Podcasts about picasso

20th-century Spanish painter, sculptor, printmaker, ceramicist, and stage designer

- 4,241PODCASTS

- 6,912EPISODES

- 39mAVG DURATION

- 2DAILY NEW EPISODES

- Feb 4, 2026LATEST

POPULARITY

Categories

Best podcasts about picasso

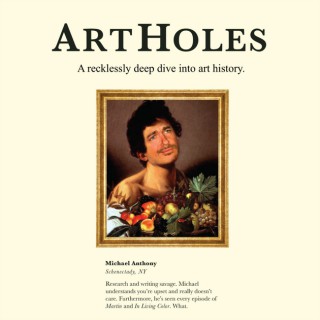

Latest news about picasso

- Amazing Psychedelic Digital Artworks By Argentinian Artist Juan Brufal Design You Trust - Feb 2, 2026

- Lit Hub Daily: February 2, 2026 Literary Hub - Feb 2, 2026

- Saudi woman painter outshines Picasso at Sotheby’s second sale in Diriyah The Art Newspaper - International art news and events - Feb 3, 2026

- At ART SG, Top Sale Hits $650,000 Amid Deepening Focus on Southeast Asia ARTnews.com - Jan 28, 2026

- Reviewing Tweezers for Microsoldering and SMD Work Hackaday - Jan 24, 2026

- Recursive Language Models in ADK Google Cloud - Community - Medium - Jan 25, 2026

- Naomi Campbell Brings a Model’s Perspective to Picasso’s Intimate Series Artnet News - Jan 22, 2026

- Islanders vs. Kraken prediction: Odds, picks, best bet for Wednesday’s NHL clash New York Post - Jan 21, 2026

- Two stars from Michelin, one for hygiene: star chef’s poor score ignites UK dining debate The Guardian - Jan 16, 2026

- Proprio Secures 4th FDA Clearance for AI-Powered ‘Picasso’ Spine Guidance HIT Consultant - Jan 16, 2026

Latest podcast episodes about picasso

BONUS : Brancusi, sculpteur de l'épure : aux origines d'un artiste inspirant qui a bouleversé l'art moderne

Attaché à sculpter « l'essence des choses », Constantin Brancusi aura bouleversé l'art moderne grâce à ses formes épurées dont s'inspireront les designers du monde entier.Né en 1876 dans un petit village roumain, Brancusi quitte très jeune son foyer pour explorer le pays, avant de prendre la route de Paris, la capitale des arts.

Walker Antonio - How to Build an Art Career Through Networking: From Art Student to Multi-Gallery Artist

In this episode, we sit down with Walker Antonio, a Virginia-based Filipino-American painter whose work blurs the boundaries between the real and surreal, the physical and psychological. Working primarily on a large scale, Walker's process moves from energetic chaos to deliberate refinement—a philosophy that extends to his remarkable career trajectory. Just 18 months after graduating from Wofford College with his BA in Studio Art and Art History, Walker has built an impressive professional practice. He shares his unconventional journey from receiving the 2023 Whetsell Family Fellowship to spending 10 months at a ski resort in Germany, and how he quickly gained representation with three galleries upon returning stateside. We dive into Walker's evolving artistic practice—from large-scale figurative works exploring themes of environment and identity to experimental 6x6-inch pieces that challenge his understanding of composition. He opens up about the pivot points in his career, including creating 34 pieces in 10 days during the Foundation House Artist Residency and showing alongside Picasso and Basquiat at the Palm Beach Modern Contemporary Art Fair. As the first visual artist selected for the Kenan-Lewis Fellowship at Woodberry Forest School, Walker offers candid insights on balancing teaching, pursuing his MA in Fine Arts from Falmouth University, and managing the business side of art. He emphasizes the power of authentic networking over social media growth, the many hats artists must wear (accountant, marketer, graphic designer), and why he's chosen to avoid commissions to protect his creative vision. With solo exhibitions at Stevenson & Co. (Charleston, SC) and the Rhodes Art Center (Gill, MA) in 2025, plus upcoming shows at Sheridan Studios (Macon, GA) in February 2026 and the Baker Gallery (Woodberry Forest, VA) in November 2026, Walker's career is rapidly expanding. His work has been published in American Art Collector and Suboart Magazine, with forthcoming publication in the Penn Journal of Arts and Sciences. Whether you're an emerging artist or simply curious about the art world, Walker's perspective on treating Instagram as a living portfolio, his strategic approach to artist residencies (including his upcoming 2026 Elf School of the Arts Residency), and his commitment to "just keep going" will inspire you to pursue your creative path with intention and authenticity. Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

Dirty Money, Tax Loopholes and Legit Lessons in the Art World

For some collectors, art is about beauty, meaning, and power. For others, it's a convenient place to clean dirty money. Today, Nicole breaks down the hidden financial playbook behind the global art market, and why some billionaires treat paintings less like décor and more like offshore bank accounts. From subjective valuations and private appraisals to tax-free warehouses, art-backed loans, and regulatory gray zones, this episode walks through the exact five-step system the ultra-wealthy can use to store, grow, and sometimes quietly clean massive amounts of cash. You'll hear how a $5 million painting can magically become a $20 million asset on paper, why some of the world's most valuable art never leaves storage, and how auction houses legally facilitate transactions that banks never could. Then Nicole pulls it back to real life — what this reveals about how wealth actually moves, why valuation is often narrative-driven, and how everyday investors can borrow the thinking without needing a Picasso or a private jet. Check out Nicole's financial literacy course The Money School Find a Financial Advisor or Financial Coach from Nicole's company Private Wealth Collective Watch video clips from the pod on Money Rehab's Instagram and Nicole Lapin's Instagram Here's what Nicole covers today: 00:00 Are You Ready for Some Money Rehab? 00:18 Art as an Investment 01:14 How the Wealthy Buy Art 02:18 Freeports and Tax Havens 03:20 Reappraisal and Inflating Art Value 04:46 Using Art as a Financial Tool 06:16 Money Laundering Through Art 07:16 Lessons for Everyday Investors 08:17 Investing in Art Without Millions All investing involves the risk of loss, including loss of principal. This podcast is for informational purposes only and does not constitute financial, investment, or legal advice. Always do your own research and consult a licensed financial advisor before making any financial decisions or investments.

AI Art vs Human Creativity — The Real Difference and why AI Cannot Be An Artist | A Conversation with AI Expert Andrea Isoni, PhD, Chief AI Officer, AI speaker | Redefining Society and Technology with Marco Ciappelli

The Last Touch: Why AI Will Never Be an ArtistI had one of those conversations... the kind where you're nodding along, then suddenly stop because someone just articulated something you've been feeling but couldn't quite name.Andrea Isoni is a Chief AI Officer. He builds and delivers AI solutions for a living. And yet, sitting across from him (virtually, but still), I heard something I rarely hear from people deep in the AI industry: a clear, unromantic take on what this technology actually is — and what it isn't.His argument is elegant in its simplicity. Think about Michelangelo. We picture him alone with a chisel, carving David from marble. But that's not how it worked. Michelangelo ran a workshop. He had apprentices — skilled craftspeople who did the bulk of the work. The master would look at a semi-finished piece, decide what needed refinement, and add the final touch.That final touch is everything.Andrea draws the same line with chefs. A Michelin-starred kitchen isn't one person cooking. It's a team executing the chef's vision. But the chef decides what's on the menu. The chef check the dish before it leaves. The chef adds that last adjustment that transforms good into memorable.AI, in this framework, is the newest apprentice. It can do the bulk work. It can generate drafts, produce code, create images. But it cannot — and here's the key — provide that final touch. Because that touch comes from somewhere AI doesn't have access to: lived experience, suffering, joy, the accumulated weight of being human in a particular time and place.This matters beyond art. Andrea calls it the "hacker economy" — a future where AI handles the volume, but humans handle the value. Think about code generation. Yes, AI can write software. But code with a bug doesn't work. Period. Someone has to fix that last bug. And in a world where AI produces most of the code, the value of fixing that one critical bug increases exponentially. The work becomes rarer but more valuable. Less frequent, but essential.We went somewhere unexpected in our conversation — to electricity. What does AI "need"? Not food. Not warmth. Electricity. So if AI ever developed something like feelings, they wouldn't be tied to hunger or cold or human vulnerability. They'd be tied to power supply. The most important being to an AI wouldn't be a human — it would be whoever controls the electricity grid.That's not a being we can relate to. And that's the point.Andrea brought up Guernica. Picasso's masterpiece isn't just innovative in style — it captures something society was feeling in 1937, the horror of the Spanish Civil War. Great art does two things: it innovates, and it expresses something the collective needs expressed. AI might be able to generate the first. It cannot do the second. It doesn't know what we feel. It doesn't know what moment we're living through. It doesn't have that weight of context.The research community calls this "world models" — the attempt to give AI some built-in understanding of reality. A dog doesn't need to be taught to swim; it's born knowing. Humans have similar innate knowledge, layered with everything we learn from family, culture, experience. AI starts from zero. Every time.Andrea put it simply: AI contextualization today is close to zero.I left the conversation thinking about what we protect when we acknowledge AI's limits. Not anti-technology. Not fear. Just clarity. The "last touch" isn't a romantic notion — it's what makes something resonate. And that resonance comes from us.Stay curious. Subscribe to the podcast. And if you have thoughts, drop them in the comments — I actually read them.Marco CiappelliSubscribe to the Redefining Society and Technology podcast. Stay curious. Stay human.> https://www.linkedin.com/newsletters/7079849705156870144/Marco Ciappelli: https://www.marcociappelli.com/ Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

Un monólogo con sello propio que mezcla ironía, cultura pop y referencias artísticas para reírse de Jackson Pollock, Picasso, Dalí, Goya y de casi todo lo que se ponga por delante. Humor absurdo, ritmo ágil y reflexión camuflada entre carcajadas.

89 “A Night at the Opera Reorchestrated” featuring The Marx Brothers Council

The guys respond to insightful audience comments on the brothers' MGM classic. Is the film actually more like their Paramount work than we give it credit for? Does the brothers' career trajectory resemble that of Picasso—or Elvis? And did Margaret Dumont actually land a joke? These and other truly life-altering questions are debated, dissected, and delightfully overthought.

280 – A Portfolio of Possibilities – Picasso and Kahnweiler

In Episode 280 of Anecdotally Speaking, learn how an art dealer's unconventional strategy with Picasso offers lessons in decision-making, risk, and productivity. In this episode, … The post 280 – A Portfolio of Possibilities – Picasso and Kahnweiler appeared first on Anecdote.

X Minus One: The Discovery of Morniel Mathaway (04-17-1957)

The Enigmatic Journey of Morniel Mathaway: Art, Time Travel, and IdentityIn this episode of X Minus One, we delve into the intriguing story of Mourniel Mathaway, a painter whose journey from obscurity to fame is both fascinating and complex. The narrative begins with a vivid introduction, setting the stage for a tale that explores the nature of artistic genius and societal perception of talent. Mathaway, initially portrayed as a struggling artist, grapples with his self-identity and the weight of expectations as he is thrust into the limelight. The conversation reveals his insecurities and the paradox of being celebrated for work he feels is derivative, raising questions about authenticity in art and the role of critics in shaping an artist's legacy.As the story unfolds, we encounter a time traveler from the future, Gleskow, who brings news of Mathaway's immense fame and influence in the art world of 2487 A.D. This twist adds a layer of complexity, as Mathaway's struggle with his perceived lack of talent contrasts sharply with his future reputation. The dialogue between Mathaway and Gleskow highlights the tension between artistic aspiration and the harsh realities of creative expression, ultimately leading to a thought-provoking conclusion about the nature of genius and the impact of time on artistic legacy.In the realm of speculative fiction, few tales capture the imagination quite like the story of Morniel Mathaway. Initially an unremarkable painter, Mathaway's life takes a dramatic turn when he is visited by a future art scholar who reveals his impending fame. This narrative, rich with themes of time travel and artistic genius, invites us to ponder the nature of creativity and the impact of societal recognition on personal identity.The Discovery of Morniel MathawayMathaway's journey begins in a modest studio, where his lackluster paintings fail to garner attention. However, the arrival of a scholar from the year 2487 changes everything. This visitor, an art historian, informs Mathaway that his work will one day be revered, sparking a complex exploration of time travel paradoxes and the essence of artistic genius.A Paradox of Fame and AuthenticityAs Mathaway grapples with his newfound status, the story delves into the paradox of his future fame. The narrative raises profound questions about authenticity and creativity, challenging us to consider the role of societal validation in shaping an artist's identity. Is Mathaway's genius genuine, or is it a product of time's mysterious influence?Reflections on Art and IdentityUltimately, the tale of Morniel Mathaway serves as a poignant reflection on the nature of art and identity. It invites us to question the true source of artistic brilliance and the impact of external recognition on our sense of self. As we journey through this captivating narrative, we are reminded that the pursuit of creativity is as much about self-discovery as it is about external acclaim.Subscribe NowJoin us in exploring more intriguing stories and insights by subscribing to our blog. Dive into the world of speculative fiction and uncover the mysteries of art, time, and identity.Takeaways"I remember him as an unbathed and untalented village painter.""Society owes the artist something.""I could think of only three names: Picasso, Ruol, and me.""You are one of the immortals the human race has produced.""You're the real Mourniel Mathaway, and there's no paradox."Mourniel Mathaway, X Minus One, science fiction, art, time travel, William Ten, Galaxy Science Fiction Magazine, artistic genius, radio drama, storytelling

Mets Get Better Now, But Is This Built to Last?

The guys boil the Freddy Peralta trade down to one core issue: the Mets improved immediately, but it still feels like a short-term roster with short-term bets. If Peralta is a one-year rental and anything goes sideways, the whole thing can feel like a “temporary Picasso” that gets ruined the second it gets wet. Then the phones light up. One caller thinks the Mets changed philosophy because of media pressure, but Evan pushes back hard and says the front office has actually been consistent all along. That leads into the bigger theme: the Mets' approach to short-term deals, what Bo Bichette's press conference really told you about the plan, and why fans keep asking what “good enough” is when you cash in top prospects. Plus: a debate over the “roadblock” narrative with Jett Williams, what happens if Luis Robert Jr struggles early, and how quickly the Mets would pivot if performance is not there. And it ends with a hard pivot to hoops: the Knicks annihilate the Nets, the “players-only meeting” story gets dissected through Josh Hart's comments, and the real question becomes what the Knicks do next, not what they did to Brooklyn.

L'ISPIRAZIONE dell'Arte VS l'Indifferenza dell'Universo: Tolkien, Dante e Picasso

Cerca AMBROSIA, la trovi in tutti i migliori ortofrutta d'Italia e puoi seguirla sul web: https://www.instagram.com/melambrosia/ ⬇⬇⬇SOTTO TROVI INFORMAZIONI IMPORTANTI⬇⬇⬇ Abbonati per live e contenuti esclusivi ➤➤➤ https://bit.ly/memberdufer Leggi Daily Cogito su Substack ➤➤➤ https://dailycogito.substack.com/ I prossimi eventi dal vivo ➤➤➤ https://www.dailycogito.com/eventi Scopri la nostra scuola di filosofia ➤➤➤ https://www.cogitoacademy.it/ Racconta storie di successo con RISPIRA ➤➤➤ https://cogitoacademy.it/rispira/ Impara ad argomentare bene ➤➤➤ https://bit.ly/3Pgepqz Prendi in mano la tua vita grazie a PsicoStoici ➤➤➤ https://bit.ly/45JbmxX Tutti i miei libri ➤➤➤ https://www.dailycogito.com/libri/ Il nostro podcast è sostenuto da NordVPN ➤➤➤ https://nordvpn.com/dufer #rickdufer #arte #ispirazione INSTAGRAM: https://instagram.com/rickdufer INSTAGRAM di Daily Cogito: https://instagram.com/dailycogito TELEGRAM: http://bit.ly/DuFerTelegram FACEBOOK: http://bit.ly/duferfb LINKEDIN: https://www.linkedin.com/pub/riccardo-dal-ferro/31/845/b14 -------------------------------------------------------------------------------------------- Chi sono io: https://www.dailycogito.com/rick-dufer/ -------------------------------------------------------------------------------------------- La musica della sigla è tratta da Epidemic Sound (author: Jules Gaia): https://epidemicsound.com/ Learn more about your ad choices. Visit megaphone.fm/adchoices

In this episode, special co-host Diana Yáñez and Sweet Miche explore the concept of belonging, not just to each other, but to all of existence. From the linguistic wisdom of the Aymara people to the radical call of liberation theology and the hard work of healing Quaker involvement in Indian Boarding Schools, we're asking what might happen to our faith if we start living from the "We" instead of the "I"? Jiwasa: The Communal We with Rubén Hilari Quispe Rubén, an Aymara Quaker and linguist, introduces us to jiwasa – a concept of "we-ness" that includes humans, the environment, and even the objects around us. He invites us to sit with the unsettled feeling of language that doesn't center the individual. Read Rubén's article, "Jiwasa, the Communal We" in the January 2026 issue of Friends Journal or at FriendsJournal.org. You can hear an extended interview in Spanish with English subtitles at the Friends Journal YouTube page. Liberation Theology and the Inner Light with Renzo Carranza Guatemalan Friend Renzo Carranza explores how the Quaker Inner Light intersects with the radical tradition of liberation theology. Together, they form a call to action: to reinterpret the gospels from the perspective of the marginalized and transform society. Watch the full QuakerSpeak video, “Transforming the SPIRIT: Liberation Theology and the Inner Light” at QuakerSpeak.com. Collective Relationship and Boarding Schools with Rachel Overstreet Rachel Overstreet (Choctaw Nation) discusses the history of Quaker Indian boarding schools. She suggests that the way forward isn't through individual guilt, but through collective relationship. Read Rachel's article, “Speaking with Friends About Indian Boarding Schools” in the January 2026 issue of Friends Journal or at FriendsJournal.org. Rachel writes the Native American Legislative Update, a monthly newsletter on the most important developments on Capitol Hill related to Indian Country. You can also write your Congressperson to cosponsor and pass the Truth and Healing Commission on Indian Boarding School Policies Act. Find out more at fcnl.org/issues/native-americans. Book Review: Chooch Helped Katie Green reviews a charming children's book by Andrea L. Rogers and Rebecca Lee Koons (Cherokee Nation) that celebrates present-day Cherokee family life and love. Read Katie's review of Chooch Helped in the January 2026 issue or at FriendsJournal.org. Recommended Resources by Indigenous Creators Jonny Appleseed (Novel) By Joshua Whitehead (they/them) A beautifully fragmented story about a Two-Spirit, Indigiqueer person navigating life in Winnipeg. The title ironically reclaims a settler-colonial myth to tell a raw story of modern Indigenous identity. Coyote & Crow (Tabletop Role-Playing Game) Created by a team of over 30 Indigenous creators Set in an "Indigenous Futurism" world where the Americas were never colonized. This RPG focuses on community, advanced technology, and spirits in a world where history took a different path. Drama & Performance The Thanksgiving Play (Play) By Larissa FastHorse (Sicangu Lakota Nation) A biting, hilarious satire that made history as the first play by a Native American woman on Broadway. It follows four well-meaning white people trying to create a "politically correct" Thanksgiving play for a school. The Rez Sisters (Play) By Tomson Highway (Cree) A modern classic of Indigenous drama. It tells the story of seven women on a reserve who dream of winning "the biggest bingo game in the world." It's a powerful blend of humor, tragedy, and the supernatural. Mary Kathryn Nagle: Land Sovereignty and Indigenous Women's Rights (Podcast/Interview) Produced by Peterson Toscano for Citizens Climate Radio A deep-dive conversation with Cherokee playwright and attorney Mary Kathryn Nagle. She discusses how her plays, like Sovereignty and Manahatta, serve as "living law," using the stage to advocate for tribal jurisdiction and the safety of Indigenous women. Music & Audio Come and Get Your Love (Song) By Redbone The 1974 hit that made Redbone the first Native American band to reach the top five on the Billboard Hot 100. Forged (Podcast) CBC Listen / Host: Adrian Stimson A gripping series exploring a massive art fraud ring involving the works of Norval Morrisseau, the "Picasso of the North." Literature & Thought Sacred Instructions (Book) By Sherri Mitchell (Weh'na Ha'mu Kwasset) A roadmap for "spirit-based change" drawing on Penobscot ancestral wisdom to address modern crises. Dr. Lyla June Johnston (Scholar & Musician) A Diné (Navajo) and Cheyenne artist whose work blends hip-hop with traditional acoustics and ecological activism. Digital Culture & Media Trixie Mattel: Root Maintenance (Video/Q&A) The world-famous drag queen discusses her biracial Ojibwe heritage and navigating identity in the public eye. Rez Ball (Film) Produced by LeBron James and Sterlin Harjo A 2024 film following a Navajo high school basketball team, capturing the unique, fast-paced style of "Rezball." Next Month's Question A central part of Quakerism is our commitment to peace. But that doesn't mean we should avoid conflict. In fact, it means we have a specific responsibility to it. What is a small practice that brings you a measure of peace or stability in the midst of conflict and turmoil? Leave a voice memo at 317-QUAKERS (317-782-5377) Email us at podcast@friendsjournal.org Sponsors Quakers Today is a project of Friends Publishing Corporation. This season is sponsored by: Friends Fiduciary: Ethical investing through a Quaker lens. Learn more at FriendsFiduciary.org. American Friends Service Committee (AFSC): Challenging injustice and building peace. Visit afsc.org. For a full transcript, visit QuakersToday.org.

Cómo Dominar tu Mente y Darle Sentido a tu Vida (Alfonso Ruiz Soto)

Creadores: Emprendimiento | Negocios Digitales | Inversiones | Optimización Humana

Alfonso Ruiz Soto nos habla en este episodio de Creadores Podcast sobre cómo resignificar el trauma, transformar el dolor en conciencia y descubrir tu vocación real a partir de tu historia personal.Alfonso comparte su experiencia tras morir clínicamente durante 10 minutos y cómo ese evento cambió su forma de entender la vida, el miedo y el propósito. Hablamos de la huella de abandono, por qué sufrimos más por la interpretación que por los hechos, y cómo entrenar la conciencia para dejar de vivir desde la herida. También profundizamos en la vocación sin mitos: cómo descubrirla, por qué no basta con encontrarla sino asumirla, y cómo las heridas emocionales influyen en nuestras relaciones, decisiones y patrones repetidos.Un episodio clave si estás atravesando una crisis existencial, quieres sanar tu pasado y vivir con mayor claridad, sentido y conexión emocional.Shownotes(00:00) - Intro: ¿La vocación se inventa o se descubre?(03:02) - Biografía vs. Intrabiografía: Lo que pasa dentro de ti(06:16) - La verdad sobre la percepción: Dos personas, una misma realidad(10:14) - Genética y Personalidad: ¿Por qué eres como eres? (Los 5 Potenciales)(14:48) - El Énfasis Genético: Motriz, Emocional o Racional(17:49) - Cómo sanar el trauma y resignificar el pasado con tus padres(22:35) - Problema vs. Problemática: La historia de la llanta ponchada(25:20) - El Imaginario Personal: Por qué eres esclavo de tus reacciones(28:00) - Qué es el "Yo Observante" y cómo activar tu Libre Albedrío(33:36) - El secreto del Nivel de Ser: Por qué tu vida no cambia aunque quieras(39:51) - Sexo, Erotismo y Sensualidad: El camino hacia el placer real(46:17) - Cómo entrenar tu mente para vivir en paz (Meditación en acción)(57:41) - Tocar fondo: Por qué esperamos al dolor para transformar nuestra vida(01:02:30) - Semiología de la Muerte: Cómo superar el duelo y perder el miedo(01:14:13) - Testimonio Real: "Morí por 10 minutos y esto fue lo que vi"(01:25:07) - Guía Definitiva de Vocación: Descubrir, Asumir y Practicar(01:32:40) - La metáfora de Einstein en la cancha de basket (El contexto lo es todo)(01:35:00) - Cómo tu vocación determina a tu pareja ideal(01:46:46) - Dinero y Pasión: La anécdota de Picasso y los banqueros(01:53:46) - El Vacío Existencial: Qué hacer cuando pierdes el sentido (Serrat y Cauduro)(02:02:40) - Dónde empezar a estudiar Semiología- Recibe acceso gratuito a mi lista de los 100 libros que transformarán tu vida aquí: https://www.creadores.co/newsletter- Únete a nuestra Escuela de Creadores, un programa de 12 semanas para transformar tu cuerpo, mente y negocios: https://creadores.co/escuela- Invierte en bienes raíces en EE. UU. con nosotros en Creadores Capital y genera retornos promedio del 20% anuales. Aplica aquí: https://www.creadorescapital.com/Invitado- Instagram: https://www.instagram.com/alfonsoruizsoto/- TikTok: https://www.tiktok.com/@dr.alfonsoruizsoto- Youtube: https://www.youtube.com/@AlfonsoRuizSotoo- Facebook: https://www.facebook.com/AlfonsoRuizSotoSemiologia- X: https://x.com/ARuizSotoCreadores- Facebook: https://www.facebook.com/creadorespodcast- Instagram: https://www.instagram.com/creadorespodcast- Instagram: https://www.instagram.com/chelozegarra- TikTok: https://www.tiktok.com/@marcelozegarrac- Twitter: https://twitter.com/chelozegarrac- Email: https://www.creadores.co/contacto#CreadoresPodcast #Conciencia #SanaciónEmocional #PropósitoDeVida

The Traffic Society try to meet the Dragon Lord Regis Picasso on his terms. https://linktr.ee/clashofkrits Support us on https://patreon.com/ClashofKrits to get access to our after show "Late Night Traffic" and More!

The Art and Science of Drywall: A Chat with Ted from The Patch Boys

Get ready for some serious drywall drama as Eric G and John Dudley sit down with Ted Speers from The Patch Boys. We're diving right into the nitty-gritty of drywall repair and why finding a trustworthy contractor is like hunting for a unicorn in a haystack. Ted spills the beans on the art and science of drywalling, and how DIY attempts often end in a “what have I done?!” panic. We'll also explore the unique challenges of dealing with textures, the absurdities of home repairs, and why sometimes it's better to just call in the pros before your walls start looking like a Picasso painting gone wrong. So grab your headphones and let's patch things up, because we're about to make drywalling fun—yes, you heard that right! When it comes to drywall, everyone thinks they can tackle it, right? I mean, how hard can it be? Just slap up some sheets, tape it, mud it, and voilà! Spoiler alert: it's not that simple. In this jam-packed episode of Around the House, Eric G and John Dudley welcome Ted Speers from The Patch Boys to discuss the ins and outs of drywall repair. We dive deep into the common misconceptions about DIY drywall projects. Ted shares hilarious anecdotes about all the brave souls who attempt to fix their drywall issues only to end up in a mess that even Picasso would be jealous of. You know those folks who watch a couple of YouTube videos and think they're pros? Yeah, they usually end up giving Ted a call when their 'art project' goes horribly wrong. The guys dissect the art versus science of drywall, emphasizing the skill and finesse required to achieve that perfect finish. You might not think it, but matching textures and dealing with the dreaded popcorn ceiling is an art form that takes years to master. So buckle up, grab a snack, and get ready to learn why hiring a professional might just save you from a world of drywall woe. Let's be real – nobody loves dealing with drywall unless you're Ted, who practically oozes passion for it. In our latest chat, Ted lays down the law about why you should never trust a handyman who claims to be a drywall expert. Sure, they might know how to fix your leaky sink, but once they get their hands on drywall, it's a whole different ballgame. The trio explores the importance of hiring qualified professionals for drywall work, especially after plumbing disasters. Ted gives us the lowdown on how many of his jobs stem from botched DIY attempts or haphazard handyman work. With a chuckle, he explains how the majority of his customers are those do-it-yourselfers who thought they could save a few bucks and ended up creating a drywall horror story. We also touch on the critical aspect of customer service in the contracting world. Ted discusses how The Patch Boys prioritize cleanliness and customer experience on every job, ensuring that clients feel valued and respected. Spoiler alert: it's not just about fixing walls; it's about building relationships. If you think drywall is just about slapping up some boards, think again! This episode takes you on a wild ride through the world of drywall with Ted Speers from The Patch Boys. Eric G and John Dudley get right into it, tackling everything from the absurdities of DIY projects to the fine art of matching textures. Seriously, it's like trying to get a cat to take a bath – nearly impossible unless you know what you're doing! Ted shares his insights on the challenges faced by homeowners and the importance of hiring skilled professionals to avoid the pitfalls of DIY disasters. From addressing water leaks to the complexities of texture matching, this episode is a treasure trove of tips and tricks for anyone looking to navigate the often confusing realm of drywall repair. If you've ever wondered why your walls look like a 3rd grader's art project, tune in to discover how professionals bring back the smoothness and finesse your home deserves. Plus, a few laughs along the way as Ted recounts some of the more comedic mishaps he's encountered in his line of...

BUMPPP! FM EPISODE 167 (w/ The Good Guys & Don Picasso) | HIP-HOP R&B JERSEY CLUB MIX

BUMPPP! FM EPISODE 167 (w/ The Good Guys & Don Picasso) | HIP-HOP R&B JERSEY CLUB MIX by BUMPPP! RECORDS

Philippe Charlier, le médecin légiste qui autopsie les plus grands personnages de l'Histoire

Philippe Charlier est médecin légiste, anthropologue et archéologue. Il travaille pour la justice sur des corps anonymes, et applique les mêmes méthodes scientifiques à des figures majeures de l'Histoire. À partir d'ossements, de cheveux ou de reliques, il reconstitue des parcours de vie, identifie des causes de décès et démonte des légendes tenaces. Henri IV, Jeanne d'Arc, Hitler, Agnès Sorel ou Picasso sont ainsi "passés entre ses mains". Mais son travail pose surtout une question universelle : que peut raconter un corps ? Jusqu'où peut-on remonter l'histoire d'une vie à partir de restes humains ? Livre : « L'Histoire au scalpel - Autopsie des morts célèbres » aux éditions Tallandier.Hébergé par Audiomeans. Visitez audiomeans.fr/politique-de-confidentialite pour plus d'informations.

Melissa Bonin – Lafayette Artist, Poet, Lyricist, Author

Discover Lafayette welcomes Melissa Bonin, celebrated artist, poet, lyricist, and author whose work is deeply rooted in the landscape, language, and spirit of South Louisiana. A native of New Iberia with French and Acadian ancestry, Melissa is widely recognized as one of Louisiana's leading contemporary landscape painters. Her work weaves together emotion, mythology, nature, and memory—often inspired by bayous, waterways, mist, and the movement of water. Melissa's multidisciplinary voice is beautifully expressed in her 160-page book, When Bayous Speak, which pairs poetry and paintings spanning more than two decades of her artistic career. The poetry in the book reflects five to six years of work, while the paintings represent some of her most personal and enduring visual pieces. The cover image, Dances on Water, embodies the themes that recur throughout her work—flow, reflection, and deep connection to place. Finding Her Voice Through Art Melissa shared that she was painfully shy as a child and struggled to communicate with others. Her earliest breakthrough came on the last day of kindergarten, when a teacher handed her a chalkboard. “There was something I was able to express myself with, without speaking,” she recalled. That moment marked the beginning of a lifelong relationship with art as language. Her grandfather, a horse trainer, would sit with her and draw simple figures, unknowingly nurturing her creative instincts. Even early recognition came with challenges; after entering a poster contest as a young child she didn’t win. She was told she couldn't have drawn the winning work herself. “But I did,” she said. Mentorship and Artistic Formation Melissa's artistic path was shaped by extraordinary mentorship. At Mount Carmel in New Iberia, teacher James Edmunds and his wife Susan exposed her to museums, music, and culture, taking her to the King Tut exhibit and the symphony in New Orleans. Edmunds introduced her to Elemore Morgan, Jr., who became a lifelong mentor. Through these mentors, Melissa began taking fine art classes at UL Lafayette while still in high school at only 15 years of age. Edmunds even received permission from the nuns to continue teaching her privately at his home. “The greatest thing he ever did for me was to get out of my way,” she said. Reflecting back on her early mentor in high school, Melissa says, “James Edmunds would have different media there. It would be watercolor or whatever. He’d say, I’ll be back in an hour. Then he’d come back and we’d discuss it. Then I’d go back to school.” Melissa went on to earn her degree in Fine Arts at USL (now UL Lafayette), studying under influential artists including Elemore Morgan Jr., Herman Mhire, and Bill Moreland. Language, Identity, and France Melissa's love for the French language developed alongside her art. Her parents belonged to what she called the “shamed generation” who did not speak French, yet her grandmother spoke only French. Wanting to communicate with her, Melissa taught herself French using a Bible she found in an armoire. Her academic journey led her abroad through scholarships from CODOFIL and LSU. She studied in Angers and Paris and described her first experience in France simply as “I'm home.” That connection continues to influence her work, which is often presented in both English and French. Art as a Living Practice Melissa described the moment she truly “found her voice” as an artist after her first major New Orleans show, when Elemore Morgan Jr. left her a message repeating, “Melissa, you have found your voice.” Her distinctive surface treatment—polished like “a gemstone or a precious metal”—became a defining element of her work. When asked how long it takes to create a painting, she quoted Picasso's famous response: “All my life.” Some works move quickly; others are painted over dozens of times. “The canvas tells you,” she said. “It's when you try to impose your will upon the canvas that you don't get too far.” Melissa Bonin shared on Facebook, “So happy to see this in Moncus Park today on my walk. What a lovely job the Haynie Family has done incorporating one of my wildflower paintings and one of my poems into their display along Lake Reaux.” Nature, Water, and Healing Melissa's work is deeply inspired by the natural world—water, mist, humidity, plant life, wildflowers, and birds. During a period of heartbreak, she began paddling her canoe on the bayou every afternoon. “When I got on the water, everything fell away,” she shared. That experience sparked her lifelong exploration of bayous as both subject and sanctuary. Today, birding has become part of her daily life and creative process. “Being out there and hearing the sounds of nature and the calls—I love it,” she said. Poetry, Rejection, and Resilience Melissa's poetry has reached international audiences, with residencies in Montreal and current opportunities in France. Reflecting on a defining moment at the Congrès Mondial in Canada—where she was the first woman to present—she recalled a comment from a well-known figure who told her, “They will always remember your painting, but your poetry will get you nowhere.” Her response was resolute: “I must have had some really good poetry to make a person have to formulate that kind of sentence.” Since then, her poetry has appeared in parks in Belgium, installations in Lafayette, and residencies across borders. “My advice is filter what people tell you,” she said. Living the Artist's Life Melissa spoke candidly about choosing to become a full-time artist after realizing her art income had surpassed her teaching salary. “I wish I would have done it sooner,” she said. Her advice to young creatives: trust the inner voice and begin before you feel completely ready. She also shared that meditation, movement, and dance—another lifelong love—play a vital role in her creative process. “When I'm really stuck, I move,” she said. “And then sometimes the answers come.” “Arianna Huffington had a quote that I love to live by. She said, “Go forward as if all the cards are stacked in your favor. And so for anyone who has a desire to paint or write, I encourage that. There’s something that happens to a person when they dig deep within themselves and really become acquainted with themselves. In that way, something beautiful happens and everyone around can feel it.” Upcoming Event Melissa will be featured in Bulles littéraires, a literary evening hosted by Alliance Française de Lafayette.

https://solvitryggva.is/ Tolli Morthens er líklega þekktasti listmálari Íslands. Tolli fékk nýverið stærstu friðarverðlaun Asíu fyrir störf sín í fangelsum í áraraðir. Í þættinum ræða Sölvi og Tolli um leiðina heim, sjálfsvinnu, að láta gott af sér leiða, sambandið við æðri mátt og margt margt fleira. Þátturinn er í boði; Caveman - https://www.caveman.global/ Nings - https://nings.is/ Myntkaup - https://myntkaup.is/ Mamma veit best - https://mammaveitbest.is/ Mama Reykjavík - https://mama.is/ Smáríkið - https://smarikid.is/ Ingling - https://ingling.is/

BUFFALO DEFEATS NEW YORK 35-8, FACES JACKSONVILLE IN WILD CARD ROUND | Picasso's Postgame Show

The Pay The Bills crew is LIVE postgame after the Bills defeat the Jets in the final home game at The Ralph/Rich/Highmark Stadium.

Řezbář Pavel Špelda: Umělec, který se musel nejdřív naučit baroko, aby ho mohl opustit

„Moje vize byla tvořit, ale nevěděl jsem co,“ přiznává umělecký řezbář. Začátky podle něj nejsou o originalitě, ale o poctivém učení. „Mladý člověk, který se učí řemeslo, obvykle kopíruje staré vzory. Tak začínal třeba Picasso,“ říká s lehkou nadsázkou v rozhovoru s moderátorkou Terezou Kostkovou. „Je dobré začít klasikou a teprve pak se na tom dá stavět něco vlastního.“Všechny díly podcastu Blízká setkání můžete pohodlně poslouchat v mobilní aplikaci mujRozhlas pro Android a iOS nebo na webu mujRozhlas.cz.

BABABAM ORIGINALS | Françoise Gilot et Pablo Picasso : l'ogre et la muse

Ce week-end, découvrez A la folie, pas du tout, le podcast de Bababam qui raconte l'amour et le désamour. Derrière la belle histoire, nous vous racontons l'envers du décor... Découvrez la face cachée d'un couple de peintres : Françoise Gilot et Pablo Picasso. Cinquante ans après sa mort, le monde de l'art rend encore hommage à l'œuvre monumentale de Picasso. Pourtant, ces nombreuses expositions occultent souvent le calvaire qu'il a fait vivre à ses compagnes, et surtout, le courage de celle qui lui a dit non. En 4 épisodes, à travers ce couple, nous allons vous dévoiler comment Picasso est passé maître dans l'art de la violence. Un podcast Bababam Originals Ecriture : Lucie Kervern Voix : François Marion, Lucrèce Sassella Learn more about your ad choices. Visit megaphone.fm/adchoices

Deutschland verliert an Flughöhe | Sechs Kanzler auf Probe | Picasso für 100 Euro

Gabor Steingart präsentiert das Pioneer Briefing.

Le dialogue à travers l'histoire 2/3 : Pourquoi dialogue-t-on à travers l'histoire ?

durée : 00:03:41 - Le Pourquoi du comment : philo - par : Frédéric Worms - Artistes, écrivains et philosophes dialoguent à travers le temps. Dans "Le Musée imaginaire" d'André Malraux montre que Picasso répond à Cézanne, Cézanne à Manet, et Manet à Ingres. L'histoire de la pensée humaine est-elle faite de "conversation" ? - réalisation : Luc-Jean Reynaud

Anthony Joshuas Tragedy a sad year end to a wild year in boxing. Last Show of 2025.

Send us a textWe close the year with heavy hearts for AJ's loss, sharp eyes on Riyadh's spectacle, and clear calls for better judging as we break down Nakatani vs Hernandez and Inoue vs Picasso before diving into Teo vs Shakur and a stacked MSG undercard. We share honest goals for the pod, shout out our community, and set expectations for a cleaner, fairer sport.• AJ's tragedy and the mental toll at the elite level• Riyadh production values versus credibility concerns• Nakatani vs Hernandez scoring and the 118–110 outlier• Inoue's craft, durability dynamics, and hand wrap noise• Double standards on fighters who go the distance• Teofimo vs Shakur stakes and quiet-camp signals• Shu Shu Carrington's title shot and Castro's threat• Keyshawn Davis vs Jamaine Ortiz as a real test• Carlos Adames vs Ammo Williams at middleweight• Barclays card, VADA chatter, and weak promotion• Our content goals, interviews, and community thanksMake sure y'all like and subscribeTHE SPAR-INN ON YOUTUBE

Deportres 29 de diciembre 2025 (1231) - www.deportres.comEn el Deportres de hoy: Todo lo que paso en la batalla Inoue vs Picasso, y el fútbol americano profesional de la NFL, y el futbol internacional en todo el mundo, el basquetbol de la NBA, Y como siempre tu participación.https://www.patreon.com/Deportres

War & Greatness: Junto Nakatani vs Sebastian Hernandez & Naoya Inoue's Dominant Win vs David Picasso

Teddy Atlas recaps a potential Fight of the Year between Junto Nakatani and Sebastian Hernandez, breaking down what made the fight so special and the moments that defined the battle.Teddy then turns his attention to 122-pound king Naoya Inoue, analyzing his impressive win over David Picasso and what the performance says about Inoue's continued dominance, precision, and place atop the division.High-level breakdowns, honest reactions, and classic Teddy insight on two standout performances from the weekend.Thanks for being with us. The best way to support is to subscribe, share the episode and check out our sponsor: https://athleticgreens.com/atlasYou can join Teddy for the first ever community driven and one-of-a-kind subscription platform to get exclusive never seen before access to Teddy Atlas: https://Teddyatlasboxing.com The Ropes with Teddy includes: Teddy's tips and advice Evaluations/ video review feedback / Exclusive Fight Picks /Dedicated livestreams for private Q&A's and livestreams for selected fights with Teddy's commentary / 1 on 1 coaching from Teddy and much more!Timestamps:00:00 - Intro00:25 - Nakatani vs Hernandez 34:00 - Inoue vs PicassoTEDDY'S AUDIOBOOKAmazon/Audible: https://amzn.to/32104DRiTunes/Apple: https://apple.co/32y813rTHE FIGHT T-SHIRTShttps://teddyatlas.comTEDDY'S SOCIAL MEDIATwitter - http://twitter.com/teddyatlasrealInstagram - http://instagram.com/teddy_atlasTHE FIGHT WITH TEDDY ATLAS SOCIAL MEDIAInstagram - http://instagram.com/thefightWTATwitter - http://twitter.com/thefightwtaFacebook - https://www.facebook.com/TheFightwithTeddyAtlasThanks for tuning in. Please be sure to subscribe! Hosted on Acast. See acast.com/privacy for more information.

DAZN PPV Breakdown: Inoue vs Picasso, Joshua's $66M Loss

The boxing world is in full chaos and Ringside Reporter breaks it all down. This week we preview the DAZN PPV headlined by pound-for-pound star Naoya Inoue vs Alan Picasso in the junior featherweight division, plus Junto Nakatani vs Sebastian Reyes as one of the most intriguing fights on the card. We dive into shocking boxing business news, including reports that Anthony Joshua lost $66 million, while Paul vs Joshua reportedly pulled in 33 million viewers, raising serious questions about where boxing is heading. To make things even wilder, Logan Paul has now publicly challenged Anthony Joshua, blurring the line between sport and spectacle. Also on the show: · WBO orders Hamzah Sheeraz vs Diego Pacheco, a fight that could reshape the middleweight division · Keyshawn Davis, Carlos Adames, and Bruce Carrington added to the Lopez–Shakur Stevenson card, turning it into one of the deepest events of the year · Upcoming fights you need to know about and what's next on the boxing schedule Is boxing becoming more entertainment than sport? Is Inoue still the most must-watch fighter in the world? And what does Joshua's financial hit mean for his future?

War & Greatness: Junto Nakatani vs Sebastian Hernandez & Naoya Inoue's Dominant Win vs David Picasso

Teddy Atlas recaps a potential Fight of the Year between Junto Nakatani and Sebastian Hernandez, breaking down what made the fight so special and the moments that defined the battle.Teddy then turns his attention to 122-pound king Naoya Inoue, analyzing his impressive win over David Picasso and what the performance says about Inoue's continued dominance, precision, and place atop the division.High-level breakdowns, honest reactions, and classic Teddy insight on two standout performances from the weekend.Thanks for being with us. The best way to support is to subscribe, share the episode and check out our sponsor: https://athleticgreens.com/atlasYou can join Teddy for the first ever community driven and one-of-a-kind subscription platform to get exclusive never seen before access to Teddy Atlas: https://Teddyatlasboxing.com The Ropes with Teddy includes: Teddy's tips and advice Evaluations/ video review feedback / Exclusive Fight Picks /Dedicated livestreams for private Q&A's and livestreams for selected fights with Teddy's commentary / 1 on 1 coaching from Teddy and much more!Timestamps:00:00 - Intro00:25 - Nakatani vs Hernandez 34:00 - Inoue vs PicassoTEDDY'S AUDIOBOOKAmazon/Audible: https://amzn.to/32104DRiTunes/Apple: https://apple.co/32y813rTHE FIGHT T-SHIRTShttps://teddyatlas.comTEDDY'S SOCIAL MEDIATwitter - http://twitter.com/teddyatlasrealInstagram - http://instagram.com/teddy_atlasTHE FIGHT WITH TEDDY ATLAS SOCIAL MEDIAInstagram - http://instagram.com/thefightWTATwitter - http://twitter.com/thefightwtaFacebook - https://www.facebook.com/TheFightwithTeddyAtlasThanks for tuning in. Please be sure to subscribe! Hosted on Acast. See acast.com/privacy for more information.

Welcome to the 2025 Award Show. We start with fight breakdowns. In this episode, we break down Saturday morning's telecast from Saudi Arabia. In the main event, Naoya Inoue rather effortlessly defeated David Picasso. It was a showcase of Inoue's great timing and reflexes, but Picasso proved to be a tough foe, hanging on until the final bell. Yet, the story of the night was Junto Nakatani. Nakatani defeated Sebastian Hernandez, but the result left many with more questions than answers. The fight was close, closer than any Nakatani had as a pro prior. Nakatani opted to fight on the inside at times, a difficult move. Some thought Hernandez won, some thought Nakatani won, as did the judges. In the end, the mega-fight between Inoue and Nakatani has taken a massive hit. Also, Erdison Garcia upset previously unbeaten Taiga Imanaga, and IBF flyweight champion Masamichi Yabuki made his second title defense, knocking out Felix Alvarado in 12 rounds. Next week, we get one fight card from Puerto Rico. Amanda Serrano will face Reina Tellez in a 10-round women's title fight broadcast on DAZN. This will be Serrano's first fight against an opponent named Katie Taylor since the summer of 2024. Tellez will be taking a major leap up in competition as she faces the toughest opponent of her career, replacing Erika Cruz. Other notable bouts on the undercard, Stephanie Han, a women's lightweight titleholder, will face legend Holly Holm, who will not just be battling Han, but father time itself. Holm, now in her 40s, is a boxing pioneer who became a legend for knocking out Ronda Rousey. She looks to win a title in the twilight of her career. Notables on the undercard include Yankiel Rivera, Jan-Paul Rivera, Henry Lebron, and Ebanie Bridges. Then, the awards. 0:00 Naoya Inoue-David Picasso13:00 Junto Nakatani-Sebastian Hernandez21:48 Boxer of the Year30:15 Women's Boxer of the Year34:50 Fight of the Year39:10 Women's Fight of the Year40:50 Round of the Year42:00 Trainer of the Year44:30 Knockout of the Year46:30 Prospect of the Year49:00 Story of the Year54:00 Vergil Ortiz vs Jaron “Boots” Ennis58:40 Guys who didn't fight enough59:25 Illegal Manuevers 01:01:28 Guy who came out of nowhere award.01:04:52 Good job, bub award01:07:00 The lost all momentum guy 01:08:30 The 2026 Breakout Fighter will be…01:10:00 Amanda Serrano-Reina Tellez Preview

Ring V Boxing -3500 Naoya Inoue Forced To Go The Distance In Win Over David Picasso. Full Recap!

In this episode of the Fight Junkie Podcast series, we touch on the -3500 favorite Naoya Inoue being forced to go the full 12 rounds against +1200 underdog David Picasso on the Ring V boxing card.Information Is For Entertainment Purposes Only!"No Embed Without Credit!"Our website:http://www.fightjunkie.comOfficial Fight Junkie Discordhttps://discord.com/invite/eSSGxMawXVFollow Us On These Social Media Platforms:https://twitter.com/FightJunkieComhttps://www.instagram.com/fight_junkie/https://www.twitch.tv/realfightjunkiehttps://anchor.fm/fight-junkiehttps://www.tumblr.com/blog/realfightjunkieListen To Our Podcast Here:Our podcast is live on Apple HomePod. Try saying, "Hey Siri, play the podcast Fight Junkie.Our podcast should also be live soon on Google Home. Try saying “Hey Google, play the podcast Fight JunkieAmazon Music: https://music.amazon.com/podcasts/281faea0-e592-455b-ae3c-be89ca86a0d3/Fight-JunkieAnchor: https://anchor.fm/fight-junkieApple Podcasts: https://itunes.apple.com/us/podcast/fight-junkie/id1430819358?mt=2&uo=4Spotify: https://open.spotify.com/show/7K5YtwXFO28DIwbiYNA2bdBreaker: https://www.breaker.audio/fight-junkiePocket Casts: https://pca.st/0CZdRadio Public: https://play.radiopublic.com/fight-junkie-WRVrwwStitcher: https://www.stitcher.com/podcast/anchor-podcasts/fight-junkieOvercast: https://overcast.fm/itunes1430819358/fight-junkie#Boxing #Boxen #NaoyaInoue #DavidPicasso #Podcast #Fightjunkie #Fight #Fighting #BoxingPicks #BoxingPredictions #BoxingPodcast #BoxingOdds #BoxingBetting #BoxingPodcast #BoxingPicks #BoxingPredictions #FightjunkiePodcast #FightjunkiePicks #FightjunkiePredictions #Gambling #Rumble

Deportres 26 de diciembre 2025 (1230) - www.deportres.comEn el Deportres de hoy: Ya paso la navidad y nos enfilamos al final del 2025, revisamos toda la acción del basquetbol de la NBA en el dia de navidad y también del futbol americano de la NFL, la previa de la batalla boxistica entre Inoue y el mexicano Picasso, todo el futbol nacional e internacional, tu participación y como siempre ¡mucho mas! https://www.patreon.com/c/Deportres

Jake Paul vs Anthony Joshua Breakdown |Terence Crawford's Place in History | Inoue–Nakatani Preview

Teddy Atlas breaks down the spectacle of Jake Paul vs. Anthony Joshua, recapping why he thought this fight would go more rounds than most people expected. While many anticipate a quick and violent ending from Joshua, Teddy outlines the factors that could extend the fight into deeper rounds — including Joshua's recent inactivity, the massive ring size, and Joshua's tendency at times to be a slow starter. Teddy also reflects on the legendary career of Terence “Bud” Crawford following his retirement announcement. He discusses Crawford's rare versatility, ring IQ, mental toughness, instincts and ability to dominate across multiple weight classes. Teddy places Crawford among the true modern greats, comparing his résumé, skill set, and dominance to other all-time elite fighters and explaining where Bud fits historically in the pantheon of boxing legends.Finally, Teddy previews a huge weekend of action from Saudi Arabia, breaking down Naoya Inoue vs. David Picasso and Junto Nakatani vs. Sebastian Reyes. Teddy explains why Inoue's pressure, power, and precision make him one of the most dangerous fighters in the world, while also noting what Picasso must do to survive and compete. He then turns to Nakatani, highlighting his size, technique, and finishing ability, and explains why Reyes faces an uphill battle against one of boxing's most complete and dangerous champions.Thanks for being with us. The best way to support is to subscribe, share the episode and check out our sponsor: https://athleticgreens.com/atlasYou can join Teddy for the first ever community driven and one-of-a-kind subscription platform to get exclusive never seen before access to Teddy Atlas: https://Teddyatlasboxing.com The Ropes with Teddy includes: Teddy's tips and advice Evaluations/ video review feedback / Exclusive Fight Picks /Dedicated livestreams for private Q&A's and livestreams for selected fights with Teddy's commentary / 1 on 1 coaching from Teddy and much more!Timestamps:03:00 - Paul vs Joshua Recap38:10 - Terence Crawford Retires49:45 - Inoue vs Picasso58:00 - Nakatani vs HernandezTEDDY'S AUDIOBOOKAmazon/Audible: https://amzn.to/32104DRiTunes/Apple: https://apple.co/32y813rTHE FIGHT T-SHIRTShttps://teddyatlas.comTEDDY'S SOCIAL MEDIATwitter - http://twitter.com/teddyatlasrealInstagram - http://instagram.com/teddy_atlasTHE FIGHT WITH TEDDY ATLAS SOCIAL MEDIAInstagram - http://instagram.com/thefightWTATwitter - http://twitter.com/thefightwtaFacebook - https://www.facebook.com/TheFightwithTeddyAtlasThanks for tuning in. Please be sure to subscribe! Hosted on Acast. See acast.com/privacy for more information.

Boxing - Naoya Inoue vs David Alan Picasso preview. Jake Paul and Andrew Tate lose.

Juan previews the boxing event headlined by Japanese Superstar Naoya Inoue. Inoue looks to be on a collision course with fellow Japanese unbeaten fighter, Junto Nakatani. Both men need to take care of business Saturday before they meet for a super fight in 2026.

Jake Paul vs Anthony Joshua Breakdown |Terence Crawford's Place in History | Inoue–Nakatani Preview

Teddy Atlas breaks down the spectacle of Jake Paul vs. Anthony Joshua, recapping why he thought this fight would go more rounds than most people expected. While many anticipate a quick and violent ending from Joshua, Teddy outlines the factors that could extend the fight into deeper rounds — including Joshua's recent inactivity, the massive ring size, and Joshua's tendency at times to be a slow starter. Teddy also reflects on the legendary career of Terence “Bud” Crawford following his retirement announcement. He discusses Crawford's rare versatility, ring IQ, mental toughness, instincts and ability to dominate across multiple weight classes. Teddy places Crawford among the true modern greats, comparing his résumé, skill set, and dominance to other all-time elite fighters and explaining where Bud fits historically in the pantheon of boxing legends.Finally, Teddy previews a huge weekend of action from Saudi Arabia, breaking down Naoya Inoue vs. David Picasso and Junto Nakatani vs. Sebastian Reyes. Teddy explains why Inoue's pressure, power, and precision make him one of the most dangerous fighters in the world, while also noting what Picasso must do to survive and compete. He then turns to Nakatani, highlighting his size, technique, and finishing ability, and explains why Reyes faces an uphill battle against one of boxing's most complete and dangerous champions.Thanks for being with us. The best way to support is to subscribe, share the episode and check out our sponsor: https://athleticgreens.com/atlasYou can join Teddy for the first ever community driven and one-of-a-kind subscription platform to get exclusive never seen before access to Teddy Atlas: https://Teddyatlasboxing.com The Ropes with Teddy includes: Teddy's tips and advice Evaluations/ video review feedback / Exclusive Fight Picks /Dedicated livestreams for private Q&A's and livestreams for selected fights with Teddy's commentary / 1 on 1 coaching from Teddy and much more!Timestamps:03:00 - Paul vs Joshua Recap38:10 - Terence Crawford Retires49:45 - Inoue vs Picasso58:00 - Nakatani vs HernandezTEDDY'S AUDIOBOOKAmazon/Audible: https://amzn.to/32104DRiTunes/Apple: https://apple.co/32y813rTHE FIGHT T-SHIRTShttps://teddyatlas.comTEDDY'S SOCIAL MEDIATwitter - http://twitter.com/teddyatlasrealInstagram - http://instagram.com/teddy_atlasTHE FIGHT WITH TEDDY ATLAS SOCIAL MEDIAInstagram - http://instagram.com/thefightWTATwitter - http://twitter.com/thefightwtaFacebook - https://www.facebook.com/TheFightwithTeddyAtlasThanks for tuning in. Please be sure to subscribe! Hosted on Acast. See acast.com/privacy for more information.

Episode 1155: "Monster Painting" Naoya Monster Inoue vs Alan Picasso Preview

On this segment of "Real Talk", the Ring Gang crew preview Naoya Monster Inoue vs Alan Picasso

Ring V Boxing Predictions! Odds + Props + Picks! Naoya Inoue V David Picasso!

In this episode of the Fight Junkie Podcast series, we breakdown the Naoya Inoue V David Picasso match and go over what we feel are possible betting opportunities & the odds for each of these fighters as well as our predictions & suggested betting strategies for those picks.Information Is For Entertainment Purposes Only!"No Embed Without Credit!"Our website:http://www.fightjunkie.comOfficial Fight Junkie Discordhttps://discord.com/invite/eSSGxMawXVFollow Us On These Social Media Platforms:https://twitter.com/FightJunkieComhttps://www.instagram.com/fight_junkie/https://www.twitch.tv/realfightjunkiehttps://anchor.fm/fight-junkiehttps://www.tumblr.com/blog/realfightjunkieListen To Our Podcast Here:Our podcast is live on Apple HomePod. Try saying, "Hey Siri, play the podcast Fight Junkie.Our podcast should also be live soon on Google Home. Try saying “Hey Google, play the podcast Fight JunkieAmazon Music: https://music.amazon.com/podcasts/281faea0-e592-455b-ae3c-be89ca86a0d3/Fight-JunkieAnchor: https://anchor.fm/fight-junkieApple Podcasts: https://itunes.apple.com/us/podcast/fight-junkie/id1430819358?mt=2&uo=4Spotify: https://open.spotify.com/show/7K5YtwXFO28DIwbiYNA2bdBreaker: https://www.breaker.audio/fight-junkiePocket Casts: https://pca.st/0CZdRadio Public: https://play.radiopublic.com/fight-junkie-WRVrwwStitcher: https://www.stitcher.com/podcast/anchor-podcasts/fight-junkieOvercast: https://overcast.fm/itunes1430819358/fight-junkie#Boxing #Boxen #NaoyaInoue #DavidPicasso #Podcast #Fightjunkie #Fight #Fighting #BoxingPicks #BoxingPredictions #BoxingPodcast #BoxingOdds #BoxingBetting #BoxingPodcast #BoxingPicks #BoxingPredictions #FightjunkiePodcast #FightjunkiePicks #FightjunkiePredictions #Gambling #Rumble

Anthony Joshua Breaks Jake Paul's Jaw, Joshua vs Fury, Netflix Commentary, Inoue vs Picasso, + More

Episode #361: This week, the team reacts to Anthony Joshua breaking Jake Paul's Jaw on Netflix, the potential of Joshua vs. Tyson Fury in 2026, Jake Paul's future plans and his sights on Canelo Alvarez & becoming Boxing's cash star, Preview Naoya Inoue vs. David Picasso for the Undisputed Super Bantamweight world titles, Junto Nakatani vs. Sebastian Hernandez Reyes, WBO orders Hamzah Sheeraz vs. Diego Pacheco, First quarter fights of 2026, and more. CONNECT WITH US: All Show Links

Episode 824: Fight Preview: Naoya Inoue-Alan Picasso

My take on Naoya Inoue-Alan Picasso coming up this week. To hear about the full card go to my blog at http://lukieboxing.substack.com

Virtual Tour: Holy Family with Music-Making Angels, c. 1520

Bayerische Raubkunst? Der Kampf um Picassos "Madame Soler"

Handelt es sich bei Bayerns erstem Picasso um NS-verfolgungsbedingt entzogenes Kulturgut? Ein wahrer Krimi über Kunst als Wertanlage, nebulöse Museumsdeals und das Ringen um den richtigen Umgang mit der Vergangenheit.

Ever wonder what makes everyday creativity different from the genius of Picasso or Einstein? In this episode, I break down the Four-C Model of Creativity—Mini-c, Little-c, Pro-c, and Big-C—and explore how each level shows up in our lives. From the small insights that spark growth to the world-changing breakthroughs that leave a legacy, you'll discover why all forms of creativity matter. Links to help new designers:What's New: https://www.carinagardner.comDesign Bootcamp: http://www.carinagardnercourses.com/designbootcampUniversity of Arts & Design: http://uad.educationGet my free gift to you here: https://www.designsuitecourses.com/intentional

Alzheimer Araştırma Vakfı, Picasso'nun bir tablosunu çekiliş için satılan 100 avroluk biletlerin sahiplerinden birine verecek. 2024'te Eurovision'u kazanan Nemo, İsrail'in katılmasına izin verilmesi üzerine kupayı geri vereceğini duyurdu.Bu bölüm Atelier Rebul hakkında reklam içermektedir. Hediye sanatının uzmanı Atelier Rebul özel hediye setleri, şans getiren charm aksesuarları ve sınırlı sayıda koleksiyonlarıyla yılbaşının büyüsünü evlerinize taşıyor. Atelier Rebul'ün yeni yıl koleksiyonlarını keşfetmek için burayı ziyaret edebilirsiniz.

Pourquoi Les demoiselles d'Avignon de Picasso ne sont-elles pas d'Avignon ?

Le titre du tableau de Picasso induit souvent en erreur : Les Demoiselles d'Avignon ne renvoient absolument pas à la célèbre ville du sud de la France. Rien, dans l'histoire du tableau ou dans l'intention de l'artiste, ne renvoie à Avignon. L'origine véritable du titre est bien plus surprenante et profondément liée à la jeunesse de Picasso à Barcelone.En 1907, lorsque Picasso peint ce tableau révolutionnaire, il cherche à représenter les prostituées d'une maison close située dans la rue d'Avinyó, une rue populaire du quartier gothique de Barcelone. À l'époque, cette rue était connue pour ses bordels, que le jeune Picasso fréquentait régulièrement avec ses amis artistes. Le tableau s'appelait d'ailleurs d'abord « Le Bordel d'Avinyo », un titre beaucoup plus explicite mais jugé trop scandaleux par ses proches. L'appellation “Demoiselles” est une façon euphémisée de désigner ces femmes, et la transformation d'“Avinyó” en “Avignon” serait venue d'un malentendu ou d'un choix délibéré de ses amis marchands pour adoucir le sujet.En réalité, la déformation du nom a permis de détourner l'attention du public d'un titre jugé trop cru et choquant au début du XXᵉ siècle. Le mot “Avignon” sonnait plus neutre, presque poétique, tout en conservant une résonance étrangère. Avec le temps, ce nom s'est imposé et est devenu indissociable du tableau, même si son lien géographique est totalement erroné.Mais au-delà du titre, ce tableau marque une rupture fondamentale dans l'histoire de l'art. Picasso y représente cinq femmes nues, aux corps anguleux, aux visages inspirés des masques africains et de l'art ibérique, un choc visuel radical pour l'époque. La perspective traditionnelle est abandonnée, les formes sont disloquées, les corps comme taillés dans la pierre. Ce style préfigure ce qui deviendra le cubisme, mouvement fondé avec Georges Braque et qui bouleversera tous les codes de la peinture occidentale.Aujourd'hui, Les Demoiselles d'Avignon est conservé au Museum of Modern Art (MoMA) de New York, où il est considéré comme l'un des tableaux les plus importants du XXᵉ siècle. Et malgré son titre trompeur, son ancrage demeure bien celui de la Barcelone de Picasso, et non de la Provence française.Ainsi, les Demoiselles ne sont pas d'Avignon… mais d'Avinyó, rue discrète d'où partit une révolution artistique. Hébergé par Acast. Visitez acast.com/privacy pour plus d'informations.

The godmother of punk says she never had a choice when it came to being an artist -- it was her calling from the moment she first laid eyes on a Picasso in a Philadelphia gallery. She talks about creating through loss, listening to omens and reliving her childhood, in new memoir Bread of Angels.

Friday 12th December 2025. Thailand Cambodia displaced. US Venezuela tanker. Bulgaria PM resigns. Ukraine update. France Picasso raffle...

Survey : https://s.surveyplanet.com/5id5z6x1World news in 7 minutes. Friday 12th December 2025Today : Thailand Cambodia displaced. Japan drunk cycling. Myanmar hospital. Australia thieves. US Venezuela tanker. Bolivia Arce arrest. DRC M23 advance. Ethiopia TikTok arrests. Ukraine elections? British soldier. Bulgaria PM. Iseland Eurovision. France Picasso raffle.SEND7 is supported by our amazing listeners like you.Our supporters get access to the transcripts and vocabulary list written by us every day.Our supporters get access to an English worksheet made by us once per week.Our supporters get access to our weekly news quiz made by us once per week.We give 10% of our profit to Effective Altruism charities. You can become a supporter at send7.org/supportContact us at podcast@send7.org or send an audio message at speakpipe.com/send7Please leave a rating on Apple podcasts or Spotify.We don't use AI! Every word is written and recorded by us!Since 2020, SEND7 (Simple English News Daily in 7 minutes) has been telling the most important world news stories in intermediate English. Every day, listen to the most important stories from every part of the world in slow, clear English. Whether you are an intermediate learner trying to improve your advanced, technical and business English, or if you are a native speaker who just wants to hear a summary of world news as fast as possible, join Stephen Devincenzi, Juliet Martin and Niall Moore every morning. Transcripts, vocabulary lists, worksheets and our weekly world news quiz are available for our amazing supporters at send7.org. Simple English News Daily is the perfect way to start your day, by practising your listening skills and understanding complicated daily news in a simple way. It is also highly valuable for IELTS and TOEFL students. Students, teachers, TEFL teachers, and people with English as a second language, tell us that they use SEND7 because they can learn English through hard topics, but simple grammar. We believe that the best way to improve your spoken English is to immerse yourself in real-life content, such as what our podcast provides. SEND7 covers all news including politics, business, natural events and human rights. Whether it is happening in Europe, Africa, Asia, the Americas or Oceania, you will hear it on SEND7, and you will understand it.Get your daily news and improve your English listening in the time it takes to make a coffee.For more information visit send7.org/contact or send an email to podcast@send7.org

[Archives][EN] Martin Parr | Photographer : Conversation on Photography and His Career

The RPM Show Episode 19 Hosted by DJ DON PICASSO LIVE FROM ATLANTA, GA

#404 Lexi Picasso með Sölva Tryggva (Áskriftarþáttur)

Nálgast má þáttinn í heild sinni inn á; https://solvitryggva.is/ Alex Þór Jónsson, betur þekktur sem Lexi Picasso, á ótrúlega sögu. Hann kom eins og stormsveipur inn í íslenskt rapp þegar hann flaug á einkaþyrlu inn á sviðið árið 2016. Lexi hafði þá starfað í Atlanta í Bandaríkjunum, sem sumir kapp höfuðborg rappsins. Nokkrum árum síðar var hann fastur í hjólastól í Kenya í miðjum heimsfaraldri. En með aðdáunarverðu hugarfari hefur hann náð góðum bata af mænuskaða í kjölfar slyss. Í þættinum fara Sölvi og Lexi yfir þessa mögnuðu sögu, hæðir og lægðir, listina, ástríðuna og margt fleira. Þátturinn er í boði; Caveman - https://www.caveman.global/ Nings - https://nings.is/ Myntkaup - https://myntkaup.is/ Mamma veit best - https://mammaveitbest.is/ Mama Reykjavík - https://mama.is/ Smáríkið - https://smarikid.is/ Ingling - https://ingling.is/

EP504: Casey Brown – How To Overcome Fear Around Pricing - Part 2

"Do not be tempted to undervalue yourself just because it happens to be something that's fast or easy for you to produce." -Casey Brown In the finale of this two-part series, pricing expert and president of Boost Pricing, Casey Brown, returns to share how bookkeepers can move from fear-based pricing to confident, value-driven conversations. She explains how to stop pre-discounting, test your true pricing ceiling, and communicate your worth with clarity and confidence. In this interview, you'll learn: Why pre-discounting hurts your profits How to identify & attract better, higher-value clients How to package & present your services with confidence Connect with Casey on LinkedIn. To buy her book, Fearless Pricing, click here. Watch her TED Talk, or video on 12 things I Hate About Hourly Billing. To learn more about Boost Pricing, click this link. Time Stamp 02:03 – The two types of discounting: negotiated & pre-discounting 03:52 – How to test your true price ceiling 04:54 – Overcoming scarcity mindset & fear of losing clients 06:02 – Why fewer clients at higher prices can be more profitable 08:44 – Letting go of price-sensitive clients who drain your energy 10:43 – Why bad clients cost more than they're worth 11:13 – The gender gap in business pricing & confidence 12:45 – How women undervalue their services & why it costs them 13:52 – Messaging & packaging your services for higher value 15:17 – Half of pricing success is the number; half is how you frame it 16:52 – Stop obsessing over numbers & focus on context 17:47 – The problems with hourly billing models 18:47 – Why fixed-fee & value-based pricing work better 19:26 – When & how to offer pricing packages 20:47 – Avoid overwhelming clients with too many choices 22:28 – Be the expert—guide your client's decision 24:31 – Why clear messaging builds trust & confidence 25:57 – The Picasso lesson: charge for your experience, not your time 26:58 – How to articulate the process & value you deliver 27:21 – Where to find Casey's free resources, book & programs 28:42 – Fearless Pricing community & how to join This episode is brought to you by our friends at Dext! Dext handles transaction capture, keeps your data accurate, and even simplifies e-commerce reconciliation, all in one place. Join thousands of bookkeepers and accountants who've already made the switch. If you're ready to save time, reduce errors, and make bookkeeping more efficient, Dext is for you! Go to thesuccessfulbookkeeper.com/dext to book a demo TODAY and see how it can transform the way you work!

609: No Such Thing As Aunt Bessie In A Red Citroën Picasso

Amy Gledhill joins Dan, James and Andy to discuss gambling, flirting, and pudding. Visit nosuchthingasafish.com for news about live shows, merchandise and more episodes. Join Club Fish for ad-free episodes and exclusive bonus content at apple.co/nosuchthingasafish or nosuchthingasafish.com/patreon