Podcasts about Honestly

- 14,225PODCASTS

- 24,005EPISODES

- 45mAVG DURATION

- 5DAILY NEW EPISODES

- Mar 3, 2026LATEST

POPULARITY

Categories

Best podcasts about Honestly

Latest news about Honestly

- Folks Are Revealing The Fancy Purchases That Are Totally Worth The Splurge — And Honestly, I'm Broke, But They're Absolutely Right BuzzFeed - Mar 3, 2026

- Jose Alvarado has been everything the Knicks were looking for (and more) NBA Basketball News, Scores, Standings, Rumors, Fantasy Games - Mar 3, 2026

- Episode 2747: You Will Perish in Flame, You and All Your Kin Darths & Droids - Mar 3, 2026

- My friends couldn't make it to my bachelorette trip, so I brought my mom instead. It was the perfect celebration. All Insider Content - Mar 3, 2026

- How We Play Live: TOURING Attack Magazine - Mar 2, 2026

- Caldecott Honor Artist Drew Beckmeyer Watch. Connect. Read. - Mar 2, 2026

- Fun & Flirty Vegas Wedding at the Neon Museum Rock n Roll Bride - Mar 2, 2026

- What Does It Mean to Exhort One Another? Randy Alcorn's Blog - Mar 2, 2026

- Grieve Honestly The Aquila Report - Mar 2, 2026

- ‘Everybody wants a bestie like this guy!’ Rush on rock’s most anticipated reunion – and its greatest bromance The Guardian - Feb 27, 2026

Latest podcast episodes about Honestly

Episode 471 - Greedo's Voice and Every Greedo Line

Sure we all love GREEDO, but have you ever tried to say each one of his lines in A New Hope? Join us this week as we go through the GREEDO scene and analyze each of his lines and attempt to say them back! And did you know his first use of Huttese is based on an actual Earth language? And just who did the Greedo voice?? So oocha goota, celebrate the love and listen today! Hear the entire conversation with Matthew Wood, David Acord and Dolby here : https://youtu.be/jkh2K6Y3_M4?si=-EjJSh33RHWAGCWA JOIN THE BLAST POINTS ARMY and SUPPORT BLAST POINTS ON PATREON! MANDALORIAN SEASON 3 BOBA FETT BEACH PARTY COMMENTARY! NEW ANDOR SEASON 2 EPISODE COMMENTARIES! HEAR EPISODES EARLY! Theme Music! downloadable tunes from episodes! Extra goodies! and so much MORE! www.patreon.com/blastpoints Blast Points T-SHIRTS are now available! Represent your favorite podcast everywhere you go! Get logo shirts while supplies last! Perfect for conventions, dates, formal events and more! Get them here: www.etsy.com/shop/Gibnerd?section_id=21195481 If you dug the show, please leave BLAST POINTS a review on iTunes, Spotify and share the show with friends! If you leave an iTunes review, we will read it on a future episode! Honestly! Talk to Blast Points on twitter at @blast_points "Like" Blast Points on Facebook Join the Blast Points Super Star Wars Chill Group here www.facebook.com/groups/BlastPointsGroup/ we are also on Instagram! Wow! www.instagram.com/blastpoints Your hosts are Jason Gibner & Gabe Bott! contact BLAST POINTS at : contact@blastpointspodcast.com May the Force be with you, always! This podcast is not affiliated in any way with Lucasfilm Ltd. LLC, The Walt Disney Company, or any of their affiliates or subsidiaries.

The Lazy Way to Build Wealth with Chloe Daniels

Yo Quiero Dinero: A Personal Finance Podcast For the Modern Latina

Honestly, I don't know why it took me this long to get Chloe Daniels — aka Clo Bare Money Coach — on the show, because she is a whole badass and we have been living parallel lives for years. She went from a torrential relationship with money (including being financially trapped in a dangerous situation abroad) to becoming one of the most refreshing voices in personal finance.Her approach is called lazy investing — and before you scroll past that, hear her out. Because when BlackRock ran 100 years of market data, the results backed it up. We're getting into all of it: the mindset blocks keeping women out of the market, why Wall Street jargon is gatekeeping on purpose, the truth about financial advisors, and the simple strategy that actually builds wealth long term.WE GET INTO:00:00 - Intro: Why It Took Us This Long to Do This Episode00:46 - Meet Chloe Daniels: From Side Hustle to Full-Time Finance Coach04:05 - The Childhood Money Belief That Held Her Back05:03 - Financially Trapped in an Abusive Relationship Abroad07:31 - Rebuilding Self-Trust and Becoming Your Own Hero09:05 - Wall Street Gatekeeping and the Paralysis of Conflicting Info11:47 - The Real Stats on Diversity in Financial Advising14:35 - What "Lazy Investing" Actually Is (and Why It Works)18:42 - ETFs vs. Index Funds vs. Mutual Funds: What You Need to Know20:45 - How to Figure Out Your Investor Type and Build Your Portfolio24:21 - The Common Mistake: Money Sitting Uninvested in a Brokerage27:11 - How to Calculate Your Retirement Number Using the 4% Rule36:16 - The One Thing to Do If You're Not Investing Yet38:46 - Lightning Round: Roth vs. 401k, DIY vs. Advisor, and MoreKEY TAKEAWAYS:Why investing feels hard on purpose — and how to cut through itThe difference between investing and trading (and why most people confuse them)How to determine your investor type before picking a single fundWhy your 401k money might be sitting uninvested without you knowingHow to use the 4% rule to calculate your actual retirement numberWhy the compound interest calculator is the mindset shift you didn't know you neededWhy the answer isn't cutting back — it's making more moneyCONNECT WITH CHLOE:Instagram: @clobaremoneycoachWebsite: https://www.thelazyinvestorscourse.com/ TAKE THE NEXT STEP:Yo Quiero Dinero Private MembershipRead my book: Financially LitLeave me a voicemailThis episode of Yo Quiero Dinero was produced by Heart Centered Podcasting. Hosted on Acast. See acast.com/privacy for more information.

https://www.uncommen.org/wp-content/uploads/2026/02/Faith-at-work.mp3 The Office Mission Field: How to Integrate Faith in the Workplace Without Being “That Guy” Quick Answers What holds men back? Fear of being labeled "weird," getting reported to HR, or losing social capital often silences men from sharing their faith in the workplace. Is excellence spiritual? Yes. Your work ethic is your primary witness. You cannot have a sloppy career and a powerful testimony; they are incompatible. Do I have to preach? No. Most workplace evangelism happens through "relational equity"—building genuine friendships first, so you earn the right to speak later. What if I'm not perfect? Perfect people don't need Jesus. Admitting your mistakes and owning your failures is often a more powerful testimony than pretending to have it all together. How do I start? Start small. Pray over your meal. Mention church when asked about your weekend. Let your "faith flag" fly just enough to invite curiosity. The Monday Morning Dilemma We all know "That Guy." You've probably seen him in a movie, or maybe, unfortunately, in the cubicle next to you. He's the guy who turns a request for a stapler into a theological debate. He's the guy who leaves tracts in the breakroom microwave. He's the guy who uses "Christianese" jargon that makes everyone else uncomfortable and frankly, a little annoyed. Because we are so afraid of becoming "That Guy," most of us swing the pendulum entirely to the other side. We go silent. We become "Secret Service Christians." We clock in, keep our heads down, do our work, and clock out, leaving our faith in the workplace completely undistinguishable from the world around us. But as Joshua and TJ discussed on the podcast, this silent approach is just as dangerous as the "weird" approach. Jesus didn't call us to be undercover agents; He called us to be the light of the world. And since most of us spend the vast majority of our waking hours at work, if our light is hidden under a bushel from 9 to 5, we are missing our primary mission field. The challenge for the Uncommon man is to find the middle ground. How do we live out a vibrant, undeniable faith in the workplace that draws people in rather than pushing them away? How do we stop viewing our jobs as just a paycheck and start viewing them as a platform? The Myth of the Secular Job One of the biggest lies men believe is the divide between the "sacred" and the "secular." We think that pastors, missionaries, and worship leaders do "God's work," while the rest of us—accountants, mechanics, sales reps, project managers—just do "regular work." This is unbiblical nonsense. There is no such thing as a secular job for a believer. Everything you do is spiritual because you are spiritual. The Holy Spirit doesn't clock out when you walk into the office. Whether you are preaching a sermon or pouring concrete, Colossians 3:23 applies: "Whatever you do, work at it with all your heart, as working for the Lord, not for human masters." When you shift your perspective to see your career through the lens of faith in the workplace, the mundane tasks of your day take on eternal significance. That spreadsheet isn't just data; it's a demonstration of integrity. That difficult client meeting isn't just a headache; it's an opportunity to show patience and grace. Joshua made a great point in the episode: We often think evangelism means standing on a desk and shouting repentance. But real, sustainable faith in the workplace often looks much more like quiet excellence. It looks like being the guy who doesn't complain when the project goes sideways. It looks like the boss who takes the blame but shares the credit. It looks like the employee who actually works a full 8 hours when everyone else is scrolling social media. Excellence is Your Apologetic If you want to share your faith in the workplace, you first have to be good at your job. It sounds simple, but it is profound. In a culture of "quiet quitting" and bare-minimum effort, excellence is a disruptor. Think about it. If you are lazy, unreliable, or constantly late, no one cares what you believe about Jesus. In fact, if you are a slacker who talks about God, you are actively doing damage to the Kingdom. You are giving Christ a bad name. Your coworkers will think, "If that's what a Christian is, I don't want any part of it." Competence creates curiosity. When you are excellent at what you do, you earn respect. And when you have respect, you have an audience. People will eventually ask, "Why do you work so hard? Why are you so joyful even when the quarterly numbers are down? Why didn't you panic like everyone else?" That is your open door. That is where faith in the workplace moves from abstract to concrete. You can say, "Honestly, my identity isn't tied to this job. I serve a different Master, and that gives me peace even when things are chaotic." You haven't preached a sermon, but you have planted a seed that only excellence could have cultivated. Relational Equity: Earning the Right to Speak In the podcast, TJ shared a powerful story about working in the design industry in New Orleans, a field often populated by people who live lifestyles very different from a biblical worldview. He didn't walk in on day one and start condemning people or handing out list of grievances. He built relationships. He went to lunch. He got to know them as human beings. This concept is called "relational equity." Think of it like a bank account. Every time you listen to a coworker, help them with a task, ask about their kids, or show genuine care, you are making a deposit. You are building trust. Many men try to make a "withdrawal"—sharing the Gospel or correcting a worldview—before they have made any deposits. That is when you become "That Guy." You are trying to cash a check that is going to bounce because you haven't earned the relational capital to cover it. Faith in the workplace is a long game. It requires patience. It requires you to actually love the people you work with, not just view them as projects to be converted. When your coworkers know that you genuinely care about them, they will be infinitely more open to hearing about what makes you tick. TJ mentioned that when he would go back to work on Monday, and people asked, "What did you do this weekend?", he wouldn't hide it. He would say, "I went to church," or "I served with my community group." He didn't make a big deal out of it, but he didn't scrub it from his life either. Over time, that consistency builds a reputation. People start to associate you with your faith in the workplace naturally. They know who you are. And when a crisis hits—a divorce, a diagnosis, a death in the family—guess whose desk they come to? They come to the guy who has been steady. They come to the guy who has hope. The "Fruit" Check: Do You Look Like the World? Here is the hard truth: You cannot share faith in the workplace if you look, act, and sound exactly like the world. If you are gossiping in the breakroom, you have lost your witness. If you are complaining about the boss behind his back, you have lost your witness. If you are getting drunk at the company happy hour, you have lost your witness. If you are fudging the numbers on your expense report, you have lost your witness. Jesus said, "By their fruit you will recognize them." Your coworkers are fruit inspectors. They are watching you closer than you think. They are waiting to see if your faith is real or if it's just a Sunday morning hobby. Living out faith in the workplace means holding yourself to a higher standard. It means having integrity when no one is watching. It means choosing your words carefully. As the podcast highlighted, this doesn't mean you have to be a prude or judgmental. You can still be fun. You can still joke around. But there is a line. When everyone else is tearing someone down, you stay silent or offer a different perspective. When everyone else is panicking, you bring a calming presence. These small, daily decisions accumulate. They create a distinct aroma of Christ. TJ noted that in the creative field, he worked with many gay colleagues. He didn't affirm everything they did, but he loved them. He treated them with dignity. And because of that, they respected him. They knew he was a Christian. They knew where he stood. But they also knew he wasn't hateful. That balance—truth and love—is the hallmark of mature faith in the workplace. Vulnerability vs. Perfection One of the reasons men hesitate to share their faith is the fear of hypocrisy. We think, "I'm not perfect. I lose my temper. I make mistakes. Who am I to talk about Jesus?" But here is the secret: Your perfection is not the point. In fact, pretending to be perfect pushes people away because everyone knows it's a lie. No one relates to a plastic saint. Real faith in the workplace is displayed most powerfully in how you handle failure. When you screw up—and you will—do you blame others? Do you make excuses? Or do you own it? Imagine the impact of a leader who says, "I was wrong. I shouldn't have spoken to you that way. I apologize. Will you forgive me?" That is counter-cultural. That is Uncommon. The world teaches us to cover our tracks and shift blame. The Gospel teaches us to confess and seek restoration. When you apologize, you are demonstrating the Gospel. You are showing that you are a sinner in need of grace, just like everyone else. This vulnerability makes your faith in the workplace accessible. It shows that Christianity isn't about being better than everyone else; it's about being forgiven. Practical Steps to Integrate Faith in the Workplace So, how do we move from theory to action? You don't need to quit your job and become a missionary. You just need to be intentional. Here are five practical ways to start exercising your faith in the workplace this week: 1.

We're back watching James Bond, this time teaming up with a sexy Russian spy to take down a deranged Swedish shipping magnate who wants to blow up the world so that he can live under the sea. Also, we get the first appearance of the henchman Jaws. Honestly, it's pretty fun, and half the movie was filmed in Egypt. Starring Roger Moore, Barbara Bach, Curt Jurgens, and Richard Kiel. Written by Christopher Wood, Richard Maibaum, and Tom Manciewicz. DIrected by Lewis Gilbert.

It's finally time to stop relying on that body! Join Zoë and Logan as they wrap up season five by ranking all the goo and gore it had to offer and crowning the winners of this season's Honestly?! awards. — Theme music by Greg Morrison. Visit Our Website: www.honestlypod.ca Email Us: thehonestlypodcast@gmail.com Follow us on Instagram: www.instagram.com/honestlypod Like us on Facebook: www.facebook.com/honestlypod Follow us on Twitter: www.x.com/honestlypod Keep up with us on Letterboxd: letterboxd.com/honestlypod/ Honestly?! A Horrorcast is available on SoundCloud, Apple Podcasts, Spotify, and wherever you get your podcasts!

Welcome back to Lez Hang Out, the podcast that wants the dykes on bikes to bring us to The Green Place. This week, Leigh (@lshfoster) and Ellie (@elliebrigida) are rewinding the clock back to our discussion about why the 2015 movie Mad Max: Fury Road Should've Been Gay. Honestly, nothing could have prepared us for how gay and campy this movie is. It's basically leather daddies vs. dykes on bikes in a post-apocalyptic desert. Furiosa, played by Charlize Theron, is from The Green Place, a lesbian mecca inhabited entirely by women known as the Vuvalini. She wants nothing more than to escape Immortan Joe's leather daddy war boy desert land and get back to her girls, but won't leave without taking all the hottest women from Joe's harem of breeders with her. When Joe realizes that Furiosa has straight up stolen all his hot ladies, he sends his war boys to track her down in a series of action-packed, explosion-filled car chases through the deserted post-apocalyptic wastelands. When she does finally get back to lesbian mecca, everyone is so excited to see her. But things are no longer going well for them in The Green Place, so Furiosa adds a bunch of the dykes on bikes to her pack and heads back to challenge and overthrow Immortan Joe. Between the intense sapphic energy of the Vuvalini, Furiosa's whole shaved head, protector of hot women aesthetic, and the absolute camp that is Immortan Joe and his pack of shiny boy toys, we cannot see this movie as anything other than a gay masterpiece. We know one thing for sure, Mad Max: Fury Road Should've Been Gay. Join us on Facebook.com/lezhangoutpod and Instagram (@lezhangoutpod). Find us individually: Leigh (@lshfoster) and Ellie (@elliebrigida). You can support Lez Hang Out while unlocking a bunch of awesome perks like access to our exclusive Discord, full length bonus episodes, weekly ad free episodes, and more by joining us on Patreon at bit.ly/lezpatreon. Learn more about your ad choices. Visit megaphone.fm/adchoices

S9 E2 –Sex And the City Extra Sugar: What SATC Taught Us About NYC

We could cue this one up with a bunch of puns and song lyrics, but hey, that's what the episode is for. In this week's Extra Sugar, we're talking about SATC's fifth main character: New York City (but like, really Manhattan, which the show largely favored of the city's five boroughs). The show lets us know – from the very first frame in the pilot that this is first and foremost – a NYC show. We love it. Honestly, after back-to-back traditional soundstage sitcoms, we're just glad to be outside! So let's see if two Southerners can do the ‘city that never sleeps' any ding-dang justice. Unclear but join us anyway, if you don't like it, you can judge it – and that's almost as good as liking something for real.

Shaping Your Inner Dialogue For Better External Results With Nick McGowan

“There’s a massive link between the way that we talk to ourselves and the results that we get in the world.” In this episode, Nick dives into the significance of our inner dialogue and its profound impact on our external experiences. He emphasizes the importance of shaping our inner dialogue to navigate life’s challenges and the ups and downs we experience each day. Nick explores the mechanics of self-talk, the role of awareness in recognizing negative patterns, and the necessity of self-reflection in personal growth. What to listen for: Our inner dialogue directly influences our external experiences We often allow ourselves to be negative without realizing it Transforming our inner dialogue requires conscious effort and practice Self-reflection is key to understanding our internal narratives Building a healthier inner dialogue takes time and commitment “If we understand our internal dialogue, we can then make different decisions.” Words do matter, and we're saying the most words to ourselves every day Recognizing the way we speak to ourselves is a critical first step to changing our inner dialogue By addressing and changing the way we speak to ourselves, we'll naturally be in a better position to understand the world around us “When we have the inner dialogue that isn’t actually healed, it’s not helpful for us; then it makes the rest of our lives more and more difficult.” The perspective of our inner dialogue colors our view of the world and instantly sets us at a disadvantage in life Think of the negative inner dialogue as a human and see how you really feel about its communication style and comments on your life When we process and heal from trauma and limiting beliefs, our inner dialogue needs to be healed as well; this can be a lifelong process About Nick McGowan I'm Nick McGowan, an entrepreneur, podcaster, and mental health advocate, and I’ve been on a 20+ year journey of personal development, learning to master my mindset, emotions, and the art of living with purpose. As a Mindset and Self-Mastery Mentor, I work with ambitious men and women who want to live their most authentic and joyous lives by helping them master their mindset, emotional awareness, and authentic communication. My mission is to empower people to lead lives that feel aligned, grounded, and truly their own. Throughout my career, I've built teams, streamlined systems, and improved client experiences across SaaS, media, marketing, and personal development spaces. Whether I'm leading cross-functional projects, optimizing SEO, Podcasting, designing strategies, or guiding clients through transformation, I bring a hands-on, solution-focused approach to everything I do. I'm also the host of The Mindset and Self-Mastery Show, where my guests and I unpack the stories that shape us, challenge us, and ultimately guide us back to who we are at our core. On this show, we uncover the secret gems others have discovered through trial and error and breakthroughs, so you can fast-track your growth and master your mindset in your pursuit of self-mastery. Check out the latest episode here. With years of podcasting and two decades of marketing experience, I've mastered the storytelling, interview flow, strategy, and technical production that elevate a podcast from “just content” to something truly impactful. Whether you’re a leader looking to amplify your message, a seasoned speaker and podcast host looking to sharpen your edge, or even a beginner who is wondering how to share their message, I mentor thought leaders through every step of having the conversation they’re here to have on this planet. So, what message are you here to share?! Resources: Check out other episodes about our inner dialogue and managing negative self-talk. Battling Negative Self Talk And The Story From Being Adopted To Becoming An Attorney With Mike Bassett It’s Time We Start Talking About Our Mental Health With Nick McGowan Interested in starting your own podcast or need help with one you already have? https://themindsetandselfmasteryshow.com/podcasting-services/ Thank you for listening! Please subscribe on iTunes and give us a 5-Star review! https://podcasts.apple.com/us/podcast/the-mindset-and-self-mastery-show/id1604262089 Listen to other episodes here: https://themindsetandselfmasteryshow.com/ Watch Clips and highlights: https://www.youtube.com/channel/UCk1tCM7KTe3hrq_-UAa6GHA Guest Inquiries right here: podcasts@themindsetandselfmasteryshow.com Your Friends at “The Mindset & Self-Mastery Show” Click Here To View The Episode Transcript Nick McGowan (00:00.302)Hello and welcome to the mindset and self mastery show. I’m your host, Nick McGowan. Today on the show, I want to talk about shaping our inner dialogue to get better external results. And on the show, I like to get really macro with things because I think that’s where change actually happens. It’s in those moments where we work on the stuff now before the situation happens that we’ll be better equipped to handle whatever situation comes up. I’ve learned this the hard way. Sometimes I think I’m really prepared. I’m good to go. Then I get into a situation and something happens. It’s like, my God, I didn’t expect that to happen. I didn’t know how to handle it or whatever it was. And those moments can literally make or break us because sometimes when we’re going through a situation that we’re maybe a little uncomfortable with or not as confident about, we can start to falter on the things like our principles. or the things that we know to be true and are really consistent within ourselves. So when I think about having an internal dialogue, that’s more of a positive mindset dialogue. This isn’t something to just bypass the stuff that you’ve been through. This is about being able to understand that the moment you’re in right then and there is the only moment that you actually have. So when you’re in that moment, whatever the situation is, If your inner dialogue is in a negative place, let’s say, then that moment’s probably going to turn out not as good as you want it to be, just straight up. But if your inner dialogue is more on a positive note, and I’m using these as black and whites in a sense, then you’re bound to have a better overall experience because of the inner dialogue. So think about it this way. If you wake up in the morning and you instantly think, Today’s gonna be such a shitty day. I hate all these things. I don’t even wanna get out of bed. don’t wanna ever. You probably argue with your partner. You yell at your kids or your animals or whatever. You get on the road, you drive to your office and you’re shitty with everybody else on the road. Nick McGowan (02:37.462)if you woke up a little differently and had a overall mindset and experience from waking up, you probably, even if something happened with your spouse, your partner or your animals or the dude driving past you, you’re probably going to handle that situation differently, at least slightly differently. Now, if you wake up in the morning and you hate yourself and you hate everything that’s going on, there’s work there. be done. It may also be part of your design. I’ve learned about myself that I will wake up in two different states. Super excited, or grumpy as fuck to put it nicely, because in those states, when I wake up and I am unsure of what I want to do or whatever it is that really determines what happens next. I’ve learned about myself that I’m in one of those two states for some reason that has happened the day before. I’ll give you a prime example. I’ve been busy for the past few months and haven’t been able to play music as much. And I’m actively working on an album. And for me, playing music and even just working through concepts of riffs and just even drum parts for like three hours does magical things for me that helps me at a bass level feel like I’m doing something for myself. Not just doing things for clients or for other people or even things for my business that are still for myself, but just, you know, they’re not me playing music and scratching that itch. Being able to spend a little bit of time with that has become really, really, really important to me because I understand that the more aware I am of that, the more that it’ll affect the next day. It’s not a magical pill. It’s not like, you know, I play guitar for two hours one night and then the next day it’s the best fucking day in the entire world. It’s not how this works. But I do understand that that is a part of how I relate to the rest of the world. And I can be aware of that and do something with it. So let’s break down what inner dialogue is. You know what it is. It’s the talking to yourself. If we look at a shitty internal dialogue, you know exactly what that is as well, because I’m pretty sure you do it pretty often. We all do. Nick McGowan (04:59.702)Even the people that say, no, I’m constantly positive. I’m constantly this, constantly that. You don’t really know what those conversations are internally. We just don’t. And I think the people that are bypassing and toxic positivity in a sense, they’re hurting themselves. And I know that because I’ve done that before too. Haven’t you? We’ve all done something like that where we’ve said, this is how I want to be. So I’m just going to do it and not do the work with it. When we have the inner dialogue that isn’t actually healed and it’s not helpful for us, then it makes the rest of our lives more and more difficult. I don’t want to take this down the path of saying this is the only thing that’ll fix everything because I have heard at times where people say you can’t just mindset your way through things. I know that is not what this is about. This is about setting yourself up from a better perspective. and also being able to look at the thing and say, you know, I’m feeling real shitty right now. Why is that? If we can understand where that has come from, even just to know this is the thing, this is what happened, or this is what made me feel this way, or the reason why I feel this way, or the reason why I’m being negative, or even the reason why I’m being super positive, we can at least understand why that is to then do something with it from there. I think sometimes we as people, just allow ourselves to be shitty, just straight up. And I get it. I am shitty at times. The people that know me the best absolutely know this. And sometimes I’ve thought that it was part of my process. That’s how I go through things. And that’s not always the case because there’s being curious, there’s being judgmental, and some of that can like overlap. But then there’s also just being really shitty about things because I don’t feel good about a situation. or feel good in my body or didn’t sleep well enough or whatever it was. But the internal dialogue that says today’s gonna be shitty or this is gonna happen, it’s gonna be bad, whatever. Sometimes those aren’t actually even words. It’s just a feeling. So if we take apart our inner dialogue just over the course of one day and catch the moments where we’re being really, really shitty, I don’t mean to just keep using that, but that’s kinda how it is. Nick McGowan (07:23.778)We’re shitty, we’re being grumpy, we’re being negative about a situation and not actually working through the situation. I’m not talking about sitting there for two hours and processing a thing, but at least understanding that right now I’m feeling this way. So what can I do now to be able to get through your work day or the situation you’re in or what have you? And it can be a mechanical sort of approach of saying, well, I’m going to choose to have a better mindset with this right now. Again, I don’t want you to think of this as bypassing. We are never bypassing. If you need to do work on these things, do the work. But that doesn’t always mean you can do it right then and there. It’s not about just saying, all right, world, time out. I need to process through a thing. Now granted, there are some people that can do that. And for business owners, sometimes it’s easier for us to do that. Sometimes it’s straight up not because there’s just a lot going on. There are many things happening, lots of questions. And as the owner of a company, we, you know, we’re the ones. so the buck stops with us. So we need to be able to answer those things or be on or what have you. But understanding where our internal dialogue is will ultimately shape how the rest of the outcomes are. And it took me a long time to really understand that. And it took me even longer to start to put it into action. And it’s taken me even longer for it to become part of who I am. I joke now about certain things that should have I thought should have taken me a lot faster to get through, but that’s not how it works. So understanding why we have the inner dialogue that we do is almost as important as what we do with that inner dialogue from there. So the ongoing beliefs, the ongoing thoughts that we have, the self-talk that just running through us day in and day out, that’s our inner dialogue. But what’s the inner dialogue like? Nick McGowan (09:27.988)I heard somebody say to me years ago, if you had a friend that talked to you the way that you talk to yourself, you’d probably want to kick his ass. If not, take them off the planet. They’re totally right. I think about the stuff that you say to yourself. Think about it. Think about the stuff you probably said to yourself a fucking hour. Just let that sink in. If some other human said that to you, you’d potentially have a restraining order. You would not want them to be part of your life. Now you may actually have people that are part of your life that do that. You don’t have to do that to yourself. I want to make that clear. You don’t have to do that to yourself. It’s not a penance or anything, depending on what you had done in the past. It’s being able to actually take the dialogue that you have right now and say, well, today’s this day. This is what I have going on today. And if I don’t like those things or I want to change those things, great. Can I do it right now? Can I instantly change it, pivot to something else or what have you? And if you can, wonderful. If you can’t, then that’s what it is. You need to work through that and you need to be in that moment to do it. I think about it in the sense of people going to jobs that they hate. I can think back to different experiences I’ve had at different jobs. I remember sitting there watching the clock. Being like, fucking hate this. I can’t be here anymore. This is nonsense. Part of it was that I knew there was a greater calling for myself. Another part of it was me just being shitty about the situation that I was in and beating myself up because I put myself in that situation. Haven’t you done that? Think about the different times that you’ve done that. Think about the amount of times maybe even today that you’ve done that. And if we just pause that and say, I understand. And yeah, I don’t want to be in this spot right now. But I also understand that I’m just not able to snap my fingers and make a change instantly, and that things will take a little bit of time. That’s where you actually get to mechanically change your mindset and say, this is what I’m going to do. This is how I’m going to put my mind into motion in this specific situation. So if we think about inner dialogue and we think about the external results from that. Nick McGowan (11:44.63)you can start to look back at different situations where you say, you know, I experienced this differently than I had in the past because of the way that I thought about it going into the situation or because of the way that my way of being is now or whatever it was. If we break it down to a very black and white level, there was probably some positive or negative emotions and thoughts and feelings tied to whatever you were doing. And Even if it was subconscious where your subconscious was like, you know what? We’ve done this before, we can do it again. And you didn’t have to really think about it. It just kind of came out. That’s fine. That’s almost like it’s how you’ve healed from it. At least to some extent. Subconscious isn’t there to make us feel better. It’s there to keep us alive and safe. So you’ve probably experienced the opposite side of that more often than not. of I don’t really know what do in this situation. So I feel uncomfortable. I feel weird. I feel this. I feel that that’s normal. We all go through that stuff. I’ll give you an example with myself. I’ve had something recently local networking where I’ve gone out and met with different people. And whenever I get called up to the front to talk about my business, talk about myself, et cetera, there’s always a little bit underneath that’s like, Oh, do you look weird? Do you sound weird? Are you saying the right things? All of that. That’s our subconscious trying to just keep us safe. It’s abnormal. And if it’s not something you do every single day, or even if it’s something you’ve done for a long, long, long time, that can still be there. It’s trying to keep you safe and trying to keep you comfortable. But I know in those situations, I can look at that and go, I’m just going to go out and do what I do. And I’m going to rest on me being authentic. And worst case scenario, somebody says, You said something weird or you looked weird or you did whatever and think about it. Honestly, in most situations like that, if somebody says, I don’t like your shirt, fuck you. Who the fuck cares? Go away. It doesn’t matter. It’s all in our own heads and we’re the ones beating ourselves up about it. And for the most part, everybody else, when they’re having their own problems or thinking of you about, don’t like your shirt or they don’t like whatever it is. That’s a them problem. That has nothing to do with you. We can take that. Nick McGowan (14:05.112)And we can say, I can do something with it or next time I’ll wear a Hawaiian shirt because fuck you, whatever you want, you know? But being able to understand your own inner dialogue can be affected by other people, other situations, other things, but it’s really up to you to do something with your inner dialogue to then turn it into something external. Now I’m not saying that this is a hustle or grind sort of situation. Like you need to have better mindset so you can go out and make millions of dollars because everybody needs 50 fucking homes. That’s not the case at all. What I’m talking about is being able to actually work through your own inner dialogue to feel confident in yourself to do the thing you’re actively doing. But this happens in a nanosecond, which is again why I like to break down these macro pieces because we can work on it right now. where down the road when you get into that situation, you don’t just instantly flounder because you’re falling back on the negative mindset. You’re falling back into the mindset of, I don’t know what to do here, so I’m just gonna shit a little bit. And like, what the fuck? What do I say? What do I do? How do I act? You wanna be able to work on this stuff before you get into those situations so you don’t actually have to think about it while you’re in those situations. Getting back to my example of speaking in front of a room. I speak all the time. I talk to people all the time. I also really love being by myself. When working on my music or going through my sports cards or reading or whatever it is, just by myself, everybody leave me alone. But I know in those moments when I’m in front of people, I have to be on in a way that is truthful to me. Now past me, years and years and years ago, I would have turned on to become somebody else. Almost like the persona, the mamba mentality in a sense. Like I would just become somebody different. And there was always a bit of authenticity to it, but there was also tying into my winning strategy of how I could be loved and how it could be admired and how I could win and all of that. If we understand those components and those pieces, because those make up our internal dialogue, we can then make different decisions. But it’s understanding why our internal dialogue is the way that it is. Some of that may be trauma. Nick McGowan (16:28.3)Some of that may be somebody said something to you as a five-year-old that led you to believe a thing either about yourself, good or bad, or about other people, good or bad. And then that affected the way that you handled things from that point on. That changed the story that you lived from that point on. What I’m talking about is being able to understand why the components make up your internal dialogue and that your subconscious mind is just there to keep you safe. doesn’t really give a shit how you feel or how confident you are in a situation. It’s just there to keep you safe. If you can understand those things and you can understand how you’re acclimated toward things, then you can do something with that. So when you’re in a situation where you have to be in front of people or pick anything that makes you uncomfortable or it’s a little outside of the norm of what you’re used to, you’ll be in a better spot at that point to be able to not only handle that situation, handle yourself because you’ve extracted what the internal dialogue is. Now with me, like I said, I’ll wake up and I’ll either feel great or bad. That’s really black and white. And I’ve asked myself, I’ve started to ask myself each morning, how am I feeling right now? Am I feeling great? Am I feeling bad? And being honest with myself. There’s sometimes I wake up in the morning and I’m like, how are you feeling right now? I’m feeling great, feeling bad. I feel like shit. And I can understand it’s because maybe I ate something too late the night before, or I didn’t sleep well, or there’s something nagging in the back of my mind about some project or something that’s going on or something around the house or whatever it is. But if I can look at that and say, it’s that thing. It’s being able look at that thing and go, cool, well, I see you. And deciding, do I get to do something with it now? Do I need to? Do I not? Whatever it is. being able look at it and just see what it is has given me a lot of confidence to go, okay, cool. Well, now I know what it is. So I’m just going to move along instead of the fear of the unknown in a sense. Now about maybe, I don’t know, 15 years ago or so I was in a a rock band in Philadelphia and we had a song called white bear because of a concept that I learned where somebody said, if I asked you to not think about a white bear, Nick McGowan (18:54.146)Whatever you do, just don’t think about a white bear. So get the white bear out of your mind. It’s whatever you do, don’t think about a white bear. How many times did a white bear pop in your head? Pretty much every time I said it, right? So if we’re focusing on, be shitty, don’t be negative, guess what you’re gonna be? More than likely, probably shitty, probably negative. And the same goes for being positive. Say be really positive be this and be that and be external and do all these things The the thought of that can spur that on But it’s the act that happens within it and what happens after it that is the most important Because even if I said don’t think about a white bear You’re probably gonna think about it because I put it near the foreground here you think about a white bear and then from there you get a choice to be able to think do I want to build out what that white bear looks like. Do I want to think of that as a Coca-Cola bears or do I want to think about it as a bear that I saw when I was younger or whatever and you will start to kind of go through that path. But if you look at the negative and positive internal dialogue that we have, if you try to force yourself to push past something and bypass it, it might work for you right then and there, but it’s going to come back to bite you. So with all of this, your internal dialogue, if you start to understand why do you typically think about X while you’re in this sort of situation, or why do you feel this sort of way when you’re in X situation and think about that now before that situation happens again, I guarantee you will at least be in a better spot to be able to handle that. I can’t guarantee that it won’t look the way that it did before, but it will start to shift a little bit. had an experience a couple of years ago where I was doing a lot of internal work and folding inside out and it was fucking messy. And I remember having a conversation with my partner and I could feel myself welling up and there was a reaction that was about to come out. There was literally a part of me that told myself, Nick, shut the fuck up and leave the house. And guess what I did? I kept fucking talking and I didn’t leave the house and I was aware of it. Nick McGowan (21:19.242)And it was maddening because I thought, you know, I thought about this. I can just do this and like grab myself and leave. No, there was still trauma that needed to be worked through. There were things that were part of my subconscious that I needed to extract. I needed to reframe and needed to look through. And it took me a long time. And there’s still moments where that happens. Not exactly how it did before, but moments where I’ll start to come up and I go, I see you, you fuck. I’m not going to go down that path again. because I was able to do that work in those moments, but I also did work after those moments to say, all right, what happened? What do I do differently? How do I do this differently? It’s sort of like in sports where they watch game tape. They’ll go back and they’re not watching it to say, you fucked up here, you did this wrong. They’re saying, what could we do differently in these situations? And there’s a reason why those people do that. In a black and white way with sports, it can be easy to say you’re tape and film from a previous game or whatever. us. If you had a really shitty day and there was a lot of negative self-talk going through and then by the time you go home all you want to do is just watch TV and veg and look I get it. Especially somebody who’s found out that he’s more of an introvert than he ever thought he was. I really enjoy being able to spend that veg time of relaxing and just being away from people. I’ve also understood in those moments there are certain times where I’m really escaping. We’re trying to escape from something. I may be a little different than you. You may be a little different than me. We’re all different than each other, but we are also very similar and we go through the same sort of things. This is why I have the podcast for us to be able to talk about this stuff and actually call this stuff out because I can almost guarantee that you’ve had some sort of shitty conversation with yourself today. Even like, why did I do that? Or why the fuck didn’t I wash this thing? Or why didn’t this thing happen? Or what about this? and maybe you don’t call yourself an idiot anymore. Nick McGowan (23:22.958)the sentiment is still there at times, right? You know, like there are different things that come up where you’re like, man, what a dumb bastard, I shouldn’t have done that, blah, blah, blah. Again, if you had a friend or somebody else that was like that, you’d call the cops on them or you’d have a restraining order or something. So if you think about your inner dialogue and the stuff that you go through every single day and how it relates to not only the dialogues, either. Positive or negative influence on you But how the long-term effects actually relate to you because you’ll keep doing that over and over and over And sometimes it can be so ingrained that it’s really difficult to get ourselves out of it So one of the things that I really like to do and that I find to be the easiest thing to do in those situations Yep, oftentimes it’s kind of difficult when you’re really charged. So just be aware of it. Just straight up see it and go, man, I’m being shitty again. But catch it and don’t be an asshole to yourself. Don’t be like you’re being shitty, you dumb fuck. Don’t, be nice to yourself about it. You also want to, in some ways, of parent yourself with that. Like, yeah, don’t do that anymore. Let’s look at what’s going on. Let’s actually talk through it. Let’s work through it. So if you have that simple awareness practice of just saying, I see these things. Maybe for you, it’s taking notes of it and saying, I saw this today, I saw this today, this happened, et cetera, et cetera. Maybe it’s just mental notes. Maybe it’s things that you’ve seen over and over and over and you actually don’t want to touch them. Oftentimes that’s because there’s a fear of the unknown or some blocker that’s blocking you from that. And that’s where professionals come into play. People that can help as therapists or different modalities or mentors or… anybody that can kind of work with you on those things that have been through some of that. But at least you can be aware of those things. And I think there’s such power in awareness. The more aware you are, the more aware you are. Like you can’t not see a thing after you’ve seen it. Sometimes it’ll take seeing it 10, 15, 20 times or even more. But you know that you probably have bad dialogue with yourself at times, but you know, I’m better off than I was before. Nick McGowan (25:41.826)or whatever excuse you add in. And that’s fine, because it’s your life, you get to do whatever you want. The question is really, how long do you want to sit in that shit for? And that can be, it can be a dumb question to certain people. They’re like, of course I don’t want to sit in that shit, but yet you’re still sitting in that shit. And look, I do this as well. Every day there are things that happen. And I ask myself, do I want to be shitty about this? No, but you’re gonna fucking damn it, blah, blah, blah. like, all right, Nick. get through it, and now let’s have the conversation. Sometimes you need to let that energy out. Sometimes you also need to go through it a bit to then understand, it’s really in these situations when this happens because I feel this way, or I think this thing. And all that inner dialogue really shapes the way that our external worlds are because we’re setting ourselves up for either success or failure when it comes to that. So I wanna reinforce. that there’s a massive link between the way that we talk to ourselves and the results that we get in the world. And that there isn’t anything to do with hustle or grind culture or going out and making bunches of money or even the total opposite of that and like saving all the homeless people from the entire world. Talking about being able to actually incorporate this into your daily life in every aspect of life. but it takes breaking down how are you having those conversations in your head and what’s coming out of those conversations every single time. And do you want to change that? Do you not want to change that? I want you to think about two things. Think about two situations where, and I’m super confident and comfortable in this sort of situation. Some people might be public speaking. Some people might be playing music. It might be whatever the thing is. And then I want you to also think of what are the situations? One or two situations that make me super uncomfortable. And I’m not telling you have to go share this with the world or talk to other people about it, but to yourself. Like there might be things that you go, I really feel uncomfortable about this, but this is a major part of my job or whatever it is. Great. Look at that. And then start to write out what comes up when I think about this. What comes up in those exact situations. Nick McGowan (28:05.838)because we can all recall a situation and we can put ourselves back in that spot. That’s a fun little playground. It’s like a simulation in the sense to be able to go through and say, I remember being in this spot and maybe feel this way and whatever. But in reality, if you’re able to actually understand why you do the things you do because of the conversations you’re having in your head, you’re able to change the way that you move through the world and therefore able to change the way that you impact the world. And that’s what this is all about. I don’t believe that purpose is just for us as selfish human beings. I believe that purpose actually incorporates the rest of the world and even just our small little corner of the web of life. But if we can change the way that we look at things internally, we can then change the way that we act around and toward other people and ultimately change the way that we live life. You also need to do the work of the things that are coming up that are blocking you or stopping you. So if you have questions about this, you wanna understand what has worked for me or what you could potentially do different than what you’re doing now, please feel free to reach out. I’d love to hear from you. And if there are certain topics like this that you want more discussions on, you want me to unpack more of, I’d love to hear from you. So thank you so much for being with me today. I hope this is helpful and I hope you do something with it. https://www.youtube.com/watch?v=I5nAkIFbQII

This week on the Oh Hell Yeah! Podcast, Eddie and Brent talk about the U.S. men's Olympic hockey team partying after their gold-medal win with friend of the show Kash Patel, the real reason RFK Jr. is always wearing denim, Kid Rock's mansion, and terrible gym behavior. Subscribe to the pod ➡️ https://www.youtube.com/@ohhellyeahpod?sub_confirmation=1 Follow the pod http://instagram.com/ohhellyeahpod https://www.tiktok.com/@ohhellyeahpod Follow Eddie Della Siepe http://instagram.com/Eddiedellasiepe https://www.eddiedellasiepe.com Follow Brent Flyberg http://instagram.com/brentflyberg A concept seldom found in the podcast world. Two male comedians having a free flowing conversation in a garage converted into a studio. Honestly...it's never been done. Comedians Eddie Della Siepe & Brent Flyberg dare you to listen to the Oh Hell Yeah! podcast every week. They bet you can't do it. Prove them wrong.

Monte Poole on How Honestly We Can Evaluate the Warriors Without Steph Curry & Jonathan Kuminga's Big Debut for the Hawks

NBC Sports Bay Area Warriors Insider Monte Poole joined Silver & JD to discuss how honestly we should evaluate a Warriors team without Stephen Curry and Jimmy Butler. He explains how Brandin Podziemski and Moses Moody find themselves in a similar predicament to Jordan Poole at the end of the 2021 season, and why De'Anthony Melton is playing his way into earning a lot more money this upcoming summer.See omnystudio.com/listener for privacy information.

#189: Offseasons Were Made for Rumors // A Melange of Sixers Stew

We are still down TWO sports from actually playing real games. That means there's always time to get ourselves WORKED UP about all sorts of things. No actual baseball happening? Let's interview Bryce Harper and see what he's dissatisfied about today! Eagles OTA's still months away? Well, then let's see if AJ Brown has made a social media post! Honestly, we're exhausted by it, but the ink continues to be written.But here on HOAGIE MOUTH - we try to keep it to the REALLY REAL, along with Foreigner karaoke. Tune in to Bob, Mike and Jeff as we cover all of the sports. That's right ALL OF THEM, no matter if they are on ice or on the hardwood or the grass or the turf. Comprehensive, that's us. Tune in to listen to Jeff figure out how close we are to 200 shows. It's happening, people.Email: hoagiemouthpod@gmail.comIG: @hoagiemouthpod

Today we talk about current events.Also… last chance to order SIGNED Copies of Strange Company and the Wasteland Saga. Thank you.Strange Company Series and The Wasteland Saga Series are ready for ordering SIGNED copies. I do this at specific times because I need to order them in advance, as they are not always available. I'd jump on this if you want SIGNED copies for yourself, or, a gift for a special friend during the holidays or birthdays.These will be SIGNED Copies.I'll be SIGNING the Strange Company Books BUNDLE for $99.99 You get all 3 Books SIGNED for that price.TRIVA: These are beautiful books. The art on the covers is done by three of the most in-demand artists working in SciFi art today. Pascal Blanche (Dune Concept Artist) did Strange Company. Trent Kaniuga (Twilight Monk, Blizzard Diablo 3 Artist) did Voodoo Warfare. And Marc Lee (Coffee and Perspectives) did Hearts of Darkness. I think these are collectors' editions and I hope you take advantage of this offer. I wanted the best artists for the Strange Company, and I think the art adds to the story in an exceptionally satisfying way.I'll also be ordering copies of The Wasteland Saga.I'll be SIGNING The Wasteland Saga Series for $69.99. You get all 3 Books SIGNED for that price.TRIVIA: Artist M.S. Corley conceived and executed a very specific vision of the covers I wanted for The Wasteland Saga books. These were the third edition of the covers. The first, way back in 2011, was a cover I bought from an artist that was expensive for me at the time but didn't necessarily evoke what I wanted. Those were the early days of Indie pub and it was all I had the money for. It was kind of a take it or leave it deal. Then I sold the series to Harper Collins and they basically did a photoshop hack job for the covers. When I finally recovered the rights in 2019 I wanted to do something that evoked the Post-Apocalyptic Hemmingway nature of the books. I have a favorite sketch from Picasso. Don Quixote. I gave an image of the sketch to M.S. Corely and together we came up with covers that finally captured the series. Honestly… they are beautiful pieces of art and I love them even without the books. But that vintage feel they give to the covers of these books is very special to me and makes it feel like it was all worth it, and I am very pleased to offer them to you, SIGNED. These are keepers and I hope you cherish them as much as I do. -Nick This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit nickcole.substack.com/subscribe

Monte Poole on How Honestly We Can Evaluate the Warriors Without Steph Curry & Jonathan Kuminga's Big Debut for the Hawks

NBC Sports Bay Area Warriors Insider Monte Poole joined Silver & JD to discuss how honestly we should evaluate a Warriors team without Stephen Curry and Jimmy Butler. He explains how Brandin Podziemski and Moses Moody find themselves in a similar predicament to Jordan Poole at the end of the 2021 season, and why De'Anthony Melton is playing his way into earning a lot more money this upcoming summer.See omnystudio.com/listener for privacy information.

Episode 470 - Star Wars Insider and the Legacy of the Rick McCallum Prequel Updates

This week we are going back to when the number one source for information on a new Star Wars movie was the infamous Rick McCallum prequel updates in Star Wars Insider magazine! Join us as we track the Episode 1 hype from 1995 to 1999 and discuss how it evolved and much Star Wars wild fan anticipation has changed and stayed the same in the past 27 years. So look at a photo of 97 Jabba with one eye, celebrate the love and listen today! JOIN THE BLAST POINTS ARMY and SUPPORT BLAST POINTS ON PATREON! MANDALORIAN SEASON 3 BOBA FETT BEACH PARTY COMMENTARY! NEW ANDOR SEASON 2 EPISODE COMMENTARIES! HEAR EPISODES EARLY! Theme Music! downloadable tunes from episodes! Extra goodies! and so much MORE! www.patreon.com/blastpoints Blast Points T-SHIRTS are now available! Represent your favorite podcast everywhere you go! Get logo shirts while supplies last! Perfect for conventions, dates, formal events and more! Get them here: www.etsy.com/shop/Gibnerd?section_id=21195481 If you dug the show, please leave BLAST POINTS a review on iTunes, Spotify and share the show with friends! If you leave an iTunes review, we will read it on a future episode! Honestly! Talk to Blast Points on twitter at @blast_points "Like" Blast Points on Facebook Join the Blast Points Super Star Wars Chill Group here www.facebook.com/groups/BlastPointsGroup/ we are also on Instagram! Wow! www.instagram.com/blastpoints Your hosts are Jason Gibner & Gabe Bott! contact BLAST POINTS at : contact@blastpointspodcast.com May the Force be with you, always! This podcast is not affiliated in any way with Lucasfilm Ltd. LLC, The Walt Disney Company, or any of their affiliates or subsidiaries.

243. Cheers to "Dave": Fun Christians, Cliché Quotes, & Marriage Green Flags

Send a textWho is “Dave,” you ask? And why are we cheersing to him? Honestly… we're not quite sure. He may be real. He may be a metaphor. We'll let you decide.This week, we're going completely off-script and having some fun — talking about things like why Christians should actually be fun, our thoughts on random cliché quotes, and marriage green flags (which Bethany may or may not fully understand).There may not be a life-changing takeaway in this episode — but if we can make your week a little lighter and a lot more entertaining, we'll call that a win.DISCLAIMER: The “bleeping” is not covering up a curse word. It exists solely to annoy you and make you wonder what on earth Corey could have possibly said that was worth bleeping out.

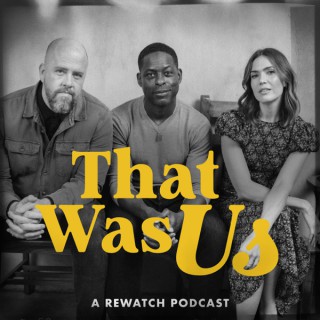

On today's episode of That Was Us, we're diving into Season 5, Episode 4: Honestly. This episode explores how patterns repeat across generations: from Kevin confronting childhood pressures and insecurities, to Randall stepping into mentorship and turning an uncomfortable moment into purpose, and Kate and Toby navigating the early steps of adoption. Plus, Mandy, Chris, and Sterling have fun in the studio chatting about sleep training, how their style has changed, and of course they also welcome 504 writer Elan Mastai to the podcast! Elan talks about how this show came into his life, what it was like moving from Canada to work on the show and how he dealt with that during Covid, and some of his most memorable and impactful moments writing for the show! That Was Us is produced by Rabbit Grin Productions. Music by Taylor Goldsmith and Griffin Goldsmith. ------------------------- Support Our Sponsors: - Find Unreal products anywhere cravings hit, including at Whole Foods, Target, Costco, and other grocery stores Visit https://UnrealSnacks.com/TWU to get $2 off a bag of Unreal. Terms and conditions apply. - Share a little extra love this February and wrap yourself, or someone you care about, in comfort that truly feels special. Head to https://cozyearth.com and use our code TWU for up to 20% off. And if you get a post-purchase survey, be sure to mention you heard about Cozy Earth right here. -------------------------

Ep 3038: More Doom, Gloom, and Long-buried Secrets

(aidate: 2.24.26) Winona Ryder is headed back into the dark and twisty universe of Wednesday, reuniting with Tim Burton and Jenna Ortega for Season 3 — because apparently Nevermore needed more legendary cheekbones. Over at the Today Show, the crew turned a New York blizzard into a newsroom sleepover so you wouldn't miss your morning headlines. Commitment level: middle school lock-in, but with better lighting. And Lindsey Vonn? After a brutal Olympic crash and critics calling her "selfish" for competing, she's making it clear — she'd rather go down swinging than sit it out. Leg saved. Regrets? None. Honestly, if this is the energy today, you've got drama, loyalty, and gothic glamour before lunch. Voted 6th Best Entertainment News Podcast! Because being #1 is soooo overrated. And @HalleBerry Listen to the daily Van Camp and Morgan radio show at: https://vancampandmorgan.com/stations buy us a coffee

Come, Follow Me with FAIR – Genesis 18–23 – Part 1 – Autumn Dickson

On Behalf of Ten by Autumn Dickson The Old Testament is chock full of stories. One of the stories this week is about Sodom and Gomorrah. They were an incredibly wicked city, and the Lord destroyed them. Before the Lord does so, He talks to Abraham about it. Abraham has a whole conversation with the Lord where he asks the Lord not to destroy the city if he can find righteous people within it. First, Abraham asks the Lord to spare it if he can find 50 righteous people. Then he keeps decreasing that number until we reach this point: Genesis 18:32 And he said, Oh let not the Lord be angry, and I will speak yet but this once: Peradventure ten shall be found there. And he said, I will not destroy it for ten's sake. The Lord agrees to not destroy it for the sake of ten righteous people. This is an oft-repeating principle throughout scriptures. The Lord preserves nations because of a few righteous within it. The first example that comes to mind is Ammonihah. When Ammonihah killed and exiled all of the believers, it was ripe for destruction, and that was precisely what happened. The entire city was demolished by the Lamanites. The second one that comes to mind is in Isaiah 65 where the Lord talks about preserving the vine on behalf of a small cluster of good grapes. It repeats far more than that, but those are just a couple of examples. And of course, there is a type in this. Let's talk about it. Sometimes it's not about preserving a nation but a person. Abraham loved people enough that He pleaded with the Lord to save the city if he could find even a little bit of righteousness within it. Abraham is a type of Christ, and Christ pleads on our behalf even when there is only a little bit of righteousness within us. He loves us and wants us to have time to figure it out. It is important to understand what that means and why He does it. When the Lord preserves a nation on behalf of the righteous who are dwelling there, He isn't declaring the entire nation righteous. He isn't turning a blind eye to the wickedness found there. He doesn't plan on interceding on behalf of those who are unrepentant. For them, it will be as if no atonement had been made. Can you imagine how Lot's daughters might have felt if Heavenly Father ignored what they had tried to do? Can you imagine how minimalized and cast aside and unsafe they would feel? Mercy and intercession are not about ignoring wickedness. Rather, it is because He is providing the righteous with an opportunity to grow if possible. In Alma 13, we read more about the king of Salem, Melchizedek. Melchizedek is a person from the Old Testament who blessed Abraham at one point. He was also king over a city that had waxed strong in abomination. They had “all” gone astray and were “full” of wickedness, except for Melchizedek. It was just Melchizedek. And yet, through the preaching of Melchizedek, the people repented and were saved. When it comes to our own hearts, the Lord is willing to intercede if we repent. If there is a shred of goodness in us that holds sway, there is a chance to be saved. On the flip side, we read about Ammonihah that I mentioned previously. Alma went there, was rejected, and left. He was commanded by an angel to return again, and in doing so, he came to Amulek. Amulek's home welcomed him in and blessed him. After Alma and Amulek were preaching, some were converted but the leaders of Ammonihah killed them by fire. Alma and Amulek escape, and Ammonihah is destroyed. If we willfully kill those good seeds within us and reject Christ that thoroughly, He will not plead on our behalf. He does not save us in our sins. He saves us from our sins when we're trying to escape them. He saves us long enough to let our choices play out in either direction, to the ultimate rejection of Him or to our repentance. I want to expand the example of Ammonihah just a bit. There are times when the Lord chooses to rain down His justice on purpose. There are times when He actively brings down trials and tragedy upon His people. When the wickedness is so bad that a softer answer won't hit the mark, the Lord is not afraid of using a hard answer. There are times that He directly brings about difficulty in an attempt to reach us. I wonder if it's just a tad different with the city of Ammonihah. I wonder if the Lord didn't have a hand in bringing the Lamanites to their doorstep to destroy them. I wonder if the Lord simply didn't protect them any longer. There is a type in this. Sometimes the Lord purposefully rains down difficulty to try and shake us awake to our awful condition. But when it comes to a “final” judgment, He simply steps aside and doesn't plead on our behalf. It is as if there is no atonement of Jesus Christ. Ammonihah wasn't a final, final judgment, but it was a type of final judgment. It was meant to teach us something about the nature of eternity. The Lord wasn't trying to reach them anymore; they had already shown that they didn't want Him. Rather, He simply stepped aside and didn't save them. His atonement simply didn't apply in their lives. Abraham pleaded on behalf of Sodom and Gomorrah because he couldn't stomach the idea of such destruction. It was hard for him to watch. After Lot was gone, I'm sure Abraham hated to watch it happen, but accepted the tragic necessity. Abraham is a type of the Lord. Our Lord and Savior pleads on our behalf. If there are even ten good people, He wants to give us time and let us play out our choices. He intercedes on our behalf and preserves us until the day that we completely reject Him. He performed the atonement, the intercession, because He couldn't stand to watch us be destroyed when there was good in us. Honestly, I think He can't stand to watch us be destroyed even after we have rejected Him, but He weighs that option with letting us destroy everything around us. I testify that the Lord wants to save us. He is pleading with us to come and be saved. He isn't standing there with a ruler ready to kick us out at any infraction. He is doing everything He can to get us to hear Him and find peace in Him. He stands ready to save us and then walk us through repentance towards a happier state of being like He did with Melchizedek and the city of Salem. He wants to save. Let Him. Work with Him. Autumn Dickson was born and raised in a small town in Texas. She served a mission in the Indianapolis Indiana mission. She studied elementary education but has found a particular passion in teaching the gospel. Her desire for her content is to inspire people to feel confident, peaceful, and joyful about their relationship with Jesus Christ and to allow that relationship to touch every aspect of their lives. Autumn was the recipient of FAIR's 2024 John Taylor Defender of the Faith Award. The post Come, Follow Me with FAIR – Genesis 18–23 – Part 1 – Autumn Dickson appeared first on FAIR.

A breakthrough mega hit that defied the odds and stood the test of time, and a band that might not have. Or maybe they did. Honestly, it's not obvious. Groove Is In The Heart, originally by Deee-Lite, covered by Blues Traveler. Outro music is the theme song from Green Acres, sung by Eddie Albert and Eva Gabor.

In this episode, we listen to the distressed response to an accusation, as depicted in Sangam Literary work, Aganaanooru 186, penned by Paranar. The verse is situated amidst the lush lotus-filled ponds of the ‘Marutham’ or ‘Farmlands landscape’ and portrays the beauty and wealth of an ancient town. வானம் வேண்டா வறன்இல் வாழ்க்கைநோன் ஞாண் வினைஞர் கோள் அறிந்து ஈர்க்கும்மீன் முதிர் இலஞ்சிக் கலித்த தாமரைநீர்மிசை நிவந்த நெடுந் தாள் அகல் இலைஇருங் கயம் துளங்க, கால் உறுதொறும்பெருங் களிற்றுச் செவியின் அலைக்கும் ஊரனொடுஎழுந்த கௌவையோ பெரிதே; நட்பே,கொழுங் கோல் வேழத்துப் புணை துணையாகப்புனல் ஆடு கேண்மை அனைத்தே; அவனே,ஒண் தொடி மகளிர் பண்டை யாழ் பாட,ஈர்ந் தண் முழவின் எறிகுணில் விதிர்ப்ப,தண் நறுஞ் சாந்தம் கமழும் தோள் மணந்து,இன்னும் பிறள் வயினானே; மனையோள்எம்மொடு புலக்கும் என்ப; வென் வேல்,மாரி அம்பின், மழைத்தோற் பழையன்காவிரி வைப்பின் போஒர் அன்ன, என்செறிவளை உடைத்தலோ இலெனே; உரிதினின்யாம் தன் பகையேம்அல்லேம்; சேர்ந்தோர்திரு நுதல் பசப்ப நீங்கும்கொழுநனும் சாலும், தன் உடன் உறை பகையே. We go on a trip full of twists and turns as we listen to the words of a courtesan, said in the earshot of the lady’s friends, conveying a pointed message about the man to the lady: “Leading a life without any poverty, one that seeks not the favour of the skies, fisherfolk pull their sturdy nets woven with strong threads, knowing the catch is caught, in the ponds, brimming with fish. The tall-stalked, wide leaf of the flourishing lotus that floats atop the waters of the dark pond, flutters, when touched by the wind, akin to the swaying ear of a huge elephant, in the town of the lord. The rumours that have risen about my relationship with him is huge indeed; Whereas the extent of his affection for me is only akin to the act of holding on to a raft of thick-stemmed reeds, when playing in the river stream; As maiden wearing shining bangles sing along to the tune of the ancient lute, as moist and cool drums are struck with sticks, the man's shoulders, wafting with the scent of cool and fragrant sandalwood, would now be embracing another woman, he's entranced with. They say his wife is furious with me; Akin to the town of Po-or, watered by the gushing Kaveri, ruled by Palaiyan, renowned for his cloud-like shields, rain-like arrows and white spears, are my beautiful bangles. I have not broken my bangles in anger; Honestly, I'm not her enemy; The one who parts away, leaving the fine foreheads of those he united to be filled with pallor, that rich lord is the right person to be called as the enemy, one within her own abode!” Time to fish in the ponds of this lush landscape! The courtesan starts with a description of the man’s town, and to do that, she brings forth a certain community of people, whom she describes as leading a life that does not know poverty, for they are fisherfolk and they don’t have to depend on the skies for their wealth and prosperity, a statement which implicitly contrasts them with another group of people in that landscape, those who follow the occupation of farming. After that philosophical statement about their work, the courtesan zooms on to the sturdy nets in their hands and the way they are hauling the fish by pulling their nets out of the ponds. She describes these ponds as brimming with water, filled with lotus flowers and leaves, whose movement in the breeze, she specifically places in parallel with that of the swaying ears of a huge elephant. After that picturesque description of the man’s town, the courtesan turns her attention to the man himself and describes how gossip about her relationship with him had spread all around town. But in reality, the way the man had treated her was nothing more than how someone would hold on to a raft, made of strong reeds, when playing in the gushing river stream, and then abandoning it, once they are done with their play. She reveals how at the very moment the man was enjoying the company of some other courtesan, embracing her and dancing to the songs of the maiden, accompanied by the music of ancient lutes. The courtesan goes on to talk about what she has just heard, about how the man’s wife, was mad at her, when he was romping around elsewhere. She then describes a rich and handsome town, one called ‘Po-or’, ruled by a chieftain named Pazhaiyan, renowned for his battle-efficient army of spears, arrows and shields. She has summoned this town only to place it in parallel to her own bangles. She talks about how the lady’s anger had not made her break those bangles of hers in oath and fury. The courtesan concludes by pointing out that the real enemy of the lady was not her, but the lady’s own husband, the lord of the town! A perfect illustration of a place where men are few, and where power and wealth accumulates in their very hands. The striking aspect of this verse is the way it tells us to pause in our moments of anger and consider who is to be blamed truly. Often, we avoid blaming ourselves or those close to us, and instead direct the anger at those others, whom we think are the cause of our troubles! Just the way this courtesan points out, it would bring great clarity to ponder on the question, ‘Who is the enemy here?’

Sunday, February 22nd 2026Win the Day! Seed the Clouds So what does it mean to seed the clouds? Honestly, I did not know that that was actually a real thing until a few years ago. But some of the original experiments on seeding clouds were done back in the 1940's. At that time, they used dry ice to seed the cloud…and it worked. Snow began to fall. But what does it mean in our lives?

Deceiving Demon Aliens - David Eells - 2.22.2026