

- The Cost of Not Having Health Insurance The Atlantic - Mar 2, 2026

- Sunday's opening shot EV Grieve - Mar 1, 2026

- Bitcoin Sell-Off Slows Down, But The Road To Recovery Is Long — Analyst NewsBTC - Feb 27, 2026

- Stream Vibora’s New Screamo Opus Egin Ez Dugun Guztia Stereogum - Feb 23, 2026

- Cody Overton Halts World Of Outlaws Run Amid Engine Woes Yahoo! Sports - Feb 21, 2026

- Gold Will Likely Outperform Bitcoin for Years As ‘Quantum Cloud’ Hangs Over BTC’s Head: Analyst Willy Woo The Daily Hodl - Feb 18, 2026

- Olympics in Milan: The women of USA Hockey are going for the GOLD! Jeff Cable's Blog - Feb 17, 2026

- Gutenberg Times: Block Theme Guide, AI Galore, Icon Block, WordPress 7.0 — Weekend Edition 357 WordPress Planet - Feb 14, 2026

- Vibestemics LessWrong - Feb 4, 2026

- Adam the Woo's family shares the YouTube personality's cause of death California - Jan 27, 2026

Latest podcast episodes about Woo

Paul Skenes or Garrett Crochet? Greene or Brown among the Hunters? How high can Chase Burns and Nolan McLean climb? These and many more questions are answered as Vlad Sedler and Jason Anthony tier up and analyze the top 50 starting pitchers through ADP 200. Enjoy! Episode Guide News and Notes Brandon Woodruff, Royce Lewis, Merrill Kelly, Chase DeLauter and more Starting Pitcher Tiers for 2026 (pt 1) An overview of 2025 results Tier 1a - Skubal, Skenes and Crochet Tier 1b - Who do we trust most among Woo, Gilbert, Yamamoto, Sanchez and Sale? Tier 2 - Cole Ragans, Hunter Brown, Hunter Greene, Freddy Peralta, Jacob deGrom. Does Logan Webb belong? Tier 3 - Some love for The Lizard, McLean Helium Rising, Solid Old Nick, Knuckleheads and Innings Limits Tier 4 - King vs. Pepiot vs. Gavin Williams; Any love for Strider? Sheehan vs. Yesavage, and more Tier 5 - A sneaky value; what about Bubba, Rogers, The Miz? Tier 6 - Three Cubs SPs behind good defense; expectations for Rodon, Baz, Castillo and Mackenzie Gore Join FTN FANTASY BASEBALL for 2026 as we help you crush your fantasy leagues! In addition to our Custom Projections, Roto and Underdog Rankings and incredible tools and content, we will be introducing amazing, new stuff such as our Top 500 Dynasty Rankings, Points Rankings, Customizable PDF Cheat Sheets and various versions for different formats of Vlad's popular GRID RANKINGS. Draft Content Hub: https://ftnfantasy.com/mlb/fantasy-baseball-draft-content-hub Rankings: https://ftnfantasy.com/fantasy/mlb/rankings Projections: https://ftnfantasy.com/mlb/custom-rankings-and-projections Cheat Sheets: https://ftnfantasy.com/mlb/fantasy-baseball-cheat-sheets Use promo code GUT26 for 10% off at FTN FANTASY today! Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

Time to discuss a 24 team playoff! WOO! WE ALL WANT THIS.

Join your tour guides Dan Hansen, Cody Havard and Stan Solo as they talk about their favorite Disney infulencers that influence them. Plus cheap seats before good seats, Adam the Woo forever, how influencers help enchance our experiences, seeing the world through their eyes, and more! Follow us on Facebook at Disney Friends of the Grand Circle Tour Podcast, on Instagram at @grandcircletourpodcast and on YouTube at @grandcircletour Brought to you by https://celebratingflorida.com/ and https://mei-travel.com/ The Grand Circle Tour Podcast is in no way part of, endorsed or authorized by, or affiliated with the Walt Disney Company or its affiliates. As to Disney artwork/properties: © Disney. Disclosure | Privacy Policy

This week, Chili Bowl champion and World of Outlaws driver for KP Motorsports, Emerson Axsom joins Steve Post and Erin Evernham to talk about winning the Chili Bowl, preparing for the 2026 WoO season, switching teams last year and much more.See Privacy Policy at https://art19.com/privacy and California Privacy Notice at https://art19.com/privacy#do-not-sell-my-info.

Recorded on the fly during art fair week, live at NADA, this conversation with Dan Attoe moves from metal-kid origin stories to Zen meditation, daily practice, tattooing, landscape painting, and the unexpected turn toward writing a horror novel. Duncan opens with a personal note: a Dan Attoe painting has been hanging in his home for 22 years, a wedding gift that quietly embedded itself into the fabric of his life, which frames the conversation, and traces Attoe's arc from rural Idaho and northern Minnesota outsider to one of the most recognizable painters of his generation. Attoe talks about the seven-year run of making a painting every weekday, a discipline that functioned less as a productivity hack and more as a survival strategy. What began as wild, sex-and-drugs-and-rowdy-party imagery rooted in imagined social worlds gradually shifted toward the meditative landscapes he's now known for. These aren't observed sites but constructed psychic spaces, built from memory, attention, and what he calls a process of "composting" experience. Zen practice, daily drawing, and tattooing form a three-part studio structure that keeps the work in motion. Learning to tattoo on his own body sharpened his attention to contrast, permanence, and empathy, feeding directly back into the paintings. Along the way we get patches, skate culture, Methodist guilt, Barry McGee installations, Walker Art Center bookstore theory dives, and the long road from being told to abandon heavy-metal imagery to fully embracing it as the engine of a mature practice. The conversation closes on writing: how Stephen King, the Iowa Writers' Workshop, and decades of accumulated art-world experience led Attoe to channel theory, narrative, and lived history into a horror novel. It's a talk about attention, energy, and letting the work tell you what it needs to become. Images courtesy of Western Exhibitions - A party for children, 2019 India ink and graphite on paper 7h x 7w in Fingertip Mountain, 2020 Oil on Canvas on Panel 24h x 24w in Forest Path with Glowing Orb, 2021 Oil on Canvas on Panel 36h x 24w in Dual Falls with Painted Arches, 2021 Oil on Canvas on Panel 36h x 24w in Names Dropped: Dan Attoe — https://www.danattoe.com Dan Attoe at Western Exhibitions — https://westernexhibitions.com/artists/dan-attoe Dan Attoe at PPOW — https://ppowgallery.com/artists/dan-attoe/ Clouds Tattoo (Attoe's shop) — https://www.cloudstattoo.com A Talking Tree — https://www.amazon.com/Taking-Tree-Dan-Attoe/dp/B0D4JGYR2F Barry McGee — https://www.ratio3.org/artists/barry-mcgee Chris Johanson — https://altman-siegel.com/artists/chris-johanson Jean-Michel Basquiat — https://gagosian.com/artists/jean-michel-basquiat/ Titian — https://www.nationalgallery.org.uk/artists/titian Giorgione — https://www.nationalgallery.org.uk/artists/giorgione Arthur Danto — https://www.columbia.edu/cu/philosophy/faculty/danto.html Dr. Woo — https://drwoo.com Natalie Goldberg — https://nataliegoldberg.com Stephen King — https://stephenking.com George Saunders — https://georgesaundersbooks.com Zen and the Art of Motorcycle Maintenance — https://www.harpercollins.com/products/zen-and-the-art-of-motorcycle-maintenance-robert-m-pirsig Jean-François Lyotard — https://plato.stanford.edu/entries/lyotard/ Jean Baudrillard — https://plato.stanford.edu/entries/baudrillard/ Walker Art Center — https://walkerart.org Iowa Writers' Workshop — https://writersworkshop.uiowa.edu Iron Maiden — https://www.ironmaiden.com Danzig — https://www.danzig-verotik.com Twin Peaks — https://www.sho.com/twin-peaks Dragonlance / Larry Elmore — https://larryelmore.com New Art Dealers Alliance –– https://www.newartdealers.org/

In this third episode of The Skeptical Shaman podcast, host Rachel White (of TOTEM Readings) chats with "Alexis Vale", aka Alan Furth-- the mind behind the incredible Hidden Frameworks Substack, sharing his own meandering explorations in the realm of synchronicity, serendipity, and the ancient concept of Wu Wei: the "invisible river" flow state that we can fall into such that it carries us along-- without us needing to force it!In this episode, Rachel and Alexis discuss the long and strange journey that comes along with following the breadcrumbs out of a life in corporate captivity-- and just how magical and disorienting it can be to listen to your intuition instead of just your logical mind. Am I going through a spiritual awakening and following my soul's purpose, or am I going through a nervous breakdown and need to check myself in somewhere?The difference between these two possibilities when you're "in the messy middle" is a lot more subtle, nuanced and fungible than you would think, so it takes a lot of courage and self-belief to keep on meandering out of the prescribed loop society set out for you and, instead, make your way to the feral borderlands of the Woo.Alexis' story is so engaging because it's still unfolding-- and publicly, on his incredible Substack and via his alter ego, named Alexis!LINKS:TOTEM Readings Website: https://www.totemreadings.comTOTEM Readings Substack: https://totemrach.substack.comRachel's Other Links: https://linktr.ee/totemrachPlease support the Sponsors of The Skeptical Shaman Podcast:TOTEM + PUCK HCKY Merch Drop: https://puckhcky.com/collections/totemThe TOTEM Flower Essence Deck: https://a.co/d/gw16LsGThe TOTEM Flower Essences: https://www.etsy.com/shop/TotemReadingsATXTOTEM Spiritual Transformation Coaching: https://www.totemreadings.com/coachingTOTEM Business of Woo Mentoring: https://www.totemreadings.com/business-of-wooAlexis' Links: https://substack.com/@alexisvalehttps://www.linkedin.com/in/alanfurth/Please note: The views and opinions expressed on The Skeptical Shaman do not necessarily reflect the official policy or position of the podcast. Any content provided by our guests, bloggers, sponsors or authors are of their opinion and are not intended to malign any religion, protected class, group, club, organization, business individual, anyone or anything. And remember: sticks and stones may break our bones, but words—or discussions of religious or spiritual topics-- will never hurt us.

A tough-as-nails cop (Chow Yun-Fat) teams up with an undercover agent (Tony Leung Chiu-Wai) to shut down a sinister gun-runner (Anthony Wong) and the rest of his gang in Hong Kong.That's the standard IMDB description for the plot of this film but as directed by master action autuer John Woo (The Killer, A Better Tomorrow, Face/Off, Mission Impossible II), it's SO much more! Infact this is now remembered as one of the more influential action films of the 1990's featuring Woo's unique blend of balletic action, melodramatic flourishes, and doves. (Well in this case, origami doves) Beloved action star Chow Yun Fat (Crouching Tiger Hidden Dragon, The Killer) leads the charge as "Tequila," a Hong Kong super-cop who has it all: he's good with babies, he plays a mean clarinet, and he can dispatch with any number of bad guys with a nickel-plated Norinco pistol in each hand. ;) Decades before John Wick would reinvent the action genre with "gun fu," this international sensation did it first....and better? Host: Geoff GershonEdited By Ella GershonProducer: Marlene Gershon Send a textSupport the showhttps://livingforthecinema.com/Facebook:https://www.facebook.com/Living-for-the-Cinema-Podcast-101167838847578Instagram:https://www.instagram.com/livingforthecinema/Letterboxd:https://letterboxd.com/Living4Cinema/

This week on the Action Movie Guys Podcast, Alex and Nate dive into Mission: Impossible 2 (2000). Directed by John Woo, this sequel takes Ethan Hunt into full slow-motion, dual-pistol, doves-flying action mode.With its stylized action, motorcycle chases, and over-the-top Woo flair, does M:I-2 hold up after all these years? Or is it the most divisive entry in the franchise? Tune in as Alex and Nate break down the action, the tone shift from the first film, and whether this sequel still delivers explosive thrills.

It's the Season 7 kickoff, everyone! Woo! We're back with Ghost Hunt TV, but coming at it from a different angle. On this episode, meet the new interns--definitely not the same as the old interns! And join them as they delve into the heart of Portland, Oregon's Shanghai Tunnels as they try not to let the light go out while we play the Shadowdark RPG, by Kelsey Dionne! You can find more Ghost Hunt TV goodies at ghosthunttv.com. We're also at gothicpodcast.com and on all sorts of social media. The Gothic Podcast is an actual-play horror-and-humor audio drama recorded from our cobbled together studios in Portland, OR and around the globe. This episode stars C. Patrick Neagle, Sharon Gollery-LaFournese, Jesse Baldwin, and Erik Halbert. We're using rules from the Shadowdark RPG, by Kelsey Dionne. We would LOVE to hear from you, and we love your fan art. Plus check out our Patreon and join our Discord. Preeeety puhleeeese. Oh, and check out Jesse's upcoming shows at www.torchsongentertainment.com Interact with the Gothic Podcast at YouTube: https://www.youtube.com/channel/UCbUoGEQE2xKIhNX7sHyVXBg Instagram: https://instagram.com/thegothicpodcast Facebook: https://facebook.com/thegothicpodcast Tumblr: https://thegothicpodcast.tumblr.com ...and Discord (

School of the Holy Beast - Heroes Three Gaiden

Thing are weird in Heroes Three HQ, so welcome back to another Heroes Three Gaiden: Three is (Not) the End. This week, Matthew is joined by Jennifer and Joey to discuss pink film, nuns, and lack of subtley with School of the Holy Beast (1974), directed by Norifumi Suzuki. AKA The TransgressorFollow Jenn on Bluesky and LetterboxdFollow Joey on Bluesky and Pachinko Pop on LetterboxdFull cast and credits - IMDBFind us online - https://linktr.ee/Heroes3PodcastEmail us! - heroes3podcast@gmail.comCheck out some H3 art and merch! - https://www.teepublic.com/user/kf_carlito Timestamps(00:00) Intro(02:00) Movie Background(05:27) Quick Recap(07:40) Our Leading Lady, Yumi Takigawa(10:34) Highlights(33:29) Home releases for Suzuki's movies(36:10) Final Thoughts(38:51) Plugs and the end

This week World of Outlaws driver for Stenhouse Jr/Marshall Racing Spencer Bayston joins Steve Post and Erin Evernham. The winner of the first WoO race of 2026 at Volusia talks about joining SJM Racing, getting to know the team, is relationship with the owners, getting ready to head back to Volusia, t-shirt sales and more. See Privacy Policy at https://art19.com/privacy and California Privacy Notice at https://art19.com/privacy#do-not-sell-my-info.

We did it, another year in the books for the LJN crew! The LJN gang discuss where we made our biggest mistakes in 2025. It's an open discussion regarding the LJN Game Ratings. Woo!

#25 - Grimmlife Collective Returns (Michael Kolence & Jessica Kolence)

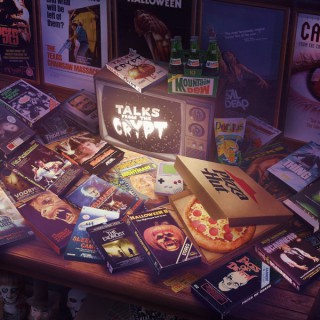

Grimmlife Collective is a horror and true-crime travel channel hosted by Michael and Jessica Kolence, known for exploring filming locations, cemeteries, abandoned sites, and dark history locations across the world. Their work blends on-location storytelling, horror fandom, and documentary-style deep dives into the strange and macabre.From traveling Europe and Disney cruises to abandoned videos, fear of flying, prophetic dreams, and night terrors. We talk Dark Universe, react to the Scream 7 release and trailer, get into horror sequels and fan theories, and why trailers are ruining movies. We get into the real exorcism of Anneliese Michel, listening to the tapes, covering Ted Bundy, being contacted by victims of cold cases, and why we're fascinated with the morbid in the first place.Michael and Jessica open up about convention politics, celebrities who don't care, the horror industry being highly competitive and cliquish, navigating social media hate, insecurities on camera, and why they stopped daily vlogs. We also get into aliens, Bigfoot, Area 51, conspiracy theories, world-ending scenarios, and the strange psychology behind negativity in the YouTube community.—Subscribe: youtube.com/@TalksFromTheCryptFollow On Social Media –Talks From The Crypt: https://instagram.com/talksfromthecrypthttps://talksfromthecrypt.com Grimmlife Collective: https://instagram.com/grimmlifecollectivehttps://grimmlifecollective.com Jessica Kolence: https://instagram.com/witchydamehttps://www.youtube.com/BabyGhoulAsmr—00:00:00 – Intro00:00:57 – Traveling the World: Europe, Disney Cruises, Abandoned Videos, Living Life Through A Lens00:06:21 – Dark Universe, Movie Trailers, Bone Temple, Scream 7 Teaser Reaction, Scream Fan Theories, Sequels and Remakes00:16:29 – Vegas and LA Tear Everything Down, Embracing History, Fear of Flying, Prophetic Dreams, and Night Terrors00:26:59 – Conventions/Signings, Celebrities That Don't Care and Bad Experiences With Them, Being In a Bad Mood While Signing00:37:00 – Horror Fans Are Great, But the Horror Industry is HIGHLY Politicized and Competitive. Not Letting the Professional Side Override the Fan Side.00:44:50 – Navigating Social Media, Creativity, Still Getting Nervous, Jessica Starting Her Own Channel, Why They Stopped Vlogs, and Insecurities00:58:56 – Area 51 Skit, Believing In Aliens, The Pyramids, Big Foot, Loch Ness Monster, Unannounced Projects01:11:27 – The Real Exorcism of Anneliese Michel, Listening to the Exorcism Tapes01:28:08 – Covering True Crime, Ted Bundy, Getting Contacted By Victims of Cold Cases, Sleepy Hollow01:38:58 – Why Are We Fascinated With Morbid Subjects?01:45:00 – Addressing the Haters in the Comment Section, Engaging With Fans, Pet Peeves of the "YouTube Community"02:00:00 – Adam the Woo's Passing, Telling People You Care, Staying Positive, Separating Work Life From Personal Life02:09:50 – World Ending Conspiracies02:20:14 – Anticipated Films of 2026, Going to the Movies, Theater Etiquette, Who Still Watches 3D02:29:33 – TFTC Poster, Grimmlife Socials, and Outro—Copyright Disclaimer (Fair Use Notice):Under Section 107 of the Copyright Act 1976, allowance is made for fair use for purposes such as criticism, comment, news reporting, teaching, scholarship, education, and research. Fair use is a use permitted by copyright law that might otherwise be infringing. All media used in this video are for the purpose of commentary, analysis, and education under fair use.

We are pleased to have been able to spend time with Judiaann Woo on our podcast. Judiaann has her pulse on the food world, which comes from a multi-faceted background and perspective, She shares her journey from a childhood passion for food to her move to New York, where she went from the French Culinary Institute to various high level pastry chef positions, eventually realizing that the kitchen wasn't going to be the place where she would thrive. She made some adjustments, while also accommodating her relationship in New York, to become a prominent figure in the culinary world before returning to Portland.. Chris and Judiaann discuss her experiences in high-end kitchens, the transition to food consulting and the impact of social media and influencer marketing on the food and travel industry. Ms Woo talks about the importance of authenticity in storytelling and the role of family values --the child of Korean immigrants -- in shaping her career. The discussion also touches on the challenges faced by the restaurant industry during and after the pandemic and the exciting renaissance of Portland's food scene, which has always had Oregon's intense agricultural richness as a foundation for the talent and food enjoyed by many. Judiaann is a thoughtful, intelligent professional who has had an impact on many businesses and organizations. A must-listen! Right at the Fork is made possible by: Zupan's Markets: www.zupans.com RingSide SteakHouse: www.RingSideSteakhouse.com Portland Food Adventures: www.PortlandFoodAdventures.com

Time traveling to UNIVERSAL STUDIOS Hollywood in the year 2000….You know we're out of ideas when we break out the home movies…Ever wanted to know what it's like to film on New York Street or “Jurassic Park?” How about “Back to the Future” or “The Burbs”. We go inside the Bates Motel and even get an up close look at the hero “A” car BTTF Time Machine. This is one I wanted to do with Adam the Woo. Now, we're sharing with you. Life is short. Love one another and live it while ya got it.Comments LIVE all show long… chime in with comments, questions, uncontrollable laughter from J's voice in the year 2000.Thank you for being with us. #latenightplayset #coasttocoast

In this long-awaited episode of The Skeptical Shaman podcast, host Rachel White (of TOTEM Readings) chats with Clay Martin, Priest of the Path of the Barbarian Spirit and author of three incredible books including: Barbarian Spirit, Prairie Fire, and Wrath of the Wendigo. Clay has taken an unusual-- but very shamanic-- road to becoming a full-time Woo Woo practitioner. He had a long and illustrious military career in active duty, having served as an infantryman, Scout Sniper, and Reconnaissance Marine and, after transitioning to the Army, he joined the 19th Special Forces Group before returning to active duty with the 3rd Special Forces Group. In 2013, Clay was medically retired, and what followed was a difficult spiral into chaos. But, in 2022, Clay underwent transcranial magnetic stimulation therapy for traumatic brain injury. Six months later, he had his first psilocybin experience. Clay now calls psilocybin "the Sacrament", and believe that true healing begins at the spiritual level. Since his use of the Sacrament, he has encountered Norse gods, channeled visions of the future, and dedicated himself to a life of healing service to other wounded warriors. He is also now an active, working priest in his pagan church, reconnecting military veterans to the old gods and the old ways. Clay upends everything The Business of Woo tells you a New Age practitioner looks, sounds, and acts like. This episode kicks off our dude-only season of the podcast for precisely this reason: men are often underrepresented and underserved by the Business of Woo, often feeling alienated and "uninvited" to this space. The result? We all suffer from the monopoly of enshittified sameness.Clay, and others like him, are challenging this paradigm. And we here at TOTEM and The Skeptical Shaman podcast sure are happy about it.LINKS:Rachel's Website: https://www.totemreadings.comTOTEM Readings Substack: https://totemrach.substack.comRachel's Other Links: https://linktr.ee/totemrachPlease support the Sponsors of The Skeptical Shaman Podcast:TOTEM + PUCK HCKY Merch Drop: https://puckhcky.com/collections/totemThe TOTEM Flower Essence Deck: https://a.co/d/gw16LsGThe TOTEM Flower Essences: https://www.etsy.com/shop/TotemReadingsATXTOTEM Spiritual Transformation Coaching: https://www.totemreadings.com/coachingTOTEM Business of Woo Mentoring: https://www.totemreadings.com/business-of-wooClay's Links:Website: https://www.barbarianspirit.com/IG: https://www.barbarianspirit.com/Please note: The views and opinions expressed on The Skeptical Shaman do not necessarily reflect the official policy or position of the podcast. Any content provided by our guests, bloggers, sponsors or authors are of their opinion and are not intended to malign any religion, protected class, group, club, organization, business individual, anyone or anything. And remember: sticks and stones may break our bones, but words—or discussions of religious or spiritual topics-- will never hurt us.

本期播客也是WOO每年的定番节目——年度总结。本次总结将会分为上下两期,上期为潮流向,下期为生活向。这期节目作为潮流总结,我们将会汇总一下主播们心目中2025年最好以及最差的鞋楦、服饰、联名、品牌等等等等。*观点均基于主播个人「主观」喜好/ 本期主播:马里奥、沙拉包、擦擦、凯德、小宋、曹煮任、小魏/ 剪辑、文案、封面:沙拉包/ 本期内容: 25年我们的年度鞋款 25年我们最不喜欢的鞋 25年我们最喜欢的服装类单品 25年我们最不喜欢的穿衣风格 视觉与产品,哪个更重要? 25年我们最喜欢的配件 25年我们最不喜欢的配件 25年我们最喜欢的联名合作 25年我们最不喜欢的联名 25年最佳运动品牌 25年最失望运动品牌 25年最佳服装品牌 26年流行趋势总结

Stoking the FireA weekend recap. Snow, and a lot of it!Brandon Sheppard wins the Sunshine Nationals titleOur thoughts on the new Volusia racing surface.More WoO drivers announced. Who are our picks for the Rookie of the Year title?WoO driver paint scheme thoughts?MOWA schedule revealedNew rules for the USAC National sprint car seriesAdded $ for the overall points winner for 3 national USAC divisions.Social media of the week: Waiting to get paid, tire dope, and an unhappy car owner. The Draft(ends around 27:00 minute mark)Feature FinishDIRTcar Nationals at Volusia Speedway Park Hunt the Front late models at Needmore SpeedwayIMCA Winter Nationals @ Central Arizona Raceway(Ends around 30:00 minute mark)The Smoke ChineseCharlie visits Penn Station after episode #212Cheeseburger MacBologna weekCarriage Inn and Hornets Nest TavernSnow day mealsChina Village Stuffed shellsThe Office Lounge on a Tuesday Klinkers Bar & Grill

A Guinness World Record | Episode # 423

Aya Eiffel is an elite endurance kitesurfer renowned for pushing the limits in long distance kitesurfing. She is a WOO record holder for the most distance traveled, and she has since elevated her legacy by securing a Guinness World Records title for the most kilometers kited in 30 days. Support the show: http://portraitkite.com https://www.fantasykite.com Contact me: adrian@portraitkite.com Follow me: http://www.kitesurf365.com https://www.instagram.com/kitesurf365/

진행자: 홍유, Chelsea ProctorTailoring, time travel and return of ceremony at Paris Men's Fashion Week기사요약: 2026년 가을·겨울 파리패션위크에서 우영미와 Juun.J는 여행과 의례, 과거와 미래를 잇는 테일러링과 형식미로 한국 패션의 존재감을 각인시켰고, 에르메스·디올·루이비통 등 글로벌 하우스들 역시 격식과 퍼포먼스, 정체성이 교차하는 ‘새로운 클래식'의 귀환을 선언했다.[1] Korean fashion asserted its place at the heart of Paris Men's Fashion Week for fall-winter 2026, with Wooyoungmi and Juun.J anchoring the season through collections that balanced heritage and modernity, while global luxury houses from Hermes to Dior and Louis Vuitton framed a week where tailoring, identity and performance converged.anchor: 중심을 이루다converge: 수렴하다[2] Wooyoungmi presented her show on Sunday at the historic Salle Wagram in the 17th Arrondissement, unveiling a collection that reimagined winter travel as an occasion for ceremony. Inspired by journeys spanning steam locomotives to subways, the lineup fused Edwardian and 1960s-70s dandy tailoring with technical outerwear, from velvet blazers and faux astrakhan waistcoats to reversible parkas and sculptural coats.locomotive: 기관차fuse: 융합하다[3] “Winter can be framed as an annoyance or a wonderland. For the fall 2026 collection, Wooyoungmi took the latter view,” the brand said, recasting cold-weather dressing as an act of elegance. Creative director Woo Young-mi looked back to the early 20th century, when the arrival of Korea's first railway transformed travel into a formal ritual. “Now more grounded in her identity, Woo proposes elegance as a form of courtesy, not a way of showing off,” the show notes added.annoyance: 성가심ritual: 의식be grounded in: ~에 기반하다[4] Korean cultural references were woven literally into the clothes. Nordic-style knits revealed themselves as dancheong, Korea's traditional decorative architecture pattern, on closer inspection, while bespoke prints on trench coats featured pagodas, mountains and traditional beoseon socks and gat hats. The soundtrack -- a moody collage of wind, rain and steam engines blended with Korean folk chants reworked through artificial intelligence -- underscored the collection's dialogue between past and future.be woven into: ~에 녹아들다기사원문: https://www.koreaherald.com/article/10662831

Wat is de prijs van een boom & Wet open overheid levert de samenleving miljarden op

(00:00) Wat is de prijs van een boom? In Amsterdam-Oost proberen buurtbewoners bij de rechter de kap van zes bomen tegen te houden. Om kans te maken, moeten ze aantonen wat die bomen waard zijn. Maar hoe doe je dat? Bomen houden water vast, filteren fijnstof en slaan CO₂ op. Maar kun je zulke voordelen ook in geld uitdrukken? Overheden experimenteren steeds vaker met het beprijzen van natuur, zodat bomen kunnen meetellen in beleid. Argos onderzoekt of het beprijzen van natuur helpt om bomen te beschermen – of juist nieuwe risico's creëert. (35:52) Wet open overheid levert de samenleving miljarden op Politiek Den Haag ziet de Wet open overheid (Woo) vaak als een lastige kostenpost die ambtenaren overbelast. Onterecht, blijkt uit nieuw onderzoek van de Open State Foundation. Transparantie kost geen geld, maar levert de samenleving jaarlijks naar schatting 4,4 miljard euro op. Volgens de onderzoekers voorkomt een open overheid kostbare beleidsfouten. Toch blijft de praktijk weerbarstig: burgers wachten lang op informatie en het kabinet wil de inzage in interne stukken zelfs verder beperken. Waarom negeert de politiek de winst van transparantie? We bespreken dit met Bas van Beek, Woo-specialist bij Follow the Money. Presentatie: Eric Arends Research reportage: Pepijn Keppel Research studiogesprek: Leon Zantinge

Wat is de prijs van een boom & Wet open overheid levert de samenleving miljarden op

(00:00) Wat is de prijs van een boom? In Amsterdam-Oost proberen buurtbewoners bij de rechter de kap van zes bomen tegen te houden. Om kans te maken, moeten ze aantonen wat die bomen waard zijn. Maar hoe doe je dat? Bomen houden water vast, filteren fijnstof en slaan CO₂ op. Maar kun je zulke voordelen ook in geld uitdrukken? Overheden experimenteren steeds vaker met het beprijzen van natuur, zodat bomen kunnen meetellen in beleid. Argos onderzoekt of het beprijzen van natuur helpt om bomen te beschermen – of juist nieuwe risico's creëert. (35:52) Wet open overheid levert de samenleving miljarden op Politiek Den Haag ziet de Wet open overheid (Woo) vaak als een lastige kostenpost die ambtenaren overbelast. Onterecht, blijkt uit nieuw onderzoek van de Open State Foundation. Transparantie kost geen geld, maar levert de samenleving jaarlijks naar schatting 4,4 miljard euro op. Volgens de onderzoekers voorkomt een open overheid kostbare beleidsfouten. Toch blijft de praktijk weerbarstig: burgers wachten lang op informatie en het kabinet wil de inzage in interne stukken zelfs verder beperken. Waarom negeert de politiek de winst van transparantie? We bespreken dit met Bas van Beek, Woo-specialist bij Follow the Money. Presentatie: Eric Arends Research reportage: Pepijn Keppel Research studiogesprek: Leon Zantinge

EP #45: The Woo & The Do - An Embodied 90-Day Planning Experience for Business Owners

This episode is a replay of a live, guided practice I hosted called The Woo & The Do.It was created as a way to kick off 2026 by clarifying the first 90 days….starting not only with strategy and planning, but with calming the nervous system.If you've ever felt stuck in overthinking, planning, or searching for the “right” approach, this episode invites you to begin somewhere different: in the body.Inside, I share why you can't systematize your way out of overwhelm, and why sustainable momentum comes from blending the woo (embodiment, intuition, nervous system care) with the do (focus, structure, and action).In this episode, you'll experience:A grounding breath + somatic movement practiceWhy self-doubt, procrastination, and overplanning are nervous system responsesThe difference between an internal yes and a pressure-based yesWhy consistency comes from safety, not disciplineA simple way to clarify your next 90 days—without forcing or hustlingHow to choose one clear focus that actually moves things forwardThis recording was originally part of a live experience, so you may hear references to participants or moments of reflection. You don't need to see anything…just let the practice meet you where you are.If this resonates and you want to go deeper, you can download the Woo & Do Starter Kit, which walks you through this full process and includes the guided practice, journal prompts, and the simple 90 day planning framework I created to help you take action on your dreams.

Healing From Emotional Abuse: From Stage Lights to Home Life: How Michael Kent Keeps His Marriage Strong While Traveling 250 Days a Year