Podcasts about Project finance

- 121PODCASTS

- 181EPISODES

- 35mAVG DURATION

- 1EPISODE EVERY OTHER WEEK

- Feb 24, 2026LATEST

POPULARITY

Best podcasts about Project finance

Latest news about Project finance

- Smackover Receives Signs of Interest for Over $1 billion in Project Finance Yahoo! Finance - Jan 24, 2026

- Project finance is the missing link for the nuclear buildout we need Utility Dive - Jan 21, 2026

- Soluna Breaks Ground on 166-MW Texas Wind-Powered Data Center for Crypto and AI POWER Magazine - Sep 18, 2025

- Blue Moon Metals gets $400M project finance Breaking News on Seeking Alpha - Aug 20, 2025

- Blue Moon Metals Secures up to US$140 Million Project Finance Package from Hartree/Oaktree to ... GuruFocus New Articles - Aug 20, 2025

- New project finance rules can help boost lending The HinduBusinessLine - Home - Jun 23, 2025

- RBI project finance guidelines easier than draft, breather for lenders Economic Times - Jun 19, 2025

- RBI issues project finance directions, banks to provide 1-1.25% for projects under construction The Hindu - Home - Jun 19, 2025

- IREDA, PFC, REC, HUDCO, IRFC Shares Rise As RBI Softens Project Finance Norms BloombergQuint - Jun 20, 2025

Latest podcast episodes about Project finance

Finance has a critical role to play in achieving conservation goals. Simply put, saving an ecosystem, or a species, isn't free. Those efforts require lots of scientific research and analysis, tools, infrastructure, and staff. WWF has been at the forefront of a variety of innovative ways to finance those efforts – from Project Finance for Permanence initiatives, to debt for nature swaps, and more. Today we're going to talk about another approach that's gaining steam: impact investing. Impact investing is all about making investments with the goal of advancing social or environmental outcomes – not about maximizing financial returns. Joining Nature Breaking today to explain how it works is Isabelle Foster, WWF's Senior Impact Investing Specialist. Isabelle is part of WWF Impact, our impact investing venture. And she's also a podcast host, having recently launched a limited-series show called Catalyzing Climate Conversations. Her new show is a partnership with the Aspen Institute's Aspen Network of Development Entrepreneurs (ANDE). Stay tuned to hear from Isabelle about how impact investing works, why WWF is investing in companies like EatCloud—whose software platform is helping grocery stores and other businesses divert food from the landfill and instead support local communities—and how these investments advance conservation outcomes on the ground. Links for More Info: Isabelle Foster bio WWF Impact PODCAST: Catalyzing Climate Conversations CHAPTERS: 0:00 Preview 0:30 Intro 1:56 What is impact investing? 5:20 How can impact investing help the planet? 8:02 WWF's approach to impact investing 13:34 Example of success: EatCloud 21:45 Podcast plug for Catalyzing Climate Conversations 27:39 Outro

Corporate Finance Explained | Project Finance and Funding Large Scale Investments

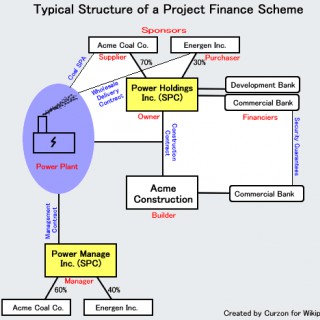

In this episode of Corporate Finance Explained on FinPod, we break down project finance and explain how companies fund massive infrastructure projects without putting their entire balance sheet at risk. From wind farms and data centers to toll roads and power plants, project finance is the financial structure that makes the physical world possible.Building billion-dollar assets comes with enormous construction, demand, and regulatory risk. This episode explains how project finance isolates that risk through special purpose vehicles (SPVs), non-recourse debt, and strict cash flow waterfalls. We explore why lenders focus on a project's cash flows rather than the parent company's credit, and how this discipline shapes everything from risk management to capital allocation.In this episode, we cover:

Unlocking project finance for large-scale carbon removal projects

Jonathan Rhone and Natalie Khtikian of CO280 join Tom Heintzman, Vice Chair, Energy and Climate Finance to discuss how CO280 is accessing project finance capital and building long-term revenue and trusted partnerships for carbon removal projects in the pulp and paper industry. Hosted by Simplecast, an AdsWizz company. See https://pcm.adswizz.com for information about our collection and use of personal data for advertising.

EV Semi-Trucks Are Here — How EV Realty is Scaling the Charging | Patrick Sullivan, CEO of EV Realty

The trucking industry operates on razor-thin margins and highly optimized schedules. Think free delivery from click to your door in 4 hours. Decarbonizing that kind of industry requires more than green intentions—it requires a highly reliable solution that drives real economic value. In the push to electrify large trucks, we often focus on the vehicles. But this rollout requires industrial-scale access to electricity in the context of an often-challenged distribution grid.My guest today is Patrick Sullivan, CEO of EV Realty. Building on decades of renewable energy development experience, navigating electricity grid constraints, Patrick and team are enabling the EV semi-truck rollout today.We discuss the coming wave of EV trucks, the realities of the freight supply chain, and how EV Realty is building a network that works for the bottom line, local communities, and the broader climate.Links:EV Realty WebsitePatrick Sullivan – CEO of EV RealtyEpisode recorded Email your feedback to Chad, Gil, Hilary, and Guy at climatepositive@hasi.com.

Infra Dig – Ravi Suri on project finance, nuclear and climate change

IJGlobal welcomes back regular guest Ravi Suri for an episode focused on nuclear power, the role that project finance will play in this mega-scale environment and saving the planet with PF. Ravi – who has recently had a shift in focus at KPMG and now is linked to the Kenya practice while still being global head of sustainable finance and impact investing – talks to IJ editorial director Angus Leslie Melville. In an episode that runs for almost 22 minutes, Ravi takes the listener through the intricacies of project finance in the challenging space of nuclear energy, how impactful the latest COP gathering was and how to save the planet.

AI-Powered Infrastructure Development with Unlimited Industries

Alex Modon is CEO and Co-founder of Unlimited Industries, a company transforming infrastructure development through AI-driven automation. Unlimited tackles one of the biggest bottlenecks in climate and industrial innovation: the outdated, risk-averse world of engineering, procurement, and construction (EPC). Traditional EPCs are often misaligned with the needs of first-of-a-kind projects. Unlimited flips the script by using AI to generate thousands of design permutations, drastically cutting feedback loops, iteration time, and overall cost. Alex shares how his background in software, combined with childhood exposure to industrial environments, inspired him to take on this hard problem—and why he believes the only way to build faster is to rebuild the entire system from the ground up.Episode recorded on July 29 (Published on Dec 3)In this episode, we cover: [03:15] An overview of EPCs[05:05] How EPCs make money[07:06] Why FOAK projects face EPC challenges[10:02] Reducing marginal cost of engineering design with AI[12:35] Alex's pivot from software to infrastructure[15:39] Why EPCs resist adopting AI tools[19:14] Unlimited's capital projects platform explained[23:41] How Unlimited manages physical construction[26:36] The company's vision of fully autonomous construction in the future[28:08] Why physical abundance drives Alex Enjoyed this episode? Please leave us a review! Share feedback or suggest future topics and guests at info@mcj.vc.Connect with MCJ:Cody Simms on LinkedInVisit mcj.vcSubscribe to the MCJ Newsletter*Editing and post-production work for this episode was provided by The Podcast Consultant

Green Energy Investments: Structuring Deals and Managing Legal Risk

Send us a textIn this episode of the Family Office Podcast, recorded live at our Beverly Hills Investor Club Summit, we dive deep into how investors structure and de-risk opportunities in the fast-growing green energy and materials sectors.Our speaker explains how off-take agreements, royalty structures, and contract-backed revenue streams can deliver stable 20–40% returns — and why government policies can either accelerate or derail these projects.

#230 Five Keys to MBA Admissions Success with N'doli Jean-Hugues Cherif, Insead MBA '26

Darren talks with N'doli Jean-Hugues "Cherif," a French and Ivorian candidate who gained admission to both INSEAD and London Business School's MBA programs. Cherif, an older full-time MBA candidate with diverse experience across five roles - including audit, management consulting, investment banking and infrastructure project finance in the public and private sector - shares his five key success factors for MBA admissions.TopicsIntroduction (0:00)Cherif's Background & Pre-MBA Plan & Goals (3:10)How Cherif Found Career Mentors & Built Future Opportunities (10:40)Cherif's 5 Key Success FactorsUnwavering Focus (17:20)Strategic Peer Review (27:15)Work with a Consultant (34:30)Self-awareness (43:15)Narrative Coherence (52:30)How Cherif Assessed his Competitiveness (1:00:00)Cherif's Interview Tips for Insead & London Business School (1:07:10)Cherif's Final Tips (1:24:00)About Our GuestN'doli Jean-Hugues Cherif graduated from Cranfield University with a Masters in Management and Concordia University with a Bachelors in Political Science. He will be attending the Insead MBA program in Fontainebleau, France, focused on a post-MBA career in infrastructure-focused private equity.After getting his Masters, Cherif worked as an auditor for PwC, management consultant for Square Management, and then in Financial Advisory and Project Finance for the government of Côte d'Ivoire and then as an investment banker for Obara Capital. He then returned to Paris with his family to do Financial Advisory and Project Finance for Egis.Show NotesFollow N'doli Jean-Hugues Cherif on LinkedInHow I Got Into Insead & London Business School: 5 Game-Changing Success Factors by N'doli Jean-Hugues Cherif (My Admissions Journey Series)Insead MBAInfravenir: Young Infrastructure Professionals in FranceThe Glocap Guide To Getting A Job In Private Equity: Behind the Scenes Insight Into How PE Funds Hire by Brian KorbLondon L. - MBA Admissions ConsultantMore ResourcesGet free school selection help at Touch MBAGet pre-assessed by top international MBA programsGet the Admissions Edge Course: Proven Techniques for Admission to Top Business SchoolsOur favorite MBA application tools (after advising 4,000 applicants)

#230 Five Keys to MBA Admissions Success with N'doli Jean-Hugues Cherif, Insead MBA '26

Darren talks with N'doli Jean-Hugues "Cherif," a French and Ivorian candidate who gained admission to both INSEAD and London Business School's MBA programs. Cherif, an older full-time MBA candidate with diverse experience across five roles - including audit, management consulting, investment banking and infrastructure project finance in the public and private sector - shares his five key success factors for MBA admissions.TopicsIntroduction (0:00)Cherif's Background & Pre-MBA Plan & Goals (3:10)How Cherif Found Career Mentors & Built Future Opportunities (10:40)Cherif's 5 Key Success FactorsUnwavering Focus (17:20)Strategic Peer Review (27:15)Work with a Consultant (34:30)Self-awareness (43:15)Narrative Coherence (52:30)How Cherif Assessed his Competitiveness (1:00:00)Cherif's Interview Tips for Insead & London Business School (1:07:10)Cherif's Final Tips (1:24:00)About Our GuestN'doli Jean-Hugues Cherif graduated from Cranfield University with a Masters in Management and Concordia University with a Bachelors in Political Science. He will be attending the Insead MBA program in Fontainebleau, France, focused on a post-MBA career in infrastructure-focused private equity.After getting his Masters, Cherif worked as an auditor for PwC, management consultant for Square Management, and then in Financial Advisory and Project Finance for the government of Côte d'Ivoire and then as an investment banker for Obara Capital. He then returned to Paris with his family to do Financial Advisory and Project Finance for Egis.Show NotesFollow N'doli Jean-Hugues Cherif on LinkedInHow I Got Into Insead & London Business School: 5 Game-Changing Success Factors by N'doli Jean-Hugues Cherif (My Admissions Journey Series)Insead MBAInfravenir: Young Infrastructure Professionals in FranceThe Glocap Guide To Getting A Job In Private Equity: Behind the Scenes Insight Into How PE Funds Hire by Brian KorbLondon L. - MBA Admissions ConsultantMore ResourcesGet free school selection help at Touch MBAGet pre-assessed by top international MBA programsGet the Admissions Edge Course: Proven Techniques for Admission to Top Business SchoolsOur favorite MBA application tools (after advising 4,000 applicants)

The need for innovative financing solutions in digital infrastructure

Marcos Torres, Global Head of Media, Communications and Entertainment, sat down with fellow RBC Capital Markets experts Chip Wadsworth, Head of Technology, Media, Telecom, Equity Capital Markets, and Nanda Kamat, Global Head of Project Finance, to explore the forces shaping digital infrastructure and the transformation of how projects are financed, structured and scaled.

Inside Microsoft's $1B Climate Fund Strategy to Hit Net Zero by 2030

Brandon Middaugh is the senior director of Microsoft's $1 billion Climate Innovation Fund, created in 2020 to accelerate technologies that help Microsoft and the wider economy meet aggressive 2030 sustainability goals: carbon‑negative, water‑positive, zero‑waste and ecosystem‑protective. Five years in, Brandon shares how the fund's “invest‑to‑procure” model aligns capital with Microsoft's own demand for clean power, fuels, carbon removal, low‑carbon materials and water solutions; what's working (a 5‑fold jump in durable CDR contracted since launch) and where supply still lags; and why scaling markets—not just piloting tech—is central to Microsoft's moon‑shot roadmap toward net‑zero and beyond. In this episode, we cover: [01:43] Microsoft's ambitious 2030 sustainability targets[02:59] Brandon's path toward climate finance[10:59] The fund's “north star” [12:18] How carbon removal demand still dwarfs current supply[17:14] Airline partnerships supporting Microsoft's net-zero goals[19:46] Investment and procurement teams' flywheel collaboration[23:22] Water-related investments and initiatives[29:36] Program mandates: innovate, accelerate, and scale[31:57] Brandon's advice on transparent engagement with Microsoft[36:43] Predicting highly distributed future energy systems[40:16] How transformation only seems inevitable in hindsightEpisode recorded on April 10, 2025 (Published on May 12, 2025) Enjoyed this episode? Please leave us a review! Share feedback or suggest future topics and guests at info@mcj.vc.Connect with MCJ:Cody Simms on LinkedInVisit mcj.vcSubscribe to the MCJ Newsletter*Editing and post-production work for this episode was provided by The Podcast Consultant

How Euclid Power Streamlines Clean Energy Development at Scale

Jacob Sandry is the CEO and co-founder of Euclid Power, a platform for renewable energy project development, financing, and operations—with AI-enabled services layered on top. MCJ is proud to be an investor in Euclid, having joined the company's seed round in mid-2022.Jacob has worked in renewable power his entire career, starting at Generate Capital right out of college, where he worked under Jigar Shah. He then spent several years on the investment team at Goldman Sachs' Renewable Power Group before having the a-ha moment that led to Euclid—and left to start it with a couple of his fellow Goldman teammates.Jacob and Cody discuss how he's seen the renewables industry evolve over the past decade, his theory of change, the insights that led to founding Euclid, and the company's current product and traction. We also touch on his thoughts on AI, power demand curves, and more. As we see it, Jacob is riding two massive waves with Euclid: the inexorable growth of solar and storage, and the curve-bending potential of AI and workflow automation.In this episode, we cover: [1:59] Jacob's early career and background[3:34] Working with Jigar Shah at Generate Capital[8:26] Time on the Goldman Sachs Renewable Power team[9:24] The origin story of Euclid Power[15:23] Challenges in building renewable energy projects[19:15] From internal Goldman tools to the Euclid platform[20:29] Client spotlight: UBS[21:57] Transitioning from project development to a software company[26:07] The role of AI in Euclid's platform[31:49] Business growth and market traction[33:35] Building Euclid as a multiplayer platform[37:10] Balancing software automation with hands-on services[40:41] Current limitations of AI and automation[42:50] Jacob's outlook on the future of renewable energy[46:05] Powering data centers and emerging demand[47:30] Where Euclid is looking for help[48:18] The meaning behind the name “Euclid”Episode recorded on April 25, 2025 (Published on May 5, 2025) Enjoyed this episode? Please leave us a review! Share feedback or suggest future topics and guests at info@mcj.vc.Connect with MCJ:Cody Simms on LinkedInVisit mcj.vcSubscribe to the MCJ Newsletter*Editing and post-production work for this episode was provided by The Podcast Consultant

Navigating climate project finance in a shifting political landscape

In this episode of Energy Evolution, host Taylor Kuykendall moderates a panel discussion at the Tom Tom Festival in Charlottesville, Virginia, focusing on the question of how to fund solutions to climate change. The panelists highlighted the current challenges faced by climate tech companies in securing funding, particularly in a volatile political and economic landscape. Their conversation delves into the complexities of measuring climate impact, the importance of transparency in forecasting, and the necessity for businesses to effectively communicate their value propositions to both investors and the public. The panel features Anne Clawson, principal at Cascade Advisory; Bettina Ring, Virginia state director for the Nature Conservancy; Gilman Callsen, founder and CEO of Rho Impact; and Michael Bobbin, senior director of mergers and acquisitions advisory at DNV. The podcast includes highlights from the lengthier April 17 discussion. Energy Evolution has merged with Platts Future Energy, and episodes are now regularly published on Tuesdays.

Navigating climate project finance in a shifting political landscape

In this episode of Energy Evolution, host Taylor Kuykendall moderates a panel discussion at the Tom Tom Festival in Charlottesville, Virginia, focusing on the question of how to fund solutions to climate change. The panelists highlighted the current challenges faced by climate tech companies in securing funding, particularly in a volatile political and economic landscape. Their conversation delves into the complexities of measuring climate impact, the importance of transparency in forecasting, and the necessity for businesses to effectively communicate their value propositions to both investors and the public. The panel features Anne Clawson, principal at Cascade Advisory; Bettina Ring, Virginia state director for the Nature Conservancy; Gilman Callsen, founder and CEO of Rho Impact; and Michael Bobbin, senior director of mergers and acquisitions advisory at DNV. The podcast includes highlights from the lengthier April 17 discussion. Energy Evolution has merged with Platts Future Energy, and episodes are now regularly published on Tuesdays.

What is Project Finance, and Why is it Important?: 3CL Seminar

Speaker: Professor Paul Deemer (Vanderbilt Law School)This lecture focuses on the development and project financing of large international infrastructure projects, and covers –What is “project finance” and what is not? How does a “project financing” differ from other types of financing?Why is project finance used on large infrastructure projects? What is “leverage,” and why is that important?What legal structures and documents are commonly used in project financings?Who are the participants in a project financing? What are their roles?What is the role of the lawyer? Why should a new lawyer be familiar with project finance?In discussing these issues, the speaker draws on his experience representing clients on projects in Europe, Asia, Africa and the Middle East.3CL runs the 3CL Travers Smith Lunchtime Seminar Series, featuring leading academics from the Faculty, and high-profile practitioners.For more information see the Centre for Corporate and Commercial Law website:http://www.3cl.law.cam.ac.uk/

What is Project Finance, and Why is it Important?: 3CL Seminar

Speaker: Professor Paul Deemer (Vanderbilt Law School)This lecture focuses on the development and project financing of large international infrastructure projects, and covers –What is “project finance” and what is not? How does a “project financing” differ from other types of financing?Why is project finance used on large infrastructure projects? What is “leverage,” and why is that important?What legal structures and documents are commonly used in project financings?Who are the participants in a project financing? What are their roles?What is the role of the lawyer? Why should a new lawyer be familiar with project finance?In discussing these issues, the speaker draws on his experience representing clients on projects in Europe, Asia, Africa and the Middle East.3CL runs the 3CL Travers Smith Lunchtime Seminar Series, featuring leading academics from the Faculty, and high-profile practitioners.For more information see the Centre for Corporate and Commercial Law website:http://www.3cl.law.cam.ac.uk/

Episode 202: Mexico's USMCA Challenges: Governance, Trade Risks, and Economic Pressures with Juan Carlos Machorro

This midweek, Dominic Bowen welcomes Juan Carlos Machorro to The International Risk Podcast to dive into the complexities of the United-States Mexico Canada Trade Agreement (USMCA). Together, they discuss the origins of the USMCA agreement, the critical elements of the 2026 Joint Review, the implications of Mexico's judicial reforms, Donald Trump's proposed tariffs, and the urgent need to strengthen Mexico-Canada trade relations. Juan Carlos Machorro is the leader of Santamarina y Steta's transactional and financial practice area, with 30 years of experience advising various national and international organizations on the development and implementation of investment and financing projects in Mexico. His areas of expertise include Mergers and Acquisitions, Project Finance and Infrastructure. His talent, practical and business acumen, and deep knowledge of his areas of specialization have earned him numerous accolades in Mexico and abroad.The International Risk Podcast is a must-listen podcast for senior executives, board members, and risk advisors. This weekly podcast explores current affairs, international relations, emerging risks, and strategic opportunities. Hosted by Dominic Bowen, Head of Strategic Advisory at one of Europe's top risk consulting firms, the podcast brings together global experts to share insights and actionable strategies.Dominic's 20+ years of experience managing complex operations in high-risk environments, combined with his role as a public speaker and university lecturer, make him uniquely positioned to guide these conversations. From conflict zones to corporate boardrooms, he explores the risks shaping our world and how organisations can navigate them.The International Risk Podcast – Reducing risk by increasing knowledge. Follow us on LinkedIn for all our great updates.Tell us what you liked!

Judy Wilson's Legacy: Leadership and Legacy with Marianne Smith | S2 EP21

In this special Master Builders episode of Navigating Major Programmes, Riccardo Cosentino and co-host Shormila Chatterjee are joined by Marianne Smith, a distinguished partner at Blakes National Infrastructure Group, to celebrate her remarkable career and pay tribute to Judy Wilson, a trailblazer in Canada's infrastructure industry. Judy, a world-renowned procurement lawyer and a champion for diversity, left an indelible mark on the sector before her passing. This episode honors her legacy while highlighting Marianne's own contributions as one of Judy's closest mentees.With over 20 years of experience in infrastructure and procurement law, Marianne has played a pivotal role in shaping public-private partnerships (P3s) across Canada. She shares her journey from working alongside Judy to becoming a leader in the field, emphasizing how mentorship and advocacy for diversity have been central to her success."Judy was a champion of diversity. She was an ally before we had the nomenclature of what an ally is. She used her power, authority, influence. Not just selfishly, but also to promote, women, people of color, anyone who might've felt, that they didn't belong in the boardroom or around the table, talking about tough, infrastructure type issues. She really did impact so many people in that way." – Marianne SmithKey Takeaways:Judy's approach challenges with creativity, focus on client needs, and advocate for diversity to drive meaningful changeHow to leverage your expertise to develop frameworks and processes that can become industry benchmarks.How to build inclusive environments that encourage collaboration and empower diverse teams to succeed.Why investing in mentorship by sharing knowledge and supporting the growth of future leaders. If you enjoyed this episode, make sure and give us a five star rating and leave us a review on iTunes, Podcast Addict, Podchaser or Castbox. The conversation doesn't stop here—connect and converse with our LinkedIn community:Follow Marianne Smith on LinkedInFollow Shormila Chatterjee on LinkedInFollow Navigating Major Programmes on LinkedInFollow Riccardo Cosentino on LinkedInRead Riccardo's latest at www.riccardocosentino.com Music: "A New Tomorrow" by Chordial Music. Licensed through PremiumBeat.DISCLAIMER: The opinions, beliefs, and viewpoints expressed by the hosts and guests on this podcast do not necessarily represent or reflect the official policy, opinions, beliefs, and viewpoints of Disenyo.co LLC and its employees.

Episode 24: Developing hydrogen ecosystems featuring HYCAP and MorGen Energy

Mark Lee talks to Ben Madden, Chief Technology Officer at Hydrogen investment fund HYCAP, and Patrick Huber, Head of Project Finance at green hydrogen developer MorGen Energy, about the challenges and opportunities in hydrogen ecosystem development, including hydrogen generation, transport infrastructure and accessing new markets for hydrogen.Their conversation covers:Financing hydrogen ecosystemsHow to identify viable hydrogen projectsCurrent European policy incentives for hydrogenEngaging with communities on hydrogen infrastructure developmentHow to accelerate hydrogen ecosystems

In this conversation, Martin Kessler, Chief Business Officer at Flowcarbon, discusses the company's role in securing asset-level financing for carbon removal projects. He explains that Flowcarbon is a vertically integrated carbon finance company focused on arranging project finance for carbon removal projects, assisting project developers with carbon credit issuance, and helping buyers procure carbon credits for their net zero goals. Martin emphasizes the interdisciplinary nature of the carbon markets and the importance of building a strong ecosystem of partners. He also provides insights into the project finance process and highlights the key factors Flowcarbon considers when evaluating projects, such as feedstock availability, revenue streams, and commercial viability. The company aims to demonstrate the viability of carbon removal projects to the private market community. Private credit investors typically get involved in the financing process once the project is at a stage where it is financeable. Flowcarbon helps developers develop financial models, create data rooms of financeable contracts, and secure necessary insurance. They also explore new market opportunities, such as environmental commodities markets and tax credits. TakeawaysFlowcarbon is a vertically integrated carbon finance company that focuses on project finance for carbon removals, carbon credit issuance, and carbon credit sales.The company works with project developers to arrange financing for carbon removal projects and helps them navigate the carbon credit issuance process.Flowcarbon also assists buyers in procuring carbon credits for their net zero goals, primarily targeting corporate clients.The carbon markets require an interdisciplinary approach, and Flow Carbon leverages its network and partnerships to provide comprehensive solutions.The project finance process can take anywhere from six to 18 months, depending on the project's readiness and complexity.Key factors considered when evaluating projects include revenue streams and commercial viability. They work with developers to structure financeable contracts and secure asset-level financing.Private credit investors typically get involved in the financing process once the project is at a stage where it is financeable.Flowcarbon helps developers develop financial models, create data rooms of financeable contracts, and secure necessary insurance.They also explore new market opportunities, such as environmental commodities markets and tax credits. Contact UsGuest: https://www.linkedin.com/in/martin-kessler-99518828/Email us: info@climatetech360.comHost: https://www.linkedin.com/in/samiaq/

Huge demand for data centers right now masks underlying credit risks

We forecast growing demand for cloud services, the adoption of new AI products and cryptocurrencies will see investment in new data center capacity exceed $2 trillion globally over the next five years. But real customer demand and continued technological improvements could limit the amount of data center capacity that is actually needed over the longer term. In this episode, John Medina explains what risks this uncertainty poses to investors in the corporate credit, leveraged loan, bank, CMBS, ABS, private credit and project finance markets.Speaker: John Medina, Senior Vice President at Moody's RatingsHost: Colin Ellis, MD-Global Credit Strategist at Moody's RatingsRelated Research:Data Centers – Global: Rapid capacity growth to serve surging computing demand poses long-term risks

Powering Tomorrow - with Viola and Chris Williams

In this episode, Viola welcomes Chris Williams, Managing Director, Head of Project Finance, London, and Global Offshore Wind at LBBW. Chris shares insights from his extensive experience in project finance, focusing on the evolving landscape of the offshore wind sector. The conversation covers a range of topics, including the challenges and opportunities in the offshore wind sector, with a particular focus on guaranteed revenue streams and the competitive landscape. Chris highlights LBBW's significant contributions to the offshore wind industry, having financed almost 10.5GW across the UK, Germany, France, and the Netherlands. Hosted by:Viola Caon - Head of Content, inspiratia Guest: Chris Williams - Managing Director, Head of Project Finance, London, and Global Offshore Wind, LBBWReach out to us at: podcasts@inspiratia.comFind all of our latest news and analysis by subscribing to inspiratiaListen to all our episodes on Apple Podcasts, Spotify, and other providers. Music credit: NDA/Show You instrumental/Tribe of Noise©2024 inspiratia. All rights reserved.This content is protected by copyright. Please respect the author's rights and do not copy or reproduce it without permission.

Streamlining Green Project Finance (with Amanda Li @ Banyan Infrastructure)

This is CC Pod - the Climate Capital Podcast. You are receiving this because you have subscribed to our Substack. If you'd like to manage your Climate Capital Substack subscription, click here. Disclaimer: For full disclosure, Banyan Infrastructure is a portfolio company at Climate Capital. Our guest host, Dimitry, is the co-founder and CEO of one of our portcos, Enduring Planet.CC Pod is not investment advice and is intended for informational and entertainment purposes only. You should do your own research and make your own independent decisions when considering any investment decision.Don't miss an episode from Climate Capital!Join guest host Dimitri Gershenson as he interviews Amanda Li, COO and Co-founder at Banyan Infrastructure. Tune in to learn more about how Banyan is streamlining sustainable infrastructure financing.Amanda's passion for good business and environmental preservation led her to co-found Banyan Infrastructure, a company that uses software to invest in sustainable infrastructure, aiming to reduce the barriers to sustainable infrastructure financing.Banyan's mission is to address the friction in the project financing process, particularly for smaller scale projects. Large banks often avoid these projects due to the high cost and time-consuming process of evaluating, managing, and maintaining them. However, Banyan's purpose-built project finance software is becoming a game-changer in this space.Banyan also works with large banks like SMBC to streamline and automate the investment process. By cutting investment time and reducing transaction fees, they're making it possible for these banks to fund smaller, but profitable projects that they would have otherwise overlooked. This not only expands the banks' market share but also accelerates the flow of capital to sustainable infrastructure projects.Notably, Banyan played an instrumental role in the Greenhouse Gas Reduction Fund, working alongside green banks and community development financial institutions. Their software helped cut down the time taken to write out small loans, ensuring the funds reached the intended communities faster.Visit banyaninfrastructure.com to learn more! Get full access to Climate Capital at climatecap.substack.com/subscribe

The Greenhouse Gas Reduction Fund (GGRF) is a generational government program deploying $27B into clean energy projects across the US. But what is the bill really?Franz Hochstrasser is an expert in financing projects in low-income areas and has a wealth of experience working on climate for the government - both of which are KEY for GGRF. Franz started his career “giving his 20s” to the government, and with that doing some amazing work as the Special Advisor to the Special Envoy for Climate Change, Deputy Associate Director at the Council of Environmental Quality, and at the USDA.Since then, Franz founded Raise Green where he democratizes the ability to invest in climate solution projects. Through this, he is an expert in sustainable finance for inclusive growth and financing projects for low-income residents. He joined S2 Strategies to navigate GGRF and other landmark legislative movements. And it was an absolute blast to have him on.Support the show

#168 Advice for Project Finance, AI x Climate, CleanTech 1.0, Late Stage Investing, & More w/ Mike Jackson (Earthshot Ventures)

In this episode, I sit down with Mike Jackson, Managing Partner at Earthshot Ventures. Earthshot Ventures calls themselves carbon generalists and invest from Seed to Series B. They mainly invest in software and “stepchange” hardware with a preference to double down on existing portfolio companies.Mike's story is great because of how intentional he has excelled at every stage and in multiple sides of building in climate. He is a successful founder from cleantech 1.0, a rockstar investing even before earthshot, experienced in project finance, and now investing in a collaborative way that is pushing the whole climatetech industry forward.---

Project Finance 101 & Infrastructure Investing Basics

What is Project Finance? In this episode, we are joined again by Rahul Culas, Julie Kim, and David Albert to get into the basics of this sector of Investment Banking. We explain what project finance is and why it's used, how it differs from the types of financing that traditional companies do, who uses project financing, who invests in project financing and more. We explore what the career path can look like from sell side Project Finance within the Investment Banking or Capital Markets division of a bank to energy and infrastructure investing at a buy side Private Equity firm. This episode is also an incredible deep dive into the role of relationships and mentors within the industry. You'll hear the crazy story of how Rahul and David moved heaven and earth to bring Julie with them when they moved from Morgan Stanley to Carlyle Group, one of the world's most prestigious Private Equity megafunds. Rahul Culas is Partner at 1585 Healthcare, an investment firm focused on healthcare services investments. Formerly, Rahul was a Partner and Managing Director at The Carlyle Group, where he co-headed funds dedicated to energy investments. Prior to Carlyle, Rahul was Head of Structured Power Finance at Morgan Stanley. Earlier in his career, he worked at Goldman Sachs in the Fixed Income Currency and Commodities Division. Rahul graduated with a Bachelor's in Mechanical Engineering from the Indian Institute of Technology (“IIT”), Bombay, and a Masters in Human Computer Interaction from the School of Computer Science at Carnegie Mellon UniversityJulie Kim is Partner at 1585 Healthcare. Formerly, Julie was a Principal at The Carlyle Group, where she played the dual role of being on the investment side as well as the Chief Operating Officer of funds dedicated to energy investments. Prior to Carlyle, Julie was an associate in Project Finance at Morgan Stanley. Earlier in her career, she worked in the Equity Derivatives group in Equity Capital Markets at Morgan Stanley. Julie graduated with a BS in Math and Finance from MIT. David Albert is Partner at 1585 Healthcare. Formerly, David was a Partner and Managing Director at The Carlyle Group, where he co-headed funds dedicated to energy investments. Prior to Carlyle, David was the Head of Tax Equity and Project & Structured Finance at Morgan Stanley. Earlier in his career, he worked at Morgan Stanley in the M&A group and Princes Gate Investors, a private equity fund within Morgan Stanley. He started his career at Salomon Brothers. David graduated with a BS in Economics from Wharton and an MBA, also from Wharton.Grab your free Financial Modeling Template and Solution Here!https://the-wall-street-skinny.ck.page/d8e9f9acddDownload Keyficient at https://www.keyficient.co/and use the code “thewallstreetskinny” for a 10% discount!”Support the showFollow us on Instagram and Tik Tok at @thewallstreetskinnyhttps://www.instagram.com/thewallstreetskinny/

Today as a followup to last week's episode where we sat down with two doctors, we are chatting with two investors in the Healthcare Private Equity space, not only talking about that segment of the investment community but also answering the mountain of questions we've gotten from listeners who ARE doctors and want to pivot into the world of finance but don't know how. Rahul Culas is Partner at 1585 Healthcare, an investment firm focused on investing in businesses that facilitate the delivery of quality healthcare to older adults and other vulnerable populations.Formerly, Rahul was a Partner and Managing Director at The Carlyle Group, where he co-headed funds dedicated to energy investments. Prior to Carlyle, Rahul was Head of Structured Power Finance at Morgan Stanley. Earlier in his career, he worked at Goldman Sachs in the Fixed Income Currency and Commodities Division.Rahul graduated with a Bachelor's in Mechanical Engineering from the Indian Institute of Technology (“IIT”), Bombay, and a Masters in Human Computer Interaction from the School of Computer Science at Carnegie Mellon UniversityJulie Yoon is Partner at 1585 Healthcare.Formerly, Julie was a Managing Director at The Carlyle Group, where she focused on funds dedicated to energy investments. Prior to Carlyle, Julie was an associate in Project Finance at Morgan Stanley. Earlier in her career, she worked in the Equity Derivatives group in Equity Capital Markets at Morgan Stanley.Julie graduated from MIT. Grab your free Financial Modeling Template and Solution Here!https://the-wall-street-skinny.ck.page/d8e9f9acddDownload Keyficient at https://www.keyficient.co/and use the code “thewallstreetskinny” for a 10% discount!”Support the showFollow us on Instagram and Tik Tok at @thewallstreetskinnyhttps://www.instagram.com/thewallstreetskinny/

'What is Project Finance, and Why is it Important?': 3CL Seminar

Speaker: Professor Paul Deemer (Vanderbilt Law School)Abstract: This lecture will focus on the development and project financing of large international infrastructure projects, and will cover –- What is “project finance” and what is not? How does a “project financing” differ from other types of financing?- Why is project finance used on large infrastructure projects? What is “leverage,” and why is that important?- What legal structures and documents are commonly used in project financings?- Who are the participants in a project financing? What are their roles?- What is the role of the lawyer? Why should a new lawyer be familiar with project finance?In discussing these issues, the speaker will draw on his experience representing clients on projects in Europe, Asia, Africa and the Middle East.3CL runs the 3CL Travers Smith Lunchtime Seminar Series, featuring leading academics from the Faculty, and high-profile practitioners.For more information: https://www.3cl.law.cam.ac.uk/

Ben Hubbard is CEO and Co-founder at Nexus PMG, an infrastructure advisory and project development organization dedicated to reducing carbon intensity and enhancing resource efficiency. Ben co-founded Nexus PMG in 2013 after multiple years of working on complex metal refining facilities in locations including Mongolia and Saudi Arabia.In this episode, Cody and Ben cover how Nexus PMG got started, what key risks the firm explores when assessing a project for development capital, Ben's advice for infrastructure-heavy startups as they scale, and how he sees the next five years of infrastructure deployment playing out. And they cover a whole lot in between, including the criticality of feedstocks, the role of insurance, opportunities for private equity, and first-of-a-kind project finance.In this episode, we cover: [01:56]: Ben's early mining experience in extreme climates during the 2007 recession[05:24]: Nexus PMG's founding story[11:51]: Abandoning all fossil-fuel projects and full transition to low-carbon focus[17:01]: Observations on declining investment returns in wind and solar projects[20:39]: Challenges in variability and quality of sustainable materials[27:15]: Turnaround of a distressed biomass plant in British Columbia[30:08]: Launch of Nexus Development Capital for scaling businesses[36:04]: Recent shifts from strategics investing to meet ESG goals[38:17]: Why team dynamics are critical to project success[42:50]: Trend forecasting in sustainable projects: hydrogen, sustainable aviation fuels[46:01]: Ben's optimism about capital deployment in the next decadeEpisode recorded on Jan 8, 2024 (Published on Feb 5, 2024) Get connected with MCJ: Jason Jacobs X / LinkedInCody Simms X / LinkedInMCJ Podcast / Collective / YouTube*If you liked this episode, please consider giving us a review! You can also reach us via email at content@mcjcollective.com, where we encourage you to share your feedback on episodes and suggestions for future topics or guests.

Jeremiah Lim, Director in the Sustainable & Impact Investment Banking group at Barclays, discusses how climate hardtech companies can raise debt / project finance to help grow and scale their businesses. He discusses how a climate tech startup can get ready to raise debt, considerations ahead of structuring offtake agreements, when to start collaborating with groups such as his, as well as his take on the “low hanging fruit” within climate tech or technologies that should be prioritized. ------------------------------------------------------------------------------------------------------Mentioned in the podcast:Mission Zero - https://www.missionzero.tech/Deep Science Ventures - https://deepscienceventures.com/UNDO - https://un-do.com/Barclays Sustainable Impact Capital: https://home.barclays/sustainability/addressing-climate-change/financing-the-transition/sustainable-impact-capital/------------------------------------------------------------------------------------------------------Connect with us:Email us: info@climatetech360.comHost: https://www.linkedin.com/in/samiaqaderGuest: https://www.linkedin.com/in/jeremiah-lim-cfa-4bb93060/

Coucou! The ABCs of Building Your Business in America from Scratch with Victoire Lester, CEO of Coucou

In this episode of French Insider, Victoire Lester, CEO of Coucou, joins host Sarah Ben-Moussa to discuss the experience of building a company in the United States from the ground up, including Coucou's approach to hiring and training native-speaking French language instructors, its strategy for attracting American customers, and their experience recruiting and managing a mixed-nationality workforce. What We Discussed in this Episode Can you tell us a bit about your background? How did you become involved with Coucou? What was behind the founding of Coucou? Where did the idea come from? How does Coucou go about hiring and training instructors? How does Coucou's approach to hiring impact the learning experience? What was it like coming to the U.S. and building a company from the ground up? What motivated Coucou to expand its offerings? What was Coucou's experience during COVID? Where did the company come out on the other side? Can you tell us a bit about the streaming platform being developed by a Coucou founder? What was Coucou's strategy for attracting U.S. customers? Can you speak to the experience of recruiting and managing a mixed-nationality workforce of French and American people? What were some resources Coucou utilized during the last 10 years of growth? Would you recommend companies retain a public relations agency? What's one piece of advice you'd offer a French entrepreneur seeking to launch a company in the U.S.? About Victoire Lester Victoire Lester is CEO of Coucou, a New York City and Los Angeles-based language school offering culturally savvy, native-taught French classes, in person or online. A Paris native, she joined Coucous as a part-time French instructor in 2016 and was promoted to director of operations just three years later. As CEO, Victoire handles marketing, product development, and operations. She was also responsible for Coucou's successful transition to an online program in 2020, which has been instrumental in the company's growth. When she's not helping Coucou grow, Victoire enjoys spending time with her family, practicing yoga, and indulging in her love of wine, cheese, and oysters. About Sarah F. Ben-Moussa Sarah F. Ben-Moussa is an associate in the Corporate Practice Group in Sheppard Mullin's New York office, where her practice focuses on domestic and cross-border mergers and acquisitions, financings and corporate governance matters. As a member of the firm's French Desk, she has advised companies and private equity funds in both the United States and Europe on mergers, acquisitions, joint ventures, financings, complex commercial agreements, and general corporate matters. As a member of Sheppard Mullin's Energy, Infrastructure and Project Finance team, Sarah also represents renewable energy companies, borrowers, financial sponsors, portfolio companies, commercial banks and other financial institutions in a variety of financing transactions. Her practice focuses on a variety of transactions in the energy sphere, representing renewable energy companies in project-level debt and equity financings of wind and solar facilities. Before joining Sheppard Mullin, Sarah spent a year and a half studying and working in France, focusing on corporate transactions and commercial contracts in Europe and internationally. Sarah is also committed to pro bono work, focusing on cases involving children seeking asylum or other immigration-related relief. Contact Information Victoire Lester Sarah F. Ben-Moussa Additional Resources Coucou Coucou on TikTok Coucou on Instagram Coucou on Facebook Coucou on YouTube Thank you for listening! Don't forget to SUBSCRIBE to the show to receive every new episode delivered straight to your podcast player every week. If you enjoyed this episode, please help us get the word out about this podcast. Rate and Review this show in Apple Podcasts, Amazon Music, Google Podcasts or Spotify. It helps other listeners find this show. This podcast is for informational and educational purposes only. It is not to be construed as legal advice specific to your circumstances. If you need help with any legal matter, be sure to consult with an attorney regarding your specific needs.

Behind the Scenes of Solar Project Finance, Alex Deng, kWh Analytics

In today's episode, Alex Deng of kWh analytics joins Dave to lift the veil on solar project finance and insurance, explaining the key but unseen role insurance plays in getting renewable energy projects built. Drawing on his experience as a project developer and now insurance underwriter, Alex breaks down the different sources of capital, ever-evolving technology risks, and surprising solar performance data that are shaping how solar projects get financed and insured today. He shares his unique perspective on provisions of the Inflation Reduction Act that will catalyze the next wave of solar growth.

Everyone today has heard about rooftop solar, or offshore wind parks, but what about adding solar to your office space, or installing microturbines to your steel factory? These comprise a mid-scale type of energy project that show a great upcoming potential for development and more importantly, are in dire need of investment and good project oversight. Join us, as we chat on how this is done using the power of software with Amanda Li, Co-Founder and Chief Operating Officer at Banyan Infrastructure. Also in the chat: can we get to one single metric that standardises risk for all energy projects? Hosts: Chris Sass, Jeff McAulay Additional Reads: Banyan Infrastructure - https://www.banyaninfrastructure.com/ Whitepaper on IRA - https://www.banyaninfrastructure.com/ira-white-paper

On this episode, meet Fradyn Suárez, a Miami partner in King & Spalding's Project Finance practice. Fradyn discusses with Jeff and Brett her journey to partner in international law firms, the unique features of a project finance practice, the challenges of moving your practice to different cities, the path to equity in big law, and the differences in practicing law in Miami versus bigger cities like New York and Chicago. They also discuss the challenges women lawyers face in the finance section and how Fradyn continues to break the glass ceiling on her path to success in the law.If you enjoyed the show, please subscribe, share, and leave a review. Subscribing to the show and leaving a review will actually help others find the show. And It will help us grow, devote more time, and produce better content for you.Streaming now on YouTube, Spotify, Google, Amazon Music, and Apple Podcasts. We are also in the top ten percent of listened-to podcasts globally.

Plunging Into the Future: What Companies Need to Know as They Embrace AI with Jim Gatto of Sheppard Mullin

In this episode of French Insider, Jim Gatto, a partner in Sheppard Mullin's Washington D.C. office and co-chair of its AI team, joins host Sarah Ben-Moussa to discuss what companies should know as they embrace generative AI, including key legal issues, the European Union's Artificial Intelligence Act, and unique due diligence concerns when acquiring or investing in companies that develop or use generative AI. What We Discussed in This Episode: What is generative AI, and why has it become so newsworthy? What are the key legal issues raised by AI? Who is liable if the output produced by generative AI infringes? Can you provide a broad overview of the European Union's Artificial Intelligence Act? How does the EU compare to the current landscape in the U.S.? Is it legal for companies to use your output to train their own AI models? What unique issues should be considered when conducting diligence for acquisitions or investments in companies using or developing generative AI? What are some of the most important things companies should do to minimize the risk when using AI? About James G. Gatto James G. Gatto is a partner in the Intellectual Property Practice Group in Sheppard Mullin's Washington, D.C. office, where he also serves as Co-Leader of the firm's Artificial Intelligence Team and Leader of the Open Source Team. Jim's practice focuses on AI, blockchain, interactive entertainment and open source. He provides strategic advice on all aspects of intellectual property strategy and enforcement, technology transactions, licenses and tech-related regulatory issues, especially ones driven by new business models and/or disruptive technologies. Jim has over 20 years of experience advising clients on AI issues and is an adjunct professor who teaches a course on Artificial Intelligence Legal Issues. He is considered a thought leader on legal issues associated with emerging technologies and business models, most recently blockchain, AI, open source and interactive entertainment. About Sarah F. Ben-Moussa Sarah F. Ben-Moussa is an associate in the Corporate Practice Group in Sheppard Mullin's New York office, where her practice focuses on domestic and cross-border mergers and acquisitions, financings and corporate governance matters. As a member of the firm's French Desk, she has advised companies and private equity funds in both the United States and Europe on mergers, acquisitions, joint ventures, financings, complex commercial agreements, and general corporate matters. As a member of Sheppard Mullin's Energy, Infrastructure and Project Finance team, Sarah also represents renewable energy companies, borrowers, financial sponsors, portfolio companies, commercial banks and other financial institutions in a variety of financing transactions. Her practice focuses on a variety of transactions in the energy sphere, representing renewable energy companies in project-level debt and equity financings of wind and solar facilities. Before joining Sheppard Mullin, Sarah spent a year and a half studying and working in France, focusing on corporate transactions and commercial contracts in Europe and internationally. Sarah is also committed to pro bono work, focusing on cases involving children seeking asylum or other immigration-related relief. Contact Information: James G. Gatto Sarah F. Ben-Moussa Additional Resources: Copyright Office Artificial Intelligence Initiative and Resource Guide | Law of The Ledger Training AI Models - Just Because It's Your Data Doesn't Mean You Can Use It | Law of The Ledger Solving Open Source Problems with AI Code Generators – Legal Issues and Solutions | Law of The Ledger Congress Proposes National Commission to Create AI Guardrails | Law of The Ledger Sheppard Mullin French Desk Blog Sheppard Mullin Launches Artificial Intelligence Industry Team | Sheppard Mullin Thank you for listening! Don't forget to SUBSCRIBE to the show to receive every new episode delivered straight to your podcast player every week. If you enjoyed this episode, please help us get the word out about this podcast. Rate and Review this show in Apple Podcasts, Amazon Music, Google Podcasts or Spotify. It helps other listeners find this show. This podcast is for informational and educational purposes only. It is not to be construed as legal advice specific to your circumstances. If you need help with any legal matter, be sure to consult with an attorney regarding your specific needs.

This episode is part of our new Capital Series hosted by Jason Jacobs. This series explores a diverse range of capital sources and the individuals who drive them. From family offices and institutional LPs to private equity, government funding, and more, we take a deep dive into the world of capital and its critical role in driving innovation and progress. Rob Day is Partner and Co-founder at Spring Lane Capital. Spring Lane Capital provides hybrid project capital with equity for small-scale systems and projects across food, water, energy, transportation, and waste markets. They also bring experienced tools and capabilities to help developers and entrepreneurs succeed with their project deployments. Rob has been around the block in climate tech even before it got its name, and he's learned a lot of useful lessons. Not to mention, Spring Lane has an innovative approach that plays in the capital gap, that so many people talk about between early-stage venture capital and project finance. In this episode, we cover: [2:36] An overview of Spring Lane Capital and the firm's origin story [4:49] The large gap between venture capital and project finance[8:05] Spring Lane Capital's broad approach to different areas of climate [10:52] Capitalizing early-stage companies, scaling, and the role of equity and debt[13:42] Advice for entrepreneurs thinking about different types of capital at various stages of a company's lifecycle [16:06] Triggers for founders to understand when equity is optimal vs debt (Rob's Atlas Organics example)[22:22] How terms vary with Spring Lane Capital's deals vs more traditional lenders [24:43] Where first-of-a-kind (FOAK) projects fit in [30:41] Spring Lane Capital's fund two and its institutional investors[33:19] Skillsets required to be successful in Spring Lane's capital allocation[38:23] Success milestones and Spring Lane's role[40:46] Changing macroeconomics and their impact on Spring Lane's corner of the industry [43:48] Spring Lane's process, key steps, diligence, etc. [50:17] Issues with financing FOAK projects and Spring Lane's plans to address themGet connected: Jason Jacobs Twitter / LinkedInRob Day Twitter / LinkedInMCJ Podcast / Collective*You can also reach us via email at info@mcjcollective.com, where we encourage you to share your feedback on episodes and suggestions for future topics or guests.Episode recorded on Jun 14, 2023 (aired on July 5, 2023)

Amanda Li found herself in the thick of the arduous and disorganized project finance lifecycle.It was 2014, and she had been hired as Generate Capital's first employee. Li was responsible for all aspects of the deal: originating and underwriting, closing, portfolio management, you name it. Each stage had its own litany of documents, and required endless hours to maintain.It was obvious to Li that the process needed a major upgrade for trillions of dollars to efficiently flow into clean energy, and our climate goals would depend on it.Episode 52 of the Factor This! podcast features Amanda Li, the co-founder and COO of Banyan Infrastructure, a fintech company streamlining clean energy project finance by digitalizing and housing each step in a single platform. Li shares how technology is activating fresh capital for distributed energy projects and bringing new players to the table. Just in time.That's all next on Factor This! You've heard me talk a lot about the GridTECH Connect Forum - Northeast event being held in Newport, Rhode Island Oct. 23-25. Well, registration is now LIVE. We're excited to partner with the DOE to bring together DER developers, utilities, and regulators around the critical issue of interconnection in the Northeast. Click here to register today.

Between Warring Giants: How European Companies Can Navigate U.S.-China Tensions in Trade and Commerce with Reid Whitten

In this episode of French Insider, Reid Whitten, Managing Partner of Sheppard Mullin's London office, joins host Sarah Ben-Moussa to discuss the U.S.-China trade war, including the conflict's origins, the Foreign Direct Product Rule, and the tangible steps European companies should be taking in light of the current tensions. What We Talked About in This Episode: What are the origins of the U.S.-China trade war? What measures did the U.S. take in the wake of the 2018 National Position Paper declaring China an adversary? As a practical matter, what do European companies need to look out for? How does the Foreign Direct Product Rule work? What is the U.S. attempting to do to get itself on a technological level where it can compete with China? Do we see China retaliating against some of the measures and heated rhetoric coming out of the U.S.? Can you explain the military end-user concept? What tangible steps should European companies be taking as they attempt to navigate the current U.S.-China tensions? About Reid Whitten As Managing Partner of Sheppard Mullin's London office, Reid Whitten focuses his practice on international trade regulations and investigations. He shares his time serving clients out of the Washington, D.C. office and also leads the firm's CFIUS Team. Reid works with clients around the world to plan, prepare and succeed in global transactions. He focuses on cross-border investments, particularly in the technology and aerospace sectors, helping clients navigate the international trade regulations that could disrupt their deals. In the areas of economic sanctions, export and defense exports, CFIUS, anti-corruption and tariffs, he supports clients in detecting and addressing potential compliance issues as well as conducting investigations and defending against enforcement actions. He also advises on U.S. anti-dumping, anti-money laundering and anti-boycott regulations. Reid is a member of Chatham House, the UK's Royal Institute of International Affair. In addition to lecturing at the New College of the Humanities in London, at the Université Catholique de Lille in France, and Wake Forest University in the U.S, he also conducts seminars on regulatory updates for industry groups in the U.S., France, Belgium, Spain and the UK. A thought leader on cross-border business regulation, Reid is frequently called upon to provide commentary and analysis for television news channels, international newspapers, and trade publications. He is also the lead author and editor of The CFIUS Book. About Sarah F. Ben-Moussa Sarah F. Ben-Moussa is an associate in the Corporate Practice Group in Sheppard Mullin's New York office, where her practice focuses on domestic and cross-border mergers and acquisitions, financings and corporate governance matters. As a member of the firm's French Desk, she has advised companies and private equity funds in both the United States and Europe on mergers, acquisitions, joint ventures, financings, complex commercial agreements, and general corporate matters. As a member of Sheppard Mullin's Energy, Infrastructure and Project Finance team, Sarah also represents renewable energy companies, borrowers, financial sponsors, portfolio companies, commercial banks and other financial institutions in a variety of financing transactions. Her practice focuses on a variety of transactions in the energy sphere, representing renewable energy companies in project-level debt and equity financings of wind and solar facilities. She also serves on the New York office's sustainability committee. Before joining Sheppard Mullin, Sarah spent a year and a half studying and working in France, becoming fluent in French and focusing on corporate transactions and commercial contracts in Europe and internationally. Sarah is also committed to pro bono work, focusing on cases involving children seeking asylum or other immigration-related relief. Contact Information: Reid Whitten Sarah F. Ben-Moussa Thank you for listening! Don't forget to SUBSCRIBE to the show to receive every new episode delivered straight to your podcast player every week. If you enjoyed this episode, please help us get the word out about this podcast. Rate and Review this show in Apple Podcasts, Amazon Music, Google Podcasts, Stitcher or Spotify. It helps other listeners find this show. This podcast is for informational and educational purposes only. It is not to be construed as legal advice specific to your circumstances. If you need help with any legal matter, be sure to consult with an attorney regarding your specific needs.

Energy Transition Trends & Developments: The Road to Net-Zero Carbon Emissions with Archie Fallon

In this episode of Emphasis Added, incoming Season 5 host Jake Guarino and Season 4 host Brock Jones met with Archie Fallon, Managing Partner of Willkie Farr & Gallagher's Houston office, to discuss developing legal and transactional trends in the energy transition space as the world marches toward its 2050 goal of net-zero carbon emissions. Archie serves as the Co-Chair of Willkie Farr's Project Finance and Power & Renewable Energy Practice Groups, generally representing private equity funds and corporate clients in strategic energy and infrastructure transactions. Archie also serves as Chair of the Renewables Practice Committee at the Institute for Energy Law and as an advisory board member of Houston's Renewable Energy Alliance. We discussed topics like Houston's involvement in the energy transition, policy implications of clean energy adoption, and recent legislation affecting the energy industry. Season 4, Episode 10 Contents:00:00 – Introduction02:28 – Houston's Renewable Energy Alliance11:37 – The Energy Transition18:04 – Transactional Trends with The Energy Transition23:47 – Policy Considerations for Clean Energy35:07 – ESG Regulations and Concerns42:31 – Greenwashing47:02 – Lawyers' Involvement in The Energy TransitionFor more Emphasis Added content, follow us on Instagram and check out our video content on YouTube!

Treasury Roles Across Different Industries with Roger Aguilar

This week's guest has travelled a long and winding road to his current treasury role, fulfilling a variety of positions and picking up invaluable experience along the way.On episode 257, we revisit a 2019 release of The Treasury Career Corner with Roger Aguilar, now Treasurer at EZCORP.Roger explains how he began his career in banking and embarked on a cross-country journey across many industries in a variety of treasury positions.Plus, he takes us back to when he de-risked the currency exposure in various jobs, compares his roles across Mexico, the States and the UK and provides top tips and priorities for treasurers in 2023.Roger began his career as Director of Corporate Banking and Project Finance with BBVA in 1995 where he remained for 11 years.He then began a multi-regional role with Merck as LATAM and EMEA Senior Manager of Treasury, automating and centralising the order-to-cash process in the SSC in Dublin.Roger then worked as Treasury Director for Jabil before becoming Senior Director – Assistant Treasurer at CEVA Logistics in 2014.Following a year-long stint as Senior Manager – Treasury Advisory Services at Deloitte, Roger became an Assistant Treasurer at Oceaneering, Treasurer at Wellborne Integrity Solutions and Head of Treasury Transformation in the US for Redbridge Debt & Treasury Advisory.Roger is currently Treasurer at EZCORP.He acquired a BE in Industrial Engineering with Honours from Tecnológico de Monterrey and later, a Finance MBA at Universitat de Barcelona.On the podcast we discussed…His routes in bankingDe-risking the currency exposure in multiple rolesHis time in Mexico, the U.S. and the U.K.The difference in treasury roles in different industriesRoger's views on the future of treasuryHis moves since his 2019 appearance on the podcastAdvice for treasurers in 2023You can connect with Roger Aguilar on LinkedIn.Are you interested in pursuing a career within Treasury?Whether you've recently graduated, or you want to search for new job opportunities to help develop your treasury career, The Treasury Recruitment Company can help you in your search for the perfect job. Find out more here. Or, send us your CV and let us help you in your next career move!If you're enjoying the show please rate and review us on whatever podcast app you listen to us on, for Apple Podcasts click here!If you're interested in learning more about the fundamental pillars of treasury, download my free Corporate Treasury eBook by clicking here!

Cade un elicottero a Kiev: tra i morti anche il ministro dell'Interno

Ucraina: caduto un elicottero nei pressi di Kiev, colpito un asilo. Tra le vittime bambini e il ministro dell'Interno Monastyrsky. In arrivo una nuova mobilitazione di soldati russi. Il punto con Marco Di Liddo, analista del CeSi (Centro Studi Internazionali). Bollette del gas in discesa a febbraio. Ne parliamo con Roberto Bianchini, economista di REF Ricerche, Professore di Corporate Finance all'Università Bocconi, direttore dell'Osservatorio Climate Finance e professore di Project Finance al Politecnico di Milano. Il ministro Schillaci: "All'esterno, in presenza di bambini e donne incinta, vietare sigarette e sigarette elettroniche". Cerchiamo di fare chiarezza sui rischi da sigarette normali, IQOS e sigarette elettroniche conRiccardo Polosa, direttore del CoEHAR, Centro di ricerca per la Riduzione dei danni dal fumo dell'Università di Catania.

Ascot Resources entered into non-binding letters of intent for C$200 million in project financing for construction of the Premier Gold Project in British Columbia. FPX Nickel announced the first step-out drillhole results confirming continued near-surface lateral extension of strong nickel mineralization at the Van Target at the Decar Nickel District in British Columbia. McFarlane Lake Mining reported early drilling results from its High Lake property in Ontario, including 9.75m grading 9.82 g/t gold. Bonterra Resources announced more results from the ongoing infill drilling campaign at the Barry underground project in Quebec including 4.4m grading 21.9 g/t Au. Denison Mines announced the successful completion of the neutralization phase of the Phoenix in-situ recovery Feasibility Field Test at its Wheeler River project in the Athabasca Basin.

96 – The importance of solid project finance during turbulent times

When things get a little choppy during a project due to factors beyond your control, like rates rising or build times blowing out, it helps to have flexible and reliable funding in place to see you through. In this conversation with regular guest and finance guru Dan Holden from Holden Capital, we will be covering: what's happening in the lending markets the outlook for the cash rate challenges many developers are currently facing with build costs and delays case studies and; the release of Dan's book called Constructive Finance. Keep an ear out for how you can win a free copy of Dan's excellent book which covers all things Australian construction finance. I highly recommend it for your property resource library. This is another awesome discussion that I'm sure you will enjoy and it is chock full of gold. Become a Million Dollar Property Developer Grab my book Become a Million Dollar Property Developer about my journey into property development. This book is ideal for anyone who intends to get into small-scale property development and wants an insider's guide to successfully obtaining wealth, fulfilment, and glory. In this book, Justin will share how he succeeded in delivering a 20-townhouse project on his first property development project and what he learned along the way. Many people have a dream of becoming a property developer. They aspire to build properties, grow portfolios, and amass great wealth. However, many people often struggle with making the leap into property development. This book has the answers for how you can make the leap into property development. Grab your copy now. Property Development Training If you are interested in learning the fundamentals of property development, in your own time and at your own pace, then be sure to head over to www.propertydevelopertraining.com and take a look. I take you step by step through the development process so you know exactly what is needed to find a site, run a feasibility and complete a small scale property development, be that a duplex or 3 or 4 unit site. The training includes a bonus program called Taking It To The Next Level for people who may want to go into developing full-time. So head over to propertydevelopertraining.com and take a look... I would love to see you on the inside... Property Developer Quiz Keen to find out how ready you might be to become a developer? Then take the Property Developer Quiz (https://www.propertydevelopertraining.com/quiz) and get a sense of where you are at… Social Connection Property Developer Podcast Facebook – https://www.facebook.com/propertydeveloperpodcast Property Developer Podcast Instagram – https://www.instagram.com/property_developer_podcast/ Property Developer Podcast LinkedIn – https://www.linkedin.com/company/property-developer-podcastLinks Links Holden Capital - https://www.holdencapital.com.au

John and Simar are joined by Dana & Phil from Flowcarbon and have a great chat about how their backgrounds led to the inception of Flowcarbon, the amazing work they've been doing to help project developers on the ground. The public consultation they've been leaning into and devoting so much time to with all the different voluntary carbon market participants. The background work that's gone into the new centrifuge pools for carbon forward projects, and what they expect to happen in the next six months for tokenizing assets and entering a new era of a liquid supply of carbon credits flowing both on and off-chain. #web3 #blockchain #refi #carbonmarket #investing Mentioned in the show https://www.flowcarbon.com/ Charles Eisenstein https://sacred-economics.com/ 00:00 Intro 02:32 Flowcarbon overview 05:30 Phil's background 07:47 Dana's background 11:53 Price discovery in carbon market 15:39 Two Way Bridge 22:08 Project Finance. Centrifuge 25:48 The Supply & Demand 29:16 The Projects on the Ground 30:40 Behind the Scenes 34:25 Whats Needed Before Mass Adoption 39:36 Future Forecast 44:05 CTA -------------------------------------------- Connect with Dana & Phil: Dana: https://twitter.com/danagibber https://www.linkedin.com/in/danasterngibber Phil: https://twitter.com/philfog https://www.linkedin.com/in/philfog/ -------------------------------------------- Join the conversation on Twitter, follow: https://twitter.com/ReFiDAOist https://twitter.com/climateXcrypto https://twitter.com/simarsmangat Thanks to our friends at Feed Ignite for the podcast and micro-content production: https://feedignite.com --- Send in a voice message: https://anchor.fm/refipodcast/message

The $9.5 billion New Terminal One at New York's John F. Kennedy Airport -- developed, financed and built by a private consortium – will be the largest terminal at the airport when completed, with state-of-the-art technology, sustainability and capacity upgrades. Construction financing for the new terminal closed this summer, followed by the official groundbreaking in September 2022. The members of the public-private partnership overcame myriad challenges – the global pandemic, volatile air traffic forecasts, supply chain challenges, and rising interest rates – to close the largest single-asset P3 project financing so far in the US. In this episode, JFK Airport's New Terminal One: “We Have Lift Off,” host Allan Marks (who led Milbank's team representing the banks that are providing over $6.6 billion in construction loans) goes behind the scenes of the project financing with two of its architects: Pete Taylor, a partner at Carlyle, which led the sponsor group developing the new terminal, and Dan Seltzer, a Managing Director at MUFG Bank, Ltd., who acted as the Financial Advisor to the developers.About the Speakers:Peter Taylor is Partner and Co-Head of the Carlyle Global Infrastructure Opportunity Fund (CGI). He is based in Washington, DC.Dan Seltzer is Managing Director for Project Finance in the Global Corporate & Investment Banking group at MUFG in New York.Podcast host Allan Marks is one of the world's leading project finance lawyers. He advises developers, investors, lenders, and underwriters around the world in the development and financing of complex infrastructure projects, as well as related acquisitions, restructurings and capital markets transactions. Mr. Marks also serves as an Adjunct Lecturer at the University of California, Berkeley at the Law School and previously at the Haas School of Business.For more information and insights, follow us on social media and podcast platforms, including Apple, Spotify, Amazon Music, Google and Audible.Disclaimer

Creating a More Accessible Solar Grid through Community Solar with Camelia Miu of Nautilus Solar EP 108